July 24, 2016.docx with charts

-

Upload

scutify -

Category

Economy & Finance

-

view

10.092 -

download

0

Transcript of July 24, 2016.docx with charts

Option Queen Letter By the Option Royals

Jeanette Young, CFP®, CFTe, CMT, M.S.

4305 Pointe Gate Drive

Livingston, New Jersey 07039

www.OptnQueen.com

July 24, 2016, 2016

Technical analysis is amazing. Two weeks ago we drew a horizontal line projecting where we

believe the S&P 500 would go basis its past behavior….today’s chart shows that the line was hit

twice last week and, for the moment, is a resistance point. A point of concern is the failing

volume in this four-day rally. This is typical of this market which has been the poster child for a

wishy washy market. Perhaps the Fed’s tinkering with the business cycle has resulted in this sort

of muted reaction where we get neither boom nor bust economies. Speaking about muted

reactions this entire seven-year economic expansion has been, at best, muted.

The USA continues as the safe bet for those suffering from negative interest rates. Naturally the

money is flowing to our shores where at least the money will earn something. It is always better

to be paid for lending money safely than paying for somebody to hold your money. Wonder why

the super smart bankers haven’t figured that one out? Oh well!

Earning season has had a few surprises some positive, some negative. Interestingly, mergers are

beginning to appear. It is a perfect environment for companies to borrow money with cheap

interest costs and merge with a company that will add to your earnings. As an effect of this

merger, employee head-counts are reduced and some real-estate is consolidated. It is also a great

time for corporations to borrow money on the cheap and buy back their stock.

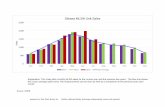

The S&P 500 gained 9.50 in the Friday session. Unfortunately, the new highs printed in the

Wednesday session and then in the Thursday session were both on declining volume, not a good

thing. During the past three days, the index either made a new high or approached the high. It

seems as though this market is getting a bit tired and just might need a rest before plowing to the

next high. All the indicators that we follow herein continue to point higher, but are getting

extended. The next level, after some digestion of the recent highs will be 2218.75. Above that

level is 2268.75. The most frequently traded price for the day-session was 2167.00. By 3:00 on

Friday afternoon, the high for the day was in place and the market began to shed some of its

excesses. This is typical behavior especially on a Friday summer afternoon as traders escape to

the beaches and flatten positions to avoid weekend chaos that could erupt.

The NASDAQ 100 gained 20.25 handles (points) in the Friday session leaving a bullish looking

candlestick on the chart. The NASDAQ high is at 4739.50 and the market is a robust rally away

from removing that resistance level. That said, the market is overbought and might need to rest

before assaulting that level. The stochastic indicator and the RSI continue to point higher albeit

at overbought levels. Our own indicators has just issued a sell-signal. The concern here is the

lack of volume. The Heikin-Ashi daily chart remains solidly bullish. The weekly chart shows

that this index has been moving higher for the past four weeks. Be aware that when we approach

the six week mark, generally the market reverses. Naturally there have been instances when the

market actually has gone up for longer than six weeks, actually as long as 13 weeks but generally

six is the magic number that halts a rally. That said, if we should take out the high, we might be

able to extend the rally a little bit longer. Friday’s high was printed at about noon and after that,

a stead drift sideways. The most frequently traded prices were 4659-4659.75.

The Russell 2000 gained 11.10 handles (points) I the Friday session. This index has been

consolidating at around these levels for nine trading days. Both the stochastic indicator and the

RSI are pointing higher. Our own indicator is issuing a continued sell-signal. The Bollinger

Bands are continuing to expand. The weekly chart shows the four-week rally and the current

stall at 1210. As the market moves higher, expect to see the index out-perform on the upside as

money moves away from yield and searches for growth. On the other hand, should the market

retreat, this index will be the source of funds and will out-perform on the downside. The most

frequently traded price was 1210-1210.50 but the highest volume was seen at 1209.50 where

13.4% of the day’s volume was seen.

The US Dollar Index rallied 0.369 handles (points) in the Friday session printing and higher low

and a higher high for the day. Both the stochastic indicator and the RSI are pointing higher and

both have room to the upside. Our own indicator is issuing a sell-signal. The Bollinger Bands

have contracted and look as though they might be ready to expand again. That would indicate

more volatility will likely be seen in the near future. The daily Heikin-Ashi chart is solidly

bullish. The weekly chart is bullish showing that the next resistance level is at 98.25 and then at

98.59. The monthly chart shows that we are midway to the recent 100.60 high seen on

December of 2015. The old high was 121.29 which was seen in July of 2001, a long time ago.

The resistance level of 100.60 has seen several attempts to break, but so far has held the market

back from further rallies. The most frequently traded price was in the overnight session and was

96.95. The most frequently traded price was 97.475-97.50. 14.2% of the day’s volume was

traded at 97.50. The Friday high was printed at 12:20 after which the market drifted on mostly

light volume. Remember, as the US Dollar rallies, most dollar based commodities will fall.

Gold is the only outlier, insomuch as it acts as a commodity sometimes and then it acts as a

currency other times. A strong US Dollar can buy lots of stuff in let’s say London where the

Pound is down quite a bit. That said, the strong US Dollar hurts the US based companies that

want to sell stuff globally. Cheap imports also hurt American made products because they

compete for the consumer’s purchase. As an additional point, increased costs such as labor costs

and raw material costs cannot be passed onto the consumers.

Crude oil retreated in the Friday session trading in the downward trending channel of 48.14 to

43.00. The trading is getting very narrow, the volume is dropping and we are beginning to coil.

There is support at 42.42. All the indicators we follow herein are pointing lower with plenty of

room to the downside. The 5-minute TradeFlow chart shows a rally into 2:40 or so and then

sideways action on low volume.

Gold lost 8.90 in the Friday session. Both the stochastic indicator and the RSI are pointing lower

with plenty of room to the downside. Our own indicator is issuing a buy-signal. We see good

support at 1310.70 and at 1306. Below that level there should be support at 1287.70. The

Bollinger Bands are contracting telling us that the volatility is subsiding. The weekly chart is

negative and indicates that further action to the downside should be expected. The monthly chart

is giving us mixed signals and has a doji candlestick which warns us that the direction could

change. This is not a reliable signal especially since it is on the monthly chart. The Heikin-Ashi

chart shows the rounding action seen in the last half dozen sessions and could be a base building.

It is still too early to tell on this one. The five-minute TradeFlow chart is negative. The take-

away from this is, be cautious and watch the action of gold. We are getting too many mixed

signals which tells us that we should not trade on this information until we have more clarity.

Risk

Trading futures, options on futures and retail off-exchange foreign currency transactions involves

substantial risk of loss and is not suitable for all investors.

Past performance is not necessarily indicative of future results.

Copywrite 2016 The Option Royals