Financial Crisis in Japan – 4 phases

description

Transcript of Financial Crisis in Japan – 4 phases

Latest Developments of The World Economy

Daisuke KotegawaResearch Director, Canon Institute for Global Studies

June 18, 2013

National Research UniversityHigher School of Economics

22

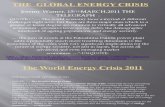

The financial crisis in Japan can be divided into 4 phases

Financial Crisis in Japan – 4 phases

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08

-2

-1

0

1

2

3

4

5

6

7Stock Price and GDP Growth Rate in JapanYen (%)

Nikkei 225 Index(left scale)

Real GDP Growth Rate(Shadow, right scale)

Lost Decade

Phase1 (1992-93)

Phase2 (1995)

Phase3 (1997-1999)

Phase4 (2001-2002)

33

Financial Crisis in Japan – Phase 3 (1997-1998)1. What happened?

On November 4, due to the bankruptcy of Sanyo Securities, the first default of financial debt in the short-term money market occurred, rendering the money

market dysfunctional

Scandals among bureaucrats in Ministry of Finance - cozy relationships between traditional bureaucracy and banks

November 3, Sanyo Securities (7th largest) went bankruptNovember15, Hokkaido-Takushoku Bank went bankrupt

November 24, Yamaichi Securities (4th largest) announced its liquidation (Nov.24)November 26, Tokuyo-City Bank went bankrupt

The resulting credit crunch caused by the banks had a negative impact on the economy. GDP recorded negative growth (-0.1%) in 1997, first time since WWII.

The stormy Financial System Parliament – debated a lot of important financial system related laws

Consecutive bankruptcies of the financial institutions, including large banks and securities in a short time (so called “Black November” in 1997)

I was the director in charge in MOF

Bear Sterns (7th largest)Lehman Bros.(4th largest)

4

• Top executives of four major entities which either collapsed or nationalized (i.e. Hokkaido-Takushoku, Yamaichi, Long Term Credit Bank and Nippon Credit Bank) were arrested for the allegations of illegal conducts, including window dressing settlement of their BS.

• After several years of court proceedings, those of LTCB were found innocent by the Supreme Court. Those of NCB are under review by the Supreme Court. Others served time in jail.

Arrest of top executives—Necessary sacrifice?

BRICs:1/3% the world (2008:1/2)

Recently: about 3%of the world

Japan

of which:1/3 EU

China:25% of the world

1980s: about 10% of the world

of which:50% USAAdvanced countries:1/3

Contribution to world economic growth (2001 -2006 )

Overview of Global Economy

How this gapcan be filled?

Total :25% of world growth

1980s: USA and EU:about 35% of the world

Not recover until 2014

Not recover until 2018

Emerging countries:1/3 BRIC s other than China: about10%of the world

66

Set of Measures

1. The measures to protect financial sector from further adverse developments in the ongoing crisis, ( Safety Net )i.e., the package of three measures,

recapitalizations, the disposal of non-performing loans. guarantees on inter-bank lending and

2. The implementation of these measures. This includes actual injection of public money and the disposal of non-performing loans.

3. The measures to be taken to avoid a vicious cycle between problems in financial sector and those of real economy. (Fiscal Stimulus)

4. The lessons learned from the ongoing crisis and the measures to be taken in order to avoid the repetition of the crisis in the future. This include, among other things,

strengthening transparency and accountability enhancing sound regulation promoting integrity in financial markets reinforcing international cooperation, and reforming international financial institutions.

5. The architecture of future global financial systems.

Established among advanced countries

Work-in Process

Not yet completed

Work-in Process

Done

Urgent

Necessary

Not Urgent

Not Urgent

7

• In the financial crisis in Japan, US urged

a hard landing with three principles; No bail-out of banks, To maintain short-selling scheme, and Observe mark-to-market accounting.

• All of these principles were breached in the ongoing crisis

US vs Japan

88

Corporate

Household

Net Export

Asset

Balance Sheet Adjustment

Government

Repayments

RepaymentsOver-borrowing

GNP GNP

GNP Shrinks without Stimulus

Liability LiabilityAsset

Over-borrowing

With stimulus GNP not shrink

How long attack from market continue?

Effectively Insolvent

Excess Liquidity

Investment banks western countries

Deficit countries

Short salesCDS

Short-term high

return

Escape from

insolvency

IMF,EU

Fiscal austerity

Vicious Circle

Recovery of housing prices has been delayed

Keys to recovery are disposal of non performing loans of financial institutions and recovery of real economy

Current stability of financial system is pretentious thanks to relaxation of accounting rules

Are the improvement in unemployment rate and favorable consumption figures good sign to recovery?

Job creation by fiscal stimulus is essential

Country of key currency does not have to worry about trade deficit

US economy

No !!

Those who gave up job search

Part-timer

11

UK, USA vs Continental Europe

Introduction of financial transaction tax

1. Expansion of ESFS to 2 Trillion Euro

By way of regular tax revenue

difficult

Europe - What is happening under the table since last fall?

Adverse effect on the City and Wall Street

Concentration of risk on ECB

Consequent additions of equities by ECB member countries

2. Purchase of Government bonds by ECB

12

Spain - NPLs of bank, Debt ratio of government

Injection of capital to banks in Spain by ECB

Injection of capital to banks in Japan(1998,1999)

Needs 100 billion

About 93 billion

GNP of Japan=4 times of GNP Spain

Greece - Debt ratio of government

Italy - Debt ratio of government

Relaxation of Loan condition by IMF & EU

Government bonds can be sold in the market?

Issues in European economy

September 12Constitutional Court of Germany

13

Reinstatement of Glass Steagal Act

Subscription for Europe

Biggest Issue in presidential election

Socialist parties in Germany & France

JPMorgan Problem = loss of US$ 2billion

2. Offense

LIBOR manipulation Victims – Local communities of US

Money Laundering HSBC, Standard Chartered

Part of UK & Sandy Weil

Destroy Investment banks

LoansInvestments

Deposits

Other Liab

Equity

Essence of Banking

Liabilities

Asset

100 50

10

100 - 10 =90

Credit Creation

15

Problem of Cyprus Scheme I

When a bank fails, shareholders first take loss, then creditors. Depositors are always asked to take loss last .

Banks can creates credits based upon depositors’ confidence

Investment banks gamble and lose money

In order to maintain confidence, governments usually put priority on protecting deposits by way of deposits insurance

Banks operates by deposits (=other people’s money)

In the financial crisis in Japan, all amount of deposits were protected. Ceiling on the deposits eligible for protection was put only after crisis was over

16

Problem of Cyprus Scheme II

Deposits in US and UK banks would not be protected.

Lack of protection on deposits over certain amount in Cyprus triggered capital flight from Spain

There is a joint paper by the FDIC and the Bank of England in December 2012

Capital flight from endangered European countries to USA.

Dutch finance minister said “Cyprus scheme will be a template”

Title II of Dodd-Frank Act Losses of any financial company placed into receivership will not be borne by

taxpayers, but by common (depositors) and ----other unsecured creditors

Is this a right move? No!