Exchange traded funds complete presentation 29-jan_2013

-

Upload

national-stock-exchange-of-india-limited -

Category

Economy & Finance

-

view

4.410 -

download

1

description

Transcript of Exchange traded funds complete presentation 29-jan_2013

KnowledgeHOUR

EXCHANGE TRADED FUNDS

YUVRAJ PATIL

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 2

ETFs are mutual funds that trade like a stock

Exchange Traded Fund (ETF)

– Simplicity– Transparency– Risk control– Diversification– Open-End Fund

Stock:– On Exchange– Trading flexibility– Trading strategies

+MUTUAL FUND STOCK

EXCHANGE TRADED FUND

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 3

ETF SETTLEMENT CYCLE

S. No. Day Time Activity

1. T - Trading day

2. T+1 1300 Custodial Confirmation

3. T+1 1430 Final Obligation download

4. T+2 1100 Securities and Funds pay-in

5. T+2 1330 Securities and Funds pay-out

6. T+2 - Auctions for shortages

7. T+3 - Securities Auction & Funds pay-in/pay-out

KnowledgeHOUR

ETF – A WORLD SCENARIO

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 5

A BRIEF HISTORY OF ETFs ETFs were launched post the 1987 crash to overcome the lack of liquidity and intense

program trading in the market

The first ETF traded on a U.S. exchange was StateStreet’s SPDR (SPY), which was

introduced in 1993. SPY tracks the S&P 500 Index and is currently the most heavily-

traded security in the world.

Due to popularity of indexing in the 1990s, ETFs soon became popular amongst individual

investors and financial advisors as a transparent and liquid method of indexing which was

also better than index mutual funds

As the availability of ETFs grew for different asset classes, investment styles and

geographic sectors, it made possible for investors to construct a well diversified portfolio

at a very low cost

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 6

GLOBAL ETF MARKET

Source: http://www.blackrockinternational.com (Nov-12)

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

0

500

1000

1500

2000

2500

3000

3500

4000

4500

5000

$0.80

$1,677

3

4542

ETF Assets # Total ETFs

Ass

ets

(USD

Bn)

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 7

ASIAN ETF MARKET

Source: http://www.blackrockinternational.com

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012$0

$20

$40

$60

$80

$100

$120

0

100

200

300

400

500

600

$10

$111

12

491

ETF Assets # Total ETFs

USD

Bill

ion

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 8

KEY BENEFITS OF ETF

• The challenging market conditions in 2008-09 caused a significant shift in investors’ risk appetite and in their desire for liquidity. ETFs met their need for greater transparency regarding cost, holdings, price, liquidity, product structure, and risk and return.

Diversified Exposure To Market

Buy And Hold Investing

Active Trading Alternative To Futures*

Cost Advantage

Broad Market Access

Easy to Implement

any Inv. Strategy

Core/Satellite Investing

Hedging

* For ETFs in US markets where the underlying is futures

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 9

FACTORS DRIVING ETF GROWTH

1

2

3

4

5

6

Large variety of indices of Equity, Fixed income, Commodity and other covered by ETFs

Facilitation of investor education & trading by large broking houses

Special market campaigns by many on-line brokers in an effort to win new accounts and cross-sell other products

Major fund platforms embracing ETFs

Regulatory changes in the US, Europe and many emerging markets that allow funds to make larger allocations to ETFs

Development and growth of investment styles that employ products like ETFs that deliver low cost beta

KnowledgeHOUR

ETF – THE INDIAN STORY

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 11

INDIAN ETF MARKET

* Average Quarterly AUM Source www.amfiindia.com

Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Sep-120

2000

4000

6000

8000

10000

12000

14000

0

5

10

15

20

25

30

35

AUM Gold ETF AUM Other ETF #ETF

AU

M (I

NR

Cror

e)

Num

ber o

f ETF

s

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 12

ETFs IN INDIA

• Gold ETF

• Liquid ETF

• Index ETF

– Nifty

– Junior Nifty

– Bank Nifty

– PSU Banks

– Shariah

• International Index ETF

– Hang Seng

– S&P CNX 500

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 13

ETFs: BENEFITS FOR THE RETAIL INVESTOR

1

2

3

4

5

Very Simple to Trade: Can be traded on NSE like any stock

Quick Diversification: Opens up multiple asset classes are affordable costs

Economical: Lowest expense ratio amongst all equity mutual funds

Only brokerage payable in buying or selling on exchange

You can track your investment value in real time

Safe

Simple

Fast

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 14

TYPICAL INVESTMENT PATTERN

Fixed Income Investment

Equity Investment

Bank Savings

Account

Fixed Deposits

Provident Funds

Cash Holdings

Few Stocks or Mutual

Funds

• This is a typical salaried individual’s investment pattern

• As we can see it is heavily tilted towards fixed income products, including his retirement savings

• This lopsided investment pattern exposes the individual to the risk of inflation and inefficient utilization of his assets

• There is a strong need to rebalance the portfolio to improve the returns and counter the risk of inflation

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 15

CORRECTING THE INVESTMENT TILT

• The best way to correct this is – To participate in the economic growth by a broad

exposure to the Indian markets– To include gold in portfolio to hedge against the

inflationary pressures– To insure against distress situations by investing in gold

• The Nifty 50 offers you an avenue to participate in the growth of Indian economy and benefit from the same

• Nifty ETF is a simple and economical way to invest in the Nifty

• Gold investment is at its simplest with Gold ETFs• They allow investors to accumulate pure gold as

and when they are ready for it.

NIFTY ETF

GOLD ETF

SAFE SIMPLE SECURE

KnowledgeHOUR

NIFTY ETF

KnowledgeHOUR

NATIONAL STOCK EXCHANGE

NIFTY ETF

– Blue chip stocks

– Well diversified

– Highly liquid

– Represents Indian business economy

Why NIFTY?

– Direct investment in benchmark index

– Lower Cost

– More Transparency

– More Flexibility

– Small ticket size

Why NIFTY ETF?

Nifty ETF is the simple and safe way to access equity markets

17

Jan-94 Dec-95 Nov-97 Oct-99 Sep-01 Aug-03 Jul-05 Jun-07 May-09Apr-110

1000

2000

3000

4000

5000

6000

7000

Jan-94 1083.74

Dec-12 5870.95

S&P CNX Nifty Index

KnowledgeHOUR

NATIONAL STOCK EXCHANGE

NIFTY ETF: A COMPARISON

Narrow Broad Broad

High Low Low

Low High Low

High Low Low

Market Rates NAV at EOD Market Rates

Yes No Yes

No May Be Yes

Yes No Yes

STOCKS NIFTY MUTUAL FUND

NIFTY ETF

EXPOSURE

VOLATILITY

EXPENSE

CAPITAL REQ

PRICE

ARBITRAGE

MARKET RETURNS

INTRADAY TRADING

18

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 19

NIFTY ETF: KEY BENEFITS

1

2

3

4

5

6

Simple: Can be traded on NSE like a stock

Instant Diversification: Single scrip to trade in a broad Indian market

Economical: Lowest expense ratio amongst all equity mutual funds

Auto Balancing: No need to rebalance portfolio after corporate actions

No costs other than brokerage are payable in buying or selling on exchange

You can track your investment value in real time

Safe

Simple

Fast

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 20

NIFTY ETF – SPECIFICATIONS

Type of fund Equity ETF

Investment In basket of securities replicating the S&P CNX NIFTY index

Taxation treatment Equity

Pricing per Unit ~ 1/10th of Index

Tick Size INR 0.01

Minimum Lot (on Exchange) 1 unit

Minimum Lot (Direct) 10000 units

Expense Ratio ~ 0.50 %

Trading hours Same as cash market

Price Market determined, tracks NAV

Trade cycle T+2

Allocation Pattern

Securities covered by S&P CNX Nifty Index Upto 100%

Money market, securitized debts, bonds and cash at call 0 – 10%

KnowledgeHOUR

GOLD ETF

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 22

WHY INVEST IN GOLD ?

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 23

0 5,000 10,000 15,000 20,000 25,000 30,000 35,0000

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Price of 10 Grams of GoldPric

e of

Bas

ket o

f Goo

ds

Correlation = 94%

• If we look at the inflation data, represented here by the price of a fixed basket of goods, against the gold prices, we will see that these have a very high correlation

• Which means that any rise in the inflation will be reflected in the rise in gold price

Source: Inflation data (Historic Inflation Rates for India http://www.inflation.eu) & Gold Price (Annual Average Prices in INR www.gold.org)

GOLD IS A HEDGE AGAINST INFLATION

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 24

WHY INVEST IN GOLD

EVEN DURING PERIODS OF CRISES,

GOLD HAS BEEN A SAFE HAVENInvesting in gold is similar to holding insurance for uncertain times

-150

-100

-50

0

50

100

150

200

Pe

rce

nt

Re

turn

s

Great De-pression

World War 2

Arab Oil Embargo

Japanese Stock Bubble

Asian Crisis

Dotcom Bust

Sub Prime Crisis

19291929 198919891973197319391939 200720072000200019971997

Gold ReturnsEquity

Returns

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 25

WHY INVEST IN GOLD

GOLD IS A FUNDAMENTALLY DIFFERENT ASSETECONOMICALLY SECURE

ASSET

INCONTROVERTIBLE LIQUIDITY

HIGH PUBLIC OCNFIDENCE

An asset which is no one’s liability

HenceNo risk of inflationNo risk of repudiation

Unaffected by exchange controls or asset freezes

Most central banks have increased gold as a percentage of total reserves in the previous decade

0%

10%

20%

30%

40%

50%

60%

70%

80%

-20%

-10%

0%

10%

20%

30%

40%

50%

21%

39%

31%

26%

2%

2%

-15% 0% -2%

20002012

Gold as a Percentage of National Reserves

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 26

WHY INVEST IN GOLD ETF?

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 27

GOLD ETFW

hat m

akes

it a

ttra

ctive

?G

old

ETF

Unit of Dematerialized Gold

Lists and trades on a stock exchange

Every ETF unit is backed by physical gold

Efficient

No wastage, impurities & extra charges

Tax Efficient

Tax efficient way to hold gold

Convenient

Can be purchased in small lots, typically 1 gram

Transparent

Transparent real time prices

SIMPLE

SAFE

TRUSTED

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 28

GOLD ETF: KEY BENEFITS

1

2

3

4

5

6

7

Your ETFs are backed by high quality physical gold

Your gold is safely stored in highly secure vaults

Lots of 1000 gm equivalents can be converted into physical gold

You can sell yours ETFs on the exchange like a share

No costs other than brokerage are payable in buying or selling on exchange

No wealth tax unlike physical purchase, also LTCG benefit available after one year

You can track your investment value in real time

Pure

Safe

Easy

Fast

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 29

GOLD ETF – SPECIFICATIONS

Type of fund Non Equity ETF

Investment In underlying physical gold

Taxation treatment Debt

Unit ~1 gm of gold, typically

Tick Size INR 0.01

Minimum Lot (on Exchange) 1 unit

Minimum Lot (Direct) 1000 units

Expense Ratio ~ 1.00 %

Trade hours Same as cash market

Price Market determined, tracks NAV

Trade cycle T+2

Allocation Pattern

Gold 90 – 100%

Money market, securitized debts, bonds and cash at call 0 – 10%

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 30

GOLD ETF: CREATION UNIT & NAV

UNIT CREATION

One creation unit =

1 kg of Physical Gold +

Cash Component

Units in 1 Creation Unit 1000NAV per unit INR 2025

Value of one creation unit INR 2,025,000Value of 1 kg Gold INR 2,050,000Cash Component1 INR - 25,000

Market Value or Fair Value of Schemes Investments2

Net Current Assets (including accrued expenses)+

Number of Units Outstanding as on Valuation Date

NAV (INR) =

NAV COMPUTATION

1 Cash Component will vary depending upon the actual charges incurred like Custodial Charges and other incidental charges for creating units2 Valuation of investments will be done as specified by the issuer in the Scheme Document

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 31

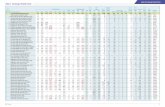

LISTED GOLD ETFsName Inception AUM

(INR Crores) Unit Size (gm)

Goldman Sachs Gold ETF Feb-07 3,023 1 Reliance Gold ETF Nov-07 2,899 1 Kotak Gold ETF Jul-07 1,135 1 SBI Gold ETS Apr-09 988 1 UTI Gold ETF Mar-07 701 1 HDFC Gold ETF Jul-10 687 1 Axis Gold ETF Nov-10 292 1 ICICI Prudential Gold ETF Jul-10 182 1 IDBI Gold ETF May-11 119 1 Birla Sun Life Gold ETF Nov-11 116 1 Religare Gold ETF Feb-10 71 0.5 Quantum Gold Feb-08 48 1 Canara Robeco Gold ETF Mar-12 47 1 Motilal Oswal MOSt Shares Gold ETF Mar-12 27 1

TOTAL 10037

* The AUM as on Sep 2012 (Source: www.valueresearchonline.com)

KnowledgeHOUR

THANK YOU

KnowledgeHOUR

ANNEXURES

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 34

Annexure 1: The Unit Creation of an ETF

CREATION UNIT

Creation Unit

=

Portfolio Deposit

+

Cash Component

1 Cash Component will represent accrued Dividends, accrued annual charges including management fees and residual cash in the Scheme. It will also include transaction cost as charged by the Custodian/ Depositary Participant, equalization of Dividend and other incidental expenses for Creating Units. It will also include Entry Load, as may be levied by the Fund from time to time and statutory levies, if any.

A pre-defined basket of Securities that represent the underlying index or gold as announced by the Fund on daily basis

The Cash Component represents the difference between the Applicable NAV of a Creation Unit and the market value of the Portfolio deposit.

UNIT CREATION PROCESS

The requisite Securities or gold constituting the Portfolio Deposit of the scheme have to be transferred to the Fund’s DP account (or vault) while the Cash Component has to be paid to the Custodian/AMC

On confirmation of the same by the Custodian/AMC, the AMC will transfer the units of the Scheme into the investor’s DP account

A fixed number of units of the scheme, which is exchanged for a basket of shares underlying the index(or gold) and cash

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 35

Structure of an ETF

Redemption

PRIMARY MARKET SECONDARY MARKET

Authorized Participants & Large Investors

ETF Issuer

Buyer

Exchange

Seller

Buy & Sell

Market Making

Arbitrage

Creation

Cash

ETF Units

Cash

ETF Units

* Creation & Redemption of ETF units is done only in integral multiples of creation units.

KnowledgeHOUR

NATIONAL STOCK EXCHANGE 36

The NAV of an ETF

Market Value or Fair Value of Schemes Investments

Net Current Assets (including accrued expenses)+

Number of Units Outstanding as on Valuation Date

NAV (INR) =

NAV COMPUTATION

Note for Valuation for Gold:

The gold held by the Scheme shall be valued at the AM fixing price of London Bullion Market Association (LBMA) in US dollars per troy ounce for gold having a fineness of 995.0 parts per thousand, subject to the following

adjustment for conversion to metric measures as per standard conversion rates

adjustment for conversion of US dollars into Indian rupees as per the RBI reference rate