Revenue & Gross Margin Expansion Since Model S...

Transcript of Revenue & Gross Margin Expansion Since Model S...

Tesla Motors – Fourth Quarter & Full Year 2014 Shareholder Letter • Introduced All-Wheel Drive Dual Motor Model S & Autopilot in Q4 • Record quarterly production of 11,627 vehicles • Delivered 9,834 vehicles, as P85D production delays pushed some to Q1 • Expanded Supercharger network to cover US coast to coast & most of Europe • Expecting over 70% growth in vehicle deliveries in 2015 • Model X to begin shipping in six months

February 11, 2015

Dear Fellow Shareholders:

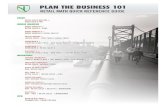

Tesla continues to drive the global transition to sustainable transport, with more pure electric car revenue than all other companies combined in 2014. From 2012 to 2014, Tesla non-GAAP revenue grew by almost 800% and GAAP revenue grew by almost 700% while gross margin simultaneously increased to unusually high levels by automotive standards. Moreover, as implied by the graph below, both vehicle production and demand are expected to accelerate in 2015.

In 2014, we also increased our number of stores and service centers by over 40%, expanded our Supercharger network by 400%, started construction of the Gigafactory and introduced numerous advances on Model S. As a result of this progress, we entered 2015 with over 10,000 orders for Model S and almost 20,000 reservations for Model X.

We built 11,627 vehicles in Q4, thus achieving our production target of 35,000 Model S vehicles in 2014. This required a herculean effort, because we held back release of our Performance All-Wheel Drive Dual Motor car (P85D) to ensure it would be a truly great experience for owners. While we were able to recover the lost production by end of the quarter, delivering those cars was physically impossible due to a combination of customers being on vacation, severe winter weather and shipping problems (with actual ships). As a result, about 1,400 vehicles slipped December and were delivered in Q1.

Our Q4 financials reflect this delivery shortfall, one-time manufacturing inefficiencies related to the introduction of P85D and Autopilot functionality, and the impact of the strong dollar. Even though the dollar has continued to strengthen by over 7% versus the euro in 2015, we believe we will be able to sustain a non-GAAP automotive gross margin of about 26% in Q1 by stabilizing production to improve manufacturing efficiencies. Without the sharp increase in dollar strength, Q1 gross margin would be about 28%. Tesla serves an international market and has a global supply chain, but most of the Model S is built in North America, so a strong dollar has a slightly negative net effect on profitability.

Non-GAAP - solid line GAAP - dashed line

0%

10%

20%

30%

40%

50%

60%

-

1

2

3

4

5

6

2012 2013 2014 2015 Guidance

Gro

ss M

argi

n

Rev

enue

($ b

illio

ns)

Revenue & Gross Margin Expansion Since Model S Introduction

(excluding ZEV credit revenue)

Non-GAAP - solid line!GAAP - dashed line!

Vehicle Enhancements & Market Expansion

We launched the P85D in November to the enthusiastic reception of automotive reporters and car buyers. Motor Trend called the Model S P85D the “quickest sedan in the world” and a YouTube video of thrilled passengers went viral. Customers responded by placing a record number of Model S orders in the quarter. While the level of Q4 orders likely reflects some pent up demand from customers who had been waiting for an all-wheel drive Model S, we also note very few customers have had an opportunity to see, or even test drive, our most innovative car yet. As our All-Wheel Drive Dual Motor cars become available in Q1 for customer test-drives worldwide, we expect this hands on experience will be a catalyst to even more orders.

Autopilot equipped cars now have traffic aware cruise control, forward collision alert, and automatic high beam dimming. Several additional autopilot features will be introduced in Q1 and Q2. With software enhancements, appropriately equipped cars are even faster and more efficient, can predict trip range based on elevation data, automatically learn a driver’s unique commuting pattern and prepare the cabin temperature for daily trips, and provide greater parking assistance with improved feedback. Our customers are delighted to find these new features added to their cars overnight, with just a finger touch on the center console of their Model S. We are also continuously improving Model S with hardware enhancements such as our optional next generation front seats, executive second row seats and a second row center console.

Our Q4 entry into Australia capped a year of international expansion, in which we launched Model S in five countries and doubled our number of sales and service locations internationally. This year, we intend to continue to grow our sales and service locations in all our existing markets. Despite initial challenges in China, we remain convinced of the vast potential of this market and are concentrating our efforts on the cities we are in currently, before launching into new cities. Our China initiatives include simplifying the buying process there by having Tesla personnel install charging points at customer homes or businesses well before vehicle delivery. We now offer a turn-by-turn navigation option in China that we provided retroactively through a remote software upgrade to all our customers with appropriately optioned cars, and we believe our new executive seats and second row center console will be quite popular with new China customers.

Our charging solutions are becoming even more widespread, helping our customers to conveniently travel much further away from home. In Q4, we installed a quarterly record of 125 Supercharger stations, and now have 380 Supercharger stations energized globally. As an extension of our Supercharger network, hotels and popular destinations have been installing our high-powered wall connectors at such a rapid pace that we are now coordinating these efforts as a Destination Charging program. Almost 900 locations in Asia and North America currently have 1,600 Tesla connectors installed. We plan to expand the Destination Charging program into Europe in Q2 of this year.

Model X development remains on plan for initial customer deliveries starting in Q3. Over 30 Beta Model X vehicles have been built and are undergoing extensive testing. The results of initial Beta phase crash testing have given us confidence that

Model X will live up to the very high safety standard set by Model S. In March, we will start building and testing a small fleet of Release Candidate Model X vehicles that will be very close to the final production-intent design. Finally, since Model S and Model X will share the same dual motor powertrain, the introduction of All-Wheel Drive Dual Motor Model S helps reduce some of the risk that would otherwise have been associated with the launch and production ramp of Model X.

P85D: Great Handing in All Conditions

Model S – Sydney, Australia

Productivity Improvements and Capacity Expansion

Ahead of the Model X launch in Q3, we plan to expand capacity in several areas. In our Lathrop manufacturing facility in central California, we are installing a state of the art, highly automated casting and machining operation for various aluminum components used on both Model S and Model X. We are also increasing production on our new drive unit line to meet All-Wheel Drive Dual Motor demand.

In late summer, we plan to begin Model X body production in our new robotic body assembly shop that will run in parallel with our current Model S body shop. Shortly thereafter, we plan to start painting Model S and Model X vehicles in our new paint facility in Fremont. Should we achieve our design targets, this new paint shop will set new standards for high volume paint shops worldwide in terms of paint quality, labor and energy efficiency, and low environmental impact. It will also be flexible enough and have the capacity to paint Model 3 in the future. These and other investments should provide us with sufficient capacity to increase our production to 2,000 vehicles per week by year-end.

Construction activity is proceeding to plan at our Gigafactory near Reno, Nevada. Significant steel fabrication of the structure started about two months ago. We remain on plan to begin equipment installation later this year and for the start of battery pack production in 2016, in partnership with Panasonic.

Q4 & Full Year Results

As always, this letter includes non-GAAP financial information because we plan and manage our business using such information. Our non-GAAP measures align the recognition of revenues and costs related to a vehicle sale with the time when the customer actually gets the car and we receive cash.

Note that this differs from the approach of other automotive manufacturers who under GAAP accounting recognize revenue when the vehicle is sold into dealership inventory rather than to end customers, even though in the case of a captive finance lease they may not collect cash for several years on a consolidated basis.

Our non-GAAP revenue and gross profit is determined by adding back the deferred revenue and related costs for cars sold with residual value guarantee and where we have collected, or will collect from a bank intermediary in a matter of days, the purchase price of the car in cash. For cars leased directly by Tesla, we recognize lease revenue and related costs over the lease term and the same way for both GAAP and non-GAAP purposes. In Q4, Tesla directly leased 647 cars to customers with $65 million of transaction value. Our non-GAAP expense and per share information also exclude non-cash stock-based compensation and interest expense.

Non-GAAP revenue was $1.1 billion for the quarter, up 44% from a year ago, while GAAP revenue was $957 million. Automotive revenue for Q4 includes $42 million of powertrain sales primarily to Daimler. It also includes $86 million of total regulatory credit revenue, of which $66 million came from the sale of ZEV credits.

In 2014, about 55% of new Model S vehicles were delivered into North America. While North American Model S orders grew year-on-year, deliveries were about flat as we directed vehicles into Asia/Pacific (APAC) markets to support our first year of deliveries there. The APAC region represented about 15% of our deliveries for the year, and the remaining 30% of deliveries were to Europe, where delivery volume more than doubled from a year ago. Since we remain production constrained, we manage regional deliveries to balance customer wait times globally.

Gigafactory Construction Continues

The average selling price of Model S increased during the quarter, but not as much as expected given the late introduction of P85D, the effect of the strong dollar on foreign sales, and the deferral of revenue related to additional Autopilot functionality that will be implemented in future software releases. Moreover, we offered small discounts when selling our remaining marketing and service loaner vehicles that did not have the desired Autopilot capability, which was recently introduced.

We achieved a Q4 total company gross margin of 26.7% on a non-GAAP basis and 27.4% on a GAAP basis. Q4 automotive gross margin excluding ZEV credits was 22.0%, on both a non-GAAP and GAAP basis. Our quarterly average gross margin was pressured roughly half by revenue factors resulting in lower than expected average selling price (as explained above) and half from cost of goods sold factors. Our vehicle warranty reserves were generally consistent with last quarter.

Our operating expenses in Q4 were $297 million on a non-GAAP basis and $337 million on a GAAP basis. Non-GAAP operating expenses were up 15% from Q3 mainly because this was a record quarter of global expansion for us. We opened a record 21 new sales and service locations and 125 Superchargers locations during the quarter. Engineering work also continued on Model X and All-Wheel Drive Dual Motor.

Our Q4 non-GAAP net loss was $16 million, or a loss of $0.13 per share based on 125.5 million basic shares, while the Q4 GAAP net loss was $108 million or a loss of $0.86 per basic share. For full year 2014, our net income was $0.14 per share on a non-GAAP basis and a loss of $2.36 per share on a GAAP basis.

We had a $86 million net cash outflow from operations in Q4 primarily due to a $143 million increase in finished goods inventory primarily for cars in transit, $74 million of growth in accounts receivable related mainly to deliveries late in the quarter and $60 million of cash used for directly leasing vehicles. Capital expenditures in the quarter totaled $369 million, and cash at quarter end, including cash equivalents was $1.9 billion.

2015 Outlook

In 2015, we expect to deliver about 55,000 Model S and X vehicles, representing more than a 70% increase over 2014 deliveries. About 40% of these deliveries are planned for the first half of the year. First quarter production is expected to be about 10,000 vehicles due to it being a shorter quarter than in Q4 and approximately a week of factory downtime to allow the workforce to rest and tooling upgrades. Cars in transit to Europe and Asia must grow to support those markets, so we plan to deliver approximately 9,500 vehicles in Q1, an increase of over 47% from Q1 last year. In Q1, we expect to directly lease about the same percentage of cars that we did in Q4.

We expect that Q1 non-GAAP automotive gross margin should be about 26%, assuming no further strengthening of the US dollar in the latter half of Q1. Given that the euro has weakened another 7% since the beginning of the year, this impacts our gross margin by about 2 percentage points. We also expect GHG/CAFE credits to contribute one less percentage point to our non-GAAP automotive gross margin in 2015, than in Q4. Hence, our gross margin expectation of 26% in Q1 represents a significant improvement resulting from our efforts to increase manufacturing efficiency and deliver a richer mix of products.

In markets where the local currency has declined significantly versus the US dollar, we recently increased prices by only about half that decline. The benefit of this price increase generally begins in Q2 as it applies only to new orders and is not retroactive to the existing book of orders.

Our goal is to continue to improve Model S profitability and we believe we can achieve a 30% gross margin on Model S for Q4 of 2015, even with foreign currency rates at current levels. We expect these gross margin improvements will be partially offset during the introduction of Model X, as Model X gross margin will be suppressed for a few quarters from supply chain and production inefficiencies that are typical of a new product introduction. Eventually we should be able to grow Model X gross margin to a similar level as Model S.

Edinburgh Airport Gets Its First Supercharger

As we continue to invest in the long term growth of Tesla, 2015 capital spending and operating expenses will increase, but at a more moderate pace than last year. Capital expenditures are expected to be about $1.5 billion as we expand production capacity, complete Model X development, and invest in the Gigafactory, our stores and service centers. We also plan to grow our Supercharger network by over 50% this year as well as continue other product development programs, including Model 3.

Operating expenses are expected to grow roughly 12% to 15% sequentially in Q1, driven mainly by increased engineering and design efforts. Growth of sales, general and administrative expenses in Q1 will be more modest as we will be particularly focused on increasing operational efficiency. In total, our operating expense growth should slow significantly. We expect 2015 operating expenses to grow 45% to 50% annually, as compared to doubling in 2014. Overall we expect to achieve a significantly higher level of non-GAAP profitability this year than the prior year, despite a significant increase in Tesla direct leasing, which reduces both our non-GAAP and GAAP profitability.

Starting in 2015, we plan to reorganize the revenue and cost of revenue subsections of our income statement so that automotive revenue and gross margin reflect only new car sales activities, including regulatory credits. Revenues and gross margin for all of our other businesses such as powertrain sales, services, trade-in sales and stationary storage will be captured in the “Services and Other” section of the income statement. This should provide clearer disclosure of our core business of new car production and deliveries.

In total, our customers have now driven their Tesla vehicles over 750 million miles. We are looking forward to achieving significant milestones in 2015, in addition to seeing our customers reach the billion miles driven mark.

Elon Musk, Chairman & CEO Deepak Ahuja, Chief Financial Officer

Webcast Information

Tesla will provide a live webcast of its fourth quarter and full year 2014 financial results conference call beginning at 4:30 p.m. PT on February 11, 2015, at ir.teslamotors.com. This webcast will also be available for replay for approximately one year thereafter.

Non-GAAP Financial Information

Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis. On a non-GAAP basis, financial measures exclude non-cash items such as stock-based compensation, the change in fair value related to Tesla’s warrant liability, non-cash interest expense related to Tesla's convertible senior notes as well as one-time expenses associated with the early repayment of the Department of Energy Loan. Non-GAAP financial measures also exclude the impact of lease accounting on related revenues and cost of revenues associated with Model S deliveries with the resale value guarantee and similar buy-back terms, as this perspective is useful in understanding the underlying cash flow activity and timing of vehicle deliveries. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. These non-GAAP financial measures also facilitate management’s internal comparisons to Tesla’s historical performance as well as comparisons to the operating results of other companies. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Tesla's operating performance. A reconciliation between GAAP and non-GAAP financial information is provided below.

Forward-Looking Statements

Certain statements in this shareholder letter, including statements in the “Revenue & Gross Margin Expansion Since Model S Introduction” graph and “2015 Outlook” section; statements regarding gross margin expansion and profitability, statements relating to the progress Tesla is making with respect to product development, including future Autopilot features and Model X development and launch plans; statements regarding growth in the number of Tesla store, service center, Supercharger and Destination Charging locations; the timing, order catalysts, pace of production and international delivery expansion for Tesla vehicles, including the production volume, rate, and ramp expectation of our new production lines; growth in demand and orders for Tesla vehicles; the ability to achieve vehicle demand, volume, production, delivery, revenue, leasing, gross margin, spending, capital expenditure and profitability targets; productivity improvments and capacity expansion plans; and Tesla Gigafactory timing, partnerships, plans and output expectations, including those related to cell and battery pack production, are “forward-looking statements” that are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties, actual results may differ materially from those projected. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: Tesla’s future success depends on its ability to design and achieve market acceptance of Model S and its variants, as well as new vehicle models, specifically Model X and Model 3; the risk of delays in the manufacture, production and delivery of Model S vehicles, including All-Wheel Drive Dual Motor Model S, or the development, production and delivery of Model X and Model 3 vehicles; adverse foreign exchange movements; the ability of suppliers to meet quality and part delivery expectations at increasing volumes; any failures by Tesla vehicles to perform as expected or if product recalls occur; Tesla’s ability to continue to reduce or control manufacturing and other costs; consumers’ willingness to adopt electric vehicles; competition in the automotive market generally and the alternative fuel vehicle market in particular; Tesla’s ability to establish, maintain and strengthen the Tesla brand; Tesla’s ability to manage future growth effectively as we rapidly grow, especially internationally; the unavailability, reduction or elimination of government and economic incentives for electric vehicles; Tesla’s ability to establish, maintain and strengthen its relationships with strategic partners such as Panasonic; potential difficulties in finalizing, performing and realizing potential benefits under definitive agreements for the Tesla Gigafactory site, obtaining permits and incentives, negotiating terms with technology, materials and other partners for Gigafactory, and maintaining Gigafactory implementation schedules, output and costs estimates; and Tesla’s ability to execute on its retail strategy and for new store, service center and Tesla Supercharger openings. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our quarterly report on Form 10-Q filed with the SEC on November 7, 2014. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a resultof new information, future events, or otherwise.

Investor Relations Contact: Press Contact: Jeff Evanson Khobi Brooklyn Investor Relations – Tesla Communications – Tesla [email protected] [email protected]

Tesla Motors, Inc.Condensed Consolidated Statements of Operations(Unaudited)(In thousands, except per share data)

RevenuesAutomotive sales (1A)Development servicesTotal revenues

Cost of revenuesAutomotive sales (1B)Development servicesTotal cost of revenues (2)Gross profitOperating expensesResearch and development (2)Selling, general and administrative (2)Total operating expensesLoss from operationsInterest incomeInterest expenseOther income (expense), net (3)Loss before income taxesProvision for income taxesNet loss

Notes:(1)

(A) Net increase in deferred revenue and other long-term liabilities as a result of lease accounting and therefore not recognized in automotive sales

(B) Net increase in operating lease vehicles as a result of lease accounting and therefore not recognized in automotive cost of sales

Under lease accounting, warranty costs are expensed as incurred instead of accrued at the time of sale.

(2) Includes stock-based compensation expense of the following for the periods presented:

Cost of revenuesResearch and development Selling, general and administrative

Total stock-based compensation expense

(3)

Net loss per common share, basic and dilutedShares used in per share calculation, basic and diluted

Due to the application of lease accounting for Model S vehicles with the resale value guarantee or similar buy-back terms, the following is supplemental information for the periods presented:

Other income, net, for the year ended December 31, 2013 includes the gain from the elimination of the $10.7 million Department of Energy (DoE) common stock warrant liability.

Dec 31,2014

Sep 30,2014

Dec 31,2013

Dec 31,2014

Dec 31,2013

956,661$ 849,009$ 610,851$ 3,192,723$ 1,997,786$

- 2,795 4,368 5,633 15,710 956,661 851,804 615,219 3,198,356 2,013,496

694,964 598,472 453,578 2,310,011 1,543,878 - 1,481 5,051 6,674 13,356

694,964 599,953 458,629 2,316,685 1,557,234 261,697 251,851 156,590 881,671 456,262

139,565 135,873 68,454 464,700 231,976 196,970 155,107 101,489 603,660 285,569 336,535 290,980 169,943 1,068,360 517,545 (74,838) (39,129) (13,353) (186,689) (61,283)

219 300 92 1,126 189 (28,703) (29,062) (6,229) (100,886) (32,934)

(588) (3,090) 4,584 1,813 22,602 (103,910) (70,981) (14,906) (284,636) (71,426)

3,719 3,727 1,358 9,404 2,588 (107,629)$ (74,708)$ (16,264)$ (294,040)$ (74,014)$

(0.86)$ (0.60)$ (0.13)$ (2.36)$ (0.62)$ 125,497 124,911 122,802 124,573 119,421

138,973$ 80,544$ 146,125$ 400,185$ 464,166$

110,234$ 63,981$ 114,221$ 312,710$ 376,979$

Under lease accounting, warranty costs are expensed as incurred instead of accrued at the time of sale.

Includes stock-based compensation expense of the following for the periods presented:

5,053$ 5,383$ 3,455$ 17,454$ 9,071$ 17,595 16,639 10,578 62,601 35,494 21,869 17,136 14,056 76,441 39,090 44,517$ 39,158$ 28,089$ 156,496$ 83,655$

Year EndedThree Months Ended

Due to the application of lease accounting for Model S vehicles with the resale value guarantee or similar buy-back terms, the following is supplemental information for the periods presented:

Other income, net, for the year ended December 31, 2013 includes the gain from the elimination of the $10.7 million Department of Energy (DoE) common stock warrant liability.

Tesla Motors, Inc.Condensed Consolidated Balance Sheets(Unaudited)(In thousands)

Dec 31, Dec 31,2014 2013

AssetsCash and cash equivalents 1,905,713$ 845,889$ Restricted cash and marketable securities - current 17,947 3,012 Accounts receivable 226,604 49,109 Inventory 953,675 340,355 Prepaid expenses and other current assets 94,718 27,574 Operating lease vehicles, net (1) 766,744 382,425 Property and equipment, net 1,829,267 738,494 Restricted cash - noncurrent 11,374 6,435 Other assets 43,209 23,637 Total assets 5,849,251$ 2,416,930$

Liabilities and Stockholders' Equity Accounts payable and accrued liabilities 1,046,830$ 412,221$ Deferred revenue (2) 483,922 273,062 Customer deposits 257,587 163,153 Capital lease obligations 21,799 20,577 Long-term debt 2,408,084 586,301 Other long-term liabilities (3) 661,123 294,495 Total liabilities 4,879,345 1,749,809 Mezzanine equity (4) 58,196 - Stockholders' equity 911,710 667,121 Total liabilities and stockholders' equity 5,849,251$ 2,416,930$

Notes:(1)

Beginning balance 376,979$ -$ First quarter 69,743 - Second quarter 68,752 123,919 Third quarter 63,981 138,839 Fourth quarter 110,234 114,221

Ending balance 689,689$ 376,979$

Model S leasing programBeginning balance -$ First quarter - Second quarter 11,214 Third quarter 23,824 Fourth quarter 46,598 Ending balance 81,636$

(2)

Beginning balance $ 227,868 -$ First quarter 38,188 - Second quarter 33,586 74,455 Third quarter 27,993 84,577 Fourth quarter 48,836 68,836 Ending balance 376,471$ 227,868$

(3)

Beginning balance $ 236,298 -$ First quarter 54,318 - Second quarter 54,575 72,357 Third quarter 52,551 86,652 Fourth quarter 90,137 77,289

Ending balance 487,879$ 236,298$

(4) Our common stock price exceeded the conversion threshold price of our convertible senior notes due 2018 (2018 Notes) issued in May 2013; therefore, the 2018 Notes are convertible at the holder’s option during the first quarter of 2015. As such, the carrying value of the 2018 Notes was classified as a current liability as of December 31, 2014 and the difference between the principal amount and the carrying value of the 2018 Notes was reflected as convertible debt in mezzanine equity on our condensed consolidated balance sheet as of December 31, 2014.

Includes the following increase in operating lease vehicles related to deliveries of Model S and subject to lease accounting, net of depreciation recognized in automotive cost of sales, for the following periods:

Resale value guarantee program (and other vehicles with similar buy-back terms)

Includes the following increase in deferred revenue related to deliveries of Model S with the resale value guarantee or similar buy-back terms and subject to lease accounting, net of revenue amortized to automotive sales, for the following periods:

Includes the following increase in other long-term liabilities related to deliveries of Model S with the resale value guarantee or similar buy-back terms and subject to lease accounting for the following periods:

Tesla Motors, Inc.Supplemental Consolidated Financial Information(Unaudited)(In thousands)

Selected Cash Flow InformationCash flows provided by (used in) operating activities (1)Cash flows used in investing activities

Other Selected Financial InformationCash flows provided by (used in) operating activities (1)Capital expendituresFree cash flow (cash flow from operations plus capital expenditures) (1)

Depreciation and amortization

Cash and InvestmentsCash and cash equivalentsRestricted cash and marketable securities - currentRestricted cash - noncurrent

(1) During the three months ended June 30, 2014, we began separately presenting the effect of exchange rate changes on our cash and cash equivalents in our condensed consolidated statement of cash flows due to our growing operations in foreign currency environments. Prior period amounts have been reclassified to conform to the current period presentation.

Supplemental Model S Leasing Program Information(in thousands, except for vehicle deliveries)

Vehicles delivered

(1) Aggregate value is the product of multiplying vehicles delivered by the average per unit price of vehicles delivered

Aggregate value of vehicles delivered (1)Average per unit price of vehicles delivered

Leasing revenue recognized

Cash flows provided by financing activities

Dec 31,2014

Sep 30,2014

Dec 31,2013

Dec 31,2014

Dec 31,2013

(86,402)$ (27,996)$ 133,987$ (57,337)$ 264,804$ (372,231) (291,643) (89,507) (990,444) (249,417)

11,325 33,755 10,517 2,143,130 635,422

(86,402)$ (27,996)$ 133,987$ (57,337)$ 264,804$ (368,661) (284,175) (89,435) (969,885) (264,224)

(455,063)$ (312,171)$ 44,552$ (1,027,222)$ 580$

67,976$ 64,972$ 37,585$ 231,931$ 106,083$

Dec 31,2014

Sep 30,2014

Dec 31,2013

1,905,713$ 2,370,735$ 845,889$ 17,947 17,331 3,012 11,374 9,090 6,435

(1) During the three months ended June 30, 2014, we began separately presenting the effect of exchange rate changes on our cash and cash equivalents in our condensed consolidated statement of cash flows due to our growing operations in foreign currency environments. Prior period amounts have been reclassified to conform to the current period presentation.

Twelve Months Ended

Dec 31,2014

Sep 30,2014

Dec 31,2014

647 347 1,152 101$ 99$ 101$

65,246$ 34,353$ 115,782$

2,993$ 1,117$ 4,280$

(1) Aggregate value is the product of multiplying vehicles delivered by the average per unit price of vehicles delivered

Year EndedThree Months Ended

Three Months Ended

Tesla Motors, Inc.Reconciliation of GAAP to Non-GAAP Financial Information(Unaudited)(In thousands, except per share data)

Net loss (GAAP)Stock-based compensation expenseChange in fair value of warrant liabilityNon-cash interest expense related to convertible notesEarly extinguishment of DoE loansNet income (loss) (Non-GAAP) including lease accountingModel S gross profit deferred due to lease accounting (1)(2)Net income (loss) (Non-GAAP)

Stock-based compensation expenseChange in fair value of warrant liabilityNon-cash interest expense related to convertible notesEarly extinguishment of DoE loansModel S gross profit deferred due to lease accounting (1)(2)Net income (loss) per share, basic (Non-GAAP)

Net loss per share, basic (GAAP)

Shares used in per share calculation, basic (GAAP and Non-GAAP)

Dec 31,2014

Sep 30,2014

Dec 31,2013

Dec 31,2014

Dec 31,2013

(107,629)$ (74,708)$ (16,264)$ (294,040)$ (74,014)$ 44,517 39,158 28,089 156,496 83,655

- - - - (10,692) 20,826 22,160 4,299 75,019 10,350

- - - - 16,386 (42,286) (13,390) 16,124 (62,525) 25,685 26,072 16,564 29,796 82,626 77,878

(16,214)$ 3,174$ 45,920$ 20,101$ 103,563$

(0.86)$ (0.60)$ (0.13)$ (2.36)$ (0.62)$ 0.35 0.31 0.23 1.26 0.70

- - - - (0.09) 0.17 0.18 0.03 0.60 0.09

- - - - 0.14 0.21 0.13 0.24 0.66 0.65 (0.13)$ 0.02$ 0.37$ 0.16$ 0.87$

125,497 124,911 122,802 124,573 119,421

Year EndedThree Months Ended

Stock-based compensation expenseChange in fair value of warrant liabilityNon-cash interest expense related to convertible notesEarly extinguishment of DoE loansNet income (loss) (Non-GAAP) including lease accountingModel S gross profit deferred due to lease accounting (1)(2)

Shares used in per share calculation, diluted (Non-GAAP)

(2) Includes deliveries of Model S with the resale value guarantee or similar buy-back terms and not deliveries under the Model S leasing program.

(1) Under GAAP, warranty costs are expensed as incurred for Model S vehicle deliveries with the resale value guarantee or similar buy-back terms and subject to lease accounting. For Non-GAAP purposes, an estimated incremental warranty reserve of $5.5 million, $3.6 million and $3.2 million is included for the three months ended December 31, 2014, September 30, 2014 and December 31, 2013, respectively. For the year ended December 31, 2014 and 2013, an estimated incremental warranty reserve of $14.6 million and $12.2 million is included, respectively. Additionally, stock-based compensation of $1.0 million, $1.0 million and $1.1 million is excluded for non-GAAP purposes for the three months ended December 31, 2014, September 30, 2014 and December 31, 2013, respectively. For the year ended December 31, 2014 and 2013, stock-based compensation of $3.4 million and $2.9 million is excluded, respectively.

Net loss per share, diluted (GAAP)

Net income (loss) per share, diluted (Non-GAAP)

(0.86)$ (0.52)$ (0.12)$ (2.07)$ (0.55)$ 0.35 0.27 0.20 1.10 0.63

- - - - (0.08) 0.17 0.15 0.03 0.53 0.08

- - - - 0.12 (0.34) (0.10) 0.11 (0.44) 0.20 0.21 0.12 0.22 0.58 0.58 (0.13)$ 0.02$ 0.33$ 0.14$ 0.78$

125,497 142,747 137,784 142,221 133,546

(2) Includes deliveries of Model S with the resale value guarantee or similar buy-back terms and not deliveries under the Model S leasing program.

(1) Under GAAP, warranty costs are expensed as incurred for Model S vehicle deliveries with the resale value guarantee or similar buy-back terms and subject to lease accounting. For Non-GAAP purposes, an estimated incremental warranty reserve of $5.5 million, $3.6 million and $3.2 million is included for the three months ended December 31, 2014, September 30, 2014 and December 31, 2013, respectively. For the year ended December 31, 2014 and 2013, an estimated incremental warranty reserve of $14.6 million and $12.2 million is included, respectively. Additionally, stock-based compensation of $1.0 million, $1.0 million and $1.1 million is excluded for non-GAAP purposes for the three months ended December 31, 2014, September 30, 2014 and December 31, 2013, respectively. For the year ended December 31, 2014 and 2013, stock-based compensation of $3.4 million and $2.9 million is excluded, respectively.

Tesla Motors, Inc.Reconciliation of GAAP to Non-GAAP Financial Information(Unaudited)(In thousands, except per share data)

Revenues (GAAP)Model S revenue deferred due to lease accounting (2)

Gross profit (GAAP)Model S gross profit deferred due to lease accounting (1)(2)Stock-based compensation expense

Research and development expenses (GAAP)Stock-based compensation expense

Selling, general and administrative expenses (GAAP)Stock-based compensation expense

(2) Includes deliveries of Model S with the resale value guarantee or similar buy-back terms and not deliveries under the Model S leasing program.

(1) Under GAAP, warranty costs are expensed as incurred for Model S vehicle deliveries with the resale value guarantee or similar buy-back terms and subject to lease accounting. For Non-GAAP purposes, an estimated incremental warranty reserve of $5.5 million, $3.6 million and $3.2 million is included for the three months ended December 31, 2014, September 30, 2014 and December 31, 2013, respectively. For the year ended December 31, 2014 and 2013, an estimated incremental warranty reserve of $14.6 million and $12.2 million is included, respectively. Additionally, stock-based compensation of $1.0 million, $1.0 million and $1.1 million is excluded for non-GAAP purposes for the three months ended December 31, 2014, September 30, 2014 and December 31, 2013, respectively. For the year ended December 31, 2014 and 2013, stock-based compensation of $3.4 million and $2.9 million is excluded, respectively.

Revenues (Non-GAAP)

Gross profit (Non-GAAP)

Research and development expenses (Non-GAAP)

Selling, general and administrative expenses (Non-GAAP)

Dec 31,2014

Sep 30,2014

Dec 31,2013

Dec 31,2014

Dec 31,2013

956,661$ 851,804$ 615,219$ 3,198,356$ 2,013,496$ 138,973 80,544 146,125 400,185 464,166

1,095,634$ 932,348$ 761,344$ 3,598,541$ 2,477,662$

261,697$ 251,851$ 156,590$ 881,671$ 456,262$ 26,072 16,564 29,796 82,626 77,878 5,053 5,383 3,455 17,455 9,071

292,822$ 273,798$ 189,841$ 981,752$ 543,211$

139,565$ 135,873$ 68,454$ 464,700$ 231,976$ (17,595) (16,639) (10,578) (62,601) (35,494) 121,970$ 119,234$ 57,876$ 402,099$ 196,482$

196,970$ 155,107$ 101,489$ 603,660$ 285,569$ (21,869) (17,136) (14,056) (76,441) (39,090) 175,101$ 137,971$ 87,433$ 527,219$ 246,479$

(2) Includes deliveries of Model S with the resale value guarantee or similar buy-back terms and not deliveries under the Model S leasing program.

(1) Under GAAP, warranty costs are expensed as incurred for Model S vehicle deliveries with the resale value guarantee or similar buy-back terms and subject to lease accounting. For Non-GAAP purposes, an estimated incremental warranty reserve of $5.5 million, $3.6 million and $3.2 million is included for the three months ended December 31, 2014, September 30, 2014 and December 31, 2013, respectively. For the year ended December 31, 2014 and 2013, an estimated incremental warranty reserve of $14.6 million and $12.2 million is included, respectively. Additionally, stock-based compensation of $1.0 million, $1.0 million and $1.1 million is excluded for non-GAAP purposes for the three months ended December 31, 2014, September 30, 2014 and December 31, 2013, respectively. For the year ended December 31, 2014 and 2013, stock-based compensation of $3.4 million and $2.9 million is excluded, respectively.

Three Months Ended Year Ended