ECON 304 Money and Banking Instructor: Bernard Malamud Office: BEH 502

-

Upload

mckenzie-alvarado -

Category

Documents

-

view

28 -

download

0

description

Transcript of ECON 304 Money and Banking Instructor: Bernard Malamud Office: BEH 502

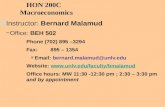

ECON 304Money and Banking

Instructor: Bernard Malamud

–Office: BEH 502

Phone (702) 895 –3294

Fax: 895 – 1354

»Email: [email protected]

Website: www.unlv.edu/faculty/bmalamud

Office hours: TR 11:30 -12:30pm; 2:30 - 3:30 pm; and by appointment

Headline: Obama to nominate Bernanke to second term.WASHINGTON — President Obama on Tuesday will nominate Ben S. Bernanke to a second term as chairman of the Federal Reserve, administration officials said. The announcement is a major victory for Mr. Bernanke, a Republican who was appointed by President George W. Bush almost four years ago and who had briefly served as chairman of Mr. Bush’s Council of Economic Advisers.A top White House official said Mr. Obama had decided to keep Mr. Bernanke at the helm of the Fed because he had been bold and brilliant in his attempts to combat the financial crisis and the deep recession.“The president thinks that Ben’s done a great job as Fed chairman, that he has helped the economy through one of the worst experiences since the Great Depression and that he has essentially been pulling the economy back from the brink of what would have been the second Great Depression,” the White House chief of staff, Rahm Emanuel, said Monday night.When Mr. Obama was elected, many Democrats considered one of the most likely contenders for Fed chairman to be Lawrence H. Summers, a former Treasury secretary under President Bill Clinton and currently director of the National Economic Council in Mr. Obama’s White House.Other rumored candidates included Alan S. Blinder, a professor of economics at Princeton and a former vice chairman of the Federal Reserve under Alan Greenspan; Janet L. Yellen, president of the Federal Reserve Bank of San Francisco; and Roger Ferguson, another former vice chairman of the Federal Reserve who is currently president of TIAA-CREF, the giant pension fund company.

• In the spring of 2007, Henry Paulson, the US Treasury secretary had told Congress that the subprime problem “appears to be contained. Bernanke, the Federal Reserve governor, repeatedly echoed that line. “Given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited.”In May, he continued, “Importantly, we see no serious broader spillover to banks or thrift institutions from the problems in the subprime market; troubled lenders, for the most part, have not been institutions with federally insured deposits.”In early June, after the collapse of Bear Stearns funds, Bernanke changed his tune slightly. “Rising delinquencies and foreclosures are creating personal, economic, and social distress for many home owners and communities – problems that likely will get worse before they get better…It seems very far-fetched to make any parallels with Japan’s crisis. The key thing to remember is that those loses are not just held by American banks, as bad as the loans were in Japan, but they are dispersed.”

Money, Banking, and Financial Markets• The role of money and monetary policy

TRUST

• How financial markets work

TRUST

• How financial institutions such as banks and insurance companies work

TRUST

• How the shadow banking system operates

TRUST?

• A security (financial instrument) is a claim on the issuer’s future income or assets

• A bond is a debt security that promises to make specified payments over time

– An interest rate is the cost of borrowing or the price paid for the rental of funds

Interest Rates on Selected Bonds, 1950–2008

Sources: Federal Reserve Bulletin; www.federalreserve.gov/releases/H15/data.htm.

• A security (financial instrument) is a claim on the issuer’s future income or assets

• A bond is a debt security that promises to make specified payments over time

– An interest rate is the cost of borrowing or the price paid for the rental of funds

• Common stock represents a share of ownership in a corporation

– A share of stock is a claim on the earnings and assets of the corporation

Banking and Financial Institutions

• Financial Intermediaries—institutions that borrow funds from people who have saved and make loans to other people and businesses

• Banks—accept deposits and make loans

• Other Financial Institutions—insurance companies, finance companies, pension funds, mutual funds and investment banks

• Financial Innovation– The information age and e-finance

– Derivatives

– Securitization

From Gillian Tett, Fool’s Gold The sun slipped slowly down the cerulean Spanish sky….[S]everal hundred

bankers stood on the elegant terrace of a futuristic, gleaming white hotel, staging a so-called champagne salute in celebration of the fact that investment banks had just enjoyed their most lucrative year in history. The date was June 11, 2007 and the occasion was the annual meeting of the European Securitisation…The meeting carried a lofty title: “Global Asset Backed Securitization; Toward a New Dawn.” An exuberant crowd including smooth talking, white toothed salesmen from large American banks, eagerly selling repackaged mortgage debt; self-deprecating British traders; and earnest, chain-smoking representatives from German insurance companies and banks. Their prey included asset managers from Italy, Spain, Germany, and Greece…A silent gaggle of Chinese and Singaporeans circulated. It was rumored that they were furtively buying CDOs to find a home for foreign exchange reserves. A few regulators could also be spotted, conspicuous in looking generally dowdier than the bankers. Some of the biggest delegations, though, came from the three credit rating agencies that were drawing fat profits from the CDO boom…Lively debate ensued about the American mortgage backed bond market, the CDO sector, the SIVs, the state of the Spanish mortgage market and the outlook for Russian ABS. There was even a high-profile debate on Islamic finance [which] some hoped would be a hot new growth area for securitization…

Innovation: Alphabet SoupABCP – asset backed commercial paperABS – asset backed securityCD – credit derivative, e.g., CDSCDO – collateralized debt obligationCDO2 – a CDO backed by CDOsCDS – credit default swapSIV – structured investment vehicleSPV – special purpose vehicle

Money Growth (M2 Annual Rate) and the Business Cycle in the United States, 1950–2008

Note: Shaded areas represent recessions.Source: Federal Reserve Bulletin, p. A4, Table 1.10; www.federalreserve.gov/releases/h6/hist/h6hist1.txt.

Money and Inflation• The aggregate price level is an average price of

goods and services in an economy

• A continual rise in the price level (inflation) affects all economic players

Money Growth (M2 Annual Rate) and Interest Rates (Long-Term U.S. Treasury Bonds), 1950–2008

Sources: Federal Reserve Bulletin, p. A4, Table 1.10; www.federalreserve.gov/releases/h6/hist/h6hist1.txt.

Monetary and Fiscal Policies• Monetary policy is the management of the money supply

and interest rates– Conducted by the Federal Reserve Bank (Fed)

• Fiscal policy is government spending and taxation – Any deficit must be financed by borrowing …

government borrowing affects interest rates

Bernanke’s Focus• Survival – Lender of last resort responsibility• Inflation Targeting

– Adjust “real” rate of interest with eye on pre-announced target rate of inflation

– Wiggle room for other objectives/emergencies– Transparency and accountability

• Joined by Mishkin on Board of Governors for while• Other Governors:www.federalreserve.gov/bios

– Oppose Deflation• Great Depression and clogged credit channel

Core Principles of Money and Banking

• Time has Value Interest rate• Risk Requires Compensation• Financial decisions are based on

Information and on TRUST• Markets set prices and allocate resources • Stability reduces risk and spurs enterprise

Where to Find the Numbers

• http://research.stlouisfed.org/fred2/• www.federalreserve.gov/releases/ • www.economist.com• www.bea.doc.gov• http://www.gpoaccess.gov/eop/

Functions of Financial Markets 101• Channel funds from those who have saved surplus

to those who need to borrow

Win - Win

• Promotes economic efficiency by producing an efficient allocation of capital

– increases production

• Improves consumer well-being

– allows them to time purchases better

Structure of Financial Markets:Address adverse selection & moral hazard problems

• Debt and Equity Markets

Short-term (maturity<1yr) /intermediate term/long-term (>10yrs)

• Primary and Secondary Markets– Investment Banks underwrite securities in primary markets

• Are any “investment banks” left?

– Brokers and dealers work in secondary markets liquidity

• Exchanges and Over-the-Counter (OTC) Markets

• Money and Capital Markets– Money markets short-term debt instruments– Capital markets longer-term debt and equities (stocks)

Principal Money Market Instruments

Principal Capital Market Instruments

Internationalization of Financial Markets

• Foreign Bonds—sold in a foreign country and denominated in that country’s currency: £ bonds in UK

• Eurobond—bond denominated in a currency other than that of the country in which it is sold: $ bond in UK

• Eurocurrencies—foreign currencies deposited in banks outside the home country– Eurodollars—U.S. dollars deposited in foreign banks outside

the U.S. or in foreign branches of U.S. banks

– Euroeuro – euros deposited in a British bank

• World Stock MarketsIndexes: USS&P 500/UKFTSE 100/GermanDAX/JapanNikkei

Function of Financial Intermediaries: Indirect Finance

• Lower transaction costs– Economies of scale– Liquidity services

• Reduce Risk– Risk Sharing (Asset Transformation: Risky less risky)– Diversification

• Asymmetric Information in Finance– Adverse Selection (before the transaction)—more likely to select

risky borrower– Moral Hazard (after the transaction)—less likely borrower will

repay loan

Principal Financial Intermediaries and Value of Their Assets

Regulation of the Financial System

• To increase the information available to investors:– Reduce adverse selection and moral hazard problems– Reduce insider trading

• To ensure the soundness of financial intermediaries:– Restrictions on entry: “upstanding citizens with impeccable

credentials” … and lots of capital upfront– Disclosure– Restrictions on Assets and Activities SIVs as end-run– Deposit Insurance– Limits on Competition/branching regulation as history– Restrictions on Interest Rates/Regulation Q as history

Disintermediation