UT Arlington CFA Challenge 2017

-

Upload

jason-warnstaff -

Category

Data & Analytics

-

view

27 -

download

1

Transcript of UT Arlington CFA Challenge 2017

CFA Institute Research Challenge

Hosted in

Southwest US – Local Challenge

Hosted by: CFA Societies Texas, Louisiana, New Mexico, and Oklahoma

The University of Texas at Arlington

This report is published for educational purposes only by students competing in the CFA Institute Research Challenge

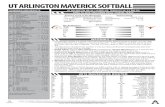

U. T. Arlington - Student Research Outpatient Rehabilitation Sector, Healthcare Industry

New York Stock Exchange U.S. Physical Therapy, Inc.

Date: 2/3/2017 Current Price: $71.45 Recommendation: Hold Ticker – NYSE: USPH Headquarters: Houston, TX Target Price: $66.07 USD

Highlights________________________________________________ We initiate coverage of U.S. Physical Therapy, Inc. (NYSE: USPH) with a HOLD recommendation based on a one-year target price of $66.07, which will give us a downside of 7.52% on February 2nd, 2018. Our recommendation is primarily driven by the following: • Financial Performance: U.S. Physical Therapy, Inc. has shown a Revenue Growth average of 9.47% since 2010. Revenue growth, Clinic operating costs, and M&A strategy are key drivers for financial growth. Operating costs are 75.51% of Revenue, in which Labor and Salary costs make up 71.06% of Operating Costs. Furthermore, the Board of Directors are very selective in any acquisition process, and how they play into the M&A strategy of growth the Board of Directors is pushing. • Valuation: Valuation methods show that there is an inherent value of $66.07 per share. While the financials currently look good for U.S. Physical Therapy, Inc., we feel there is no way that they can sustain their current or projected growth rate. We achieved this result through a mixture of Discounted Cash Flow analysis and relative multiple valuations.

• Risks: The largest risk by far to U.S. Physical Therapy, Inc. is the current political climate and how it will affect the ability of customers to pay for the services through either insurance or Worker’s Compensation. The second largest risk, but by no means any less damaging would be the inherently fragmented nature of the industry and the possibility of many new competitors and lack of new growth, with a main focus on M&A’s to grow. Recent News_______________________________________ • US Physical Therapy Completes First Acquisition of 2017 –

01/03/2017: U.S. Physical Therapy, Inc., a national operator of outpatient physical therapy clinics, announced that the Company has just completed the acquisition of a physical therapy practice that owns and operates 17 clinics and manages an additional 8 clinics. Source: Business wire

Stock Price vs Rebased S&P 500

52 Week Range $45.62 - 73.05Avg Daily Vol (3 Mo) 81,913Market Value (M) 885.9Ent Value (M) 960.7Shares Out (000) 12,522.00Dividend Yield 0.947%Float 96.00%Institutional 98.42%Top 10 Inst Hldrs 51.10%Analyst Coverage 6Target Price $66.07LT Growth Rate 12.50%Avg Rating Hold (1.83)

Market Statisitics

• U.S. Physical Therapy Announces 12 Clinic Group Acquisition – 12/01/2016 - U.S. Physical Therapy, Inc. USPH, +1.56% a national operator of outpatient physical therapy clinics, announced that the Company has just completed the acquisition of a 12 clinic group. USPH acquired a 60% interest with the physical therapy practice’s clinical owners retaining 40%. Source: U.S. Physical Therapy Press Release

• New Strong Sell Stocks For November 14th – 11/14/2016: U.S. Physical Therapy Inc., USPH, operates outpatient physical and occupational therapy clinics. It has seen the Zacks Consensus Estimate for its current year earnings being revised 4% downward over the last 30 days. Source: www.nasdaq.com

Business Description_________________________________ U.S. Physical Therapy is the largest publicly-traded, pure-play operator of outpatient physical and occupational therapy clinics, with approximately 510 Clinics in 42 States. U.S. Physical Therapy, Inc., incorporated on April 1, 1992, and through its subsidiaries, operates outpatient physical therapy clinics that provide pre-and post-operative care and treatment for orthopedic-related disorders, sports-related injuries, preventative care, rehabilitation of injured workers and neurological-related injuries. U.S. Physical Therapy, Inc.’s segment is made up of various clinics within different partnership agreements. U.S. Physical Therapy, Inc. primarily operates through subsidiary clinic partnerships, in which it owns a general partnership interest and a limited partnership interest, and the managing therapists of the clinics own the remaining limited partnership interest in the clinics.

Geography U.S. Physical Therapy, Inc. (heretofore known as USPH) is headquartered in Houston, TX and operates clinics all across the United States. There are approximately 380 clinics operated under Clinic Partnerships and over 100 operated as USPH-owned Facilities. In addition to its owned clinics, it also manages physical therapy facilities for third-parties, primarily physicians, with over 20 third-party facilities under management. USPH operates clinics in Tennessee, Texas, Michigan, Virginia, Washington, Maryland, Georgia, Pennsylvania and Wisconsin, just to name a few. Physical therapy is a need that is shared across the country and is not limited to certain geographic areas. USPH has diversified itself across the country to attempt to meet the needs of patients everywhere. While urban centers have more of a necessity, this is due to a population disparity with rural America, not an economic one. Where there are more people, there tend to be more injuries and health problems that require rehabilitation. Strategy USPH originally made a name for itself by starting rehabilitation clinics from the ground up, or as de novo (Latin: “of new”) start-ups. This led to a very profitable venture which formed the foundation of the company.

Figure 1: Net Revenue (in Millions)

Source: FactSet, Team Estimate

Figure 2: Ownership Structure

Note: Institutional Includes Mutual Funds

Source: Mornigstar

Source: FactSet

Figure 3: 2016 Valuation

P/E 36.10Dividend Growth Rate 1.95Dividend Yield (%) 0.947%P/FCF 1.37EV/EBITDA 17.2x

Valuation

Currently, about 60% of USPH’s clinics are from those start-ups, with the rest being acquired through the purchase and partnerships of existing rehabilitation centers. • Focus: USPH focuses primarily in the areas of trauma, work-related, and sports injuries, and pre- and post-op surgical cases. This allows USPH to excel at their chosen areas of expertise, rather than attempting to diversify out to the point of mediocrity in all areas of physical therapy. By focusing on certain aspects of the physical therapy environment, USPH is able to drive customers to their clinics through referrals with some help from marketing representatives. • Acquisitions: USPH has taken on a strategic bent of acquiring new clinics instead of starting up new ones, but in such a way as to treat them as partners instead of a straight take-over and rebranding. In most cases, the original owners retain some control, and USPH takes over and streamlines the running of the business while the existing therapists retain their positions and continue to work with their patients. This acquisition method has led to a rapid increase in USPH’s customer base and potential client base. Management and Governance_________________________ USPH’s executive team has been a key factor in the growth and success of the firm. Chris Reading joined the firm in 2003 as COO but got promoted to CEO and the Board of Directors in 2004. Larry McAfee and Glenn McDowell both joined the company in 2003 and got promoted to the team that is mainly responsible for finding new potential clinics for acquisitions. USPH has established an effective way of carefully vetting potential clinics and only making acquisitions if the top management team believes that a number of factors, both financially and in terms of their opinion on the therapist’s line up with the company’s philosophy (Appendix B shows an example).

In terms of corporate governance, the firm is separating the CEO and Director of the Board positions. 73% of the Board members are independent and the average tenure of the Board members is 11 years. Two Board members have been on the Board for 25 years and skew the average tenure.

• Audit and Oversight: There has been no problem in this area and the results indicate that USPH has an efficient oversight and auditing process. • Shareholder Rights: USPH has started to pay a dividend in 2012 but this dividend is only paying a low amount of earnings back to shareholders, in order to keep enough cash available for future acquisitions. This growing dividend along with the ability to call special meetings and annually elect directors gives shareholders a strong power base. • Consistency in Management: Having consistency in the top management positions has given USPH a comparative advantage in finding new groups of clinics. As long as the top management stays in place, this advantage will continue to help USPH grow.

Figure 4: 2016 Analyst P/E Est

Source: Nasdaq.com

Figure 5: Stock Value

Source: USPH

Source: FactSet, Team

Figure 6: ROIC vs WACC

Source: IBISWorld

Industry Overview and Competitive Positioning__________ Industry Overview The healthcare sector has always been an attractive place for the money, and within that sector, one cannot ignore the physical and occupational therapy industry. The physical and occupational therapy industry (referred to as “the industry” hereafter) boasts a market of $29.6 billion, with an expected CAGR of 7%. The industry is divided into IRF’s (inpatient rehabilitation facilities) and ORF’s (outpatient rehabilitation facilities) with ORF’s accounting for about $19 billion market. The highest part of the outpatient rehabilitation expenses goes to orthopedic physical therapy consisting of 40% of the total expenditure. • Demand: The largest demand for this industry is to be found in the changing demographics of the country as a whole. As the population at large gets older, there will need to be more pre- and post-operative care as well as an ability to deal with the problems of an aging and increasingly less active society. • Ageing Population and the need to maintain an active lifestyle: The average age of the American population is increasing and the number of people above the age of 65 are predicted to increase significantly and their need to maintain an active lifestyle arising out of personal or economic reasons leads to the creation of demand for physical therapy services. • Increasing obesity : Obesity is one of the major health issues in the United States and is ever increasing. Obesity leads to a lot of additional health problems and issues and a great deal of them will create a need for physical and occupational therapy. • Worker’s Comp: While the demand for this type of treatment only represents about 17% of USPH’s current patient revenue, through the Company’s focused worker’s comp business, USPH is trying to drive up demand by focusing on industrial areas of the work sector and bring other services to them than just physical therapy and rehabilitation.

Competitive Positioning As previously stated, the industry is worth $29.6 billion with an expected CAGR of 7%. However USPH finds itself in a complex competitive environment. The industry is highly fragmented with no market player having a market share of greater than 10% and is largely dominated by small and medium clinics with regional footprints and with revenues up to $1 million per center. This leads us to an important conclusion; growth is possible and can be highly stimulated through M&A activities, and pushing for organic growth will be expensive and ineffective. Spending on acquisitions to attempt to consolidate the industry will be a better way of driving growth.

Source: NCHS

Source: NCHS

Figure 7: Health trends

Figure 8: Population Age

Figure 9: Competitive Market

• Growth Opportunities: There are barriers to entry in this industry which are created by the huge initial outlay required to set up clinics and the long start up period. Thus, smaller independent clinics are unable to move out of their local areas due to poor referral mechanisms and investment constraints. This is why most small clinics are operating as partnerships among multiple practitioners. Also, though not a major issue, the anti-POPT (physician owned physical therapy practices) sometimes create barriers, though POPTs provide great opportunities for physicians. • Business Model: All of this further supports the conclusion that as a large, national level, publicly owned company with access to resources, both monetary and human, USPH can benefit greatly by continuing and expanding their M&A activities as market consolidation helps them drive the revenues their way. Acquired new clinics also benefit from the resources that come from the acquirer in terms of administrative and accounting help and becoming a part of a greater referral network. USPH seems to have a sound mechanism for that. The problem, however, arises with a few big players in the industry being on an acquisition spree for the smaller clinics, and so the terms of an acquisition may not always be favorable to USPH. When the industry growth stagnates, the large capacity developed through acquisitions will be a huge burden on the bottom line if the leverage ratio is too high. Slow and steady is a better option than all-encompassing and fast. Investment Summary________________________________ Merits • Capacity and Growing Customer Base: USPH has the capacity to deal with a large and growing customer base, as discussed in the industry overview. The ageing population and the increasing need for surgical care in a large population will provide a robust potential customer base for the foreseeable future. • Growth Strategy: At its heart, USPH has a good growth strategy through an aggressive M&A program to allow them to take over existing small therapy operations and give themselves a built in customer base. • Increasing Dividend: As you can see from Figure 12 and Figure 13, the dividend decreased in 2013 to $0.40 from $0.76 in 2012 and the yield decreased from 2.76% in 2012 to 1.13% in 2013. While a decrease in the dividend yield is usually considered a good thing, we feel that the drop in dividend amounts and the attempts to regain it are signs that the company may be moving too aggressively at the moment. Concerns • Highly Fragmented Industry: The Physical Therapy (PT) and Outpatient Therapy (OT) industry is a highly fragmented industry that can pose potential problems when trying to acquire and work with a large name brand. There are many other companies that are doing the same strategy as USPH and at some point there won’t be any other opportunities to grow as the market is such a specialized one that there will come a time when the market reaches full saturation.

Source: USPH, IBISWorld

Figure 10: Porters 5 Forces

Figure 11: SWOT Analysis

Figure 12: Dividend Pay Out

Source: FactSet

Source: Team Estimate

• Over-Leveraged: While USPH currently is not too leveraged, the need and desire to keep up the current growth rate and to keep investors happy will cause the company to have to pay more and more for existing companies and restructuring and branding. This will lead to the need for more debt and could potentially cause an issue if the payouts from insurers and Medicare/Medicaid are reduced or extended. Financial Analysis___________________________________ Overview USPH has seen a remarkable increase in revenue with an average growth of 9.47% annually from 2010 to 2015. This has allowed the company to reach the #3 slot in the top market share of the industry. USPH had a total free cash flow of $51.347 million for 2016, which has allowed it expand its business through M&A. Ratio Analysis

Source: FactSet, Team Estimates As we can see from the above ratios, there can be no doubt that USPH has had solid growth the last two years, and has a predicted growth that is fairly robust. The Gross Margin for 2016 was 83.65% which exceeded both the 2015 margin and the 5 year average. Notice that both the ROA and ROE have declined for 2016 from 2015. This trend is expected to continue on through the next 5 years. While the decline is not that great, it is still a significant indicator. The decline in ROA from 2015 to 2016 was only 0.08%, but over the next 5 years, that decline will be a cumulative 2.22%. As for the ROE, the decline of 0.75% is larger, but the total decline over the next five years of 2.78% is approximately the same. We estimate that the Return on Invested Capital will increase for 2017, but then start a slow decline back down to more manageable levels due to the industry saturation and lack of potentially good acquisitions in the market. As pertains to Liquidity, while there is an existing trend of both the Current Ratio and Cash Ratio to increase, we feel that with the political landscape and fewer expected acquisitions will hamper growth. This may

Financial Conditions 2015 2016 2017 E 2018 E 2019 E 2020 E 2021 EProfitability %Gross Margin 78.36 83.65 83.05 87.35 92.19 94.57 96.86Return on Assets 8.5 8.42 8.7 8.02 7.56 6.94 6.2Return on Equity 11.54% 10.80% 7.15% 5.85% 4.54% 3.08% 1.50%Return on Invested Capital 10.55 10.99 11.05 10.46 10.23 9.74 9.25Liquidity (X)Current Ratio 3.17 3.2 3.23 3.55 3.98 4.21 4.49Cash Ratio 0.83 0.87 0.88 0.98 1.11 1.19 1.28Financial Leverage (%)Long-Term Debt To Equity 30.53 18 16.35 15.73 13.53 11.73 9.19Total Debt to Equity 40.3 27.38 25.06 23.34 19.43 17.45 14.08Interest Coverage 45.87 34.23 28.95 23.37 18.04 15 11.95Shareholder RatiosFCF per Share ($) 2.82 3.55 3.47 3.67 3.66 3.90 3.76Dividend Yield (%) 1.12 1.02 0.95 0.91 0.87 0.81 0.77

Figure 13: Dividend Yield

Source: FactSet

Figure 14: Operating & Profit Margin

Source: FactSet, Team

Figure 15: # of OPT Clinics

Source: USPH

be evident in the next year or two and therefore USPH may not have the resources to pay its debts.

The Financial Leverage looks very good when you consider the current trends and the numbers by themselves. Long Term Debt to Equity especially is nicely lowered from a current 18% to 9.19 % in 5 years, assuming the company stays the course with its current investment plan and does not have to borrow to pay higher and higher acquisition costs for the few remaining available sectors of the current industry. As well, the massive drop in Interest Coverage indicates that the company is spending money to pay off debt, which is good for the shareholders in the long run, however, this does leave them open to acquiring more debt without too much in the way of trouble and could become a detriment for a long term investor. DuPont Analysis

As we can see, utilizing a DuPont analysis shows us that the declining ROE has some significantly interesting trigger warnings for any future investor in USPH. The Net Margin decreasing from 2017 onwards shows a potential for an inability to pay for future debt coverage. While this is a worrisome factor, the lowering of the Asset Turnover ratio is actually a good sign. As the asset turnover ratio lowers, we are seeing that the company should have a higher profit margin overall. As USPH is primarily a service based company, this may not hold true since their total assets may not change as much, and thus, a lower ratio means lower sales revenues. A decreasing equity multiplier is generally seen as a good thing as that means the equity is growing faster than the assets. For a service based industry this can be a good thing, as it means your existing assets (facilities, technicians, therapists) are generating higher income without the necessary need to expand. However, a change from 1.45 to 1.14 over 6 years is not necessarily a large enough change over that time period to warrant too much concern. Valuation__________________________________________ Valuation Target Price: $66.07 Recommendation: HOLD In the valuation part we use a variety of methods to attempt to derive a target price for USPH, including a Discounted Free Cash Flow Model, Dividend Discount Model, Residual Income Model, and Relative Multiples Valuation. Discounted Free Cash Flow Model By utilizing a Discounted Free Cash Flow Model, we can estimate the attractiveness of an investment opportunity. We will use this method to

ROE Decomposition 2015 2016 2017 E 2018 E 2019 E 2020 E 2021 ENet Margin (%) 6.72 6.46 6.52 6.26 6.03 5.71 5.39

Asset Turnover (X) 1.18 1.31 1.24 1.2 1.17 1.13 1.06Equity Muliplier (X) 1.45 1.27 1.25 1.23 1.19 1.17 1.14

ROE (%) 11.54% 10.80% 7.15% 5.85% 4.54% 3.08% 1.50%

Figure 16: ROE Decomposition

Source: FactSet, Team

Source: FactSet, Team

Source: FactSet, Team

Figure 17: DuPont vs Profit Margin

Figure 18: DuPont Analysis

estimate out 5-year projections of the free cash flows to analyze our target price of USPH. • Weighted Average Cost of Capital (WACC): The risk free rate that we utilize for our calculations is the 10 year treasury rate which is 2.48% as of February 2017. The Beta that we use is generated by a regression of the 5-year historical daily return of the S&P 500 and USPH stock price, for which we get a Beta of 0.69. The cost of equity is derived from the CAPM model and the cost of debt is derived from USPH’s current long term debt structure. Using the 5-year historical long term debt structure we generate a cost of debt of 21.08%. The effective tax rate for USPH is 30.46%. The capital structure is laid out as 78.5% of equity and 21.5% of debt using the market value of each. Overall, we can estimate the WACC to be 8.44%. • Revenue Growth: USPH has a good history of growth, and the current long term growth trend is at 12.50% with a Sustained Growth Rate(SGR) of 12.37%. Utilizing such a large growth rate however will not be sustainable. At some point there will come a market saturation point, which could be 2 years from now or 10. The annual growth rate will be declining based on our calculations to the terminal rate of 12.37%. Dividend Discount Model USPH pays dividends regularly, with an occasional year-end special dividend. Dividend per share has increased from $0.40 in 2013 to $0.68 in 2016. The average dividend yield for the past 5 years has been 1.42%. Residual Income Model Residual income is the difference between projected comprehensive income available to common and required earnings. Required earnings is calculated as the equity cost of capital times the beginning of the year book value of common shareholders’ equity. The Residual Income Model uses the cost of equity as the discounting factor, rather than the Weighted Average Cost of Capital (WACC). The cost of equity was estimated based on the Capital Asset Pricing Model (CAPM) as seen above. Relative Multiples Valuation We used a myriad of multiples to calculate our target price of $66.07, which helps to bolster our HOLD recommendation. We used as a guide, but not limited to, Price/Earning, Price/Free Cash Flow, Price/Sales, Price/Book, EV/EBIT, EV/EBITDA, and EV/Sales. The price that we generated is a 7.52% reduction of the current price. There are no comparable companies with which to compare to USPH. The top competitors are Private Equity backed and thus have no public information available. As well, trading comps are useless in this type of comparison as the market is so highly fragmented as to be untenable for any sort of accurate comparison. In the future, USPH will be competing with the top two in the market for saturation of acquisition targets in the market. This will create value for the acquisition target but will lower the profitability index from acquisition activities. The major driving factor for

Figure 19: WACC Figures

Figure 20: WACC Analysis

Source: FactSet, Team

Figure 21: Executive Compensation

Source: Morningstar

Source: FactSet, Team

WACC AnalysisTotal Debt 59.43Total Equity 217.04CAPM 1.14%Tax Rate 30.46%Risk Free Rate 2.48%Cost of Equity 3.62%Cost of Debt 21.08%WACC (%) 8.44%

revenue growth is acquisition activities. U.S. Physical Therapy only exists in outpatient clinics, and an increase to the number of outpatient clinics due to a shift away from hospitals will allow organic growth for physical therapy. Investment Risks____________________________________ Regulatory Risk Audit Risk(RR1) The practice of physical therapy is subject to a huge amount of regulation that the practitioners need to adhere to and for USPH, it’s no different. Tight scrutiny and frequent audits occur, which if they result in an adverse finding, could very badly affect revenue and reputation and recovery from which maybe hard or even impossible. Lawsuits(RR2) USPH Has so far been lucky in that there have not been any major lawsuits that have been filed against them. The largest potential downside here is if an audit uncovers any collusion with insurance companies or Medicare/Medicaid fraud. This is not to say that this is going on at USPH, and there are no indicators of it, but as with all ongoing operations in the medical industry, there is always the potential for it, and it must be considered as a risk, albeit a low one at the moment.

Market Risk Population Needs (MR1) As the ageing population requires more and more medical care, there is the possibility that a wave of common sense could overtake the population and a new health craze could cause the company to lose some of its market share. As well, the constant advent of new herbal and New Age/ Holistic remedies for physical ailments could cause a reduction in the available market for consumers. While this is not likely, since the base is the population as a whole, it must at least be noted. Competition (MR2) In this highly fragmented market, there is a constant risk of competition. Currently, USPH is ranked 3rd in its industry for number of clinics, with their largest competitor having almost 3 times the number of clinics. As the ability to create new clinics in the de novo style (new from the ground up) is greatly decreasing due to the saturation of the market, there will only be avenues available through growth by Mergers and Acquisitions. As the competitive landscape grows, and the major players have deeper pockets, the ability to acquire the existing clinics and add to their existing portfolio will diminish, and those that are available will become more expensive through simple supply and demand.

Source: Team – Utilizing a Monte Carlo Simulation

Source: WS Journal

Figure 23: Current Analyst Ratings

Figure 24: OT Expenditures

Source: seekingalpha.com

Figure 22: Predicted Stock Price

Source: USPH 10-K

Economic Risk

Payor Risk (ER1) There are many different avenues of revenue for USPH, however, from the above exhibit, it is visible that Medicare/Medicaid and commercial health insurance together account for 52.8%. Given the current political scenario where tightening state budgets are leading various states to cut down on the Medicare/Medicaid budget and commercial health insurance premiums are going higher, this is leading to a lot of people being uninsured. Any drastic adverse impact to these 2 elements can create a huge negative impact on the revenues

Operational Risk Salaries/Therapists (OR1) As has been mentioned, the current landscape of the physical therapy sector is highly fragmented. The need for talented and reliable help can lead to salary disputes and disparity which can cause existing employees to migrate to a competitors operation that is willing or able to pay more. Political Risk Reduction of Benefits (PR1) The current political climate, especially as it relates to healthcare, is a minefield of unknowns. The potential for a large reduction in the number of insured persons, and the potential for a reduction of the amount that federally funded programs, such as Medicare, are allowed to pay for specific procedures, or the number of visits covered can greatly affect USPH’s bottom line. As of February 2017, no one can predict exactly how the current political administration will ultimately affect this particular industry but if even half of the promises that have been made along the way are brought to fruition, it will be a bad hit for revenues for USPH.

Table 1: Risk Matrix

Catastrophic(5)

Major(4)

Moderate(3)

Minor(2)

Insignificant(1)

Almost Certain(5)

Likely(4)

ER1

Possible(3)

PR1 OR1, MR2 RR1

Unlikely(2)

RR2

Rare(1)

MR1

IMPACT

LIKE

LIHO

OD

RISK MATRIX

APPENDIX A

APPENDIX B

U.S. Physical Therapy Acquires 12-Clinic Group

Published on December 1, 2016

U.S. Physical Therapy (USPH) announces it has completed the acquisition of a 12-clinic group of physical therapy providers.

A news release from USPH notes that the acquisition of the practice group, which sees more than 90,000 patients per year and generates more than $10 million in annual revenue, gives USPH a 60% interest, with 40% interest remaining with the owners of the provider group. The group’s purchase price was $11.5 million.

“We are extremely pleased to complete this transaction with a very talented and capable group of partners. This practice has been recognized as National Physical Therapy Practice of the Year, similar to several other award winning practices which have elected in recent years to join our large and growing family of partnerships,” says Chris Reading, U.S. Physical Therapy CEO, in the release.

We look forward to continuing our growth by attracting high quality owner-operators who want to maintain their identity and retain a significant ownership interest in their business, further supported by a very capable team dedicated to helping them grow and scale their brand and culture within the local communities they serve,” he adds.

USPH operates 540 outpatient physical therapy clinics in 42 states. In addition, it manages 21 physical therapy facilities for unaffiliated third parties, including hospitals and physician groups.

[Source(s): U.S. Physical Therapy, Business Wire]

APPENDIX C

Top Management TeamName Position Age Insider Holdings (%) Salary Total Comp.David S. Chernow President & Chief Executive Officer 59 0.60% $740,000 $4,485,266Martin F. Jackson Chief Financial Officer & Executive Vice President 62 1.35% $600,000 $3,109,436Robert G. Breighner, Jr. Vice President-Compliance & Audit Services 48 0.02% - -John A. Saich Chief Human Resources Officer & Executive VP 48 0.25% - -Michael E. Tarvin, CPA Secretary, Executive VP & General Counsel 56 0.25% - -Scott A. Romberger, CPA Chief Accounting Officer, Senior VP & Controller 56 0.13% - -Joel T. Veit Treasurer & Senior Vice President -- --Scott Nordlund, MBA EVP-Partnership Growth & Innovation -- --Robert H. Brehm President-Inpatient Rehabilitation Hospital -- --

APPENDIX D

2011 2012 2013 2014 2015 2016 2017E 2018E 2019E 2020E 2021EWACC 9.99% 8.26% 11.56% 10.52% 10.33% 8.44% 8.09% 7.81% 7.19% 6.73% 6.02%Total Debt 41.672 37.055 69.014 69.961 77.96 59.43 64.01 68.30 67.89 69.07 67.25Total Equity 121.58 134.659 151.017 167.214 193.11 217.04 255.35 292.63 340.44 395.69 477.43CAPM 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.02 0.02 0.02Cost of Debt 0.36 0.35 0.35 0.34 0.34 0.35 0.35 0.35 0.36 0.36 0.36Tax Rate 27.15% 29.62% 32.00% 31.93% 31.62% 30.46% 31.13% 31.43% 31.31% 31.19% 31.10%Risk Free Rate 1.87% 1.70% 3.00% 2.25% 2.30% 2.48% 3.02% 3.37% 3.75% 4.14% 4.54%

52 Week Range $45.62 - 73.05Avg Daily Vol (3 Mo) 81,913Market Value (M) 885.9Ent Value (M) 960.7Shares Out (000) 12,522.00Dividend Yield 0.947%Float 96.00%Institutional 98.42%Top 10 Inst Hldrs 51.10%Analyst Coverage 6Target Price $66.07LT Growth Rate 12.50%Avg Rating Hold (1.83)

Market Statisitics

Financial Leverage 2011 2012 2013 2014 2015 2016 2017E 2018E 2019E 2020E 2021ELong Term Debt to Equ 20.85% 15.41% 30.36% 26.59% 30.53% 18.00% 16.37% 15.73% 13.53% 11.72% 9.19%Financial Leverage 34.28% 27.52% 45.70% 41.84% 40.37% 27.38% 25.07% 23.34% 19.94% 17.45% 14.09%Operating Leverage -0.55 2.84 0.16 1.16 0.39 0.73 1.03 0.76 0.83 0.70 0.78Interest Coverage 63.36 68.95 72.06 42.07 45.87 34.24 28.95 23.33 18.04 15.00 11.95

DuPont AnalysisProfit Margin 0.091 0.072 0.048 0.068 0.067 0.065 0.065 0.063 0.060 0.057 0.054Asset Turnover 1.418 1.454 1.178 1.247 1.184 1.312 1.243 1.207 1.180 1.135 1.063Equity Muliplier 1.343 1.275 1.484 1.463 1.450 1.274 1.251 1.233 1.199 1.175 1.141DuPont Calculation for 17.25% 13.32% 8.42% 12.47% 11.54% 10.80% 10.14% 9.32% 8.54% 7.65% 6.55%

Fundamental Highlights 2011 2012 2013 2014 2015 2016 2017E 2018E 2019E 2020E 2021ENet Revenues 231.523 249.651 264.058 305.074 331.302 362.6673303 396.901857 435.6458353 481.6489498 527.7192051 579.21764Operating Margin 13.57% 15.38% 14.68% 15.00% 14.28% 13.94% 12.05% 11.35% 10.64% 9.69% 8.70%Return on Assets 12.85% 10.71% 6.43% 8.90% 8.50% 8.42% 6.13% 5.03% 4.02% 2.79% 1.42%Return on Equity 17.25% 13.32% 8.42% 12.47% 11.54% 10.80% 7.15% 5.85% 4.54% 3.08% 1.50%Profit Margin 9.06% 7.18% 4.82% 6.84% 6.72% 6.46% 4.60% 3.93% 3.21% 2.31% 1.24%Return on Invested Capital 16.03% 13.29% 7.53% 11.52% 10.55% 11.00% 7.78% 6.56% 5.44% 3.92% 2.12%Weighted Average Cost of Capital 9.99% 8.26% 11.56% 10.52% 10.33% 8.44% 8.09% 7.81% 7.19% 6.73% 6.02%

Financial Liquidty 2011 2012 2013 2014 2015 2016 2017E 2018E 2019E 2020E 2021ECurrent Ratio 2.80 2.78 2.14 2.15 3.17 3.20 3.24 3.55 3.98 4.21 4.50Quick Ratio 2.80 2.78 2.14 2.15 3.17 3.20 3.24 3.55 3.98 4.21 4.50Cash Ratio 0.61 0.72 0.56 0.56 0.83 0.87 0.88 0.98 1.11 1.19 1.28ProfitabilityReturn on Assets 12.85% 10.71% 6.43% 8.90% 8.50% 8.42% 6.13% 5.03% 4.02% 2.79% 1.42%Return on Equity 17.25% 13.32% 8.42% 12.47% 11.54% 10.80% 7.15% 5.85% 4.54% 3.08% 1.50%Net Revenues 231.52 249.65 264.06 305.07 331.30 362.67 396.90 435.65 481.65 527.72 579.22Operating Margin 13.57% 15.38% 14.68% 15.00% 14.28% 13.94% 13.98% 13.69% 13.47% 13.12% 12.86%

APPENDIX E

Balance Sheet - As Reported 31 Dec '15 (Ann) 31 Dec '16 (Ann) 31 Dec '17E (Ann) 31 Dec '18E (Ann) 31 Dec '19E (Ann) 31 Dec '20E (Ann) 31 Dec '21E (Ann)USD USD10-K 10-K

Total assets 279.91 276.47 319.36 360.94 408.34 464.75 544.68 Total current assets 60.18 65.14 71.86 79.08 86.96 95.46 105.17 Cash and cash equivalents 15.78 17.70 19.64 21.81 24.25 27.01 30.02 Patient accounts receivable, less allowance for doubtful accounts 36.23 38.70 42.79 46.46 50.65 55.08 60.16 Accounts receivable - other, less allowance for doubtful accounts 2.39 2.71 3.13 3.68 4.65 5.49 6.56 Other current assets 5.79 6.03 6.30 7.13 7.41 7.88 8.43 Fixed assets, net 16.65 19.95 22.52 26.08 30.17 35.14 40.25 Fixed assets 69.91 74.08 79.05 84.40 90.17 96.10 102.56 Furniture and equipment 44.75 47.56 50.87 54.38 58.01 61.89 66.11 Leasehold improvements 25.16 26.53 28.18 30.02 32.17 34.20 36.45 Accumulated depreciation and amortization -53.26 -54.13 -56.53 -58.32 -60.00 -60.96 -62.31 Goodwill 171.55 149.40 167.89 175.52 184.29 188.44 199.83 Other identifiable intangible assets, net 30.30 40.85 55.93 79.07 105.70 144.50 198.20 Other assets 1.23 1.14 1.16 1.19 1.21 1.21 1.22Total liabilities and shareholders' equity 279.91 276.47 319.36 360.94 408.34 464.75 544.68 Total liabilities 77.96 59.43 64.01 68.30 67.89 69.07 67.25 Total current liabilities 19.01 20.36 22.20 22.27 21.83 22.68 23.38 Accounts payable - trade 1.64 1.60 1.57 1.53 1.47 1.44 1.40 Accrued expenses 16.60 17.83 19.48 19.48 18.96 19.63 20.12 Current portion of notes payable 0.78 0.93 1.15 1.26 1.39 1.61 1.86 Notes payable 4.34 1.14 1.31 1.53 1.71 2.00 1.54 Revolving line of credit 44.00 31.88 33.56 36.79 36.14 36.47 34.97 Deferred rent 1.40 1.04 1.06 1.10 1.12 1.14 1.09 Deferred taxes and other long-term liabilities 9.22 5.01 5.89 6.61 7.09 6.76 6.27 Deferred taxes -- Other long-term liabilities -- Redeemable non-controlling interests 8.84 Total equity 193.11 217.04 255.35 292.63 340.44 395.69 477.43 Total U. S. Physical Therapy, Inc. shareholders’ equity 162.79 180.10 199.72 222.35 246.26 272.44 301.49 Preferred stock 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Common stock 0.15 0.15 0.15 0.15 0.15 0.15 0.16 Additional paid-in capital 45.25 47.88 50.90 53.88 56.82 60.14 63.67 Retained earnings 149.02 163.70 180.29 199.95 220.92 243.77 269.29 Treasury stock at cost -31.63 -31.63 -31.63 -31.63 -31.63 -31.63 -31.63 Non-controlling interests 30.33 36.95 45.25 54.45 69.36 85.31 105.19

Income Statement - As Reported 31 Dec '15 (Ann) 31 Dec '16 (Ann) 31 Dec '17E (Ann) 31 Dec '18E (Ann) 31 Dec '19E (Ann) 31 Dec '20E (Ann) 31 Dec '21E (Ann)USD USD10-K 10-K

Net revenues 331.3020 362.67 396.90 435.65 481.65 527.72 579.22Total clinic operating costs -252.9410 -279.02 -306.20 -338.12 -375.86 -415.05 -458.26Gross margin 78.3610 83.65 90.70 97.52 105.79 112.67 120.95Corporate office costs -31.0670 -33.09 -35.21 -37.90 -40.93 -43.45 -46.47Operating income 47.2940 50.55 55.49 59.62 64.86 69.22 74.49Interest and other income, net 0.0810 0.10 0.02 0.04 0.04 0.04 0.06Interest expense -1.0310 -1.48 -1.92 -2.56 -3.59 -4.61 -6.23Income before taxes including non-controlling interests 46.3440 49.17 53.59 57.10 61.31 64.65 68.32Provision for income taxes -14.6530 -16.23 -18.01 -19.81 -21.84 -23.78 -26.20Net income from continuing operations including non-controlling interests 31.6910 32.95 35.59 37.29 39.47 40.87 42.11Discontinued operations, net of tax benefit 0.0000 0.00 0.00 0.00 0.00 0.00 0.00Net income including non-controlling interests 31.6910 32.95 35.59 37.29 39.47 40.87 42.11Net income attributable to non-controlling interests -9.4120 -9.51 -9.68 -10.01 -10.41 -10.59 -10.84Net income attributable to common shareholders 22.2790 23.44 25.90 27.29 29.06 30.28 31.27

Clinic Costs 2015 2016 2017E 2018E 2019E 2020E 2021ETotal clinic operating costs -252.94 -279.02 -306.20 -338.12 -375.86 -415.05 -458.26 Salaries and related costs -180.51 -199.10 -218.68 -242.11 -269.48 -297.84 -329.21 Rent, clinic supplies, contract labor and other -68.05 -75.38 -82.89 -91.71 -102.40 -113.50 -125.73 Provision for doubtful accounts -4.17 -4.42 -4.60 -4.56 -4.60 -4.71 -4.83 Closure costs -0.21 -0.30 -0.48 -0.59 -0.73 -0.98 -1.34 Salaries and related costs % 0.71 0.71 0.71 0.72 0.72 0.72 0.72 Rent, clinic supplies, contract labor and other % 0.27 0.27 0.27 0.27 0.27 0.27 0.27 Provision for doubtful accounts % 0.02 0.02 0.02 0.01 0.01 0.01 0.01 Closure costs % 0.00 0.00 0.00 0.00 0.00 0.00 0.00∑ω 1.00 1.00 1.00 1.00 1.00 1.00 1.01

Excess Return Matrix (XTX)S&P500 USPH

S&P500 0.810965255 0.565807818USPH 0.565807818 5.88160952

Var-Cov MatrixS&P500 USPH

S&P500 0.000130717 9.12005E-05USPH 9.12005E-05 0.000948035

Std. Dev.S&P500 0.011433132USPH 0.030790178

Std. Dev. Matrix SST

S&P500 USPHS&P500 0.000130717 0.000352028USPH 0.000352028 0.000948035

Correlation MatrixS&P500 USPH

S&P500 1 0.259071552USPH 0.259071552 1Beta (Raw)USPH 0.697696744

Sales DEC '15 DEC '14 DEC '13 DEC '12 DEC '11 DEC '10 DEC '09 DEC '08 DEC '07 DEC '06365 Days 365 Days 365 Days 366 Days 365 Days 365 Days 365 Days 366 Days 365 Days 365 Days

Total 331 305 264 252 237 211 201 188 152 135Outpatient Physical Therapy Clinics 331 305 264 252 237 211 201 188 152 135

Percent of Total (%)DEC '15 DEC '14 DEC '13 DEC '12 DEC '11 DEC '10 DEC '09 DEC '08 DEC '07 DEC '06

Total 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0Outpatient Physical Therapy Clinics 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0

Growth (%)DEC '15 DEC '14 DEC '13 DEC '12 DEC '11 DEC '10 DEC '09 DEC '08 DEC '07 DEC '06

Total 8.6 15.5 4.7 6.4 12.2 4.9 7.3 23.7 12.2 2.3Outpatient Physical Therapy Clinics 8.6 15.5 4.7 6.4 12.2 4.9 7.3 23.7 12.2 2.3

Disclosures: Ownership and material conflicts of interest: The author(s), or a member of their household, of this report does not hold a financial interest in the securities of this company. The author(s), or a member of their household, of this report does not know of the existence of any conflicts of interest that might bias the content or publication of this report. Receipt of compensation: Compensation of the author(s) of this report is not based on investment banking revenue. Position as a officer or director: The author(s), or a member of their household, does not serve as an officer, director or advisory board member of the subject company. Market making: The author(s) does not act as a market maker in the subject company’s securities. Disclaimer: The information set forth herein has been obtained or derived from sources generally available to the public and believed by the author(s) to be reliable, but the author(s) does not make any representation or warranty, express or implied, as to its accuracy or completeness. The information is not intended to be used as the basis of any investment decisions by any person or entity. This information does not constitute investment advice, nor is it an offer or a solicitation of an offer to buy or sell any security. This report should not be considered to be a recommendation by any individual affiliated with CFA Societies of Texas, Louisiana, New Mexico, and Oklahoma, CFA Institute or the CFA Institute Research Challenge with regard to this company’s stock.

CFA Institute Research Challenge