The Mortgage Observer July 2012

-

Upload

newyorkobserver -

Category

Documents

-

view

1.392 -

download

0

Transcript of The Mortgage Observer July 2012

Q&A

The M.O. talks shop withMadison Realty Capital’s

Josh Zegen

Specialty Lenders: An In-Depth LookPOWER PROFILE

RICK LYONCAPITAL ONE: SLOW AND STEADY WINS RACES

100 Church Street$230 Million Loan and Lease Renewal

Investors BankMarathon Purchase Deepens Reach

Willy WalkerWalker & Dunlop’sCWCapital Buy

Fitch RatingsA CMBS at the Head of the Class

Moinian Group$50 Million Refi on Park Avenue South

The Insider’s Monthly Guide to New York’s Commercial Mortgage Industry July-August 2012The Insider’s Monthly Guide to New York’s Commercial Mortgage Industry

Cover_TMO_0712.indd 1 6/21/12 5:52:30 PM

Relationship Driven.Execution Focused.Only Meridian Capital Group’s powerful financing relationships can consistently achieve the unparalleled results our clients require.

Meridian Capital Group, LLC proudly advised on financing for the following transaction:

350 Park AvenueNew York, NY

585,000 Sq. Ft. Office Tower

$300,000,0001 Battery Park Plaza New York, NY 10004 | 212 972 3600 | www.meridiancapital.com

Untitled-29 1 6/20/12 9:50:52 AM

321 West 44th Street, New York, NY 10036 212.755.2400

Carl Gaines Editor

Jotham Sederstrom Editorial Director

Daniel Geiger Daniel Edward Rosen

Staff Writers

Sam Chandan Joshua Stein

Columnists

Michael Stoler Contributor

Barbara Ginsburg Shapiro Associate Publisher

Robyn Weiss Director of Real Estate

Ed Johnson Production and Creative Director

Peter Lettre Photo Editor

Lauren Draper Designer

Lisa Medchill Advertising Production

OBSERVER MEDIA GROUP

Jared Kushner Publisher

Elizabeth Spiers Editorial Director

Christopher Barnes President

Barry Lewis Executive Vice President

Jamie Forrest Associate Publisher, Senior Vice President

Michael Woodsmall Editorial Manager

Zarah Burstein Marketing Manager

Mark Pasquerella Controller

Tracy Roberts Accounts Payable Manager

Accounts Receivable Ian McCormick

July-August 2012 / Contents

Editor’s Letter 02

News Exchange 04-10Mortgage originations, note sales, investments, industry research 100 Church Street secures $230 Million loan HFF: Long Island City hotel refinanced West 30th Street Tower gets financing Investors Bank to buy Marathon Bank No sale for Deutsche Bank’s RREEF Fitch: AAAsf-rated CMBS head of the class

In-Depth Look 11-12Specialty Lenders: Where to Lookby Michael Stoler

Scheme of Things 14Monthly charts of commercial real estate financings in the boroughs

Stein’s Law 16Clarity On How Mortgage Recording Tax Applies to Interest Rate Swaps by Joshua Stein

The Basis Point 17European Recession, the American Fiscal Cliff and Commercial Mortgage Lending by Sam Chandan

Workforce 18Hirings, promotions, defections and appointments

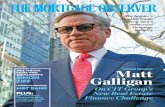

Power Profile 20-23Capital One Grows, Minus Painsby Carl Gaines

Outside Looking In 24-29Smaller lenders are zeroing in on the Manhattan marketby Daniel Geiger

Q&A 28Josh Zegen of Madison Realty Capitalby Carl Gaines

The Sked: July/August 31Our picks for the months’ must-attend events

Of Interest 32An index of all the people, places, addresses and companies mentioned in this issue

Cover Photo by Michael Nagle

20

2404

05

TMO.0712.ContentsCS3.indd 1 6/21/12 5:15:28 PM

2

Editor’s Letter / July-August 2012

For the July/August issue of The Mortgage Observer, I got to know Rick Lyon from Capital One Bank. And, equally important, I learned that those Vikings in their ads—well, they’re not Vikings at all. But, rather, they’re Visigoths.

This really brought up an interesting point: How does a bank so well known for the ads promoting its mono-line credit card business maintain that image while growing and diversifying in areas like commercial real estate lending, which Mr. Lyon heads up for the northeast?

As it turns out, by just doing it—by gobbling up some other banks that had a presence in commercial real estate and by carving out a niche in the New York tristate area as a lender for a lot of the workforce housing that dots the outer boroughs. Mr. Lyon talked to me about Capital One’s lending philosophy for commercial real estate, as well as his background and how he got his start.

With the most recent Greek election now behind us and a pro-bailout, coalition government forming there, columnist Sam Chandan takes a look at how the ongoing financial crisis in Europe is affecting the commercial real estate market here at home. Even in light of the election results there is obviously no short-term solution

for the troubles plaguing Europe’s southern countries, and the fallout continues to have ripple effects. Stay tuned.

Contributor Michael Stoler for this issue took an in-depth look at financing for specialty assets. With the availability of financing for even construction projects coming back, these assets can still prove tricky to get funded. Think hospitality, health clubs, bars and golf courses. Michael, as always, uses his unparalleled industry expertise and knowledge to delve into how these projects, in the end, are financed.

And for our second feature this month, Daniel Geiger looks at the phenomenon of smaller lenders outside the city zeroing in on the Manhattan market—particularly the still-hot multifamily market. Competition is fierce and more and more of them are looking to be players and originate loans in the Big Apple.

Have a great summer. We’ll be back in the fall with our September issue and more profiles, deals and analysis.

Carl Gaines, Editor

Competition Heats Up

TMO.0712.EditorsLetterCS3.indd 2 6/21/12 5:16:55 PM

A city like no other deserves amultifamily lender like no other.

With decades of experience, Chase is New York’s go-to source for multifamily lending.

L O W F E E S | G R E AT R AT E S | S T R E A M L I N E D P R O C E S SCall 866-310-2490 or visit www.chase.com/MFL

Credit is subject to approval. Rates and programs are subject to change; certain restrictions apply.Products and services provided by JPMorgan Chase Bank, N.A. #1 claim based on 2011 FDIC data.©2012 JPMorgan Chase & Co. Member FDIC. All rights reserved.

There’s no city quite like New York. And there’s no company quite like Chase when it comes to serving the city’s multifamily fi nancing needs. Offering great rates and low fees in a fast, effi cient process, Chase brings New York deep market knowledge and industry expertise that’s second to none. Work with the nation’s #1 multifamily lender on your next purchase or refi nance transaction on a 5+ unit apartment building. Give us a call today.

Untitled-28 1 6/19/12 1:32:40 PM

4

News Exchange / July-August 2012

SL Green Realty Corp. has refinanced 100 Church Street, after looking for several months for a loan to place on the building. Andrew Mathias, the REIT’s president, confirmed to The Mortgage Ob-server that the loan, from Wells Fargo, had closed June 15.

Proceeds from the $230 million, 10-year loan will be used for “general corporate purposes,” the com-pany said. It bears an interest rate of 4.7 percent.

SL Green took ownership of 100 Church Street after taking joint venture partner Gramercy Capi-tal’s interest in the building. The two foreclosed on the building in January 2010 when the previous owner, Sapir Organization, defaulted. As previous-ly reported, Sapir had $145 million of senior debt and $85 million of mezzanine debt in the building.

“Wells Fargo has a longstanding relationship with SL Green and is thrilled to provide financing for 100 Church in light of the exciting changes in the downtown New York City office market,” Robert Rosenberg, a managing director of real estate capital markets at Wells Fargo, said. Mr. Rosenberg’s team on the transaction included Rick Oberman, a vice president in the same division.

Wells Fargo’s longstanding history with 100 Church Street is in addition to Mr. Rosenberg’s own history with the building. He helped to place previous financing on the 1.05-million-square-foot

building pre-recession, while at Wachovia Bank.“That loan was originated, if I remember correctly,

late 2007 or early 2008, right when we were going into the financial meltdown that we’ve experienced over the last several years,” Mr. Rosenberg recalled. “SL Green also held a mezzanine position on the loan—they held one of the junior positions—and the pri-or borrower was unable to lease up the property and obviously based on the market meltdown. SL Green was able to foreclose out that interest and has just done a phenomenal job stabilizing the building—taking the building from somewhere in the mid-50s to its current 85 percent occupancy level. “

In addition to the refinancing, the building re-ceived another recent boost: the city of New York, which occupies 372,520 square feet of space there for its law division’s offices, renewed its lease for 20 years. That lease was set to expire in October of next year and covered floors two through six, 20 and part of the concourse.

10 West 74th Street Gets Freddie Mac Loan

CBRE Capital Markets Debt & Equity Finance recently arranged a $19 million Freddie Mac loan for 10 West 74th Street, a 79-unit apartment building owned by Elk Investors. The 10-year loan has a rate of 3.37 percent and a sub-50 percent loan to value.

The CBRE team of Mark Fisher, Keith Braddish, Ja-son Gaccione and Keenan Williams arranged the loan, which has a 30-year amorti-zation schedule.

“Our team was intimately familiar with 10 West 74th Street, having financed the luxury high-rise doorman apartment building a few years ago, and favorable market conditions set the stage for another refinancing—this time for a 10-year period,” Mr. Fisher said. “We are experiencing historically low interest rates, and the borrower is taking advantage of this environment by removing interest-rate risk for the next decade.”

This Freddie Mac multifamily transaction is nothing

Originations

TO GET YOUR DEAL DONE, YOU NEED LAWYERS WHO KNOW THEIR WAY AROUND.

With a long history of handling the most complex commercial real estate transactions, a deep knowledge of the unique realities of the New York market, and a wealth of relationships forged in real estate and government, the lawyers of Cozen O’Connor are prepared to help you with your transactional, development and litigation needs.

575 Lawyers | 21 Offices | © 2012 Cozen O’Connor

Abby M. Wenzel New York Office Managing Partner212.883.4997 | [email protected] | 277 Park Avenue | New York, NY 10172

For more information, visit us online at www.cozen.com.

$230 Million Wells Fargo Loan Secured for SL Green’s 100 Church Street

100 Church Street

new for the team at CBRE Capital Markets, which has originated more than 1,500 of them—at over $23.8 bil-lion—since 2001.

According to sources, the previous Freddie Mac loan on the building was also $19 million, and applied when Elk Investors bought it from BlackRock Re-alty for $38 million in 2009.

$50 M Refinance for 450-460 Park

The Moinian Group’s 450-460 Park Avenue South has been refinanced. The roughly 167,000-square-foot building got a $50 million, fixed-rate loan from Guggenheim Commercial Real Estate Finance.

According to data from Real Capital Analytics, the loan, which has a loan-to-value ratio of 70 percent, was arranged by Robert Verrone’s team at Iron Hound Management Company. It’s for a period of seven years and was completed with an unidentified insur-ance company as co-lender.

Hudson Funds Refinances 164 Elizabeth Street

Hudson Realty Capital has supplied a $5.3 mil-lion first mortgage to refinance a 13,707-square-foot mixed-use building in the Nolita neighborhood of Manhattan, The Mortgage Observer has learned.

The six-story building at 15-25 Kenmare Street, aka, 164 Elizabeth Street, contains 15 residential units and two ground-floor commercial spaces, including the newly opened industrial bras-serie Ken & Cook, which is operating in the for-mer Travertine space.

The loan’s proceeds are being used to replace maturing debt and to establish operating reserves.

“Hudson was able to provide funding that al-lowed the borrower to pay off the maturing debt, without a prepayment penalty,” said Hudson man-aging director Spencer Garfield. He added that this type of middle market funding is typical of the work Hudson is currently doing throughout the country.

The owner, David Zahabian, bought it back in 2007 for roughly $10 million.

Financing for Related West 30th Street Tower

Wells Fargo has provided a $190 million con-struction loan for the Related Co.’s multifamily

Keith Braddish

TMO.0712.NewsExchangeCS3.indd 4 6/21/12 6:15:42 PM

5

development located at 500 West 30th Street, just off the Hudson Yards development site. The 32-sto-ry tower will include 385 rental apartments, retail space and parking. Joanna Rose, a Related spokesper-son, told The Mortgage Observer that the project “is expected to go vertical by the end of the year.”

Alan Wiener, group head of Wells Fargo Multifamily Capital, said that the loan is in line with the types of projects the bank tends to fi-nance in the New York area. “It’s going to be an 80/20 and even though it’s outside the Hudson Riv-er Yards, it’s right across the street,” Mr. Wiener ex-plained. “We’re providing the letter of credit and it’s being financed by bonds issued by the Housing Finance Agency.”

Those bonds are also backed 50 percent by JP Morgan Chase.

The Real Estate Finance Group at law firm Morrison & Foerster advised Wells Fargo on the loan. Mark Edelstein, its chair, led, along with partner John McCarthy.

HFF: Long Island City Hotel Refinanced

The Holiday Inn Manhattan View, a 136-key hotel at 39-05 29th Street in Long Island City, has been refinanced, thanks to a team at HFF.

Managing director Robert Delitsky and director K.C. Patel arranged the $25 million, five-year, fixed-rate loan on

behalf of Queens Plaza North, LLC. The hotel was completed in December 2008 and is situated near the Queensboro Bridge and Northern Avenue.

Mr. Patel declined to name the lender or the rate, citing confidentiality, but said that the $25 million loan will be partly securitized.

All-Equity Financing for 7 Bryant Park

Houston-based development company Hines has received an all-equity investment from J.P. Morgan

Asset Management for 7 Bryant Park, the 28-sto-ry office tower designed by Pei Cobb Freed & Partners that, when completed, will overlook Bry-ant Park and beyond.

J.P. Morgan Asset Management’s investment is believed to be worth upwards of $350 million, in-dustry sources told The Mortgage Observer.

With the equity investment intact, both Hines and joint venture partner Pacolet Milliken Enter-prises, Inc. will move forward with construction, which is set to begin in the fourth quarter of this year. First occupancy is slated for the fourth quar-ter of 2014. The bank is offering 100 percent of the financing on an equity basis.

The 470,000-square-foot building, to be designed by architect Henry N. Cobb, will offer spaces for major tenants looking to occupy 100,000- to 250,000-square-foot floorplates. The building’s façade will be “punctuated by a concave sculptural detail that cuts into the building in an hourglass shape,” Hines said.

The new office space will offer 10-foot finished ceilings and column-free floor plans, and is slated for LEED Gold certification.

TO GET YOUR DEAL DONE, YOU NEED LAWYERS WHO KNOW THEIR WAY AROUND.

With a long history of handling the most complex commercial real estate transactions, a deep knowledge of the unique realities of the New York market, and a wealth of relationships forged in real estate and government, the lawyers of Cozen O’Connor are prepared to help you with your transactional, development and litigation needs.

575 Lawyers | 21 Offices | © 2012 Cozen O’Connor

Abby M. Wenzel New York Office Managing Partner212.883.4997 | [email protected] | 277 Park Avenue | New York, NY 10172

For more information, visit us online at www.cozen.com.

July-August 2012 / News Exchange

Holiday Inn Manhattan View

TMO.0712.NewsExchangeCS3.indd 5 6/21/12 6:11:31 PM

6

News Exchange / July-August 2012

Multi-Million Financing Spree at Eastern Union

Eastern Union’s Shaya Ackerman—a managing director in the firm’s Howell, N.J. office—racked up a massive $94 million in financings over the last 60 days for a variety of property types and deals. He shared with The Mortgage Observer details on the deals, which he said are picking up thanks to a shift in the type of players in the market.

“From 50,000 feet up, there’s definitely been a tremendous uptick in quality financings,” Mr. Ack-erman said. “It’s completely come full circle—you don’t have any more of the syndicators and the wheeler-dealers. You’re dealing more with the real people who don’t have one building but have five, 15, 20 buildings. They’re more sophisticated, so it makes life a little easier for the borrowers, for the banks to get comfortable.”

The deals contributing to Mr. Ackerman’s volume of recent financings in the area include a $28.4 million refinancing for two medical office buildings in New-ark. He conceded that for several reasons, including the fact that they are medical office with short-term leases, the properties were challenging to get approved. “The tenant in place doesn’t have that long of a term left on the lease and there were different terms in that deal that really protected the bank for that,” he said. This deal was closed by TD Bank and the refinance fea-tured a floating rate of 350 bpi over the 30-day Libor.

TD Bank also provided $9.25 million to refinance a 54,200-square-foot commercial building on Queens Boulevard, at a rate normally seen only for multifam-ily properties. The loan is for a five-year term, with 25-year amortization and limited recourse at a rate of 3.73 percent.

In Astoria, Mr. Ackerman secured a $9.6 million loan to refinance a multifamily project it is building there. “Alma Realty put up that project and was the spon-sor,” he said. “It was actually a two-story building that they gut renovated and added four stories on top of it.” Investors Bank provided a five-plus, five-year loan with a 30-year amortization at 4.375 percent.

Construction has been picking up in the city and this is a trend that Mr. Ackerman pointed to in the work coming his way as well. “A year or two ago you couldn’t call a lender about a construction deal—now you can actually call them and get it done,” he said, adding: “For the right sponsor and the right location they’re getting done.”

One such example is a $6.6 million construction loan that Investors Bank provided to the Marcal Group for the acquisition and gut renovation of a multifamily building in Brooklyn. That loan is for a two-year term at 75 percent of all costs and at a rate of prime plus one.

And even with this recent activity, Mr. Ackerman pointed out that there is more in the pipeline. Tuesday he got two commitments on $21 million and $11 million construction loans. “Those should hopefully be in the hopper in two weeks as well.”

Investors Bank’s Recent Financings

Investors Bank said recently it had closed six real estate transactions in the first quarter of 2012—deals whose combined value hit nearly $100 million. Jo-seph Orefice, senior vice president and head of

commercial real estate lending at the bank, told The Mortgage Observ-er that some of the deals were for repeat customers with a solid track record, a theme that has echoed throughout the lending community even as the market improves.

Mr. Orefice added that the bank is “very active heading toward New York—not only in lending, but in our branch network.”

In Newark, N.J., Investors Bank provided a $20 million fixed-rate mortgage to refinance the loan on Hallmark House—a 429-unit apartment com-plex at 10 Hill Street that’s owned by Wilshire In-vestments Corp. In 2011, Investors had provided a $27 million mortgage to refinance Wilshire’s Colon-nade, a 22-story, 560-unit multifamily property at 25 Clifton Avenue.

Mr. Orefice said the bank was excited to put the loan together, and added that “it is right within what we consider our wheelhouse.”

In Manhattan, Investors originated a $25 mil-lion fixed-rate mortgage for an undisclosed 240,089-square-foot Columbus Avenue retail space. This deal, a participation, represents an area that the bank will likely explore further in the future.

“The $25 million deal we did on Columbus Av-enue was a participation with another lender, and that’s an area that we’re probably going to ex-pand,” he said. “It’s just an area of the bank where we’re kind of growing into more of a commercial bank.” This loan was done in conjunction with New York Community Bank.

Among this pool of announced loans was one con-struction loan, as well—$10.5 million for the con-struction of a townhome community in Lakewood, N.J. Mr. Orefice pointed out that the type of con-struction financing the bank is providing these days, though, is different than what was seen pre-crash.

“I don’t think it’s any secret that for us and for

other banks construction was a rough patch over the last couple of years,” he said. “Today it’s very dif-ferent—we’re not really doing for sale, per se. Even though one of these is a townhome community, it’s really more of a pre-sold construction versus just the spec construction. It’s structurally very different, and I think a lot safer for us.”

The other loans rounding out the $100 million in financing from Investors were refinances—a $10.9 million, adjustable-rate mortgage for a Bethlehem, Penn., office building, a $14 million adjustable-rate mortgage for a Brooklyn multifamily property and a $19.5 million fixed-rate loan for a 260,714-square-foot office building in Rockaway, N.J.

Walker & Dunlop Purchases CWCapital

Bethesda, Md.,-based Walker & Dunlop entered into an agreement to buy CWCapital, the company announced last week. The pending deal has impli-cations for lending in the New York tristate region, with Walker & Dunlop CEO Willy Walker telling The Mortgage Observer that the firm will be better positioned now to compete with larger, well-estab-lished New York lenders.

The deal is expected to close in between 90 and 120 days and is subject to all the usual approvals from stockholders, the government and regulatory agencies. The purchase price comes to $220 mil-lion—$80 million in cash and another $140 million in Walker & Dunlop stock.

Walker & Dunlop is now poised to become the second-largest multifam-ily lender and the eighth-largest commercial real estate lender in the coun-try, the company said. CWCapital and Walker & Dunlop had a combined volume of $7.7 billion in CRE loan originations in 2011 and a combined ag-gregate servicing portfo-

lio of over $33.7 billion. It should allow Walker & Dunlop to throw down the gauntlet and compete in New York as never before.

“New York is the largest multifamily market in the U.S. and as such, if you’re going to be a significant player in the multifamily space you better have a good presence in Manhattan,” Mr. Walker told The Mort-gage Observer. “What’s kind of interesting is Walker & Dunlop and CW, for being as large lenders as both of us are in the multifamily space, both have a reason-ably small footprint or platform in the Manhattan area. So it would be my expectation that this combination

Joseph Orefice

Willy Walker

TMO.0712.NewsExchangeCS3.indd 6 6/21/12 6:11:53 PM

Untitled-27 1 6/19/12 1:31:20 PM

8

News Exchange / July-August 2012

only adds to our both brand as well as market presence in the major markets such as New York and L.A.”

One large advantage will be added feet on the ground in the New York tristate area. Mr. Walker said that CW Capital has some great origination talent focused on the Manhattan market already, which will be further de-veloped and integrated with Walker & Dunlop’s talent once the deal goes through.

“The New York market is obviously one that has a huge amount of potential and we’ve had a good amount of originations there, but as it relates to our market standing in New York vis-à-vis some of our competition, some of the larger bank-owned multifamily lenders have a much larger market presence there. So we’ll figure out how we effectively compete and continue to win business.”

Asked about plans to staff up in the region, Mr. Walker said that the first order of business will be to ensure that the two companies are seamlessly integrated. “Then we will focus on where we need to expand,” he said.

CW Financial Services will become the largest share-holder in Walker & Dunlop when the acquisition is ap-proved and closed. Fortress Investment Services bought CW Financial Services in 2010 for $292 million.

In personnel news, Michael Berman, CEO of CWCap-ital, will take on a senior role at Walker & Dunlop. Mr. Walker said that he and Mr. Berman were in the midst of “detailed discussions about what that role will be.”

No Sale for Deutsche Bank’s RREEF

Talks between Deutsche Bank and Guggenheim Part-ners over a possible sale of the bank’s global alternative asset management business—RREEF—have concluded without the parties reaching an agreement.

The bank released a statement that said parties “were unable to agree on terms for the sale of the business and mutually agreed to end exclusive negotiations.” A spokes-person for Deutsche Bank, Mayura Hooper, declined to give additional details.

However, according to documents from its May 31 an-nual general meeting, Deutsche Bank won’t sell assets like RREEF unless the sale would be highly profitable—re-quiring a committed sales plan by management, an active marketing plan and likelihood of closing within a year.

RREEF focuses on real estate investments and had $57.4 billion in assets under management as of Dec. 31, 2011—$30.8 billion of which was in the Americas.

The breakdown of negotiations between the bank and Guggenheim Partners over its potential sale follows earlier, similarly abandoned negotiations, around the sale of some other Deutsche Bank businesses. These included DWS Americas, DB Advisors and Deutsche Insurance Asset Management. And it effectively concludes talks that had

Investors Bank has entered a definitive agreement to acquire Marathon Banking Corp. for $135 million in cash, it said last week. The deal will deepen Investors’ reach into the New York market while allowing it to carve out a niche in the city’s Greek community.

Kevin Cummings, president & CEO of Investors Bank, told The Mortgage Observer that the acquisition is part of the Short Hills, N.J., bank’s strategy to deepen its already sig-nificant New York franchise. He estimated that 54 percent of Marathon’s portfolio is in commercial real estate—with a significant fo-cus on multifamily.

“This continues our strategic initiative to expand in the boroughs, in the greater New York area,” Mr. Cummings said. “But certain-ly our New York franchise is very significant already. We kind of went in there in a big way and opened up our loan production office in January 2010, and that office has originated over, I would say through today, over $1.5 bil-lion of loans.”

Marathon is the U.S. subsidiary of Pi-raeus Bank S.A., and so likely familiar to the city’s Greek community—the bulk of which is concentrated in the Astoria neighborhood of Queens. With the ongoing financial crisis in Greece, Mr. Cummings pointed out that the acquisition provided the upside of continued

support of the city’s Greek community, with-out exposure to the calamitous events taking place there.

“Through our acquisition of Millenni-um Bank in 2010 we’ve been in Astoria,” he pointed out. “So we’ve been serving that community anyway with our two Astoria branches.”

Christine Barry, a research director at Aite Group, an independent research and advisory firm that focuses in part on busi-ness’ impact on the financial services indus-try, said that acquisitions like this one provide a leg up in New York’s competitive lending environment.

“We’re seeing a lot of the smaller banks trying to carve out a niche,” Ms. Barry said. “Competition is becoming a lot fiercer throughout all the markets—and in the New York market especially, because there are so many banks. So Investors Bancorp through this acquisition can go after Greek-Americans, of whom there are many in the New York area.” She said that special services and prod-ucts tailored to particular communities can be part of the mix as well.

In Queens alone, there are more than 16,000 Greek households according to the U.S. Cen-sus Bureau’s 2006-2010 American Communi-ty Survey.

Marathon is headquartered in Astoria and has $902 million in assets, $783 million in deposits and more than a dozen full-service branches in the New York tristate area.

“They’re much more like a commercial bank than we are because 94 percent of their assets are in commercial assets,” Mr. Cum-mings said. “And, more importantly, they have a lower cost of funds because they’re a commercial bank of 60 basis points and non-interest-bearing deposits of approximately 28 percent.”

He added that Investors would now be able to service Marathon’s customers with “our larger lending capabilities,” making larg-er loans. “The bottom line is it’s a very clean portfolio from a credit perspective.”

Pending regulatory approvals, the deal is ex-pected to close in the fourth quarter of 2012.

Investors Bank to Buy Marathon Bank

Miscellany

Miscellany

Kevin Cummings

TMO.0712.NewsExchangeCS3.indd 8 6/21/12 6:12:15 PM

A trusted financial partner.

Now, more than ever, you need a bank that stands beside you.

TD Bank helps you make the most of every opportunity. We provide you with experience, guidance, and smart solutions that position you and your business for success.

• Commercial Loans and Lines of Credit• Cash Management Services

For a higher level of personal service, connect to www.tdbank.com/commercialbanking or call 1-888-751-9000.

TD Bank. N.A. | Loans subject to credit approval. Equal Housing Lender | TD Bank Group is a trade name for The Toronto-Dominion Bank. Used with permission. For detailed credit ratings for The Toronto-Dominion Bank and TD Bank, N.A. visit http://www.td.com/investor/credit. Credit ratings are not recommendations to purchase, sell, or hold a financial obligation inasmuch as they do not comment on market price or suitability for a particular investor. Ratings are not subject to revision or withdrawal at any time by the rating organization.

• Corporate and Commercial Cards• Equipment Financing

ADpage.indd 30 4/17/12 3:35:09 PM

10

News Exchange / July-August 2012

begun following the bank’s Nov. 22, 2011 announce-ment that it would be undertaking a strategic review of its asset management businesses.

Asked if the bank was actively looking for other buy-ers for RREEF, Ms. Hooper would say only: “We’re obligated to listen to all proposals from a shareholder perspective.”

BlackRock Now in Global Real Estate Securities

Investment manager BlackRock has launched a global securities division designed to capitalize on the firm’s real estate investment and fundamental equity investment expertise through investments in real es-tate securities.

Mark Howard-Johnson, formerly of Building & Land Technology, has been appointed to head the division, which is expected to take on about six more investment professionals by the end of the year, the company said.

As global head of Real Estate Securities Manage-ment, Mr. Howard-Johnson will lead a team whose mandate is to source investible trends in real estate.

“BlackRock real estate investments span a wide range of strategies which now, with the addition of the active strategy, will be even more integrated and com-plementary of each other,” Mr. Howard-Johnson said in a statement. “I’m proud to be part of this superi-or team and look forward to strengthening the firm’s product offering for the benefit of our clients.”

BlackRock’s global head of Real Estate Jack Chan-dler said that the move was “a natural extension of the firm’s robust real estate capabilities,” adding that it “will further strengthen our ability to offer our insti-tutional and retail clients an unrivaled set of real estate solutions.”

Mr. Howard-Johnson was previously chief invest-ment officer at Building & Land Technology, where he launched its real estate securities management di-vision. He was also global head and chief investment officer of REIT management at Goldman Sachs As-set Management.

CRE Loan Values Continue Upward Trend

Data from DebtX show that aggregate commercial real estate values that the loan sale advisor priced and that collateralize CMBS increased over the month of April, continuing a several-month trend.

These loan values rose from 87.3 percent as of

March 31, 21012 to 88.1 percent as of April 30, 2012. At the end of this past February, CMBS-col-lateralized loans were at 86.9 percent. Meanwhile, looking back a full year to the figure as of April 30, 2011, they stood at 80.9 percent.

“Commercial real estate loan prices increased for a fourth consecutive month in April and are up strongly from a year ago,” DebtX CEO Kingsley Greenland said. “Improving CRE fundamentals,

along with a decline in Treasuries and a decrease in credit spreads, drove loan prices higher in April.”

An investor flight to safety, caused by Spain’s growing banking crisis and concerns about Eu-rope’s general financial health, has helped to push Treasury yields down.

For this most recent data, Debt X priced 55,803 commercial real estate loans. They had an aggre-gate balance of $767.6 billion.

Classes of U.S. CMBS rated AAAsf by Fitch Ratings are pretty sturdy, it turns out. A stress test run by the ratings agency found that they could withstand some pretty calamitous eco-nomic conditions, including deterioration in real estate markets and a hypothetical double-dip recession.

Fitch’s findings come on the heels of data from Trepp that showed that CMBS delinquen-cy rates—loans 30-plus days in arrears—had passed 10 percent for the first time ever.

Mary MacNeill, manag-ing director and head of U.S. surveillance at Fitch, told The Mortgage Observer that per-formance is measured by more than just delinquencies. “Fitch’s Loan Delin-quency Index factors in 60-plus delinquencies, which peaked in July 2011 at 9.01 percent,” Ms. MacNeill said. “Fitch has found the 60-plus de-linquency number to be more reliable than the 30-plus bucket, which is more volatile.”

The stress test that Fitch ran on the AAAsf-rated CMBS included both moderate and severe scenarios. The moderate scenario, it said, was similar to pressures seen during a severe double-dip recession—cash flow decreasing across all property types as cap rates stayed close to those seen in the agency’s surveillance analysis.

All AAAsf-rated bonds in this scenario would redeem in full following the moderate stress pe-riod. Furthermore, 77 percent would retain their AAAsf rating, with only 3 percent falling below investment grade. This scenario was most simi-lar to what actually happened to similar tranches

during the global credit crisis. Fitch made the severe scenario somewhat

worse than the agency might expect for such a turn of events—marked by an extreme peak-to-trough drop in average property cash flow. “Cap rates,” the agency said in this scenario, “rise from

the average market and property specific cap rates used in Fitch’s surveillance analysis.” Roughly 85 percent of these bonds would redeem in full, and 40 percent would retain their AAAsf rating.

Despite the persistent uncer-tainty in Europe’s financial mar-kets, Ms. MacNeill was reticent to make a prediction about how it might affect U.S. investors. “It is unclear how the European crisis

will impact the U.S. market,” she said. “Fitch’s moderate scenario provides investors insight as to further rating migration, should a further stress to the macro economy occur.”

Broken down by vintage, the test showed that seasoned transactions, circa 2002-2004, were more resilient, even in the severe scenario. Of these, 93 percent retained their investment grade rating. Vintages from 2005 to 2008, however, were more susceptible to downgrades. Ms. Mac-Neill explained that the seasoned vintages typi-cally have built up higher credit enhancement.

“The existing AAA credit enhancement for these deals typically exceeds Fitch’s AAA tar-gets, which means they can survive higher mul-tiples of base case losses,” Ms. MacNeill said. “The seasoned transactions were more conser-vatively underwritten and have benefitted from amortization.”

Industry Research

Fitch: AAAsf-Rated CMBS Head of the Class

Mary MacNeill

Industry Research

TMO.0712.NewsExchangeCS3.indd 10 6/21/12 6:13:13 PM

11

July-August 2012 / In-Depth LookA comprehensive look at CRE finance trends

For summer 2012, financing has returned for many real estate investors. And borrowers are able to secure it at record-low interest rates, especially if the asset is a residential rental property. Pricing for a five-year, fixed-rate loan is as low as 3 percent, with a 25- to 40-year amortization, and in certain instances interest only for the first two to 10 years of the mortgage.

Financing for certain asset classes, including construction financing, has also become much more readily available to well-capitalized, experi-enced borrowers, who are having an easier time securing record loan rates for mixed-use retail, residential, office, urban retail and industrial assets. Yet financing for unique assets, which may include hospitality, golf courses, health clubs, restaurants, bars, student housing and vacant land, is available to only a small group of borrowers. When it is available under these circumstances, the terms and conditions require higher interest rates, shorter amortization and—in nearly all instances—the borrower must personally guarantee the loan.

Construction financing for residential rentals and condominium developments has become more readily available to established, well-capitalized developers. Nevertheless, a number of lenders are offering construction financing to lesser experienced and lesser capitalized borrowers at higher rates and conditions.

“We are still actively seeking construction and renovation deals in the $1 million-to-$6 million range in the boroughs, with a focus on condos

and apartment buildings,” said Shannon Eidman, a senior vice president in the East Coast regional lending office of Chicago-based Builders Bank. “We will also look at townhouse reposition/construction and fractured condo financing.”

“Builders Bank is committed to providing quality service to meet the construction, interim and permanent financing needs of the developer-investor whose business plan may include small to midsize assets, frequently disregarded by the larger

banks,” he added. “We are offering loans of up to 70 percent of cost—underwriting a condo to a break even or requiring full 100 percent recourse on the construction. The borrowers or sponsors of the deal need to have a few deals under their belt and good financials.”

While construction financing by major money center lenders is now being offered at rates as low as 200 to 250 basis points over Libor, Builders Bank is pricing its construction financing at prime plus 100 basis points, with a floor set in the 5 percent range and rates ranging from 5 percent to 5.5 percent. The borrower will also be responsible for an origination fee of one point for up to 24 months,

as well as an additional fee of 25 basis points for each three-month increment of extension option.

A number of private equity funds and private lenders are serving as a major source of financing for interim and bridge financing.

“Over the past decade, we have provided specialized financing for unique asset classes,” said Mark Zurlini, principal at direct lender Palisades Financial. “In the state of New Jersey, Palisades has provided financing for golf courses, substantially

completed condomi-nium and rental properties and, in cer-tain instances, land for development. Finan-cing is made available if the borrower meets certain criteria, includ-ing reputation and the proven ability to complete the project. While our rates are more expensive than traditional banks’, we offer quick turn-around, guidance to borrowers and, in most instances, the ability to coordinate an exit strategy for the borrower. Most important in all of our

transactions is that the borrower has capital, or the proverbial skin in the game.”

If you pass a pub, bar or restaurant near Penn Station or on Second Avenue in Manhattan, there is an excellent chance the mortgage financing for the property was secured through a banking relationship with Country Bank.

New York-based Country Bank, with assets of $500 million, has been an active player in commercial real estate lending for 20 years. The bank specializes in originating loans from $1 million to $6 million, with a further specialty in owner-occupied and investor real estate. Financing is available for mixed-use, hotel,

Financing is flowing for construction, but still lags for some unique, more exotic assets.

Specialty Lenders: Where to Look

by Michael Stoler

Mark Zurlini, Palisades Financial

Most important in all of our

transactions is that the borrower has capital, or the proverbial skin in

the game.

‘’

TMO.0712.CS3.InDepthLook.indd 11 6/21/12 5:18:46 PM

12

In-Depth Look / July-August 2012 A comprehensive look at CRE finance trends

owner-occupied commercial, pub/restaurant, self storage, garage, warehouse and brownstone/townhouses.

“Recent transactions that we have provided financing for include acquisitions, cash-out refinancing, partner buyouts, leasehold mortgages, leasehold fee purchases and bridge loans,” said Joseph Murphy Jr., president of Country Bank. “The bank recently provided $3.2 million in financing for an investor-owned, single-tenant restaurant property on the West Side’s Restaurant Row. The loan was fixed-rate for five years, requiring the borrower to provide full recourse. In the Park Slope section of Brooklyn, the bank provided a $1.5 million fixed-rate loan with full recourse for an owner-occupied building.”

Mr. Murphy said that other recent deals have included financing for the acquisition of a foreclosure short sale of a non-flagged, 100-key, limited-service hotel in Queens. That hotel was over-leveraged with a CMBS loan, had lost its flag and was being operated by the special servicer, he said.

Progressive Credit Union, also based in Manhattan, provides specialized financing for unique real estate assets. Many of the tristate area’s diners, garages, and auto body and repair shops have secured permanent financing from this $600 million credit union. Over the past three years it has been responsible for the acquisition and construction financing of resort properties on Fire Island and a lifestyle hotel and cabaret on the West Side.

Robert Familant, its treasurer & CEO, said Progressive has “a niche in providing financing for unique assets that require going the extra mile in the underwriting process.” Risk, he said, determines many factors as well.

“We have provided financing for distressed debt, construction and investor-owned luxury condominiums for rental and are open to any transactions that provide suitable collateral and adequate debt coverage,” Mr. Familant added.

If you visit a local lender and request financing for a stand-alone restaurant or a franchise operation typically the response is “no.” A national lender that provides specialized franchise-restaurant financing is United Capital Business Lending,

a BankUnited Company. It offers loans of up to $10 million for a period of up to 10 years, and 100 percent financing.

The Small Business Administration continues to be a source of financing for commercial real estate. A number of borrowers who are unable to secure bank financing have turned to local institutions that include CIT Bank-Small Business Lending,

ValueXPress, the New York Business Development Corp. and other local financial institutions that originate SBA 504 and 7A mortgage financing. “SBA mortgage loans cater to owner-occupied property with higher loan-to-value than available in the private sector,” Mr. Murphy pointed out.

The SBA 504 Loan Program provides small businesses with long-term, fixed-rate financing. The 504 loans are made available through Certified Development Companies, the SBA’s community-based partners for providing the 504 loans.

The 504 loans are typically structured with the SBA providing 40 percent of the total project cost, a participating lender covering up to 50 percent and the borrower contributing 10 percent. Under certain circumstances, a borrower may be required to contribute up to 20 percent of the total project costs.

Last year, ValueXpress obtained a $4.5 million mortgage loan commitment with its New York

banking partner, Country Bank, from the SBA for a Quality Inn located in Brooklyn. The property securing the loan is a four-story, 81-room, limited-service hotel. The borrower was able to purchase the fee and recapture equity in the property.

New York City is the Mecca of colleges and universities. Nevertheless, the city lacks dormitories and student housing facilities. For

example, until two years ago Brooklyn College lacked its first dormitory. In the fall of 2009 a local developer of residential properties acquired land located less than two blocks from the entrance to the campus, and filed and secured permits. However, no commercial lenders were offering financing for the developer’s planned dorms. Subsequently, construction and mini-permanent financing was provided by private equity fund Madison Realty Capital. The borrower obtained $12 million in construction financing for a term of two years. Upon completing and renting the rooms, the developer secured permanent financing from New York State’s largest credit union, Bethpage Federal Credit Union.

With the commercial real estate market in New York City and the region improving, expect more lenders to welcome the opportunity to finance these previously difficult-to-finance, specialty assets.

Robert Familant, Progressive Credit UnionJoseph Murphy Jr., Country Bank

TMO.0712.CS3.InDepthLook.indd 12 6/21/12 5:18:22 PM

CL Tower$13,000,000 | 12-story high-rise

Commercial Real Estate Finance

Financing provided by:

Drew [email protected]

Alan [email protected]

Atlanta | Bethesda | Chicago | Dallas | Ft. Lauderdale | IrvineMilwaukee | Nashville | New Orleans | New York | Walnut Creek

www.walkerdunlop.com

Untitled-28 1 6/19/12 1:34:37 PM

930

204

9758

181

73

409

14

Scheme of Things / July-August 2012 Monthly charts of commercial real estate financings in the five boroughs

The Mortgage Observer has compiled a month’s snapshot of top commercial real estate financings in New York City. This month we take a look at refinances versus purchases, top recent lenders, total sales by borough and the six zip codes that saw the most action. Data are drawn from Actovia, which tracks mortgage information and stream-lines leads from city records.

Mortgage Charts

736

138

April’s slight dip in commercial real estate financings turned into a precipitous drop for May, which saw them fall off by nearly 200. Purchases were down significantly for May as well.

APR MAYREFINANCES

APR MAYPURCHASES

11211 32 11238 21

10011 32 11226 21

11237 26 11222 21

11206 23 10468 20

11226 20 11216 19

11238 20 11215 18

ZIP CODE APR 2012 ZIP CODE MAY 2012

The 11238 zip code—Prospect Heights and parts of Clinton Hill—topped May’s list of most active zip codes, tied with 11226 and 11222. But they trended down.

APR MAYBRONX

APR MAYALL

APR MAYMANHATTAN

APR MAYBROOKLYN

APR MAYQUEENS

Total sales were way down for May, falling by 121 compared to the month previous. In fact, in all four boroughs studied, they declined in May. Queens has seen an over 50 percent decrease in sales, in fact, since March, when they were at 105 in the borough.

288

6347

128

50

New York Community Bank maintained May’s top spot among lenders—with 152 transactions reported. New for May are TD Bank, which came in with 21 transactions, and M&T, which saw 18. The Top 10’s total decreased from 497 in April to 435 in May, 35 percent of which was from New York Community Bank.

New York Community Bank 108 New York Community Bank 152

Signature Bank 80 JPMorgan Chase 67

JP Morgan Chase 66 Signature Bank 55

Astoria Federal Savings Bank 48 Capital One 33

US Bank 41 Flushing Savings Bank 25

Capital One 37 Astoria Federal Savings Bank 24

Flushing Savings Bank 33 Dime Savings Bank of Williamsburgh 22

Deutsche Bank 31 TD Bank 21

Investors Bank 30 Wells Fargo 18

Dime Savings Bank of Williamsburgh 23 M&T 18

BANK APR 2012 BANK MAY 2012

Refinances vs. Purchases

Most Active Zip Codes–Financing

Top 10 Lenders

Total Sales by Borough

TMO.0712.CS3.SchemeOfThings.indd 14 6/21/12 5:19:15 PM

BERKLEY | ACQUISITIONS

140 W 57th St. NYC, NY 10019 T +1 212 867 1234 Contact : Eli Braha

BERKLEY ASSET FUNDS WILL BE EXTENDING THEIR NYC PORTFOLIO TO INCLUDE SOUTH FLORIDASouth Florida Distressed Real Estate Opportunity

BerkleyAcq.com

R.E.O.Multi Family HousingForeclosed PropertiesFractured Condo UnitsUncompleted Residential Condo ProjectsDistressed Commercial Real Estate OpportunitiesSenior Notes in Forecloser backed by Real Property

Untitled-29 1 6/20/12 9:54:22 AM

16

The M.O. Columnists / July-August 2012

Stein’s Law

Joshua Stein

Clarity On How Mortgage Recording Tax Applies To Interest Rate Swaps

New York prides itself on being the capital of capital. But it imposes on real estate financing transactions a peculiar tax—the

New York mortgage recording tax—that creates spurious issues and problems for many elements of modern sophisticated financing transactions. To the state’s credit, though, it recently clarified how that wretched tax applies to a technique that borrowers and lenders often use to hedge interest rate risk. In doing so, the state passed up an opportunity to impose yet a further burden and gratuitous complexity on commercial real estate finance transactions.

The potential problem arises whenever a borrower obtains a floating-rate loan and also enters into an interest rate swap to convert that floating rate into a fixed rate. If rates go down and then the borrower goes into default, the swap may terminate and require the borrower to pay a termination payment, which can be substantial. The borrower will typically need to have its real property secure the obligation to make that payment.

Until recently, industry participants sometimes feared that the state might impose a mortgage recording tax to the extent that a mortgage secured

a possible swap termination payment. Tax officials had sometimes suggested that if a mortgage secured a swap termination payment, that was just like securing an obligation to pay a principal debt in the same potential amount—i.e., an obligation that would attract a mortgage recording tax of up to 2.8 percent.

The industry generally ignored that position. New York borrowers routinely gave their lenders mortgages to secure swap termination payments for swaps the borrower obtained for the same loan that the mortgage otherwise secured. Even though tax officials had sometimes made noises to the contrary, the industry believed that these mortgages could secure swap termination payments without incurring additional mortgage recording tax.

In early June, the state’s Department of Taxation and Finance issued a

ruling basically accepting the industry’s position on how to treat swap termination payments for mortgage recording tax purposes. In order to avoid incremental tax on those payments, the ruling made it clear that the transaction just needs to satisfy a few conditions that are not onerous.

First, the mortgage documents need to refer

to the swap termination payments as “additional interest.” That’s a reasonable requirement, because that’s what a termination payment effectively is—an accelerated payment of some of the fixed interest that the borrower agreed to pay by entering into the swap but had to pay earlier because the borrower went into default.

Second, the swap termination payment can’t be secured by a separate mortgage with a separate stated principal amount. This would take the payment too close to being principal indebtedness, and it does not seem unreasonable to impose a tax in that case. The same problem would arise if a single mortgage secured both the loan and a stated dollar amount of potential swap termination payment. Instead, one mortgage should secure both the loan and a generic nonquantified swap termination payment.

Third, the termination payment needs to arise from a swap issued for the same loan that the mortgage secures. That’s a reasonable requirement too. Without it, the swap termination payment really would be nothing more than a potential obligation to pay a “bad bet”—something that should be treated as taxable principal indebtedness. But parties must still beware of “dragnet” language that might make a mortgage secure not only a loan-related swap, but also termination payments arising under other swaps for other loans or transactions.

Finally, the swap needs to relate to an amount of indebtedness equal to the mortgage loan. This requirement goes a bit too far. It shouldn’t matter if a swap relates to, say, only half the mortgage loan. The borrower and the lender should be free to decide they don’t need to hedge the entire interest-rate risk of the loan, just part of it. And in that case there’s no reason to deny tax-free treatment to the swap termination payment. Did the state really intend to do that?

Setting aside that last detail, the state’s treatment of swap termination payments seems practical, reasonable and consistent with industry expectations. And with the same exception, the new ruling also conforms to the tax treatment of swap termination payments that I summarized and recommended in my book on New York commercial mortgage transactions. In fact, some of the language in the state’s ruling echoes the language I used in my description of this entire issue and how I thought—and how the industry believed—the taxation of swap termination payments should work. It’s a pleasure and an honor to see my language copied in this way.

I’d be even happier if the state adopted some of my language on how the mortgage tax should treat revolving loans. More on that in the next issue.

Joshua Stein is the sole principal of Joshua Stein PLLC. The views expressed here are his own. He can be reached at [email protected].

TMO.0712.CS3.Columnists.indd 16 6/21/12 5:19:51 PM

17

July-August 2012 / The M.O. Columnists

The Basis Point

Sam Chandan

European Recession, the American Fiscal Cliff and Commercial Mortgage Lending

Europe stayed its most immediate existential threat when parties committed to the Hellenic bailout carried Greece’s

mid-June election, the second election in as many months. New Democracy eked out a slim plurality of votes for the Parliament of the Hellenes and, with the expected support of the smaller PASOK party, will hold to the austerity measures agreed to in exchange for 240 billion euro (approximately $300 billion) in financial support since May 2010.

Investors’ natural response to the Greek results conveyed a sense of relief, echoed on the margins in easing measures of systemic financial stress in Europe and the United States. Leading up to the vote, monetary policymakers around the world had been positioning to brace financial markets against a Greek exit from the eurozone. Such a move would have disrupted any remaining notions of structural stability and driven borrowing costs in Spain, Italy and other large economies well beyond manageable levels.

Contagion across the eurozone is hardly theoretical. Italy’s short-term financing costs have doubled between May and mid-June, rising to four times their early 2012 low. The results of the most recent three-year bond auction suggest no relief as yields on those bonds increased to 5.30 percent. To put this in perspective, Americans can finance their homes at lower interest rates.

While the prospect of financial market seizure may have receded temporarily, the fundamental issues that imperil stability across the Continent remain unresolved. Absent consistent bank regulation and a European program of debt mutualization that

can reduce the cost of sovereign finance—such as might be the case under the terms of a Hamiltonian redemption fund—resolution will remain elusive. The next moment of crisis will never be far off, whether it relates to banks in Spain or the threat of a continent-wide bank run.

Balancing political reality with the glaring need for a comprehensive plan to address Europe’s problems is a task that falls to German Chancellor Angela Merkel. As the crisis has spiraled, Chancellor Merkel has signaled provisional support for a bond program that would bring sovereign indebtedness back in line with Maastricht Treaty levels. But exactly what happens next is unclear. And therein lies the problem.

Commenting at the Group of 20 summit that followed the Greek vote, French President François Hollande

offered that “in this permanent race between events, speculation and political decisions, political decisions must get ahead of the uncertainty.” It is obvious to everyone involved that the uncertainty fomented by a glacial decision-making process is taking a toll, both on the economic outlook and the costs of resolving the crisis. Bank of England Governor Sir Mervyn King echoed this view, saying that the impact of the “euro area crisis has been to create a large black cloud of uncertainty hanging over not only the euro area, but our economy, too—and the world economy as a whole.” That characterization of the crisis held water going into the Greek vote and it remains true after the vote.

The costs of exaggerated uncertainty are the realm of neither the anecdotal nor the ideological. For European investors and businesses, the

chance that assets may be redenominated in a new currency—or in the euro of a fundamentally altered eurozone—has chilled activity to an extent that Europe has effectively fallen back into recession. The United States may not fare much better if the year-end Fiscal Cliff is left unaddressed until the 11th hour. Businesses and households will delay major expenditures if after-tax incomes are less predictable.

Seeking to quantify the intuitive relationship, current research by Scott Baker and Nick Bloom at Stanford University and Steve Davis at the University of Chicago suggests that political uncertainty takes a substantial toll on growth. Their foray into the difficult area of study puts the cost of uncertainty between 2006 and 2011 at 2.3 million American jobs. Conceding a wide confidence interval on the exact number, the results of their work still offer a sense of the magnitude.

While the Greek drama and the larger European crisis play out on center stage, the impact is being felt in myriad corners of the financial markets. Capital flows into the United States have pushed yields on the Treasury to new historic lows, below the prevailing rate of inflation. Lower Treasury yields are not a vote of confidence in the American economic outlook per se, but do reflect that Treasuries are still the safest haven for wanderlust global capital. For corporate bonds, spreads are higher and volatility measures have risen.

European headwinds represent a significant obstacle for real economic activity in the United States. The lending market is impacted as well. Given the special position of Fannie Mae and Freddie Mac in relation to the market for guaranteed bonds, lower Treasury yields generally mean lower apartment financing costs. That is a benefit and a potential challenge for apartment investors, inasmuch as borrowers are taking on undue interest rate risks. Although I am in the minority, I have argued that apartment investors and lenders are under-assessing these risks.

On the other side of the coin, MBS without a guarantee becomes less competitive as global conditions demand higher yields for risk invest-ments. For borrowers outside of the apartment market, volatility in corporate bonds undermines CMBS lending and issuance. Inasmuch as the latter might be more attractive to investors if it was diversified into apartments and not consistently over-weighted to retail and hotel exposures, the strengthening of the Agency’s advantage impedes its progress toward recovery.

Sam Chandan, PhD, is president and chief economist of Chandan Economics and an adjunct professor at the Wharton School. The views expressed here are his own. He can be reached at [email protected].

TMO.0712.CS3.Columnists.indd 17 6/21/12 5:20:15 PM

joint ventures, as well as Meridian’s leading position in debt capital markets, the company’s expansion into equity services is a natural plat-form extension at a time when market demand for these services is his-

torically high,” Mr. Steier said. For his part, Mr. Corso said he was “excited and

proud to be a part of Meridian’s best-in-class team of dedicated professionals and to lead” the cooperative and condominium finance group for the firm.

Robert Fagin and Philip Cushman have joined Cowen Group as director of research and head of Equity Sales at Cowen and Co., respectively. Both are based in New York.

“Robert and Philip bring significant experience and talent to enhance our equity platform from both the content and sales perspectives with a focus on our core industry verticals,” Cowen and Co. CEO Jeff Solomon said. “I look forward to working closely with them and the other members of our team as we continue to expand our product and service offer-ings to best meet the needs of our clients.”

Mr. Fagin was previously co-director of U.S. eq-uity reseach at Jefferies, where he also oversaw global technology, media and telecom research.

Mr. Cushman was also most recently at Jefferies, where he was a managing director and head of global equity product management.

Garett Stoffels has been appointed senior managing director and head of equity capital markets at BGC Real Estate Capital Mar-kets. He’ll report to Michael Lehrman, global head of real es-tate at BGC.

“Having worked with Garett for many years, I’ve long admired his extensive relationships, deep knowledge base and distinguished career in real estate investment banking and capital markets,” Mr. Lehrman said. “Garett’s appointment marks the continued expansion of our real estate equity and debt capital markets capabilities and offers a natural complement to the leasing, management, investment sales and other services already offered by Newmark Grubb Knight Frank.”

Mr. Stoffels was previously global head of Cantor Fitzgerald’s Private Capital Group.

Garett Stoffels

David Eyzenberg, formerly the managingdirector and head of commercial real estateat financial advisory firmNewOak Capital, has joined Avison Young as a principal. He will focus on raising

capital and providing the firm’s clients investment banking services, among other responsibilities.

At NewOak Mr. Eyzenberg completed numer-ous assignments related to property financing and CMBS CDO valuation assignments.

Arthur Mirante, principal and tristate pres-ident at Avison Young—and himself new to the firm—said that Mr. Eyzenberg’s addition would boost its capital markets team. “David’s expert knowledge of the intricacies of commercial real es-tate financing, coupled with his deep understand-ing of equity/joint venture structuring, provides us with a competitive advantage in providing the high-est level of consulting services to our institutional and private equity clients,” Mr. Mirante said.

The Mortgage Bankers Associa-tion is searching for a new president and CEO after announc-ing at the end of May that David Stevens would be leaving as of June 30. Chief of staff and senior vice presi-dent Marcia Davies will fill in until a permanent replacement is found.

Mr. Stevens joined the association in May 2011 from the Federal Housing Administration, where he was commissioner and assistant secre-tary for housing. He will now head up SunTrust Mortgage as president.

Investment manager BlackRock has tapped Mark Howard-Johnson to head up its new global securities division. The division is designed to capitalize on the firm’s real estate investment and fundamental equity investment expertise through investments in real estate securities.

Mr. Howard-Johnson most recently served as the chief investment officer at Building & Land Technology.

As global head of real estate securities manage-ment, Mr. Howard-Johnson will lead a team whose mandate is to source investible trends in real estate. The team is expected to take on about six more

investment professionals by the end of the year, the company said.

“BlackRock real estate investments span a wide range of strategies that now, with the addition of the active strategy, will be even more integrated and complementary of each other,” Mr. Howard-Johnson said. “I’m proud to be part of this superior team and look forward to strengthening the firm’s product offering for the benefit of our clients.”

BlackRock’s global head of real estate, Jack Chandler, said the move was “a natural extension of the firm’s robust real estate capabilities.”

Akash Sharma has been hired as an ac-quisitions associate in the New York office of Clairvue Capi-tal Partners. In his new role, he’ll support the underwriting and execution of the San Francisco-based firm’s investment opportuni-ties. Mr. Sharma was previously an investments associate at real estate and infrastructure invest-ment firm CIM Group.

“Akash joins our team of professionals at an ex-citing time,” said Brendan MacDonald, a partner at the firm who manages the acquisitions team. “We are seeing a growing need for liquidity within commer-cial real estate funds and investment vehicles. Debt maturities, slow economic growth and new financial regulations are each contributing to a growing need for recapitalizations and secondary sales of real estate funds and investment vehicles.”

Mr. MacDonald went on to say that Mr. Sharma’s past experience would help the firm identify and unlock value in real estate investment vehicles.

Meridian Capital Group continues to grow, with several recently announced hires. Robert Corso Jr. has joined the company as senior vice president and managing director in charge of its Cooperative and condominium finance group, a newly created position.

His past positions include vice president and man-aging director at Brown Harris Stevens, where he ran its commercial mortgage brokerage group.

Peter Steier has also joined Meridian, as manag-ing director and head of equity capital markets. Mr. Steier joins from the Carlton Group, where he was a managing director. In his new role, he’ll work to build a full-service equity capital markets platform to stand alongside Meridian’s debt capital markets work.

“With the current trend of recapitalizations and

18

Work Force / July-August 2012 Hirings, promotions, defections and appointments

David Eyzenberg Robert Corso Jr.

David Stevens

Akash Sharma

TMO.0712.WorkForceCS3.indd 18 6/21/12 5:44:22 PM

LET THE GREEN TEAM show you how your building can save energy and money.Visit conEd.com/greenteam or call 877-634-9443.

SAVE ENERGY, SAVE CASH,WITH GREEN INCENTIVES

FOR MULTI-FAMILY BUILDINGSEARN UP TO $20,000 TO GO GREEN!

Scan for more information.

Con Edison is offering incentives to ownersand managers of multi-family buildings with 5 to 75 units, to help cover the cost of upgrading to energy management systems.

The systems are an effective way to retrofit anexisting building to be more energy efficient. They pay for themselves over time by offering better control over a building’s temperature andreducing energy costs. And Con Edison offersincentives that will help cover the installation,making it an even smarter investment.

Building owners can receive $6,000 to $20,000 in reimbursements for certainupgrades, which typically cost between $15,000 and $25,000 to install.

In addition to energy management systems andother heating controls, incentives are availablefor the following energy-efficiency improvementsin common areas:

• Upgrades to high-efficiency heating systems

• Roof and heating pipe insulation

• Upgrades to high-efficiency fluorescentlighting, occupancy sensors, and light-emitting diode (LED) exit signs

• Premium efficiency motors for pumps and fans

• Upgrades to high-efficiency central airconditioning

Incentives are also available for residents ofindividual apartments.

Untitled-28 1 6/19/12 1:33:44 PM

20

Power Profile / July-August 2012

RICK LYON

Capital One Grows, Minus Pains

Capital One Bank has grown steadily since it was founded by current chairman, CEO and president Richard Fairbank in 1993. Along the way it grew from a mono-line credit card company funded through the capital markets into a more diversified entity with commercial and consumer banking. It managed to make Visigoths funny and capitalize on Alec Baldwin’s Words With Friends meltdown, while simultaneously deepening its reach into lines of business like commercial real estate.

The bank as a whole had $294.5 billion in loans outstanding and $216.5 billion in deposits as of March. 31, 2012, according to its first quarter 2012 results. The commercial and multifamily real estate portion of this has increased when comparing year-end results recently as well—rising to $15.4 billion for the period ended Dec. 31, 2011 from $13.4 billion the previous year.

For Rick Lyon, executive vice president and head of commercial real estate at the bank, the growth, the Visigoths and the diversification all make sense. Mr. Lyon told The Mortgage Observer that he is focused on continuing to provide the types of financing that the bank has become known

for, particularly in the New York area. A big concentration of this is multifamily—specifically workforce housing, he said.

Mr. Lyon has been with Capital One since January 2008, having joined after 27 years with Wachovia. “I was running the real estate business for Wachovia—which was one of the largest real estate banks before they became Wells Fargo—for the northeast,” Mr. Lyon said. “Boston to D.C. was the market that I was responsible for.” Then, in 2008, “a fascinating opportunity,” as he described it.

The term fascinating is used time and time again by Mr. Lyon to describe the rise of Capital One and the development of its commercial real estate operations—and rightfully so.

Significant milestones in its history include its 1995 spinoff, as a credit card company, from Richmond, Va.,’s Signet Bank. When Signet was having trouble, it spun off the credit business into Capital One. Signet had become overly bulky during the last real estate crisis, prompting the move.

“Our chairman, who is a very strategic thinker, basically said, ‘There are a couple of things we’re missing. One, we are a mono-line credit card company and we don’t have inherent funding

by Carl Gaines

Its capital and questions (What’s in your wallet?) keep bank’s area CRE loans fl owing.

TMO.0712.CS3.Feature.indd 20 6/21/12 5:21:27 PM

21

ILLU

STR

ATIO

N B

Y P

AU

L K

ISS

ELE

V

TMO.0712.CS3.Feature.indd 21 6/21/12 5:21:44 PM

22

of branches and banking businesses so we fund ourselves in the capital markets. That works very well when it’s all good, but in the tougher times it’s good to have dependable deposits for funding and diversification.”

Three other acquisitions that would significantly affect the company’s direction and, subsequently, its commercial real estate lending philosophy, took place a decade later. In a strange twist, Capital One agreed to buy New Orleans-based Hibernia Bank in March 2005 for $5.4 billion. Then, that August, Hurricane Katrina devastated the Gulf Coast area.

“We were supposed to close a day or two after Katrina,” Mr. Lyon remembered. “That got delayed a little bit but we still did what we said we were going to do—we still bought the bank a couple of months after Katrina. That was the first foray for Capital One into banking.” In the end, a renegotiated price of $4.9 billion was settled on to reflect the fact that hundreds of Hibernia branches had been damaged during Katrina, and the deal went through.

The following year, Capital One acquired North Fork Bank, a New York-area lender, for $13.2 billion, which created the third-largest retail-

depository institution in the New York tristate area, with deposits exceeding $84 billion and a managed loan portfolio of more than $143 billion. Then, in 2009, Capital One made another acquisition—Washington, D.C.,’s Chevy Chase Bank, which it picked up for $520 million in cash and stock.

As all of the acquisitions were being put together and a commercial banking business built, Mr. Lyon arrived from Wachovia.

“One of the hallmarks of Capital One is that we tend to be a very conservative institution,” he said. “While we take credit risks on credit cards, obviously, we have a very good model as to how to do that and manage that risk and the appropriate returns. But as a company we tend to keep more capital than most other banks have historically kept.” Capital One, he said, is not trying to eke out an extra 25 basis points by taking unnecessary risks.

When the subprime mortgage crisis and credit crunch hit—those aforementioned “tougher times”—having capital on hand became a real asset.

“The first thing that happened in the Great Recession was a liquidity crunch,” Mr. Lyon said.

“We were able to stay strong through that part of the cycle, and then the next thing was capital requirements. We had good capital and so it allowed us to continue to grow through the recession.” That recession-time growth included some of the bank’s acquisitions—like Chevy Chase.

Some recent deals Mr. Lyon and his team have put together include the refinancing of Jeffrey Gural’s 40 Worth Street in Tribeca. The 702,815-square-foot Newmark Holdings building got a $101 million first mortgage from Capital One in May.

Reached by phone, Mr. Gural, chairman of Newmark Grubb Knight Frank, said that Mr. Lyon had over the years become a good friend. In addition to business deals, they’re also involved in some of the same charities. Mr. Gural is president of the New York, New Jersey and Connecticut chapter of the Starlight Children’s Foundation, which is dedicated to helping seriously ill children. Mr. Lyon is on the board as well.

“When Capital One acquired North Fork, we had a large relationship with North Fork and as a result of them buying North Fork we made a decision to stay with Capital One rather than

Power Profile / July-August 2012

One of the hallmarks of Capital One

is that we tend to be a very conservative

institution.

‘’

ph

oto

s b

y M

ich

ae

l N

ag

le

TMO.0712.CS3.Feature.indd 22 6/21/12 5:22:23 PM

23

July-August 2012 / Power Profile

move the accounts to another bank,” Mr. Gural explained. “It’s been a terrific decision—Capital One has been a great bank to work with.”

“There are a lot of folks who are more philanthropic than I am in the real estate business—talk to Jeff Gural,” Mr. Lyon said for his part. “Jeff is the definition of a mensch—if you know what a mensch is—and I just got to know him, like him, and he got me involved in that organization.”

He’s also on the board of the Real Estate Councils for both Lincoln Center and the Metropolitan Museum of Art.

A Villanova University graduate, where he got his degree in accounting, Mr. Lyon and his wife still live outside Philadelphia, though they have an apartment in New York, as well. It’s a convenient jumping off point, considering his geographic area of responsibility spans Boston to D.C. and down through parts of the Gulf Coast. It makes visiting the couple’s three sons, all in various stages of their 20s, easier as well.

“It’s perfect,” Mr. Lyon said. “One lives in New York, one lives in Philly and one lives in D.C. I can go up and down and connect with each one of my kids—my wife sometimes travels with me. So we

are an Acela family.”In the New York area, in addition to 40 Worth

Street, Capital One has provided financing for Jamestown Properties’ $81.4 million purchase of 31-00 47th Avenue in Long Island City, known as the Falchi Building, and the $12.2 million sale of 141 apartment units at 3576-3578 Dekalb Avenue in the Bronx.

Multifamily units in the outer boroughs like those on Dekalb Avenue are a big focus.

“We think of it as workforce housing,” he said. “We’re not doing it and packaging it up and selling it to Fannie or Freddie, we’re doing it on our balance sheet. The multifamily portfolio is about $6 billion in the New York tristate area and it’s predominately in the boroughs of New York—in Brooklyn, the Bronx, Queens—some of it in New Jersey and Long Island, but predominately in the boroughs.”

With construction coming back in the city, Mr. Lyon pointed out that Capital One is very picky where these loans are concerned.