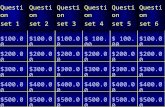

Daily Oral Language XVIII Set 086 Set 087 Set 088 Set 089 Set 090.

set-54988381-0e2c0bc7ad5a237475eb701580300bab

description

Transcript of set-54988381-0e2c0bc7ad5a237475eb701580300bab

1. Analytical procedures must be used during whichphase(s) of the audit?: Planning & Completion; NOT Test ofControls2. Appropriateness of evidence is a measure of the:: qualityof evidence.3. Audit documentation should provide support for:: Theaudit Report; NOT the financial statements4. Audit evidence has two primary qualities for the auditor;relevance and reliability. Given the choices below whichprovides the auditor with the most reliable auditevidence?: confirmation of accounts receivable balancereceived from a customer5. Audit evidence obtained directly by the auditor will notbe reliable if:: the auditor lacks the competence to evaluate theevidence.6. The auditor is concerned that a client is failing to billcustomers for shipments. An audit procedure thatwould gather relevant evidence would be to:: trace asample of shipping documents to related duplicate sales invoices.7. The auditor must gather sufficient and appropriateevidence during the course of the audit. Sufficientevidence must:: be persuasive enough to enable the auditor toissue an audit report.8. Auditors may decide to replace tests of details withanalytical procedures when possible because the::analytical procedures are considerably less expensive.9. The auditor's results of evidence gathering proceduresare contained in audit documentation for the audit.When preparing the requisite audit, documentationshould be cognizant of:: Audit documents are designed tofacilitate the review and supervision of the work performed by theaudit team by a reviewing partner.10. Audit procedures are concerned with the nature, extent,and timing in gathering audit evidence. Which, of thefollowing, is true as to the timing of audit procedures?:Prior to the fiscal year-end of the client & Subsequent to the fiscalyear-end of the client11. A benefit obtained from comparing the client's data withindustry averages is that it provides a(n):: benchmark tocompare the company against industry averages.12. Calculating the gross margin for the current year underaudit as a percent of sales and comparing it withprevious years is what type of evidence?: analyticalprocedures13. Determine which of the following is most correctregarding the reliability of audit evidence.: An effectiveinternal control system provides more reliable audit evidence.14. Due professional care, the third general standard, isconcerned with what is done by the independentauditor and how well it is done. For example, due carein the matter of audit documentation requires thataudit documentation of the evidence gathered by theauditor meets which of the following criteria?: Thecontent be sufficient to provide support for the auditor's opinion,including the auditor's representation as to compliance withauditing standards.15. Evidence is generally considered appropriate when:: ithas the qualities of being relevant, objective, and free fromknown bias.16. Evidence is usually more persuasive for balance sheetaccounts when it is obtained:: as close to the balance sheetdate as possible.17. An example of an external document that providesreliable information for the auditor is:: bank statements18. Given the audit procedures below, which one providesthe most reliable evidence?: Confirmations19. Given the economic and time constraints in whichauditors can collect evidence about managementassertions about the financial statements, the auditornormally gathers evidence that is:: persuasive20. An important benefit of industry comparisons is as:: anaid to understanding the client's business.21. Indicate whether confirmation of accounts receivableand accounts payable, provided they each aresignificant accounts, is required or optional:: AccountsReceivable = Required; Accounts Payable =Optional22. Often, auditor procedures result in significantdifferences being discovered by the auditor. The auditorshould investigate further if:: Significant differences are notexpected but do exist & Significant differences are expected but donot exist23. The permanent audit file would usually include thefollowing:: organizational chart of the company's employees24. The permanent files included as part of auditdocumentation do not normally include:: a copy of thecurrent and prior years' audit programs.25. "Physical examination" is the inspection or count by theauditor of items such as:: cash, inventory, securities, notesreceivable, and tangible fixed assets.26. "The use of comparisons and relationships to assesswhether account balances or other data appearreasonable compared to the auditor's expectations" is adefinition of:: analytical procedures.27. To be considered reliable evidence, confirmations mustbe controlled by:: a financial statement auditor28. The two characteristics of the appropriateness ofevidence are:: relevance and reliability.29. Two determinants of the persuasiveness of evidenceare:: appropriateness and sufficiency.Audit Ch 7Study online at quizlet.com/_wqlb130. What client information is needed by auditors in creating lead schedules?: General ledger information, including unadjustedending balances and beginning balances for accounts.31. When auditors use documentation to support recorded transactions and amounts, the process is usually called::vouching32. When making decisions about evidence for a given audit, the auditor's goal is to obtain a sufficient amount of timely,reliable evidence that is relevant to the information being verified. In addition, the goal of audit efficiency is to gatherand evaluate the information:: at the lowest possible total cost.33. When the auditor develops supporting evidence for amounts posted to account balances with documentary evidence,that process is called:: vouching34. When the auditor used the audit procedure vouching she is primarily concerned with which of the following auditobjectives when testing classes of transactions?: Completeness35. When the auditor uses tracing as an audit procedure for tests of transactions she is primarily concerned with whichaudit objective?: Occurrence36. Which items affect the sufficiency of evidence when choosing a sample?: Selecting items with a high likelihood of misstatement;NOT The randomness of the items selected37. Which of the following best describes one of the primary objectives of audit documentation?: Provide reasonable assurancethat the audit was conducted in accordance with auditing standards.38. Which of the following discoveries through the use of analytical procedures would most likely indicate a relatively highrisk of financial failure?: A higher than normal ratio of long-term debt to net worth as well as a lower than average ratio of profits tototal assets.39. Which of the following is not a characteristic of the reliability of evidence?: education of auditor40. Which of the following statements is most correct regarding the primary purpose of audit procedures?: to gathercorroborative audit evidence about management's assertions regarding the client's financial statements41. Which of the following statements relating to the competence of evidential matter is always true?: Evidence must be bothreliable and relevant to be considered appropriate.42. Which one of the following is not one of the primary purposes of audit documentation prepared by the audit team?: Abasis for determining work deficiencies by peer review teams.43. You are auditing the company's purchasing process for goods and services. You are primarily concerned with thecompany not recording all purchase transactions. Which audit procedure below would be the most effective auditprocedure in this case?: Tracing vendor invoices to recorded amounts in the accounts payable account.