REPORT ON THE EXECUTION OF THE CENTRAL AND LOCAL...

Transcript of REPORT ON THE EXECUTION OF THE CENTRAL AND LOCAL...

REPORT ON THE EXECUTION OF THE CENTRAL AND LOCAL BUDGETS FOR 2015 AND ON THE CENTRAL

AND LOCAL DRAFT BUDGETS FOR 2016

Fourth Session rif the Twe!fth National People's Congress

March 5, 2016

Ministry of Finance

The official Chinese version of this report will be released by Xinhua News Agency.

Fellow Deputies,

The Ministry of Finance has been entrusted by the State Council to submit

this report on the execution of the central and local budgets for 2015 and on the

drafts of the central and local budgets for 2016 to the fourth session of the

Twelfth National People's Congress (NPC) for your deliberation and for

comments from the members of the National Committee of the Chinese People's

Political Consultative Conference (CPPCC).

I. Execution of the Central and Local Budgets for 2015

In the face of a complex international environment and the formidable tasks

of domestic reform, development, and stability in 2015, the Central Committee

of the Communist Party of China (CPC) and the State Council have brought

together and led all of the people of China in taking an active approach to

economic and social development, adapting to the new normal in economic

growth, and responding appropriately to all major risks and challenges. As a result,

the economy has maintained a medium-high rate of growth, the economic

structure has improved, reform has been deepened, opening up has been

promoted, further improvements have been made to the people's quality of life,

and social stability was ensured. Both the central and local government budgets

were executed satisfactorily last year.

1. Implementation of the NPC's budget resolution

In accordance with the resolution of the third session of the Twelfth NPC on

the report on both the execution of the central and local budgets for 2014 and the

central and local draft budgets for 2015 as well as the review of that report by the

NPC Financial and Economic Affairs Commission, we have developed new ways

to improve macro regulation through fiscal policy, made steady progress in the

reform of fiscal and tax systems, and worked hard to bring about sustained,

healthy economic and social development.

Rule of law has been strengthened throughout fiscal and tax work.

We made efforts to ensure that governments at all levels, departments, and

organizations improved their rule of law awareness as they put into effect all of

the requirements laid down in the Budget Law. We strengthened the development

of the Budget Law's complementary institutions, soliciting comments ft:om the

general public on the draft revisions to the Implementation Regulations of the

Budget Law, launching management regulations for special transfer payments

from the central government to local governments, and revising management

regulations for general transfer payments and other rules and regulations. We

collaborated With the relevant NPC department on further clarifying the principle

1

of law-based taxation 1n the Legislation Law, and drew up guidelines for

implementing this principle. We also actively assisted legislative work, such as the

preparations for enacting an environmental protection tax.

Budgetary work has been made more authoritative and consequential in all aspects.

We have tightened budgetary constraints and made sure that all expenditures

are based on budgets. We further increased the detail of budget itemization, scaled

down the amount of tentative budgets prepared by the Ministry of Finance for

other governments offices or programs, and examined and approved

departmental budgets in a timely fashion. We accelerated the work to break down

and disseminate budgetary expenditure targets and intensified inspections of

programs implemented by central government departments, therein achieving

noticeably faster budget execution. We improved the regulatory system for

budgets and made budget assessment an essential part of the budgetary

management procedures. We introduced regulations such as the provisional

regulations for performance target management of special transfer payments from

the central government to local governments. The number and yuan value of

central government department programs that received performance evaluations

rose by 26.3% and 27% respectively, and the evaluation results were linked to the

allocation of this year's budgets. We expanded the number of government

departments whose budgets and fmal accounts are subject to NPC review, and for

the first time, publicly released budgets for special transfer payments broken down

by region and by program. We also carried out inspections on the disclosure of

local governments' budgets and fmal accounts with a view to enhancing their

fiscal transparency.

Proactive fiscal policy has been made more targeted and effective.

In responding to economic developments, we exercised targeted and

well-timed regulation on the basis of range-based regulation and strengthened

anticipatory adjustments and fine-tuning, ensuring that the Chinese economy

operated within an appropriate range.

First, we maintained a necessary level of spending intensity. We increased the

government deficit by an appropriate amount in the 2015 budget, and put to use

funds carried over from previous years to increase the intensity of spending. We

took a host of measures, such as thoroughly reviewing carryover and surplus

funds and strengthening inspections and accountability, to put existing

government funds to use for the purposes of ensuring the wellbeing of the people,

strengthening points of weakness, and making development more sustainable. A

total of 3.2 trillion yuan worth of bonds were issued to replace outstanding debt

of local governments close to maturity, helping reduce their interest burden and

debt repayment pressure and free up fmancial resources for the development of

key programs. 2

Second, we stepped up efforts to reduce taxes and fees. We expanded the

scope of certain preferential policies, such as those concerning corporate income

tax for low-profit small businesses and the accelerated depreciation of fixed assets.

We exempted small and micro businesses from 42 different kinds of

administrative charges and cancelled or suspended the collection of 57 kinds of

central-level administrative charges. We lowered premiums for unemployment,

workplace injury, and maternity insurance schemes, and expanded the scope of

the policy of providing subsidies from the unemployment insurance fund to

enterprises that maintain stable employment during structural adjustments.

Third, we strengthened the guiding role played by fiscal funds and fiscal

policies. We made great efforts to promote the use of the public-private

partnership (PPP) model, and we encouraged nongovernmental capital to enter

public service sectors by providing investment and operation subsidies or through

franchising or other methods. We moved ahead with pilot reforms of

management over the use, disposition, and profit rights of scientific and

technological advances made in central-level public institutions. We improved the

policy of additional tax deductions for enterprise research and development. We

selected the first group of demonstration cities to act as business start-up and

innovation hubs for small and micro businesses.

&forms of the fiscal and tax rystems have been deepened.

We introduced a number of new reform measures in an orderly manner and

improved mechanisms related to their implementation, ensuring that these reform

measures took firm root.

First, we accelerated the reform of the budgetary management system. We

transferred local educational surcharge and ten other items from the budgets of

government-managed funds into general public budgets. We drew up

management regulations for the budgets of central state capital operations,

transferred more funds from such budgets iuto general public budgets, and

established a mechanism for making transfer payments from the budgets of

central government state capital operations to the budgets of local government

state capital operations. We moved forward with medium-term financial planning.

We made further progress in organizing and integrating special transfer payments,

cutting the number of items from 150 in 2014 to 96 iu 2015. We established a

standardized mechanism for local governments to secure financing through

bond-issuance, placed local government debt under budgetary management by

category, and imposed ceilings for such debt. All local government bonds are now

issued and repaid by their respective provincial governments. We enacted

regulations and operational guidelines for the preparation of government financial

reports, published basic principles on government accounting, and revised the

general fiscal budget accounting system.

3

Second, we deepened tax reforms. We carried out research on a plan for

implementing trials of replacing business tax with value added tax (VAT) in all

sectors and a reform plan for taxing personal income on the basis of both

adjusted gross income and specific types of income. We further expanded the

coverage of ad valorem taxation, extending it to the reform of resource taxes on

rare earths, tungsten, and molybdenum. We carried out research relating to the

excise tax reform plan and improved excise tax policies. We intensified efforts to

review and standardize fees and charges levied on businesses.

Third, we made steady progress in the reform of the fiscal system. We

improved the mechanism for sharing the cost of export tax rebates between the

central and local governments. We studied and moved ahead reform of the

division of administrative authority and spending responsibilities between the

central and local governments. As the tax reform progressed, we worked promptly

to draw up a transitional plan for adjusting the division of revenue between the

central and local governments.

Financial discipline has been tightened up.

We have been conscientiously putting into practice the CPC Central

Committee's eight-point decision on improving Party and government conduct

and the State Council's three-point decision on curbing government spending,

rigorously controlling general expenditures, and have achieved a reduction of 11.7%

. in the central government's budgetary expenditures related to official overseas

visits, official vehicles, and official hospitality as compared to 2014. We improved

regulations on practicing thrift and opposing waste, strengthened the management

of meeting venue selection, and made adjustments to standards for business travel

and accommodation expenses of Party and government organization workers. We

improved standards for basic expenditure quotas, moved faster to develop a

system of standards for program expenditure quotas, and improved budgetary

management of program expenditures. We launched a campaign to rectifY the

abuse of funds earmarked for agriculture, farmers, and rural areas, investigated

relevant problems and punished those responsible, released representative cases of

financial discipline violations, and further ensured that the management of funds

is in line with standards and relevant loopholes are closed. We stepped up

financial oversight and implementation supervision to ensure that our fiscal and

tax policies were productive in promoting steady growth.

2. Budgetary revenue and expenditures in 2015

(1) General public budgets

Revenue in general public budgets nationwide totaled 15.221665 trillion yuan,

an increase of 5.8% over 2014 (this figure for the year-on-year increase, including

those below, have been adjusted to account for the inclusion into general public

4

budgets of 11 items originally contained in the budgets of government-managed

funds). Adding in the 805.512 billion yuan of utilized carryover and surplus funds

and funds transferred from other sources, total revenue reached 16.027177 trillion

yuan. Expenditures in general public budgets nationwide amounted to 17.576778

trillion yuan, up 13.2%. Including the 70.399 billion yuan used to replenish the

Central Budget Stabilization Fund, expenditures totaled 17.647177 trillion yuan.

Total expenditure therefore exceeded total revenue leaving a deficit of 1.62 trillion

yuan, which is consistent with the budgeted figure.

Revenue in the central government's general public budget amounted to

6.923399 trillion yuan, which is 100% of the budgeted figure and an increase of

7%. Adding in the 100 billion yuan contributed by the Central Budget

Stabilization Fund, total revenue came to 7.023399 trillion yuan. Expenditures in

the central government's general public budget amounted to 8.073 trillion yuan,

which is 99.1% of the budgeted figure and an increase of 8.6% (this includes

2.5549 trillion yuan in central government expenditures and 5.5181 trillion yuan in

tax rebates and transfer payments from the central government to local

governments). Adding in the 70.399 billion yuan used to replenish the Central

Budget Stabilization Fund, central government expenditures totaled 8.143399

trillion yuan. The central government's total expenditures exceeded total revenue

leaving a deficit of 1.12 trillion yuan, which is consistent with the budgeted figure.

Central government debt had an outstanding balance of 10.659959 trillion yuan at

the end of 2015, which meant it had been kept within the limit of 11.190835

trillion yuan budgeted for the year. The Central Budget Stabilization Fund had a

balance of 115.637 billion yuan.

Figure 1

Revenue and Expenditures in the General Public Budget of

the Central Government in 2015

yuan (billions)

9,000

8,000

'·""" 8,000

5, 000

'· 000 7,023.399

3,000

2,000

1,000

Total revenue

5

Payments to the Central lr"--,- Budget Stabilization Fund

(70.399)

Total expenditures

Tax rebates and transfer

governments (5,518.1)

Central government

expenditures (2,554.9)

Revenue in local governments' general public budgets came to 8.298266

trillion yuan, an increase of 4.8%. Adding in the 5.5181 trillion yuan in tax rebates

and transfer payments from the central government, revenue in local governments'

general public budgets totaled 13.816366 trillion yuan. Adding in the additional

705.512 billion yuan of utilized carryover and surplus funds and funds transferred

from other sources, local government revenue totaled 14.521878 trillion yuan.

Expenditures in local governments' general public budgets came to 15.021878

trillion yuan, up 13.2% (or an increase of 7.9% after deducting utilized carryover

and surplus funds and funds transferred from other sources). Total expenditures

therefore exceeded total revenue leading to a local government deficit of 500

billion yuan, which is consistent with the budgeted figure.

The following details the specific situation in regards to the execution of the

central government's 2015 general public budget.

1) Main revenue items

Domestic VAT revenue was 2.099682 trillion yuan, which is 97.7% of the

budgeted figure. This shortfall was mainly due to the continuous decline in the

producer price index (PPI). Revenue from domestic excise taxes stood at 1.054216

trillion yuan, which is 94.1% of the budgeted figure. Revenue fell short of the

budget primarily because the real revenue from higher excise taxes on cigarettes

and refined oil products were lower than expected. Revenue from VAT, excise

taxes, and customs duties on imports amounted to 1.507151 trillion yuan, which is

82.4% of the budgeted figure. This discrepancy was mainly due to the fall in both

the prices and total volumes of imported commodities. Corporate income tax

revenue was 1.763923 trillion yuan, which is 102.9% of the budgeted figure.

Individual income tax revenue was 517.089 billion yuan, which is 106.2% of the

budgeted figure. VAT and excise tax rebates on exports came to 1.286702 trillion

yuan, which is 105% of the budgeted figure. Non-tax revenue totaled 699.691

billion yuan, which is 163.9% of the budgeted figure. This surplus was mainly

attributable to an increase in the profits turned in by some enterprises directly

under the central government and some financial institutions.

2) Main expenditure items

Central government expenditures amounted to 2.5549 trillion yuan, which is

102.1% of the budgeted figure and an increase of 12.8%. Of this amount,

education expenditures came to 135.705 billion yuan, up 8.3%; foreign

affairs-related expenditures stood at 47.834 billion yuan, up 32.8%; national

defense spending was 886.85 billion yuan, up 10.1%; public security expenses

amounted to 158.416 billion yuan, up 7.2%; expenditures on general public

services reached 105.619 billion yuan, up 0.5%; and interest payments on debt

were 286.69 billion yuan, up 11.3%.

6

Tax rebates and transfer payments to local governments from the central

government came to 5.5181 trillion yuan, which is 98.7% of the budgeted figure

and an increase of 6. 7%. This includes 508.198 billion yuan in tax rebates, the

same as in 2014; 2.84754 trillion yuan in general transfer payments, up 6.8%; and

2.162362 trillion yuan in special transfer payments, an increase of 8.4%, which

was mainly due to the addition of one-time investments from central government

reserve funds during budget execution.

(2) Budgets for government-managed funds

In 2015, revenue into government-managed funds nationwide came to

4.233014 trillion yuan. Adding in the 65.613 billion yuan carried over from 2014

and the 100 billion yuan raised by local governments through the issuance of

special bonds, revenue related to government-managed funds nationwide totaled

4.398627 trillion yuan. Expenditures related to these funds amounted to 4.236385

trillion yuan.

Revenue into central government -managed funds totaled 411.202 billion yuan,

which is 94.2% of the budgeted figure and an increase of 5.2%. Adding in the

65.613 billion yuan carried forward from 2014, revenue related to central

government-managed funds totaled 476.815 billion yuan. Expenditures related to

central government-managed funds came to 435.642 billion yuan, which is 85.7%

of the budgeted figure and an increase of 7.5%. Of this, central government

expenditures were 302.449 billion yuan and transfer payments to local

governments amounted to 133.193 billion yuan. Revenue into central

government-managed funds exceeded expenditures by 41.173 billion yuan, which

includes 24.817 billion yuan carried forward to 2016; 9.454 billion yuan for

statutory replenishment of the Central Budget Stabilization Fund from the

portions of the carryover funds of individual government-managed funds that

exceeded 30% of their respective funds' revenue; and 6.902 billion yuan in surplus

funds from the five items to be transferred from government-managed fund

budgets into the general public budget in 2016.

Revenue into funds managed by local governments reached 3.821812 trillion

yuan, a decrease of 17. 7%. This was mainly due to a significant decline in the

revenue from the sale of state-owned land use rights. Adding in the 133.193

billion yuan in transfer payments from central government-managed funds and

the 100 billion yuan raised by local governments through the issuance of special

bonds, total revenue related to local government-managed funds was 4.055005

trillion yuan. Total expenditures related to local government-managed funds came

to 3.933936 trillion yuan, which includes expenditures of 3.28953 trillion yuan

related to the proceeds of selling state-owned land use rights.

7

(3) Budgets for state capital operations

In 2015, budgetary revenue from state capital operations nationwide totaled

256.016 billion yuan, and budgetary expenditures on state capital operations

nationwide totaled 207.857 billion yuan.

Budgetary revenue from the central government's state capital operations was

161.292 billion yuan, which is 104.1% of the budgeted figure and an increase of

14.3%. Adding in the 14.398 billion yuan carried forward from 2014, total revenue

stood at 17 5.69 billion yuan. Budgetary expenditures on the central government's

state capital operations came to 135.967 billion yuan, which is 80.3% of the

budgeted figure and a decrease of 4.2%. This shortfall was mainly due to slower

than expected progress in the reform of collectively owned businesses operated

by state-owned enterprises (SOEs) and in the reform to relieve SOEs of the

burden of providing water, electricity, heating, gas, and property management

services to their employees' homes. Of the total expenditures on the central

government's state capital operations, 123.53 7 billion yuan was spent at the central

level, which includes 23 billion yuan brought into the general public budget and

used for ensuring and improving the people's quality of life as well as 12.43 billion

yuan used as transfer payments to local governments. A total of 39.723 billion

yuan of budgetary revenue from the central government's state capital operations

was carried over to 2016.

Budgetary revenue from the state capital operations of local governments

totaled 94.724 billion yuan. Adding in the 12.43 billion yuan in transfer payments

from the central government's state capital operations budget, total revenue stood

at 107.154 billion yuan. Total budgetary spending on the state capital operations

of local governments amounted to 84.32 billion yuan.

(4) Budgets for social security funds

In 2015, revenue into social security funds nationwide totaled 4.466034 trillion

yuan, which is 103.6% of the budgeted figure. This includes 3.251848 trillion yuan

from insurance premiums and 1.019815 trillion yuan from government subsidies.

Expenditures from social security funds nationwide totaled 3.935668 trillion yuan,

which is 102.3% of the budgeted figure. Therefore, social security funds were left

with a surplus of 530.366 billion yuan in 2015, and the year-end balance reached

5.700233 trillion yuan after this surplus was rolled over.

3. Implementation of major expenditure policies in 2015

• Promoting education reform and development

We supported implementation of the second phase of the three-year action

plan for preschool education. We put in place mechanisms for guaranteeing

compulsory education funding in rural areas as well as the policy of waiving

tuition and miscellaneous fees for students receiving compulsory education in

8

urban areas, benefiting approximately 110 million students in rural areas and 29.44

million students in urban areas. We implemented the quality improvement plan for

modern vocational education and worked to reshape the vocational education

system. We reformed the budgetary appropriation system for institutions of

higher learning directly under the central government to guide them in improving

their models of development. We worked to guarantee the educational rights and

interests of special needs groups through our support for the development of

special needs education. We improved government financial aid policies for

students, such as study assistance loans and student grants, providing aid to

approximately 7.75 million college students, 5.14 million regular high school

students, and 2.65 million secondary vocational school students, as well as

exempting 10.45 million secondary vocational school students from paying

tuition.

• Pursuing innovation-driven development

We deepened reform of the management of science and technology initiatives

financed by the central government. By completing the optimization or

integration of a majority of these initiatives, we were able to concentrate resources

on major programs that embody national strategic intentions. We redoubled

efforts to support science and technology activities for the public interest,

particularly those involving basic research. We supported the implementation of

major science and technology projects. We worked to ensure research institutions

had the support they needed as they conducted research into their own choice of

subjects, and improved the conditions for undertaking research. We launched

trials of the insurance compensation mechanism for newly-developed major

technological equipment.

• Helpingprovide better social security and employment seroices

Basic pension benefits for enterprise retirees were increased to an average of

2,270 yuan per person per month. The minimum social pension benefits for

participants of the basic old-age insurance for rural and non-working urban

residents were raised from 55 yuan to 70 yuan per person per month. We moved

forward with reform of the pension system for employees of Party and

government offices and public institutions, establishing an annuity scheme for

these employees while at the same time adjusting their basic salaries. We

intensified efforts to implement the employment assistance initiative for university

graduates as well as the scheme for guiding university students in starting their

own business, and we also worked to strengthen the capacity of the government

for providing public employment services. We gave stronger support to assistance

efforts for subsistence allowance recipients, orphans, people with disabilities, and

other disadvantaged groups. We further increased subsidies and living allowances

to entitled groups, and worked to ensure the proper delivery of pension and other

9

benefits to retired military personnel who now recelVe their benefits from the

government.

• Deepening reform of the heaithcare system

Government subsidies towards the new rural cooperative medical scheme and

the basic medical insurance for non-working urban residents were increased to

380 yuan per person per year with a corresponding rise in the rates for individual

contributions to 120 yuan per person per year. We raised per capita government

spending on basic public health services from 35 yuan to 40 yuan per year, with

the entirety of the additional funds in rural areas being used to purchase basic

public health services from doctors. We carried out comprehensive reform of

county-level public hospitals in all counties and county-level cities and expanded

trials of the comprehensive reform of urban public hospitals to 100 cities. We

continued to support community-level healthcare facilities as well as village clinics

in implementing the system of essential medicines. We promoted standardized

training programs for resident physicians. We also improved medical assistance

programs and the system for providing assistance for emergency medical

treatment in both urban and rural areas.

• Promoting .rustainab!e development of agriculture

We expanded trials for restoring and improving cultivated land contaminated

by heavy metals and for comprehensively dealing with the over-abstraction of

groundwater. We conducted in selected areas trial reforms of direct subsidies to

grain growers, subsidies for purchasing superior crop varieties, and general

subsidies for purchasing agricultural supplies with the aim of protecting the soil

fertility of cultivated land and supporting appropriately scaled-up grain operations ..

We promoted the development of water conservation and supply projects,

large-scale, high-efficiency, water-saving regional irrigation projects, and

high-grade farmland. We made further increases to the amount of funding

available for poverty alleviation efforts, facilitating the launch of a number of

poverty reduction projects that produced outstanding results. We helped

strengthen grassland ecological conservation and supported the implementation of

a new round of efforts to return 667,000 hectares of marginal cropland back into

forest or grassland as well as the expansion of efforts to bring a complete end to

the commercial logging of natural forests. We launched key national water and soil

conservation projects, bringing soil erosion under control across 6,570 square

kilometers of land. We made coordinated progress in the trials related to

comprehensive rural reform. We supported the work to determine and open up

registration for contracted rural land-use rights.

• Conserving energy, reduting emission.r, and improving the environment

With a focus on key areas, we increased funding to deliver further results in

10

the prevention and control of air pollution. We moved forward with trials to

construct networks of underground utility corridors and build sponge cities, as

well as with efforts to prevent and treat heavy metal pollution in 38 key areas. We

launched trials to comprehensively improve the conditions around rivers on the

geographical scale of each drainage basin. We moved ahead with key forest

shelterbelts and other ecological conservation projects. We supported

comprehensive environmental improvement efforts in nearly 20,000 villages and

channeled greater effort into supporting the operations and management of rural

environmental protection infrastructure. We worked to facilitate the development

of new energy and renewable energy industries. With our establishment of a

well-rounded system of supportive policies, the production and sales of

new-energy vehicles last year rose by approximately 400% and 300% respectively.

We carried out comprehensive demonstrations of achieving energy conservation

and emissions reductions through fiscal policy.

• Improving government housing support

We provided housing support through the provision of both physical housing

and rent subsidies, and carried out trials of developing and operating public rental

housing through PPP models. We supported the renovation of 6.01 million

homes in run-down urban areas and 4.32 million dilapidated rural houses.

• Giving impetus to cultural prosperi!J and development

We promoted implementation of national standards for the provision of basic

public cultutal services, accelerated the development of a modern system of public

cultutal services, and supported the construction of multipurpose centers for

providing cultutal services in communities. We worked to strengthen the

protection of cultutal heritage sites and traditional Chinese villages. We promoted

the development of leading cultutal enterprises and creative and cultutal industries.

We worked to strengthen the international communication capacity of key news

media outlets and enhance the country's soft power.

For a detailed account of the budget execution related to the above items,

please refer to the 2015 Nationwide Budget Execution Report and draft 2016

Nationwide Budget of the People's Republic of China.

Over the course of 2015, despite mounting downward pressure on the

economy, subdued government revenue growth, and increased difficulty in

maintaining a balanced government budget, our fiscal operations remained

basically stable and we were able to effectively implement all fiscal and tax policies,

providing strong support for accomplishing the major targets for economic and

social development of the year as well as realizing a successful conclusion to the

12th Five-Year Plan.

11

Looking back over the last five years, it is clear that the reform and

development of public finance work in China has reached a new level, and that its

role as the foundation of the country's governance has been effectively utilized.

We constantly deepened the reform of the budgetary management system, made

systematic headway in replacing business tax with VAT and in reforming excise

tax and resource tax systems, and achieved major progress in building a modern

fiscal system over five years of continuous refinement. In exercising macro

regulation through fiscal policy, we paid great attention to keeping market

expectations stable, unleashing internal forces for driving economic growth, and

promoting structural improvements, and helped achieve a better-quality,

higher-efficiency, and steadily operating economy by relying more heavily on

market forces and adopting more reform measures. The wellbeing of our people

has seen continual improvements, and we increased spending in related areas

while working hard to improve related expenditure policies and institutional

arrangements, emphasizing their public nature as well as increasing their

sustainability. We established a general institutional framework for the

management of local government debt, developed a clear picture of total

outstanding debt, and carried out the systematic replacement of a portion of

outstanding debt to ensure better overall control of debt-related risks.

We owe these achievements to the sound policymaking and firm leadership of

the CPC Central Committee and the State Council; to the oversight, guidance, and

strong support of the NPC, the CPPCC National Committee, and all of their

members; and to the joint efforts and hard work of all regions, government

departments, and all our people.

At the same time, we are soberly aware that there are still a number of

difficulties and problems standing in the way of fiscal work. Among these are the

increasing difficulty in maintaining a balanced budget and the inflexibility in the

structure of expenditures. Debt pressure on local governments is mounting,

instances of borrowing in breach of regulations or in disguised form are still

occurring, and the prevention and control of potential risks is becoming

exceptionally difficult. The capacity of certain departments and organizations to

execute their budgets is still quite poor, and work on some major programs has

not gotten off the ground on time or has progressed at an unacceptably slow pace.

Furthermore, government funds can still be utilized in a more coordinated, secure,

and effective manner. We view these issues as extremely important, and will take

effective measures to resolve them.

H. Central and Local Draft Budgets for 2016

This year is the first year of the decisive stage in finishing building a

moderately prosperous society ill all respects and an important year for

12

surmounting difficulties in the push towards structural reform. China's economic

fundamentals remain favorable for long-term growth, its economy remains

resilient with strong potential and ample room for growth, the foundation and

conditions for supporting sustained growth remain intact, and the momentum for

economic structural adjustment has not slackened. Yet at the same time, China

must simultaneously deal with the slowdown in economic growth, make difficult

structural adjustments, and absorb the effects of previous economic stimulus

policies. Structural issues are pulling down total factor productivity growth, and

the economy still faces considerable downward pressure.

On the fiscal front, China receives most of its tax revenue from taxes related

to goods and services, so as economic growth slows down and the PPI continues

to fall, fiscal revenue growth is slowing at a rate greater than that of GDP growth.

Additionally, the greater reductions in taxes and fees aimed at maintaining steady

economic growth and pushing forward structural reform, and the substantial loss

in revenue from across-the-board implementation of the reform to replace

business tax with VAT in particular, are further pulling down growth in fiscal

revenue. On the other hand, government expenditures are rather inflexible and

will be driven up by the efforts to transform the growth model, strengthen points

of weakness, and guard against risks. On the whole, the fiscal situation in 2016

will present a more challenging environment in which to achieve a balance of

payments.

In light of the fiscal and economic landscape, in preparing the budgets for

2016 and carrying out public finance work, we need to thoroughly put into

practice the guiding principles from the 18th National Congress of the CPC, the

third, fourth, and fifth plenary sessions of its 18th Central Committee, the Central

Economic Work Conference, and General Secretary Xi Jinping's major policy

addresses. Acting in accordance with the decisions and plans of the CPC Central

Committee and the State Council, the overall plan for promoting all-round

economic, political, cultural, social, and ecological progress, as well as the

Four-Pronged Comprehensive Strategy,* we must firmly establish and put into

practice the philosophy of innovative, coordinated, green, open, and shared

development, adapt to the new normal in economic development, adhere to the

policy of reform and opening up as well as the general principle of making

progress while keeping performance stable, and follow the general guidelines that

macro policies should be stable, industrial policies targeted, micro policies flexible,

reform policies practical, and that social policies should ensure basic living needs.

*The Four-Pronged Comprehensive Strategy is to make comprehensive moves to: 1) finish building a moderately prosperous society; 2) deepen reform; 3) advance the law-based governance of China; and 4) strengthen Party self-conduct.

13

We will continue to implement proactive fiscal policy and increase its intensity. We

will accelerate reform of the fiscal and tax systems, promote supply-side structural

reform while moderately expanding aggregate demand, support efforts to cut

overcapacity and excess inventory, deleverage, reduce costs, and strengthen points

of weakness, and facilitate adjustments to the industrial structure and the

emergence of new drivers of growth. We need to continue to manage public

finances on the basis of law and fulfill all of the requirements of the Budget Law.

We need to increase overall coordination in the use of government funds, put

both idle and additional funds to work, and optimize the structure of budgetary

expenditures to improve the performance of fiscal spending. We need to tighten

our belts, practice thrift, and prioritize expenditures towards ensuring the basic

living standards of the people while stricdy controlling general expenditures and

reducing other expenditures. We need to strengthen government debt

management, effectively guard against fiscal risks, and work hard to ensure a good

beginning for economic and social development in the 13th Five-Year Plan period.

1. Fiscal policy for 2016

We will continue to implement proactive fiscal policy in 2016 and increase its

intensity. This will be mainly reflected in the following four areas.

First, we will further reduce taxes and fees.

We will implement the trials for replacing business tax with VAT in all sectors,

extending it to the construction, real estate, financial, and consumer service

industries, and allowing businesses to deduct the VAT on their new real estate

purchases or on their payments for real estate rentals. We will step up efforts to

clear up and reform administrative charges and government-managed funds by

expanding the scope of exemptions for 18 types of administrative charges from

only small and micro businesses to all enterprises and individuals, reducing

required payments into new vegetable land development funds and forestry

maintenance funds to zero, suspending the collection of payments into price

adjustment funds, and increasing the body of tax payers eligible for exemption

from educational surcharges, local educational surcharges, and water conservancy

development fund payments by raising the cutoff for eligibility from a monthly

sales or turnover figure of 30,000 yuan to 100,000 yuan. It is projected that the

above tax and fee reduction policies will save businesses and individuals more than

500 billion yuan over the course of 2016.

Second, we will allow the deficit to increase.

Government deficit for 2016 is projected to be 2.18 trillion yuan nationwide,

an increase of 560 billion yuan over 2015, and the deficit to GDP ratio is

projected to be 3%, 0.6 percentage points higher than 2015. While appropriately

increasing mandatory government expenditures, we will ensure the expanded

14

deficit goes mainly towards filling the gap in government revenue left by tax and

fee reductions, enabling the government to meet its expenditure responsibilities.

In addition, we will also allow a considerable rise in the special debt of local

governments that is included in the budgets of government-managed funds, and

we will put into use more carryover and surplus funds so as to ensure sufficient

levels of both total spending and key area spending.

Third, we will adjust and optimize the structure of expenditures.

We will make the proper arrangements for expenditures aimed at promoting

the wellbeing of the people in line with the principles of sustainability and

ensuring basic needs .. We will stricdy control budgets for spending on official

overseas visits, official vehicles, and official hospitality, while also reducing general

expenditures such as those related to meetings. We will carry out rational

assessments of policy-linked expenditures and unsustainable expenses, such as

those made on overly ambitious commitments or on overly high expenditure

standards during times of high revenue growth, and make prompt reductions on

the basis of these assessments. We will improve the structure of transfer payments,

focusing on cutting the number of special transfer payment items while making

corresponding increases to general transfer payments aimed at creating more

equitable access to basic public services as well as to transfer payments for old

revolutionary base areas, areas with concentrations of ethnic minorities, border

areas, and poor areas. Infrastructure investment by the central government will be

more focused on basic public welfare projects within its purview, and less on small

or miscellaneous projects. This investment is projected to be 500 billion yuan in

2016, which is an increase of 22.4 billion yuan over 2015.

Fourth, we will imrease overall coordination in the use of jisml funds.

We will appropriately trim the 2016 budgets for regions and departments that

had a significant amount of government funds left over at the end of 2015. We

will prompdy reallocate funds that are no longer being used into key spending

areas and reduce carryover expenditures produced by accrual accounting. We will

move the carryover and surplus funds of government-managed fund budgets that

exceed stipulated ratios into general public budgets so that they can be utilized in a

coordinated way. We will also raise the proportion of funds transferred from the

budgets for state capital operations into general public budgets. At the same time,

we will make innovations in the way the government carries out its expenditures

with a view towards increasing efficiency.

The primary policies regarding government expenditures are as follows:

• Education

We will further improve the mechanisms for ensuring funding for urban and

rural compulsory education and set a unified benchmark for public funding per

15

student in compulsory education schools. We will continue to carry out major

projects such as the initiative for improving conditions in badly built or poorly

operated rural schools providing compulsory education, and eligible students from

families with financial difficulties will be the first to be exempted from tuition and

miscellaneous fees at regular senior high schools. We will continue to implement

the quality improvement plan to develop modern vocational education,

encouraging local governments to establish sound systems for allocating funds to

vocational colleges based on student enrollment, improving conditions in

secondary vocational schools, training a contingent of teachers strong in both

theory and practice, and promoting the integration of vocational education with

industry work as well as cooperation between colleges and businesses. We will support the development of kindergartens open to all children. We will improve

the budgetary appropriation system for institutions of higher learning and guide

these institutions in improving their quality, optimizing their structure, and

developing their own unique characteristics. We will improve the system of

policies for providing financial aid to students from poor families and make such

aid more targeted.

• Science and technology

We will complete the optimization and integration of science and technology

programs financed by the central government, finish building an open and unified

national science and technology management platform, and establish a mechanism

for entrusting the management of research programs to specialized agencies. We

will give a high level of support to the National Natural Science Foundation of

China, major science and technology projects, and key research and development

programs. We will accelerate the implementation of the national seed fund for

encouraging the application of scientific and technological advances and put in

place loan default compensation mechanisms for banks in order to encourage

them to provide loans to medium, small, and micro businesses. We will promote

the establishment of a number of national laboratories in important innovation

fields. We will facilitate the reform and development of research institutions by

improving the mechanisms for providing them with consistent support. We will

put in place management mechanisms for post-research program subsidies.

• Social security and employment

In 2016, the central government will subsidize local governments in raising

the level of subsistence allowances by 5% in urban areas and 8% in rural areas. We

will conduct research on the establishment of a sound system for providing basic

necessities to extreme poverty groups as well as mechanisms for guaranteeing

funding for these efforts. We will support localities in comprehensively

establishing systems for providing living allowances to needy persons with

disabilities and for providing care serv1ce subsidies to people with serious

16

disabilities. We will ensure the implementation of benefits for entitled groups and

support the proper settlement of demobilized military personneL

In consideration of factors such as the rates of increases in average wages and

price levels, as of January 1, 2016, pension benefits for retirees of enterprises,

Party and government offices, and public institutions will be increased by around

6.5%, with appropriate preference given to those who have retired some time ago

and are on relatively low pension benefits as well as those who have retired from

enterprises in hardship and remote areas. We will put in place a mechanism for

making regular adjustments to basic salaries and promote coordination between

the benefit increases for those employed and retired. We will improve the personal

account side of the old-age insurance scheme for workers, ensure that it remains

in actuarial balance, establish more transparent and easily understood collection

and payment systems, and further improve incentives for encouraging people to

contribute more. We will also improve the reform plan for the old-age insurance

systems and conduct research on putting the social pension of workers under

national unified management.

We will improve policies that encourage college graduates to seek employment

in small and medium-sized high-tech, high-innovation enterprises, start their own

businesses, or find employment at the community level in urban and rural areas,

and we will expand the channels through which college graduates can look for

jobs. We will conduct research on policies for regulating public-service job

positions, set up long-term mechanisms to support the employment of groups

having difficulties in finding jobs, and help migrant workers obtain equal access to

public employment services.

• Health care

We will set up sound, sustainable mechanisms for vartous parties to

reasonably share the costs of health insurance. We will raise the annual

government subsidies for basic health insurance for rural and non-working urban

residents from 380 yuan to 420 yuan per person, and increase annual personal

contributions from 120 yuan to 150 yuan per person, with the increases to be

mainly used to provide better basic medical insurance and boost support for the

major disease insurance scheme for rural and urban non-working residents. We

will increase government subsidies for basic public health services from 40 yuan

to 45 yuan per person per year. We will integrate the basic health insurance

systems and their management systems for rural and non-working urban residents.

We will comprehensively advance the reform of health insurance payouts to help

control medical expenses and regulate medical treatment practices. We will press

altead with the reform of public hospitals and community-level health care

institutions, adjust and optimize the distribution of medical resources in

conjunction with tlte new type of urbanization, and put in place a tiered diagnosis

17

and treatment system. We will work to reduce the burden of medical expenses on

low-income patients suffering from major or critical diseases by providing them

with assistance and ensuring such assistance is better linked with other health

rnsurance programs.

• Fightingpoverry

In 2016, the central government will increase poverty alleviation funds by 20.1

billion yuan, an increase of 43.4% over last year. We will further expand the pilot

scheme for helping those living in poverty realize returns on their asset

investments, work hard to relocate those living in inhospitable areas, support poor

counties in integrating the use of government funds for rural development, and

concentrate our efforts on tackling severe poverty. We will continue to provide

assistance to ethnic minorities living in poverty and to poor state-owned

agricultural farms and forestry farms, and we will also provide poverty-relief

employment programs. We will put into effect programs to use public welfare

funds financed by lottery proceeds in support of old revolutionary base areas

facing poverty. While delegating powers for the review and approval of programs

supported by poverty-relief funds, we will strengthen supervision over such funds

to ensure their secure and effective use. With targeted measures for reducing

poverty, we will work to help poor areas tap into their potential for development

and make their development sustainable so that both poor areas and poverty

groups can lift themselves out of poverty at an even faster pace.

• Agriculture

We will make adjustments to the structure of agricultural expenditures,

increasing support to efforts to promote sustainable agricultural development. We

will work to discourage the excessive use of insecticides and fertilizers and explore

conducting trials on the implementation of systems of crop rotation and fallow

land. We will introduce policies to promote adjustments to the agricultural

production mix and support comprehensive price reform of water used for

agricultural purposes. We will continue to move ahead with trials for restoring and

improving cultivated land contaminated by heavy metals as well as trials for

comprehensively dealing with the over-abstraction of groundwater.

We will support the implementation of a food crop production strategy based

on farmland management and the application of technology in order to ensure

the effective supply of agricultural products as well as grain security. We will make

a large-scale push to develop farmland irrigation systems and high-quality

farmland in order to help increase overall grain production capacity. We will carry

out nationwide reform of direct subsidies to grain growers, subsidies for

purchasing superior crop varieties, and general subsidies for the purchase of

agricultural supplies. We will support the development of diverse forms of

18

appropriately scaled-up agricultural operations and work to promote integrated

development of the primary, secondary, and tertiary industries in rural areas. We

will improve mechanisms for subsidizing major grain growing areas and increase

rewards given to major grain-producing and edible oil-producing counties. We will support the reform and development of state forestry farms, state forestry areas,

and state farms built on reclaimed land. We will promote the orderly and effective

operation of the China Overseas Agricultural Investment and Development Fund

and work to see China's agriculture go global.

We will provide support for the reform of logistics systems for grain and

other agricultural products. We will deepen the pilot reform for ensuring

guaranteed base prices for cotton and soybeans. We will promote reform of the

system for purchasing and stockpiling corn. We will also improve mechanisms for

stockpiling and regulating the supply of major agricultural products. Although the

above reform measures will increase government expenditures for a time, this is a

necessary cost of reform. Following the establishment of a market-based price

formation mechanism for grain, cotton, and edible oils, we will work towards

gradually reducing stockpiles of these products to appropriate levels so that the

fiscal burden from stockpiling expenses can see a corresponding return to normal

levels.

9 Ecological conseroation and environmental protection

We will go further in supporting efforts to control air pollution. We will

promote the implementation of the action plan for water pollution prevention and

control. We will carry out trials for the restoration and improvement of mountain,

water, forest, and farmland ecosystems. We will implement a new round of

policies for providing subsidies and awards to efforts to return marginal farmland

back into forest or grassland and to preserve the ecology of grasslands. We will

put in place nationwide coverage of protective policies for all natural forests, and

appropriately increase subsidies for natural forest protection projects as well as the

levels of compensation for forest management and conservation efforts that

produce a positive ecological impact We will strengthen wetlands protection

efforts and expand the scope of work to return cultivated land back into wedands.

We will increase efforts to promote the use of new-energy vehicles and accelerate

the construction of battery-charging facilities. We will work to ensure the cleaner

use of resources by promoting more efficient, centralized coal operations and

utilizing pollutant-capturing equipment while restricting less efficient, dispersed

coal operations. We will improve the mechanism for subsidizing the use of

renewable energy for electricity generation and work to see that electricity

generated from renewable energy can come on the grid at a price comparable to

that of conventional electricity generation methods as soon as possible. We will

expand the comprehensive demonstrations of achieving energy conservation and

19

emissions reductions through fiscal policy as well as the scope of trials for having

provinces situated on the upper and lower reaches of river basins compensate

each other for their impact on water quality. We will promote reform of

environmental monitoring systems so as to step up the pace of establishing a

monitoring system in which the central and local governments assume separate

responsibilities.

• Government-subsidized housingprojects

We will continue to carry out the trials of developing and operating public

rental housing through PPP models. We will put in place preferential tax and fee

policies and loan interest subsidy policies for projects to renovate run-down urban

areas, promote efforts to grant direct monetary housing subsidies to people

displaced by the redevelopment of such areas, and actively encourage government

procurement of renovation services. This year we plan to start renovating 6

million housing units in run-down urban areas and 3.14 million dilapidated houses

in rural areas.

• Culture and sports

We will work hard to ensure that access to basic public cultural serv1ces

becomes increasingly standardized and equitable, and that both quality and

efficiency are increased in the provision of public cultural services. We will

support efforts to help socialist art and literature thrive while promoting cultural

exchanges and communication. We will improve the systems for providing policy

support to cultural industries. We will continue to promote public fitness

programs and support the reform and development of soccer in China. We will work to ensure adequate funding for China's preparation for and participation in

the 2016 Olympic Games in Rio de Janeiro.

• National defense and armed forces development

We will support efforts to deepen the reform of national defense and the

armed forces and strengthen the military in all respects so that it is more

revolutionary, modern, and standardized. We will promote integrated development

of the economy and national defense. We will work hard to ensure that the

capabilities of the armed forces are constantly improving, and that they are able to

safeguard the sovereignty, security, and development interests of China.

• Overcapacity reductions and the resettlement of workers

We will urge local governments and enterprises directly under the central

government to accelerate their efforts to cut overcapacity in the steel and coal

industries through the use of a combination of methods such as mergers,

reorganizations, debt restructurings, and banktuptcy liquidations. In this process,

the market should serve as a check, enterprises should be the major actors, local

20

governments should play a coordinating role, and the central government should

provide due support, while the responsibility for making sure that overcapacity

reductions happen in a locality will be on the relevant provincial-level government.

We will allocate a total of 100 billion yuan from the central government budget,

including 50 billion yuan to be used in 2016, for setting up tiered awards and

subsidies for eligible worker resettlement projects by local governments and

central government enterprises. These awards and subsidies will be provided on

the basis of levels of performance (linked mainly to overcapacity reductions), the

number of workers that require resettlement, the level of hardships faced by the

local government, and other factors. At the same time, local governments should

also allocate funds on the basis of their task requirements to ensure that adequate

financing is available during overcapacity reductions and work together with the

central government to carry out this work successfully.

2. Revenue projections and expenditure appropriations for 2016

(1) General public budgets

Revenue in the central government's general public budget is expected to

reach 7.057 trillion yuan, an increase of 2.2% over the actual figure for 2015.

Adding in the 100 billion yuan from the Central Budget Stabilization Fund and

the 31.5 billion yuan from the budgets of central government-managed funds and

central government state capital operations, total revenue in 2016 should amount

to 7.1885 trillion yuan. Expenditures from the central government's general public

budget are projected to reach 8.5885 trillion yuan, an increase of 6.3% (or an

increase of 6.7%, if the use of the 172.5 billion yuan carried over from previous

years is included). Total expenditures are projected to exceed total revenue leaving

a deficit of 1.4 trillion yuan, an increase of 280 billion yuan over last year. The

ceiling for the outstanding balance of central government bonds will be

12.590835 trillion yuan. The Central Budget Stabilization Fund will carry a balance

of 15.637 billion yuan.

Expenditures in the central government's general public budget are divided

into central government expenditures, tax rebates for local governments, general

transfer payments to local governments, special transfer payments to local

governments, and payments to central government reserve funds.

Central government expenditures are projected to total 2. 7355 trillion yuan,

up 7% over last year. This consists of 270.643 billion yuan for science and

technology expenditures, up 9.1 %; 51.971 billion yuan for foreign affairs-related

expenditures, up 8.6%; 954.354 billion yuan for national defense spending, up

7.6%; 166.815 billion yuan for public security expenses, up 5.3%; 120.138 billion

yuan for expenditures on general public services, up 13. 7%; and 329.929 billion

yuan for interest payments on debt, up 15.1%. Central government spending on

21

official overseas visits, official vehicles, and official hospitality will adhere to the

policy of zero-growth.

Central government tax rebates to local governments are projected to be

508.857 billion yuan, which is basically consistent with the actual figure for 2015.

General transfer payments to local governments will amount to 3.201782

trillion yuan, up 12.2% over last year. Of this amount, transfer payments for

equalizing access to basic public services will account for 2.039225 trillion yuan,

up 10.2%, which will be mainly used to help alleviate the burden on local

governments due to falling revenue growth and increased expenditures; transfer

payments to old revolutionary base areas, areas with concentrations of ethnic

minorities, border areas, and poor areas will reach 153.791 billion yuan, up 22.4%;

transfer payments for basic pension schemes will total 504.276 billion yuan, up

14.5%; and transfer payments for the rural and non-working urban resident health

insurance systems will come to 242.627 billion yuan, up 14.3%.

Special transfer payments to local governments will come to 2.092361 trillion

yuan, a reduction of 3.2% from last year. The number of items eligible for special

transfer payments will be strictly limited and the payment amounts for each item

will be effectively reduced, particularly with regard to projects that involve

competitive areas or subsidies for enterprise operations. Expenditures that are not

in line with policy intentions or are no longer highly beneficial, such as price

subsidies for refined oil products, will be reduced by a large margin. Expenditures

that have been made unnecessary due to changes of circumstances, such as

interest subsidies on loans used to finance public infrastructure construction in

development zones, will be canceled. Additionally, special transfer payments for

miscellaneous or redundant local projects will be further reduced or cancelled. At

the same time, special transfer payments to be used for ensuring basic living

standards will be increased overall, with increases in the following areas: 17.663

billion yuan for the quality improvement plan for modern vocational education,

up 19.4%; 137.013 billion yuan in basic living allowances and subsidies for people

facing financial difficulties, up 5.7%; 40.933 billion yuan in subsidies for entitled

groups, up 19.8%; 54.121 billion yuan for public health services, up 8.8%; 14.113

billion yuan in subsidies for medical assistance, up 9.2%; 23.286 billion yuan in

subsidies for agricultural resource and ecological conservation efforts, up 16.5%;

121.8 billion yuan in funds earmarked for central government subsidies for urban

housing projects, up 0.8%; 26.335 billion yuan for renovating dilapidated rural

houses, up 1.4%; and 39.771 billion yuan in allowances for the settlement of

decommissioned military personnel, up 12.7%.

A total of 50 billion yuan will be appropriated for central government reserve

funds.

22

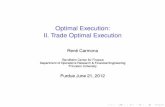

Figure 2

Projected Revenue and Expenditures in the General Public Budget of

the Central Government for 2016

yuan (billions)

5,000

<,000 7,188.5

3,000

Central government deficit {1,400)

....,.,.,.,,.,.:!, Contribution from the

Total revenue

Centr:al Budget Stabilization Fund (100)

budgets for central

government-managed

funds and centta1 government state capital operations (3 1.5)

8,588.5

rr----r- R~~<fm<<h (50}

Total expenditures

Tax rebates and tnnsfeJ: payments to local governments (5,803)

Central government expenditures (2,735.5)

Revenue in local governments' general public budgets is projected to total

8.663 trillion yuan, up 3.6% from last year. Adding in the 5.803 trillion yuan in tax

rebates and transfer payments from the central government and the 40 billion

yuan transferred from other local sources, total local government revenue is

expected to reach 14.506 trillion yuan. Expenditures from local governments'

general public budgets are projected to total 15.286 trillion yuan, which after

deducting utilized carryover and surplus funds from last year anc! funds

transferred from other sources is an increase of 6.3%. The projected local

government deficit therefore stands at 780 billion yuan, an increase of 280 billion

yuan over last year. This deficit will be made up for thtough the issuance of local

government general bonds. The ceiling for the outstanding balance of local

governmentgeneral bonds will be 10.70724 trillion yuan.

Combining the general public budgets of the central and local governments, it

is projected that nationwide revenue will amount to 15.72 trillion yuan, up 3%

from last year. Adding in the 171.5 billion yuan transferred from other sources,

total revenue available is expected to reach 15.8915 trillion yuan. Nationwide

expenditures are budgeted at 18.0715 trillion yuan, which after deducting local

governments' utilized carryover and surplus funds from last year and funds

transferred from other sources is an increase of 6. 7%. This will produce a national

deficit of 2.18 trillion yuan, an increase of 560 billion yuan over 2015.

The above figures of budgeted revenue and expenditures for 2016 also take

into account figures from government-managed fund budgets that were

23

transferred into general public budgets: from January 1, 2016, the revenue and

expenditures of five government-managed funds, such as water and soil

conservation subsidies, were transferred into general public budgets. While

budgetary revenue and expenditures for government-managed funds have been

reduced, we have made corresponding increases in the estimated revenue and

expenditure figures for the 2016 general public budgets as well as in the revenue

and expenditure baseline figures for 2015.

2. Budgets for government-managed funds

Revenue into central government-managed funds is projected to reach

427.165 billion yuan, up 5% from last year. Adding in the 24.817 billion yuan

carried forward from last year, revenue into central government-managed funds

will total 451.982 billion yuan. Expenditures from central government-managed

funds will be 451.982 billion yuan, up 5.5%. This figure consists of 340.523 billion

yuan of central government expenditures, up 12.8%, and 111.459 billion yuan of

transfer payments to local governments, down 11.9%.

Revenue into local government-managed funds is projected to be 3.290209

trillion yuan, down 12.4%. This figure includes 2.82486 trillion yuan from the sale

of state-owned land use rights, down 13.2%. Adding in the 111.459 billion yuan in

transfer payments from central government-managed funds and the 400 billion

yuan of revenue generated from local government special debt (an increase of 300

billion yuan over last year), total revenue related to local government-managed

funds is projected to be 3.801668 trillion yuan. Total expenditures related to local

government-managed funds will be 3.801668 trillion yuan. This includes 3.202408

trillion yuan of expenditures related to the proceeds of selling state-owned land

use rights, down 2.6%. The balance of outstanding special debt of local

governments will be no more than 6.48019 trillion yuan.

Combining the budgets for the central and local government-managed funds,

revenue into these funds is projected to be 3.717374 trillion yuan, a decrease of

10.7% from last year. Adding in the 24.817 billion yuan carried forward from last

year and the 400 billion yuan of revenue generated from local government special

debt, revenue into government-managed funds nationwide will be 4.142191

trillion yuan. Total expenditures related to these funds will reach 4.142191 trillion

yuan, down 1.2%.

It should be noted that, following the inclusion of the revenue and

expenditures of five government-managed funds, such as water and soil

conservation subsidies, into general public budgets, total budgetary revenue and

expenditures of central and local government-managed funds will decrease in.

2016. Because of this, we have correspondingly lowered the baseline figures for

2015 so that the level of growth can be calculated on a comparable basis.

24

3. Budgets for state capital operations

In 2016, we will strive to further refine the budgeting system for state capital

operations. First, the proportion of funds allocated from the state capital

operations budget of the central government to its general public budget will be

raised from 16% in 2015 to 19% this year. Second, a total of 68 enterprises,

including China Railway Corporation, will be incorporated into the central

government's state capital operations budget. Third, the utilization of funds will be prioritized towards addressing longstanding problems of SOEs, reducing

overcapacity, and making proper arrangements for laid-off employees.

Budgetary revenue from the state capital operations of the central

government is projected to be 140 billion yuan, down 13.2% from last year. This

decrease comes primarily from lower than expected enterprise profits in the

petroleum, petrochemical, steel, and coal industries. Adding in the 39.723 billion

yuan carried forward from last year, total budgetary revenue from central

government state capital operations is projected to be 179.723 billion yuan.

Budgetary expenditures on these operations are expected to be 155.123 billion

yuan, up 37.3%. Of this, 119.123 billion yuan is to be spent at the central level, an

increase of 18.5%, and 36 billion yuan is to be transferred to local governments,

an increase of 189.6%. A projected 24.6 billion yuan will be transferred into the

general public budget.

Budgetary revenue from the state capital operations of local governments is

projected to be 89.47 billion yuan, down 5.5% from last year. Adding in the 36

billion yuan of transfer payments from the central government's state capital

operations budget, total budgetary revenue from local government state capital

operations will be 125.4 7 billion yuan. Budgetary expenditures on local

government state capital operations are estimated to be 106.782 billion yuan, up

29 .2%. This increase is primarily due to a rise in transfer payments allocated from

the budgets of the central government's state capital operations for the purpose

of helping relieve SOEs of their obligation to provide water, electricity, heating,

gas, and property management services to their employees' homes as well as

advancing the reform of collectively owned businesses operated by SOEs. A

projected 18.688 billion yuan is to be allocated to local government general public

budgets.

Combining the state capital operation budgets of the central and local

governments, budgetary revenue nationwide is projected to be 229.47 billion yuan,

down 10.4% from last year. Adding in the 39.723 billion yuan carried over from

last year, total budgetary revenue from state capital operations nationwide will be

269.193 billion yuan. Budgetary expenditures on state capital operations

nationwide are expected to be 225.905 billion yuan, up 23.3%. A projected 43.288

billion yuan will be transferred into general public budgets.

25

4. Budgets for social security funds

Revenue into social security funds nationwide is projected to be 4.714419

trillion yuan, up 5.6% from last year, which includes 3.437659 trillion yuan from

insurance premiums and 1.084804 trillion yuan from government subsidies.

Expenditures from social security funds nationwide will total 4.354653 trillion

yuan, up 10.6%. With a projected surplus of 359.766 billion yuan this year, the

year-end balance will be 6.06 trillion yuan after the balance from 2015 has been

rolled over.

It should be noted that as local budgets are formulated by local people's

governments and submitted for approval to the people's congresses at their

respective levels, the relevant data is still in the process of being compiled. As

such, the above-mentioned figures for local revenue and expenditures have been

compiled by the central finance authorities.

For a detailed account of the budget arrangements related to the above items,

please refer to the 2015 Nationwide Budget Execution Report and draft 2016

Nationwide Budget of the People's Republic of China.

In accordance with the Budget Law, after the beginning of a new financial

year and prior to the approval of the drafts of the central and local government

budgets by the National People's Congress, arrangements may be made for the

following expenditures:

--¢> carryover expenditures from the previous financial year

--¢> basic expenditures and program expenditures of government

departments and transfer payments to lower-level governments that must

be made in the current year, after referring to the amount of budgetary

expenditures for the corresponding period of the previous year

--¢> expenditures mandated by law

--¢> expenditures for dealing with natural disasters and other emergencies

In accordance with the above stipulations, in January 2016, expenditures in

the central government's general public budget totaled 838.7 billion yuan, which

includes 153.7 billion yuan spent at the central level and 685 billion yuan in tax

rebates and transfer payments made to local governments.

In. Working towards Successful Public Finance Management and Reform in 2016

1. Implementing the Budget Law

We will work faster to unveil the revised Implementation Regulations of the

Budget Law at the earliest possible time so as to strengthen the institutional 26

foundation for law-based public finance management. We will expand efforts to

ensure that budgets and final accounts are released to the public and accelerate the

establishment of a transparent budget system. We will move ahead with mid-term