No Slide Title the revenue recognition concept. ... Learning Objective 2. Journalize entries for ......

Transcript of No Slide Title the revenue recognition concept. ... Learning Objective 2. Journalize entries for ......

Prepared by: C. Douglas Cloud Professor Emeritus of AccountingPepperdine University

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

1

The Adjusting Process

Chapter 3

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Learning Objectives

1. Describe the nature of the adjusting process.

2. Journalize entries for accounts requiring adjustment.

3. Summarize the adjustment process.4. Prepare an adjusted trial balance.5. Describe and illustrate the use of vertical

analysis in evaluating a company’s performance and financial condition.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Learning Objective 1

Describe the nature of the adjusting process.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Nature of the Adjusting Process

The accounting period concept requires that revenues and expenses be reported in the proper period.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Nature of the Adjusting Process

Under the accrual basis of accounting, revenues are reported on the income statement in the period in which they are earned.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Nature of the Adjusting Process

The accounting concept supporting the reporting of revenues when they are earned regardless of when cash is received is called the revenue recognition concept.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

The accounting concept supporting reporting revenues and related expenses in the same period is called the matchingconcept, or matching principle.

LO 1

Nature of the Adjusting Process

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Under the cash basis of accounting, revenues and expenses are reported on the income statement in the period in which cash is received or paid.

LO 1

Nature of the Adjusting Process

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

The Adjusting ProcessLO 1

Under the accrual basis, some of the accounts need updating at the end of the accounting period for the following reasons: Some expenses are not recorded daily. Some revenues and expenses are

incurred as time passes rather than as separate transactions. Some revenues and expenses may be

unrecorded.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

The Adjusting ProcessLO 1

The analysis and updating of accounts at the end of the period before the financial statements are prepared is called the adjusting process.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

The Adjusting ProcessLO 1

The analysis and updating of accounts at the end of the period before the financial statements are prepared is called the adjusting process.

The journal entries that bring the accounts up to date at the end of the accounting period are called adjusting entries.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-1

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Types of Accounts Requiring AdjustmentLO 1

Prepaid expenses are the advance payment of future expenses and are recorded as assets when cash is paid.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Prepaid ExpensesLO 1

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Prepaid ExpensesLO 1

(concluded)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Types of Accounts Requiring AdjustmentLO 1

Unearned revenues are the advance receipt of future revenues and are recorded as liabilities when cash is received.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Unearned RevenuesLO 1

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Unearned RevenuesLO 1

(concluded)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Types of Accounts Requiring AdjustmentLO 1

Accrued revenues are unrecorded revenues that have been earned and for which cash has yet to be received.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Accrued RevenuesLO 1

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Accrued RevenuesLO 1

(concluded)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Types of Accounts Requiring AdjustmentLO 1

Accrued expenses are unrecorded expenses that have been incurred and for which cash has not yet been paid.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Accrued ExpensesLO 1

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Accrued ExpensesLO 1

(concluded)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-2

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Learning Objective 2

Journalize entries for accounts requiring

adjustment.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Adjusting EntriesLO 2

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Adjusting EntriesLO 2

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

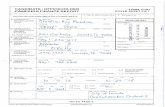

NetSolutions’ Supplies account has a balance of $2,000 on the unadjusted trial balance. Some of these supplies have been used. On December 31, a count reveals that the amount of supplies on hand is $760.

Supplies (balance on trial balance) $2,000Supplies on hand, December 31 – 760Supplies used $1,240

Prepaid ExpensesLO 2

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Prepaid ExpensesLO 2

Assets = Liabilities + Stockholders’ Equity (Expense)

Accounting Equation Impact

decrease

increase

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

The debit balance of $2,400 in NetSolutions’ Prepaid Insurance account represents the December 1 prepayment of insurance for 12 months.

LO 2

Prepaid Insurance

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Prepaid Insurance

Assets = Liabilities + Stockholders’ Equity (Expense)

Accounting Equation Impact

decrease

increase

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Impact of Omitting Adjusting Entries

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-3

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Unearned Revenues

The credit balance of $360 in NetSolutions’ Unearned Rent account represents the receipt of three months’ rent on December 1 for December, January, and February. At the end of December, one month’s rent has been earned.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Unearned Revenues

Assets = Liabilities + Stockholders’ Equity (Revenue)

Accounting Equation Impact

decreaseincrease

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Impact of Omitting Adjusting Entry

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-4

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Accrued Revenues

NetSolutions signed an agreement with Danker Co. on December 15 to provide services at a rate of $20 per hour. As of December 31, NetSolutions had provided 25 hours of services. The revenue will be billed on January 15.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Unearned Revenues

Assets = Liabilities + Stockholders’ Equity (Revenue)

Accounting Equation Impact

increase increase

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Impact of Omitting Adjusting Entry

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-5

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Accrued WagesLO 2

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Accrued Wages

NetSolutions pays its employees biweekly. During December, NetSolutions paid wages of $950 on December 13 and $1,200 on December 27. As of December 31, NetSolutions owes $250 of wages to employees for Monday and Tuesday, December 30 and 31.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Accrued Wages

Assets = Liabilities + Stockholders’ Equity (Expense)

Accounting Equation Impact

increaseincrease

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Accrued Wages

NetSolutions paid wages of $1,275 on January 10. This payment includes the $250 of accrued wages recorded on December 31.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Impact of Omitting Adjusting Entry

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-6

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Depreciation Expense

Fixed assets, or plant assets, are physical resources that are owned and used by a business and are permanent or have a long life.

As time passes, a fixed asset loses its ability to provide useful services. This decrease in usefulness is called depreciation.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Depreciation Expense

All fixed assets, except land, lose their usefulness and , thus, are said to depreciate.

As a fixed asset depreciates, a portion of its cost should be recorded as an expense. This periodic expense is called depreciation expense.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Depreciation Expense

The fixed asset account is not decreased (credited) when making the related adjusting entry. This is because both the original cost of a fixed asset and the depreciation recorded since its purchase are reported on the balance sheet. Instead, an account entitled Accumulated Depreciation is increased (credited).

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Depreciation Expense

Accumulated depreciation accounts are called contra accounts, or contra assetaccounts.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Depreciation Expense

Normal titles for fixed asset accounts and their related contra asset accounts are:

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Depreciation Expense

NetSolutions estimates the depreciation on its office equipment to be $50 for the month of December.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Depreciation Expense

Assets = Liabilities + Stockholders’ Equity (Expense)

Accounting Equation Impact

increase

increase

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Depreciation Expense

The difference between the original cost of the office equipment and the balance in the Accumulated Depreciation—Office Equipment account is called the book value of the asset (or net book value). It is computed as shown below.

Book Value of Asset = Cost of the Asset – Accumulated Depreciation of Asset

Book Value of Off. Equip. = Cost of Off. Equip. – Accum. Depre. of Office Equip.

Book Value of Off. Equip. = $1,800 – $50

Book Value of Off. Equip. = $1,750

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 2

Impact of Omitting Adjusting Entry

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-7

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-8

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Learning Objective 3

Summarize the adjustment process.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 3

Summary of Adjustment Process

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 3

Summary of Adjustment Process

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 3

Summary of Adjustment Process

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 3

Summary of Adjustment Process

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 3

Summary of Adjustment Process

(concluded)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Adjusting EntriesAdjusting Entries—NetSolutions

LO 3

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Adjusting EntriesLO 3

Adjusting Entries—NetSolutions

(concluded)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 3

Ledger with Adjusting Entries

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 3

Ledger with Adjusting Entries

Ledger with Adjusting Entries─ NetSolutions

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 3

Ledger with Adjusting Entries

Ledger with Adjusting Entries─ NetSolutions

(continued)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

LO 3

Ledger with Adjusting Entries

Ledger with Adjusting Entries─ NetSolutions

(concluded)

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Learning Objective 4

Prepare an adjusted trial balance.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Adjusted Trial Balance

The purpose of the adjusted trial balance is to verify the equality of the total debit and credit balances before the financial statements are prepared.

LO 4

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Adjusted Trial Balance

Adjusted Trial Balance

LO 4

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-9

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Learning Objective 5LO 5

Describe and illustrate the use of vertical

analysis in evaluating a company’s performance and financial condition.

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Vertical Analysis

Comparing each item in a financial statement with a total amount from the same statement is referred to as verticalanalysis.

LO 5

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Vertical AnalysisLO 5

$12,500 = .067 or 6.7%$187,500

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Vertical AnalysisLO 5

$3,000 = .02 or 2%$150,000

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-10

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

EE 3-10

Prepared by: C. Douglas Cloud Professor Emeritus of AccountingPepperdine University

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

82

The Adjusting Process

The End