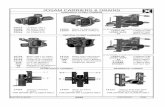

Indexed UL Carriers and Products

Transcript of Indexed UL Carriers and Products

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product

Nontobacco Pref Plus Standard Tobacco

Tobacco Standard Tobacco All other classes

Juvenile All other classes Ages 0-50, up to $1m uses Non-med underwriting

Non-med UW

Full UW

Indexed 5.00% Non-preferred 3.00% Non-preferred 3.00%

Yrs 1-10 2.91% Preferred 2.00% Preferred 2.00%

Yrs 11+ 1.96% Participating Loans available yr 1 Participating Loans available yr 1

Decreasing charge for 19 years Decreasing charge for 14 years

Child Term Accelerated Access Solution Accelerated Access Solution

Accidental DB Accidental DB Children's Insurance

Children's Insurance Dollar Cost Averaging Early Cash Value

Loan Protection Rider Dollar Cost Averaging Income For Life

Premium Deposit Fund Overloan Protection Overloan Protection Select Income

Supplemental Term Protected Premium Terminal Illness

Terminal Illness Select Income Waiver of Monthly Deduction

Waiver of New Charges Terminal Illness Waiver of Specified Premium

Waiver of Specified Premium Waiver of Monthly Deduction

Available DB Gtes

level level level

increasing increasing increasing

return of premium

Floor

Standard: 1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ High Cap

1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Par Rate 1-Yr S&P 500 Point-to-Point w/ High Bonus

1-Yr. S&P 500 Point-to-Point Trigger Method 1-Yr Point-to-Point Blend* Uncapped 1-Yr Point-to-Point Blend Participation Rate*

1-Yr S&P 500 Monthly Sum w/ Cap 1-Yr Point-to-Point Global Blend** Uncapped 1-Yr Point-to-Point Global Blend Participation Rate**

1-Yr Blended* Point-to-Point w/ Cap *Uses ML Strategic Balanced Index (S&P 500 and *Uses ML Strategic Balanced Index (S&P 500 and

1-Yr Bloomberg US Dynamic Balance Index II Point- Merrill Lynch 10-Year Treasury Futures Total Merrill Lynch 10-Year Treasury Futures Total

to-Point w/ Par Rate w/ ER (Excess Returns) Return Index) Return Index)

1-Yr PIMCO Tactical Balanced** Point-to-Point w/ Par Rate **Uses PIMCO Global Optima (blend of global equities, **Uses PIMCO Global Optima (blend of global equities,

w/ ER (Excess Returns) domestic fixed income, and dividends) domestic fixed income, and dividends)

Classic (guaranteed 90bps bonus yrs 1+)

1-Yr Blended* Point-to-Point w/ Cap

1-Yr Bloomberg US Dynamic Balance Index II Point-

to-Point w/ Par Rate w/ ER (Excess Returns)

1-Yr PIMCO Tactical Balanced** Point-to-Point w/ Par Rate

w/ ER (Excess Returns)

Bonused (15% Multiplier, no charge):

1-Yr Blended* Point-to-Point w/ Cap

1-Yr Bloomberg US Dynamic Balance Index II Point-

to-Point w/ Par Rate w/ ER (Excess Returns)

1-Yr PIMCO Tactical Balanced** Point-to-Point w/ Par Rate

w/ ER (Excess Returns)

Select (40% Multiplier)***

1-Yr Blended* Point-to-Point w/ Cap

1-Yr Bloomberg US Dynamic Balance Index II Point-

to-Point w/ Par Rate w/ ER (Excess Returns

1-Yr PIMCO Tactical Balanced** Point-to-Point w/ Par Rate

w/ ER (Excess Returns

*Blended Index (35% DJIA, 35% Bloomberg Barclays US

Aggregate Bond, 20% EURO STOXX, 10% Russell 2000)

**PIMCO Tactical Balanced uses S&P 500, PIMCO Synthetic

Bond Index, duration overlay, and cash

***Multiplier charges 100bps/yr in yrs 1+ for guaranteed 40%

multiplier

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

AIG/American General

Chronic Illness

Issue AgesAges 0-17

Ages 18-75

2.00%

$1,000,001

Ages 18-80

Death Benefit

Options

2.00%

Loan Rate

Option A=

Option C=

Option 2=

Option 1=

$50,000

0.10%

Decreasing charge for 12 years

Up to age 90

2.00%

Minimum Face

Amount

GTD Interest Rate

$100,000

2.00%

$50,000

Interest Credited on

Policy Loans

2.00%

Riders

Enhanced Liquidity

Surrender Charges

Index Crediting

Strategies

0%

Life Pro+ Advantage IUL

0.25% (High Bonus Rate); 0% all other strategies

Option 1=

Option 2=

Lesser of 20 yrs or age 75, not less than 10 yrs

0%

Option B=

Age last birthday

Value+ Protector II IUL Max Accumulator+ II IUL

Ages 18-85

Ages 18-80

Varies by age from 5-10 years

Ages 18-80 Ages 0-80

Allianz Life

Ages 0-85

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 1 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product C C

Pref Plus Standard Tobacco Ages 0-85

All other classes All other classes

Ages 0-50, up to $499,999 uses Non-med

underwriting

Non-med UW

Full UW

Non-preferred 4.00% Non-preferred 3.00%

Preferred 3.00% Preferred 2.00% Fixed and variable loans available

Participating Loans available yr 1 Participating Loans available yr 1

Decreasing charge for 19 years Decreasing charge for 14 years Decreasing charge for 10 years

Accelerated Access Solution Accelerated Access Solution Accelerated DB (Terminal, Chronic, Critical)

Accidental DB Children's Insurance Accidental DB Children's Insurance Children's Term

Overloan Protection Income For Life Maturity Extension Disability Waiver of Minimum Premium

Overloan Protection Select Income Disability Waiver of Stipulated Premium

Terminal Illness Guaranteed Insurability

Waiver of Monthly Deduction Overloan Protection

Waiver of Specified Premium

Available DB Gtes

level level level

increasing increasing Option B= increasing

Option C= return of premium

Floor

1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Value Cap

1-Yr S&P 500 Point-to-Point w/ Par Rate 1-Yr S&P 500 Point-to-Point w/ Par Rate 1-Yr S&P 500 Point-to-Point Uncapped w/ Interest Rate

Spread

1-Yr S&P 500 Point-to-Point w/ Multiplier*

1-Yr S&P 500 Point-to-Point w/ Multiplier Plus**

1-Yr S&P MARC 5% Low Volatility Point-to-Point Uncapped

1-Yr NASDAQ 100 Point-to-Point Growth Cap

*Multiplier charges 190bps/yr for 24% guaranteed

multiplier yrs 1+

**Multiplier charges 365bps/yr for 60% guaranteed

multiplier yrs 1+

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

10 year DB guarantee

Loan Rate

2.00%GTD Interest Rate

$500,000$100,000

6% in arrears

2.00%

3.00% 2.00% 6.00%

Riders

Surrender Charges

Interest Credited on

Policy Loans

Waiver of Monthly Deduction

Premium Protection Rider

Lesser of 20 yrs or age 75

Death Benefit

OptionsOption 2=

Option 1=

Index Crediting

Strategies

0% 0% (1.5% w/ Higher Floor)0.25% (Core Cap); 0% all other strategies

Option 1= Option A=

Option 2=

Available beyond age 90

Value+ Protector IUL Signature Performance IUL

$50,000

Ages 18-80Ages 18-85

Ages 18-80

$25,000Minimum Face

Amount

American National

2.00%

Ages 0-80

AIG/United States Life of NY

Max Accumulator+ IUL

Issue Ages

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 2 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product C C

Ages 18-80 Ages 0-85 Non-Nicotine Ages 18-75 Preferred Plus

Ages 18-85 Nicotine Preferred, Select

Ages 18-85 Standard

Juvenile

Yrs 1-5 3.50%

Fixed and variable loans available Fixed and variable loans available Yrs 6+ 2.50%

Variable loans beginning in year 3

Accelerated DB (Terminal, Chronic, Critical) Accelerated DB (Terminal, Chronic) Accidental DB Care4Life

Children's Term Children's Term Early Cash Value

Disability Waiver of Premium Disability Waiver of Minimum Premium Guaranteed Insurability

Disability Waiver of Stipulated Premium Disability Waiver of Stipulated Premium Insurance Exchange

Guaranteed Insurability Guaranteed Insurability Lifetime Income Overloan Protection

Overloan Protection Overloan Protection Term Insurance for Other Insured

Supplemental Coverage

Waiver of Monthly Deductions

Waiver of Specified Premium

Available DB Gtes

level level Option A= level

Option B= increasing Option B= increasing Option C= return of premium

Option C= return of premium

Floor

1-Yr S&P 500 Point-to-Point w/ Value Cap 1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap

1-Yr S&P 500 Point-to-Point Uncapped w/ Interest Rate 1-Yr S&P 500 Point-to-Point w/ Cap and Higher Floor 1-Yr Russell 2000 Point-to-Point w/ Cap

Spread 1-Yr S&P 500 Point-to-Point w/ Specified Rate 1-Yr MSCI EAFE Point-to-Point w/ Cap

1-Yr S&P MARC 5% Low Volatility Point-to-Point Uncapped 1-Yr S&P 500 Point-to-Point Uncapped w/ Interest Rate 1-Yr BNP Paribas Momentum Multi-Asset 5 Uncapped

1-Yr NASDAQ 100 Point-to-Point Growth Cap Spread 2-Yr S&P 500 Point-to-Point Capped

2-Yr BNP Paribas Momentum Multi-Asset 5 Uncapped

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

American National

1.50%

Ameritas LifeAmerican National of NY

6% in arrears

6.00%

Signature IUL NY Value Plus IUL

6% in arrears

6.00%Interest Credited on

Policy Loans

10 year DB guarantee

Decreasing charge for 10 years

Loan Rate

GTD Interest Rate

Dialable from age 80 to age 121

Children's Insurance

Surrender Charges

Option A=

0%

Index Crediting

Strategies

0%; 3% Lookback Guarantee after 10 years

Death Benefit

Options

Option A=

0% (1.5% w/ Higher Floor)

Decreasing charge for 19 years

Issue Ages

1.00%

Minimum Face

Amount

Riders

1.00%

Ages 0-17

$50,000

2.50%

Ages 18-80

Varies from 5-50 years

Signature Protection IUL

Decreasing charge for 19 years

$250,000 $25,000

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 3 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product C C

Ages 18-75 Preferred Plus Ages 18-75 Preferred Elite Ages 18-75 Premier

Preferred, Select Preferred NT Ages 18-85 All other classes

Ages 18-85 Standard Tobacco Ages 0-85 Standard Plus

Standard Nontobacco All other classes

all issue ages

if Charitable is elected

Yrs 1-5 3.50% Yrs 1-10 3.00%

Yrs 6+ 2.50% Yrs 11+ 2.00% Fixed, Linked, Variable loans available

Variable loans beginning in year 3 Alternate loans available beginning in yr 4

Accidental DB Care4Life Cash Value Plus Child Term Additional Insured

Early Cash Value Living Benefit (terminal) Accelerated Access Rider (Chronic Illness)

Guaranteed Insurability Loan Extension Endorsement

Insurance Exchange LTC Services Children's Insurance Guar. Purchase Option

Lifetime Income Overloan Protection Overloan Protection

Term Insurance for Other Insured ROP DB Primary Insured Wellness for Life

Supplemental Coverage Waiver of Monthly Deductions Waiver of Specified Premium

Waiver of Monthly Deductions

Waiver of Specified Premium

Available DB Gtes

Option A= level Option A= level Option 1= level

Option C= return of premium Option B= increasing Option 2= increasing

Floor

1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap

1-Yr Russell 2000 Point-to-Point w/ Cap 1-Yr Point-to-Point Russell 2000 w/ Cap 1-Yr S&P 500 Point-to-Point Increased Par

1-Yr MSCI EAFE Point-to-Point w/ Cap 1-Yr Point-to-Point MSCI EAFE w/ Cap 1-Yr S&P 500 Point-to-Point Elevated Cap

1-Yr S&P 500 Monthly Sum Capped 3-Yr S&P 500 Point-to-Point w/ Cap 1 Yr S&P 500 Monthly Cap

1-Yr S&P 500 Point-to-Point High Participation 1-Yr Hang Seng Point-to-Point

1-Yr BNP Paribas Momentum Multi-Asset 5 Uncapped 2-Year S&P 500 Point-to-Point

2-Yr S&P 500 Point-to-Point Capped

2-Yr BNP Paribas Momentum Multi-Asset 5 Uncapped

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

10 year DB guarantee

0%; 4% Lookback Guarantee after 10 years

$50,000

Children's Insurance

Ameritas Life

Growth IUL

Ages 18-80

Ages 0-85

BrightLife Grow IUL

Decreasing charge for 15 years

2.00%

Accidental DB

Lesser of 10 years or age 90

Accelerated DB

Surrender Charges

Riders

Decreasing charge for 15 yearsDecreasing charge for 10 years

Index Crediting

Strategies

Death Benefit

Options

Lesser of 40 yrs/age 90 (NT), 30 yrs/age 80 (Tobacco)

Option to Purchase Additional Insurance

3.85%; Preferred loans (2%) yrs 11+

2.00%

Minimum Face

Amount$100,000

$50,000

$1,000,000

Interest Credited on

Policy Loans

Ages 18-80

2.00%1.00%

2.00%1.00%

Loan Rate

Issue Ages

GTD Interest Rate

2% Alternate Policy Account value if greater than CV at

surrender or death

Charitable Legacy

2% at end of each segment term or contract termination

Lifetime Foundation Elite IUL

Ages 18-85

Equitable Global Atlantic

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 4 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product

Ages 18-75 Premier Ages 18-75 Premier

Ages 0-85 Standard NT Ages 0-85 Standard NT

Ages 18-85 All other classes Ages 18-85 All other classes

Premier, Pref $100,000 Premier, Pref $100,000

Ages 0-17 $25,000 Ages 0-17 $25,000

Ages 18-85 (Std) $50,000 Ages 18-85 (Std) $50,000

Non-preferred 3.85%

Fixed, Linked, Variable loans available Preferred (yrs. 10+) 2.00%

Fixed, Linked, Variable loans available

Additional insured Additional Insured

Accelerated Access Rider (Chronic Illness) Accelerated Access Rider (Chronic Illness)

Children's Insurance Children's Insurance

Guaranteed Purchase Option Guaranteed Purchase Option

Overloan Protection ROP (w/ DBO 3) Overloan Protection ROP (w/ DBO 3)

Primary Insured Wellness for Life Primary Insured Wellness for Life

Waiver of monthly deduction/specified premium Waiver of Monthly Deduction/Specified Premium

Available DB Gtes

Option 1= level Option 1= level

Option 2= increasing Option 2= increasing

Option 3= ROP (via rider) Option 3= ROP (via rider)

Floor

1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap

1-Yr S&P 500 Point-to-Point Increased Par 1-Yr S&P 500 Point-to-Point Increased Par

1-Yr S&P 500 Point-to-Point Elevated Cap 1-Yr BlackRock Diversa Volatility Control Point-to-Point

1 Yr S&P 500 Monthly Cap 1-Yr S&P 500 Point-to-Point SMART Buy-UP Secure*

1-Yr Hang Seng Point-to-Point 1-Yr S&P 500 Point-to-Point SMART Buy-UP Performance**

2-Year S&P 500 Point-to-Point *Multiplier charges 125bps/yr for 25% non-guaranteed

multiplier years 6+

**Multiplier charges 525bps/yr for 100% non-guaranteed

multiplier after funding ratio threshold met

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

Global Accumulator IUL

2.00%

Lifetime Builder Elite IUL

5 years

Riders

Accelerated DB

5 years

2% at end of each segment term or contract termination

Decreasing charge for 15 years

Death Benefit

Options

2% at end of each segment term or contract termination

2.00%

Minimum Face

Amount

2.00%

Accelerated DB

Decreasing charge for 15 years

Interest Credited on

Policy Loans

3.85%; Preferred loans (2%) yrs 11+

2.00%

Index Crediting

Strategies

Global Atlantic

Surrender Charges

Accidental DB Accidental DB

Issue Ages

GTD Interest Rate

Loan Rate

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 5 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product C C

Ages 3 months-90 Standard NS Ages 0-90 Standard NS Ages 18-75 Elite

Ages 20-80 Super Preferred NS Ages 20-80 Super Preferred NS Ages 0-85 Standard NS

Ages 20-90 All other classes Ages 20-90 All other classes Ages 18-85 All other classes

Standard and Index Loans available Standard 3.25% yrs 1-10; 3% yrs 11+ 4.00%

Fixed Indexed 5% Participating Fixed 5.00%

Indexed Variable Participating Variable loans available

Standard Loan spread of 1.25% in yrs 1-10, Standard: Net cost no greater than 2% in all yrs Standard Loan spread of .50% in yrs 1-10, 0%

.25% in yrs 11+ in yrs 11+

Decreasing charge for 12 years

Accelerated benefit Accelerated Benefit Accelerated DB (Terminal, Chronic, Critical

Cash Value Enhancement Cash Value Enhancement Illness, Critical Injury)

Critical Illness Benefit Critical Illness Benefit Add'l Protection Benefit Balance Sheet Benefit

Disability payment of specified premium Disability Payment of Specified Premium Benefit Distribution Opt Charitable Matching DB

LTC Rider LTC Rider Children's Term DB Protection

Return of premium Overloan Protection Gtd Insurability Lifetime Income Benefit

Vitality GO or PLUS (Healthy Engagement) Return of Premium Other Insured Overloan Protection

Vitality GO or PLUS (Healthy Engagement) Systematic Allocation

Qualified Plan Exchange Privilege

Waiver of Specified Premium

Available DB Gtes Varies by age, 7-15 yrs

Option 1= level Option 1= level Option A= level

Option 2= increasing Option 2= increasing Option B= increasing

(Option 2 not available w/ LTC Rider or ROP) (Option 2 not available w/ LTC Rider or ROP)

Floor

1-Yr S&P 500 Point-to-Point w/ Select Capped* 1-Yr S&P 500 Point-to-Point Base High Par Capped 1-Yr S&P 500 Point-to-Point w/ Cap

1-Yr S&P 500 Point-to-Point Base High Par 1-Yr S&P 500 Point-to-Point w/ Select Capped* 1-Yr S&P 500 Point-to-Point High Par

1-Yr S&P 500 Point-to-Point w/ Cap** (n/a in NY) 1-Yr S&P 500 Point-to-Point w/ Cap** 1-Yr S&P 500 Point-to-Point 1% Floor

1-Yr S&P 500 Point-to-Point High Par* (n/a in NY) 1-Yr S&P 500 Point-to-Point High Cap*** 1-Yr Credit Suisse Uncapped

1-Yr S&P 500 Point-to-Point High Cap*** (n/a in NY) 1-Yr S&P 500 Point-to-Point High Par**

2-Yr S&P 500 Point-to-Point Base Capped 1-Yr S&P 500 Point-to-Point Enhanced Cap****

*Multiplier 5% guaranteed multiplier yrs 1+, no charge 1-Yr S&P 500 Point-to-Point Enhanced High Cap*****

**Multiplier charges 198bps/yr for 65% guaranteed 2-Yr S&P 500 Point-to-Point w/ Base Capped

multiplier yrs 1+ 1-Yr S&P 500 Point-to-Point w/ Base Capped (NY only)

***Multiplier charges 198bps/yr for 38% guaranteed 1-Yr S&P 500 Point-to-Point w/ Base High Capped (NY only)

multiplier yrs 1+ 1-Yr Barclays Global MA Bonus Uncapped

1-Yr Barclays Global MA Classic High Par Uncapped

*Multiplier 5% guaranteed multiplier yrs 1+, no charge

**Multiplier charges 198bps/yr for 45% guaranteed

multiplier yrs 1+

***Multiplier charges 198bps/yr for 30% guaranteed

multiplier yrs 1+

****Multiplier charges 498bps/yr for 106% guaranteed

multiplier yrs 1+

*****Multiplier charges 498bps/yr for 80% guaranteed

multiplier yrs 1+

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

Issue Ages

$50,000$50,000 $50,000

Life Insurance Co. of SW/National Life

Accumulation IUL

Minimum Face

Amount

2.00%1.00%

10-30 yrs via DB Protection Rider

Surrender Charges

Riders

Death Benefit

Options

Index Crediting

Strategies

0%, except 1% Floor option0%

Life Expectancy

0%; 2% Cumulative Guarantee upon surrender

Waiver of Mo. Deductions

Decreasing charge for 10 years

Standard

2.00%

Decreasing charge for 10 years

GTD Interest Rate

John Hancock USA

Flex Life IUL

Loan Rate

Interest Credited on

Policy Loans

Protection IUL

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 6 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product C

Ages 20-80 Pref Plus, Preferred Ages 20-80 Pref Plus, Preferred Ages 20-80 Pref Plus, Preferred

Ages 0-85 Standard Nontobacco Ages 0-85 Standard Nontobacco Ages 16-85 Standard classes

Ages 15-85 Standard Tobacco Ages 15-85 Standard Tobacco

Fixed: 4% yrs 1-10, 3% yrs 11+ Fixed: 4% yrs 1-10, 3% yrs 11+ Fixed: 4% yrs 1-10, 3% yrs 11+

Participating: 5.5% up to age 121; 3% after age 121 Participating: 5.5% up to age 121; 3% after age 121 Participating: 6% yrs. 1-10, 5% yrs. 11+

Decreasing charge for 14 years Decreasing charge for 14 years

Accel DB w/ Critical Illness Accelerated DB Accel DB w/ Critical Illness Accelerated DB

Change of Insured Children's Term Change of Insured Children's Term Change of Insured

DI Waiver of Monthly Deductions DI Waiver of Monthly Deductions DI Waiver of Monthly Deductions

DI Waiver of Specified Premium Extended No-Lapse Minimum Premium Extended No-Lapse Minimum Premium

LifeAssure ADB for Chronic Illness LifeAssure ADB for Chronic Illness LifeAssure ADB for Chronic Illness

Lincoln Care Coverage for LTC Lincoln Care Coverage for LTC Overloan Protection

Lincoln Enhanced Value Rider Overloan Protection

Overloan Protection Supplemental Term on Primary Insured

Supplemental term Supp term on other insured Supplemental Term on Other Insured

Surrender Value Enhancement

Available DB Gtes 25 yrs; lesser or 40 yrs/age 90 (via rider) 10 yrs; lesser or 40 yrs/age 90 (via rider)

Option 1= level Option 1= level Option 1= level

Option 2= increasing Option 2= increasing Option 2= increasing

Option 3= return of premlium Option 3= return of premlium Option 3= return of premlium

Floor

1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap

1-Yr S&P 500 Point-to-Point Multiplier w/ Cap* 1-Yr S&P 500 Point-to-Point Fixed Bonus w/ Cap**

1-Yr S&P 500 Point-to-Point Fixed Bonus w/ Cap** 1-Yr S&P 500 Point-to-Point Performance Trigger

1-Yr S&P 500 Point-to-Point Performance Trigger 1-Yr Fidelity AIM Dividend High Par Uncapped

1-Yr Fidelity AIM Dividend High Par Uncapped 1-Yr Fidelity AIM Dividend Fixed Bonus Uncapped

1-Yr Fidelity AIM Dividend Fixed Bonus Uncapped **25bps guaranteed Account Value Enhancement yrs 1+

*Multiplier charges 200bps for guaranteed 50%

multiplier yrs 1+

**25bps guaranteed Account Value Enhancement yrs 1+

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

Lincoln Life of NY

0.25%

$100,000

WealthPreserve IUL NY (2017)

Loan Rate

0.25%

Minimum Face

Amount

WealthPreserve 2 IUL

3.00%

10 year DB guarantee

Accelerated DB

Index Crediting

Strategies

.25% on Fixed Bonus option; 0% on others

Death Benefit

Options

1%.25% on Fixed Bonus option; 0% on others

3.00%Interest Credited on

Policy Loans

Decreasing charge for 9 years Surrender Charges

Riders

GTD Interest Rate

WealthAccumulate 2 IUL

1.00%

3.00%

$100,000$100,000

Lincoln Life

Issue Ages

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 7 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product C

Ages 20-80 Pref Plus, Preferred Standard Non Tobacco Standard Non Tobacco

Ages 18-85 Standard classes All classes All classes

Ages 81-85 Standard classes Ages 81-85 Standard classes

Age last birthday Age last birthday

Fixed: 4% yrs 1-10, 3% yrs 11+ years 1-9 (Standard) years 1-9 (Standard)

Participating: 6% yrs. 1-10, 5% yrs. 11+ years 10+ (Standard) years 10+ (Standard)

Indexed Indexed

Standard Standard

Decreasing charge for 9 years

Accelerated DB Accidental DB

Change of Insured Children's term rider Accidental DB Accidental DB

DI Waiver of Monthly Deductions Additional Insured (Self, Other) Additional Insured (Self, Other)

DI Waiver of Specified Premium Dependent Child Dependent Child

Guaranteed Insurability Disability Continuation of Planned Premiums Disability Continuation of Planned Premiums

LifeEnhance ADB for Chronic Illness Disability Waiver of Policy Charges Disability Waiver of Policy Charges

Overloan Protection Guaranteed Insurability Guaranteed Insurability

Supplemental Term on Primary Insured Guaranteed Refund Option Guaranteed Refund Option

Supplemental Term on Other Insured Lapse Guard Lapse Guard

Surrender Value Enhancement Endorsement LTC Rider LTC Rider

Available DB Gtes 10 yrs.

Option 1= level Option 1= level Option 1= level

Option 2= increasing Option 2= increasing Option 2= increasing

Option 3= return of premlium

Floor

1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap

1-Yr S&P 500 Point-to-Point High Par 1-Yr S&P 500 Point-to-Point High Par 1-Yr S&P 500 Point-to-Point High Par

1-Yr S&P 500 Point-to-Point Uncapped 1-Yr S&P 500 Point-to-Point Uncapped 1-Yr S&P 500 Point-to-Point Uncapped

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

1.00%

Lincoln Life of NY

$100,000

6.00%

Income Advantage IUL

2.00%

4.00%

6.00%

Ages 0-17

Ages 18-80

WealthAdvantage IUL NY

2.00%

Loan Rate

Ages 0-17

Ages 18-80

Surrender Charges

0%

Varies by age, max of 10 yrs

Index Crediting

Strategies

0%

Death Benefit

Options

1%

Interest Credited on

Policy Loans3.00%

Decreasing charge for 14 years

Accelerated DB for Terminal, Chronic illness

Decreasing charge for 14 years

GTD Interest Rate

2.00%

2.00%

Varies by age, max to age 90

Accelerated DB for Terminal, Chronic illness

2.00%

$100,000

4.00%

2.00%

Riders

Issue Ages

Minimum Face

Amount$100,000

Life Protection Advantage IUL

Mutual of Omaha/United of Omaha

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 8 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product

Non-Tobacco Ages 0-85 NT Standard Ages 0-85 NT Standard

Tobacco Ages 18-85 Tobacco Standard Ages 18-85 Tobacco Standard

Age last birthday Ages 18-80 All other classes Ages 18-80 All other classes

Ages 18-50 $25,000-$300,000

Ages 51-60 $25,000-$250,000

Ages 61+ $25,000-$150,000

years 1-9 (Standard)

years 10+ (Standard) Alternate (Indexed)

Indexed Alternate (Indexed) loans available after year 1

Standard

Decreasing charge for 10 years

Accidental DB Accidental DB Accidental DB

Dependent Child Children's Insurance Children's Insurance

Disability Continuation of Planned Premiums Conditional ROP Extended NLG Rider

Disability Waiver of Policy Charges LTC Rider II LTC Rider II

Guaranteed Insurability Overloan Lapse Protection II Overloan Lapse Protection II

Waiver of Surrender Charges for Partial Withdrawals Premium Waiver Premium Waiver

Spouse Term Spouse Term

Waiver of Monthly Deductions Waiver of Monthly Deductions

Available DB Gtes Varies by age, max of 20 yrs Extended NLG Riders to age 90 or 120

Option 1= level Option 1= level Option 1= level

Option 2= increasing Option 2= increasing Option 2= increasing

Option 3= return of premlium Option 3= return of premlium

Floor

1-Yr S&P 500 Point-to-Point w/ Cap Core Strategies: Core Strategies:

1-Yr S&P 500 Point-to-Point High Par 1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr Point-to-Point S&P 500

1-Yr S&P 500 Point-to-Point Uncapped 1-Yr Monthly Average Multi-Index* 1-Yr Monthly Average Multi-Index*

1-Yr S&P 500 Point-to-Point Uncapped 1-Yr S&P 500 Point-to-Point Uncapped

High Cap: High Cap:

1-Yr Point-to-Point S&P 500 1-Yr Point-to-Point S&P 500

1-Yr Monthly Average Multi-Index* 1-Yr Monthly Average Multi-Index*

*Uses S&P 500, NASDAQ 100, DJIA *Uses S&P 500, NASDAQ 100, DJIA

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

IUL Express

Nationwide

$100,000

4.00%

Issue Ages

Mutual of Omaha/United of Omaha

IUL Accumulator II 2020

Ages 18-70

1.00%

Loan Rate 2.00%

IUL Protector II 2020

Lesser of 20 years or age 80

2.00%

$100,000

Ages 18-65

GTD Interest Rate

1.00%

1.00%

Decreasing charge for 14 years

6.00%

3.90%

Interest Credited on

Policy Loans

0%0%

Index Crediting

Strategies

Death Benefit

Options

0%

Riders

1.00%

Accelerated DB for Terminal, Chronic, Critical illness

Surrender ChargesDecreasing charge for 15 years to age 65; scales to

10 years to age 70

8.00%

Accelerated DB for Terminal, Chronic, Critical illness

2.00%

Accelerated DB for Terminal, Chronic, Critical illness

4.50%

Minimum Face

Amount

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 9 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product

Ages 15 Days-75 Standard Non Tobacco Ages 15 Days-85 Standard Classes Ages 15 Days-80 Standard Non Tobacco

Ages 15-75 Standard Tobacco Ages 18-85 All other classes Ages 15-80 Standard Tobacco

Ages 18-75 All other classes Ages 18-80 All other classes

Ages 0-70 $50,000 Ages 0-70 $50,000

Ages 71+ $100,000 Ages 71+ $100,000

Fixed strategy 1.50% Fixed strategy 1.50% Fixed strategy 1.50%

Indexed strategy 0.00% Indexed strategy 0.00% Indexed strategy 0.00%

Standard (years 1-5) Standard (years 1-5) Standard (years 1-5)

Preferred (years 6+) Preferred (years 6+) Preferred (years 6+)

Participating and Variable loans available beginning yr 1 Variable loans available beginning yr 1 Variable loans available beginning yr 1

1.50%; Variable available 1.50%; Variable available 1.50%; Variable available

Accelerated DB: Terminal, Critical, Chronic Accelerated DB: Terminal, Critical, Chronic Accelerated DB: Terminal, Critical, Chronic

Accidental DB Accidental DB Accidental DB

Children's Term Children's Term Children's Term

Guaranteed Insurability Rider Guaranteed Insurability Rider Guaranteed Insurability Rider

Waiver of Monthly Deductions Premium Guarantee Rider Waiver of Monthly Deductions

Premium Recovery Endorsement Waiver of Surrender Charge Option

Waiver of Monthly Deductions

Available DB Gtes

Option A= level Option A= level Option A= level

Option B= increasing Option B= increasing Option B= increasing

Option C= return of premium Option C= return of premium

Floor

1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap

1-Yr S&P 500 Point-to-Point High Par 1-Yr S&P 500 Point-to-Point High Par 1-Yr S&P 500 Point-to-Point High Par

1-Yr S&P 500 Point-to-Point Uncapped 1-Yr S&P 500 Point-to-Point Uncapped 1-Yr S&P 500 Point-to-Point Uncapped

1-Yr S&P 500 Point-to-Point Monthly Cap 1-Yr S&P 500 Point-to-Point Monthly Cap 1-Yr S&P 500 Point-to-Point Monthly Cap

1-Yr S&P 500 Point-to-Point w/ Spread 1-Yr S&P 500 Point-to-Point w/ Spread 1-Yr S&P 500 Point-to-Point w/ Spread

1-Yr S&P MidCap 400 Point-to-Point w/ Cap 1-Yr NASDAQ 100 Point-to-Point w/ Cap 1-Yr NASDAQ 100 Point-to-Point w/ Cap

1-Yr Russell 2000 Point-to-Point w/ Cap 1-Yr S&P MidCap 400 Point-to-Point w/ Cap 1-Yr S&P MidCap 400 Point-to-Point w/ Cap

1-Yr Fidelity Multifactor Yield Index 5% ER Point-to-Point 1-Yr EURO STOXX 50 Point-to-Point w/ Cap 1-Yr EURO STOXX 50 Point-to-Point w/ Cap

Uncapped 1-Yr Russell 2000 Point-to-Point w/ Cap 1-Yr Russell 2000 Point-to-Point w/ Cap

1-Yr Multi-Index* Point-to-Point w/ Cap 1-Yr Multi-Index* Point-to-Point w/ Cap

1-Yr Fidelity Multifactor Yield Index 5% ER Point-to-Point 1-Yr Fidelity Multifactor Yield Index 5% ER Point-to-Point

Uncapped Uncapped

*Uses S&P 500, EURO STOXX 50, Russell 2000 *Uses S&P 500, EURO STOXX 50, Russell 2000

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

6.00%

Protection Builder IUL

Age last birthday

North American

Smart Builder IUL 2

Age last birthday

Issue Ages

GTD Interest Rate

1.50%

Minimum Face

Amount

Decreasing charge for 10 years Decreasing charge for 15 years for ages 0-80, 10 years

for ages 81+

6.00%

Loan Rate

$100,000

Varies by age, max of 20 yrs

Surrender Charges

Index Crediting

Strategies

0% floor; 2% Minimum Account Value calculated every

10 yr; greater of CV or MAV at surrender or death

Death Benefit

Options

2.5% Minimum Account Value calculated every 10 yr;

greater of CV or MAV at surrender or death

Varies by age, max of 15 yrs

Riders

Interest Credited on

Policy Loans

Builder Plus IUL 3

6.00%

1.50% 1.50%

Decreasing charge for 10 years

Varies by age, max of 15 yrs

2.5% Minimum Account Value calculated every 10 yr;

greater of CV or MAV at surrender or death

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 10 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product

Super Preferred NS Super Preferred NS

All other classes All other classes

years 1-10 Standard

years 11+ Alternate loans available beginning yr.4

Children Term Alternate Surrender Value

Chronic Illness Accelerated DB Children Term

Cost of Living Extended NLG Chronic Illness Accelerated DB

Life Paid-Up (Overloan Protection) Cost of Living

Salary Increase Life Paid-Up (Overloan Protection)

Terminal Illness Salary Increase

Waiver of Monthly Policy Charge Terminal Illness

Waiver of Monthly Policy Charge

Available DB Gtes

Option 1= level Option 1= level

Option 2= increasing Option 2= increasing

Option 3= return of premium Option 3= return of premium

Floor

Price Return Index Annual S&P 500 Point-to-Point Price Return Index Annual S&P 500 Point-to-Point

Total Return Index S&P 500 Monthly Average Price Return Index Annual S&P 500 Point-to-Point

High Cap

Total Return Index S&P 500 Monthly Average

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

Decreasing charge for 10 years

2.00%

2.50%

2.00%

Indexed UL Accumulation II

Minimum Face

Amount

Ages 20-80

Ages 20-85

Ages 20-80

2.00%GTD Interest Rate

Issue Ages

Surrender Charges

Interest Credited on

Policy Loans

Loan Rate

Index Crediting

Strategies

Varies between 10-25 yrs, max to age 90

0% 0%

Death Benefit

Options

Ages 20-85

$50,000

4.50%

10 years

Riders

3.50%

Decreasing charge for 19 years; scales to 14 years at age

65

$100,000

2.00%

Principal

Indexed UL Flex II

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 11 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product

Non-Tobacco Ages 0-85 Options A, B Ages 0-85

All other classes Ages 0-70 Options C Age last birthday

Age last birthday

Ages 0-80 Ages 0-80

Ages 81-85 Ages 81-85

Standard (years 1-10) Standard (years 1-10)

Preferred (years 11+) Preferred (years 11+)

Participating loans available beginning yr.4

Participating Offset by mkt gains

Based on client’s age, face amount, and

UW category; declines annually after issue

Accidental DB Accidental DB BenefitAccess Accidental DB BenefitAccess

Children's Term Life Children Level Term Rider Children Level Term Rider

Disability Benefit Enhanced CV Rider Enhanced CV Rider

ExtendCare Enhanced Disability Benefit Enhanced Disability Benefit

Income Provider Option Living Needs Benefit Living Needs Benefit

Terminal Illness Overloan Protection Rider Overloan Protection Rider

Available DB Gtes

Option A= level Option A= level Option A= level

Option B= increasing Option B= increasing Option B= increasing

Option C= return of premium Option C= return of premium

Floor

1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap

1-Yr Goldman Sachs Voyager Uncapped 1-Yr S&P 500 Point-to-Point Uncapped w/ Spread

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

Founders Plus UL

Decreasing charge for 14 years

Protective Prudential

GTD Interest Rate

0%

3.00%

$100,000

Ages 0-80

Indexed Choice UL

$100,000

2.50%

$250,000

1.00%

Issue Ages

Interest Credited on

Policy Loans

Surrender Charges

Loan Rate 3.05%

4.00%8.00%

Index Crediting

Strategies

Varies case to case, up to lifetime

1% Alternate Contract Fund; greater of CV or ACF at

surrender or death0%

Death Benefit

Options

$250,000

1.00%

3.05%

4.00%

PruLife Index Advantage UL

$100,000

Ages 18-80

Minimum Face

Amount

Decreasing charge for 19 years

3.00%

Varies between 10-30 yearsAvailable to age 90

Riders

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 12 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product C

Ages 0-85

Ages 0-17 $50,000 Ages 0-17 $50,000

Ages 18-80 $100,000 Ages 18-80 $100,000

Fixed Fixed Fixed

Indexed Indexed Variable loans available

Variable loans available Variable loans available

Yrs 1-10 Yrs 1-10 Yrs 1-10

Yrs 11+ Yrs 11+ Yrs 11+

ADB for Chronic Illness ADB for Terminal Illness ADB for Chronic Illness ADB for Terminal Illness Accelerated Benefits for Terminal Illness

Chronic Illness Access Early Values Chronic Illness Access Chronic Illness

Exchange of Insureds Guaranteed Insurability Option Corporate Enhanced Values

Guaranteed Insurability Option Inflation Agreement Early Values

Income Protection Flex Inflation Agreement No-Lapse Guarantee Guaranteed Insurability Option

Overloan Protection Overloan Protection Indexed Loan No-Lapse Guarantee

Premium Deposit Account Premium Deposit Account Premium Deposit Account

Surrender Value Enhancement Waiver of Premium Surrender Value Enhancement

Term Insurance Waiver of Premium Term Insurance

Waiver of Charges Waiver of Premium

Available DB Gtes

Option 1= level Option 1= level Option 1= level

Option 2= increasing Option 2= increasing

Option 3= return of premlium

Floor 2% lifetime interest crediting guarantee 2% lifetime interest crediting guarantee 2% lifetime interest crediting guarantee

1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap 1-Yr S&P 500 Point-to-Point w/ Cap

1-Yr S&P Low Volatility Index Point-to-Point Uncapped 1-Yr S&P Low Volatility Index Point-to-Point Uncapped 1-Yr S&P 500 Point-to-Point High Par

1-Yr EURO STOXX 50 Point-to-Point w/ Cap 1-Yr EURO STOXX 50 Point-to-Point w/ Cap 3-Yr S&P 500 Point-to-Point High Par

1-Yr Rainbow* Point-to-Point w/ Cap 1-Yr Rainbow* Point-to-Point w/ Cap 1-Yr EURO STOXX 50 Point-to-Point w/ Cap

*Rainbow Index (S&P 500, S&P Low Volatility, EURO *Rainbow Index (S&P 500, S&P Low Volatility, EURO 1-Yr Blended* Point-to-Point w/ Cap

STOXX 50; 50% highest, 30% 2nd highest, 20% lowest) STOXX 50; 50% highest, 30% 2nd highest, 20% lowest) *Blended Index (35% S&P 500, 35% Barclays Capital

US Aggregate Bond, 20% EURO STOXX, 10% Russell

2000)

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

4.00%

5.00%

3.00%

$100,000

2.00%

Eclipse Protector II IUL

4.00%

2.00%

Ages 0-80

Eclipse IUL

Ages 0-80

Securian - Securian Life

4.00%

Minimum Face

Amount

Eclipse Accumulator IUL

Securian - Minnesota Life

Death Benefit

Options

Index Crediting

Strategies

Decreasing charge for 10 years Decreasing charge for 10 years Decreasing charge for 15 years

3.00%3.00%

2.00%GTD Interest Rate

Issue Ages

Surrender Charges

Loan Rate

4.00%

5.00%

Lifetime via No-Lapse Guarantee Agreement

3.90%3.90%

Riders

Interest Credited on

Policy Loans

Varies Lifetime via No-Lapse Guarantee Agreement

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 13 of 14

Indexed UL Carriers and ProductsAll carriers shown may not be available. Please check your approved carrier list before proceeding.

Company

Product

Ages 20-85 Ages 20-85 Ages 18-70 Pref. Elite/Plus

Ages 18-75 Preferred classes

Ages 18-85 All other classes

Preferred classes

All other classes

4.25% 4.25% Yrs 1-10

Participating 5.00% Participating 5.00% Yrs 11+

Accelerated DB for Chronic Illness Accelerated DB for Chronic Illness Accel DB for Chronic, Critical, Terminal Illness

Accelerated DB for Terminal Illness Accelerated DB for Terminal Illness Accidental DB Base Insured (10x's face)

Charitable Giving Charitable Giving Additional Insured Children's Benefit

Chronic Illness Plus Chronic Illness Plus Concierge Planning Rider

Overloan Protection Overloan Protection Disability Waiver of Monthly Deductions

Supplemental Protection (4:1 blend) Surrender Value Enhancement Disability Waiver of Premiums

Surrender Value Enhancement Guaranteed Insurabilty Benefit

Income Protection Option

Long Term Care

Overloan Protection Rider

Available DB Gtes

Option A= level Option A= level Option 1= level

Option B= increasing Option B= increasing Option 2= increasing

Option C= return of premium Option C= return of premium

Floor 2% Lookback Guarantee every 8 years 2% Lookback Guarantee every 8 years

Allocation Index Allocation Index 1-Yr S&P 500 Point-to-Point w/ Cap

1-Yr S&P 500/JPMorgan ETF Efficiente 5 w/ VIX Uncapped 1-Yr S&P 500/JPMorgan ETF Efficiente 5 w/ VIX Uncapped 1-Yr Global Index* Point-to-Point w/ Cap

2-Yr S&P 500/JPMorgan ETF Efficiente 5 w/ VIX Uncapped 2-Yr S&P 500/JPMorgan ETF Efficiente 5 w/ VIX Uncapped * Uses S&P 500, EURO STOXX 50, Hang Seng;

Base Base 50%/30% of either S&P or EURO STOXX,

Base 1-Yr S&P 500 Point-to-Point w/ Cap Base 1-Yr S&P 500 Point-to-Point w/ Cap 20% of Hang Seng

Base Uncapped JPMorgan ETF Efficiente 5 Base Uncapped JPMorgan ETF Efficiente 5

1-Yr Point-to-Point 1-Yr Point-to-Point

Base Uncapped 2-Yr Point-to-Point w/ Base Uncapped 2-Yr Point-to-Point w/

Blended Option* Blended Option*

Core Core

Core 1-Yr S&P 500 Point-to-Point w/ Cap Core 1-Yr S&P 500 Point-to-Point w/ Cap

Core Uncapped JPMorgan ETF Efficiente 5 Core Uncapped JPMorgan ETF Efficiente 5

1-Yr Point-to-Point 1-Yr Point-to-Point

Core Uncapped 2-Yr Point-to-Point w/ Core Uncapped 2-Yr Point-to-Point w/

Blended Option* Blended Option*

Select Select

Select 1-Yr S&P 500 Point-to-Point w/ Cap** Select 1-Yr S&P 500 Point-to-Point w/ Cap**

Select Uncapped JPMorgan ETF Efficiente 5 Select Uncapped JPMorgan ETF Efficiente 5

1-Yr Point-to-Point** 1-Yr Point-to-Point**

Select Uncapped 2-Yr Point-to-Point w/ Select Uncapped 2-Yr Point-to-Point w/

Blended Option* ** Blended Option* **

*Uses S&P 500 and JPMorgan ETF Efficiente 5 *Uses S&P 500 and JPMorgan ETF Efficiente 5

**Select Option charges 50bps on 1-year, 100bps **Select Option charges 50bps on 1-year, 100bps

on 2-year on 2-year

Changes since last publication C Approved in NY

• Features subject to current contract terms at time of sale.

• Carriers and products offered through Crump Life Insurance Services may not be approved for use in all states.

• For informational use only-- Subject to change without notice. Survey based on information from various sources. Prepared for agent use only

3.00%

Symetra

Symetra Accumulator IUL

Standard

$100,000

1.00%

Standard

Financial Foundation IULSymetra Protector IUL

$100,000

$25,000

Age last birthday

1.00%

$100,000

Symetra

2.00%

Transamerica

Decreasing charge for 14 years

2.25%

Lesser of 40 years or to age 90; available to 120 Varies by age between 5-20 yearsUp to 20 years

0.75%

2% in arrears

Decreasing charge for 9 years

4.00%

Decreasing charge for 10 to 15 years

4.00%

Issue Ages

Death Benefit

Options

Minimum Face

Amount

GTD Interest Rate

Loan Rate

Interest Credited on

Policy Loans

Index Crediting

Strategies

Surrender Charges

Riders

© Copyright 2022 Crump Life Insurance Services, Inc. Last Updated 2/8/2022 Page 14 of 14