HCREO

-

Upload

republic-media-the-arizona-republic -

Category

Documents

-

view

214 -

download

0

description

Transcript of HCREO

B Y M I C H A E L F E R R A R E S I

very child deserves the best education possible, clear and simple. For many Arizona youths, an education at a public school ranked among the worst in the U.S. is the only option. Private school tuition,

especially for multiple children, is often out of the question for a family struggling to pay the mortgage or cope with medical bills. Enter Arizona's School Tuition Organization tax credit programs. The first program was introduced nearly 15 years ago as a way to provide

deserving low and middle income families with a chance to send their children to private schools. Since then, two more scholarship programs have been created with one focused on special needs students.

GRADING ARIZONA’SSCHOLARSHIP ORGANIZATIONS

PRIVATE SCHOOL TUITION ORGANIZATIONS CAN CHANGE LIVES, CREATE OPPORTUNITIES

THIS SPECIAL REPORT GRADES SCHOOL TUITION ORGANIZATIONS

ON HOW WELL THEY

ARE SERVING ARIZONA’S FAMILIESUsing the state tax credit, charitable

scholarship organization's known as STOs, turn donations from individuals and businesses into scholarships for students. Each STO judges a student's merit and need in awarding scholarships. But "need" is subjective.

Many STOs target students from poor or working class families, while others provide a majority of their scholarship money to students whose parents earn more than $75,000 annually. Advocates say those lower-income children should have an equal right to a quality education, yet, even after recent changes to provide more accountability, some school tuition organizations favor students from financially stable families.

The school tuition tax credit program can make a huge difference when scholarships are granted as it was originally intended. Julio Fuentes, president and chief executive officer of the Hispanic Council for Reform and Educational Options, understands this better than most. His national organization works to educate families about the program.

"This is a program that should focus on low income children," Fuentes said. "I'm in a position where I do have that choice for my kids. But that's not the same for many families in a poor or working class

neighborhood down the road. They have no choice."

Two years ago, the Arizona Legislature enacted measures to make the tuition tax credit laws stricter, forcing STOs to publicly report a breakdown of scholarships by family income.

Advocates believe more financially challenged families will benefit from this

public disclosure, since those students deserve the same right to choose as students whose parents can pay their tuition comfortably, without help from an STO. Students like Jorge Solis.

Olga Solis said she could never afford to keep her son, Jorge, 18, enrolled in a private school without the help of Arizona School Choice Trust. The STO provides Jorge, a senior at Glendale Christian Academy, and his two younger siblings, with more than $1800 apiece for annual scholarships. Jorge has received annual STO scholarships for 10 years, allowing him to continue to excel in private schools and work toward attending Arizona State University this fall. Solis's husband Jorge Sr., works as a landscaper and earns about $25,000 annually. Without the help from an STO, Jorge would have to fight harder for the same classroom and extracurricular attention that he receives freely at Glendale Christian.

"The smaller class sizes allow him to unfold his dreams, where he doesn't feel so intimidated or scared by such large numbers of students," Solis said.

S U N D A Y , J U N E 3 , 2 0 1 2

THIS REPORT COMMISSIONED BY THE HISPANIC COUNCIL FOR REFORM AND EDUCATION OPTIONS (HCREO) CREATED BY REPUBLIC MEDIA CUSTOM PUBLISHING

WHAT ARE SCHOOL TUITION ORGANIZATIONS?An STO is a charity that provides scholar-ships for students to attend private schools in Arizona. Individuals and businesses that donate to an STO charity get a tax credit that reduces their taxes by an amount equal to 100 percent of their donation. The scholar-ships help families afford private schools and provide a savings to taxpayers. Arizona law requires that the STOs use at least 90 percent of their annual dona-tions to provide scholarships. STO Board members evaluate student applications and grant scholarships based upon merit and need. Each STO judges that merit or need uniquely. If you’re interested in learning more about STOs, call 602-320-9491 or visit www.hcreo.com.

J O R G E S O L I S B Y R I C K D ' E L I A

E

wareness is the key to making a difference. Few poor and working class parents are

aware of the scholarships available for their children through three different Arizona scholarship programs. But more are learning through the outreach efforts in poor and working class neighborhoods by groups such HCREO, the Hispanic Council for Reform and Educational Options.

Some of the community meetings hosted by HCREO have drawn

hundreds of people interested in learning how their children can get a scholarship to attend the private school of their choice. With increased awareness, HCREO hopes to connect more deserving families to the scholarships their children are eligible to receive.

For more information on Arizona STOs and how you can assist in improving our children's education, call 602-320-9491 or visit www.hcreo.com.

B Y M I C H A E L F E R R A R E S I

tatistics can be interpreted in many ways, but some numbers are indisputable.

Last year marked the first fiscal cycle in which Arizona school tuition organizations were required by revised state law to fully disclose a full breakdown of their scholarship awards based on the financial standing of students’ families.

The data reported by nearly 60 Arizona STOs to the state Department of Revenue shows many of the organizations do a remarkable job of spending most of their resources helping students of low and middle income parents cover tuition for private schools.

Ten school tuition organizations provided a disproportionate share of their scholarships to students from poor families that qualify for the Free and Reduced Price Lunch program (less than $41,348 for a family for four). Meanwhile, 22 STOs provided a disproportionate share of their scholarships to poor and working class families (less than $76,494

for a family of four). Still, not enough of these

scholarships are going to poor and working class families in part because so many of them are unaware of the scholarship opportunities available to their children.

THE NUMBERS GAME: RESEARCH REVEALS WHICH STOs BEST SERVE

ARIZONA’S POOR FAMILIES

A

| 2 | SUNDAY, JUNE 3, 2012

HCREO WORKS TO HELP POOR FAMILIES GET SCHOLARSHIPS

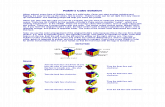

PERCENT OF NUMBER OF PERCENT OF SCHOLARSHIPS SCHOLARSHIPS FOR: SCHOLARSHIP SCHOLARSHIPS SCHOLARSHIPS AWARDED TO (1) LOW (2) POOR (3) POOR & (4) SCHOOL (5) AWARDS

DOLLARS AWARDED AWARDED POOR AND ADMIN. STUDENTS WORKING CHOICES BY MERIT AWARDED IN FISCAL TO POOR WORKING COSTS CLASS AVAILABLE OR NEED ORGANIZATIONS IN 2011 YEAR 2011 FAMILIES CLASS FAMILIES STUDENTS PHONE

Arizona School Choice Trust $1,156,643 455 85.5% 100.0% 623-414-3429

Arizona Waldorf Scholarship Foundation $169,429 61 57.5% 92.3% 520-529-1032

BEST Student Fund $207,581 66 80.0% 98.6% 480-392-9729

White Mountain Tuition Support Foundation $262,280 137 60.0% 88.8% 928-521-3826

Arizona Adventist Scholarships $368,805 344 48.5% 100.0% – 480-991-6777

Catholic Education Arizona $8,821,131 5,314 47.1% 78.3% – 602-218-6542

Catholic Tuition Support Organization $2,430,729 1,363 87.5% 100.0% – 520-838-2571

Jewish Tuition Organization $1,553,215 361 59.9% 86.6% – 480-634-4926

Montessori Scholarship Organization $309,401 151 16.2% 100.0% – 623-583-0571

School Tuition Association of Yuma $206,237 145 17.5% 80.0% – 928-782-5786

Shepherd of the Desert Education Foundation $277,657 132 98.7% 100.0% – 480-951-3432

Southern Arizona Foundation for Education Lutheran $327,608 160 35.4% 72.6% – 520-742-2882

Institute for Better Education $4,545,097 2,688 46.1% 81.2% – – 520-512-5438

Pappas Kids Schoolhouse Foundation $199,050 71 89.3% 100.0% – – 602-441-5707

School Choice Arizona $93,897 9 91.2% 100.0% – – 480-722-7502

Yuma’s Education Scholarship Fund for Kids $564,586 463 10.3% 45.2% – – 928-314-0033

Arizona Christian School Tuition Organization $11,257,854 5,327 21.9% 53.4% – – 480-820-0403

Arizona Independent Schools Scholarship Foundation $855,122 144 27.2% 55.2% – – 520-798-0900

Arizona Tuition Organization $1,074,685 644 21.8% 57.5% – – 602-295-3033

Christ Lutheran School Foundation $198,767 70 68.6% 94.5% – – 602-957-7010

Christian Scholarship Foundation $192,486 135 52.7% 98.2% – – 928-771-2018

Christian Scholarship Fund of Arizona $311,146 194 42.0% 81.4% – – 520-322-0966

Cochise Christian School Tuition Organization $446,540 318 35.5% 60.7% – – 520-378-3177

H.E.L.P. Scholarship Foundation $792,081 546 10.2% 23.4% – – 623-694-3487

Northern Arizona Christian School Scholarship Fund $304,744 197 40.2% 72.6% – – 928-282-4934

Schools With Heart Foundation $279,034 73 39.5% 75.2% – – 602-274-0071

Arizona Private Education Scholarship Fund $1,247,878 557 17.3% 41.7% – – – 480-699-8911

Arizona Scholarship Fund $3,782,696 2,753 29.9% 52.3% – – – 480-497-4564

Tempe Montessori Parent’s Organization $41,913 21 0% 0% x x – 480-966-7606

Tuition Organization for Private Schools (TOPS for kids) $1,146,809 800 25.0% 61.9% – – – 480-414-8677

Arizona Lutheran Scholarship Organization $136,100 55 0% 13.3% – – – 480-229-1727

Lutheran Education Foundation $117,626 59 0% 0% x x – 602-864-9197

New Valley Education Partners $342,364 33 0% 0% – x x 928-284-2272

Chabad Tuition Organization $20,000 12 0% 0% – x x – 602-944-2753

Arizona Episcopal Schools Foundation $694,564 146 20.1% 20.1% – – – – 520-320-1386

Brophy Community Foundation $893,885 412 0% 0% – x x – 602-264-5291

Jewish Education Tax Credit Organization $634,584 112 27.0% 65.8% – – – – 520-647-8442

Orme Primavera Schools Foundation $196,570 118 34.0% 52.4% – – – – 928-445-5382SOURCES: ARIZONA DEPARTMENT OF REVENUE 2011, ARIZONA DEPARTMENT OF EDUCATION, U.S. CENSUS

S 10 STOs THAT HELP POOR STUDENTS THE MOSTEach of these STOs awarded a disproportionate share of their scholarships to poor students:• Shepherd of the Desert

Education Foundation• School Choice Arizona• Pappas Kids Schoolhouse

Foundation• Catholic Tuition Support

Organization• Arizona School Choice Trust• BEST Student Fund• Christ Lutheran School

Foundation• White Mountain Tuition

Support Foundation• Jewish Tuition Organization• Arizona Waldorf Scholarship

Foundation

SCHOOL TUITION ORGANIZATIONS WITH OVER $100,000 IN SCHOLARSHIPS

RANK

( 1 ) LOW ADMINISTRATIVE COSTSArizona law requires that 90 percent of a School Tuition Organization's revenue be paid out in scholarships. Stars () were awarded to STOs that met the standard; a dash (–) signifies those that did not meet the standard in the first year of reporting. STOs paying less than 90 percent are not necessarily in violation of the law. The Department of Revenue allows STOs a year or two to improve scores, or risk a review. The DOR is not currently concerned with the percentage of donations awarded as scholarships at any STO.

( 2 ) SCHOLARSHIPS TO POOR STUDENTSStarting Jan. 1, 2011, STOs were required to collect family income information. They are required to report the amount of scholarships going to students with family incomes up to 185 percent of the poverty level ($41,348 for a family of four) and the amount of scholarships going to families with family incomes between 185 and 342.25 percent of the poverty level ($76,494 for a family of four). We have labeled the first category as poor students and the second category as working class students.

The first year's reports do not provide a full year of data. Analysis of awards to poor and working class families is based upon scholarships awarded in the second half of fiscal year 2011. Information could be further distorted as the time tables for scholarship awards are different for each STO.

( x ) Five STOs (New Valley Education Partners, Chabad Tuition Organization, TEMPO, Lutheran Education Foundation, and Brophy Community Foundation) awarded no scholarships in the second half of fiscal year 2011.

According to the Arizona Department of Education, statewide 57 percent of students are eligible for free and reduced price lunch because their families make less than 185 percent of the poverty level.

() STOs that provided more than 57 percent of their scholarships to poor students were given a star.

(–) STOs that provided less than 57 percent of their scholarships to poor students were given a dash.

( 3 ) SCHOLARSHIPS FOR POOR AND WORKING CLASS STUDENTS STOs were required to report the amount of their scholarships going to students in poor families (185 percent of the poverty level) and working class families (185 to 342 percent of the poverty level.) A working class family of four would be making less than $76,494. According to the census, 71.5 percent of Arizona children live in a family making less than $75,000.

() STOs that provided more than 71.5 percent of their scholarships to poor and working class students were given a star.

( – ) STOs that provided less than 71.5 percent of their scholarships to poor and working class students were given a dash.

( 4 ) SCHOOL CHOICES AVAILABLEAccording to the tax law, STOs must make their scholarships available for more than one school.

() STOs that allow students to use their scholarships at any school of their choice.

( ) STOs that allow students to use their scholarships at only a smaller, approved list of schools.

( – ) STOs that gave scholarships to students at only one school

( 5 ) AWARDS MADE BY MERIT OR NEEDState law prohibits donors from designating a specific student to benefit from their charitable contribution. STOs may allow donors to make recommendations, but can-not award, designate or reserve scholarships solely on the basis of donor recommenda-tions. We believe STOs should award scholar-ships based solely on student merit or need.

() STOs that do not allow student specific recommendations but rather have donations serve a general fund or a particular school fund.

( – ) STOs that permit donors to make student specific recommendations.

SUNDAY, JUNE 3, 2012 | 3 |

PERCENT OF NUMBER OF PERCENT OF SCHOLARSHIPS SCHOLARSHIPS FOR: SCHOLARSHIP SCHOLARSHIPS SCHOLARSHIPS AWARDED TO (1) LOW (2) POOR (3) POOR & (4) SCHOOL (5) AWARDS

DOLLARS AWARDED AWARDED POOR AND ADMIN. STUDENTS WORKING CHOICES BY MERIT AWARDED IN FISCAL TO POOR WORKING COSTS CLASS AVAILABLE OR NEED ORGANIZATIONS IN 2011 YEAR 2011 FAMILIES CLASS FAMILIES STUDENTS PHONE

Arizona School Choice Trust $1,156,643 455 85.5% 100.0% 623-414-3429

Arizona Waldorf Scholarship Foundation $169,429 61 57.5% 92.3% 520-529-1032

BEST Student Fund $207,581 66 80.0% 98.6% 480-392-9729

White Mountain Tuition Support Foundation $262,280 137 60.0% 88.8% 928-521-3826

Arizona Adventist Scholarships $368,805 344 48.5% 100.0% – 480-991-6777

Catholic Education Arizona $8,821,131 5,314 47.1% 78.3% – 602-218-6542

Catholic Tuition Support Organization $2,430,729 1,363 87.5% 100.0% – 520-838-2571

Jewish Tuition Organization $1,553,215 361 59.9% 86.6% – 480-634-4926

Montessori Scholarship Organization $309,401 151 16.2% 100.0% – 623-583-0571

School Tuition Association of Yuma $206,237 145 17.5% 80.0% – 928-782-5786

Shepherd of the Desert Education Foundation $277,657 132 98.7% 100.0% – 480-951-3432

Southern Arizona Foundation for Education Lutheran $327,608 160 35.4% 72.6% – 520-742-2882

Institute for Better Education $4,545,097 2,688 46.1% 81.2% – – 520-512-5438

Pappas Kids Schoolhouse Foundation $199,050 71 89.3% 100.0% – – 602-441-5707

School Choice Arizona $93,897 9 91.2% 100.0% – – 480-722-7502

Yuma’s Education Scholarship Fund for Kids $564,586 463 10.3% 45.2% – – 928-314-0033

Arizona Christian School Tuition Organization $11,257,854 5,327 21.9% 53.4% – – 480-820-0403

Arizona Independent Schools Scholarship Foundation $855,122 144 27.2% 55.2% – – 520-798-0900

Arizona Tuition Organization $1,074,685 644 21.8% 57.5% – – 602-295-3033

Christ Lutheran School Foundation $198,767 70 68.6% 94.5% – – 602-957-7010

Christian Scholarship Foundation $192,486 135 52.7% 98.2% – – 928-771-2018

Christian Scholarship Fund of Arizona $311,146 194 42.0% 81.4% – – 520-322-0966

Cochise Christian School Tuition Organization $446,540 318 35.5% 60.7% – – 520-378-3177

H.E.L.P. Scholarship Foundation $792,081 546 10.2% 23.4% – – 623-694-3487

Northern Arizona Christian School Scholarship Fund $304,744 197 40.2% 72.6% – – 928-282-4934

Schools With Heart Foundation $279,034 73 39.5% 75.2% – – 602-274-0071

Arizona Private Education Scholarship Fund $1,247,878 557 17.3% 41.7% – – – 480-699-8911

Arizona Scholarship Fund $3,782,696 2,753 29.9% 52.3% – – – 480-497-4564

Tempe Montessori Parent’s Organization $41,913 21 0% 0% x x – 480-966-7606

Tuition Organization for Private Schools (TOPS for kids) $1,146,809 800 25.0% 61.9% – – – 480-414-8677

Arizona Lutheran Scholarship Organization $136,100 55 0% 13.3% – – – 480-229-1727

Lutheran Education Foundation $117,626 59 0% 0% x x – 602-864-9197

New Valley Education Partners $342,364 33 0% 0% – x x 928-284-2272

Chabad Tuition Organization $20,000 12 0% 0% – x x – 602-944-2753

Arizona Episcopal Schools Foundation $694,564 146 20.1% 20.1% – – – – 520-320-1386

Brophy Community Foundation $893,885 412 0% 0% – x x – 602-264-5291

Jewish Education Tax Credit Organization $634,584 112 27.0% 65.8% – – – – 520-647-8442

Orme Primavera Schools Foundation $196,570 118 34.0% 52.4% – – – – 928-445-5382SOURCES: ARIZONA DEPARTMENT OF REVENUE 2011, ARIZONA DEPARTMENT OF EDUCATION, U.S. CENSUS

HOW WE RATED THE STOsTo help parents and potential donors determine which School Tuition Organizations are the best, we have rated STOs with more than $100,000 in donations on five key factors:

• Have they kept their administrative overhead costs low so that more than 90 percent of their donations are used for student scholarships?

• Are they providing a disproportionate share of scholarships to poor students? • Are they providing a disproportionate share of scholarships to poor and working class students?• Are they letting students use their scholarships at any school the family chooses?• Are they awarding scholarships based upon the need and merit of the students rather than

the recommendations of donors?

We recognize the STO rating is a work in progress. We know that the first year of the information provided to the state does not provide a complete picture because it covers just the second half of fiscal year 2011. Still, we believe that shining a spotlight on the information about STOs sitting in state government files will help increase the confidence of donors and guide them to the best STOs. We hope that this will increase the overall financial support that is given to STOs and improve the quality of all the STOs participating in Arizona's scholarship programs.

RATING THE STOs SCHOOL TUITION ORGANIZATIONS WITH OVER $100,000 IN SCHOLARSHIPS

DREAMING IS BELIEVING: SCHOLARSHIP PREPARES BLIND BROPHY PREP STUDENT ‘FOR LIFE’

B Y M I C H A E L F E R R A R E S I

eading Braille by hand is far slower than having a computer read it.

Max Ashton knows the difference. The Brophy College Preparatory sophomore, who suffers from a degenerative blindness known as Leber’s congenital amaurosis, is thankful to have the computer help him “see” his homework.

The 15-year-old drummer and varsity wrestler earned his place at Brophy through a $12,500 annual scholarship through Arizona School Choice Trust, a school tuition organization that helps students with disabilities. Max’s family would otherwise have struggled to keep him enrolled in a private school.

“Really it was kind of awesome because it’s really expensive, so we really would have had to made sacrifices in our everyday lives,” said Max, who has testified to the Arizona Legislature about the benefit of his disabled student tax credit tuition scholarship.

If Max attended public school, he would still be involved with the same extracurricular programs but he said he doubted he would be as prepared for honors or advanced placement coursework.

“I think Brophy is more difficult so it’s really going to prepare me for life,” Max said. “I’d probably still play drums and wrestle and stuff, but just having to have everything in Braille, that’s just really the main thing with school. It’s so much more difficult to do everything.”

By earning the tuition tax credit to attend Brophy, Max’s father Marc Ashton estimated that the scholarship saves the state several thousand dollars each year.

One size does not fit all, and that is especially true of special needs students. That is why Arizona created a specific scholarship program that allows parents of special needs students to send their children to the school that best meets their needs. As a result, hundreds of children with disabilities, such as Max, are being well educated in Arizona's private schools.

Max’s textbooks are on the computer at Brophy. All he needs is a computer program that translates the text. In a public school, where the technology is less accessible, he would require more personal assistance.

For him, the Brophy scholarship means the difference between dreaming of going to schools like Stanford or Cornell, and having a strong chance at being accepted at those schools.

| 4 | SUNDAY, JUNE 3, 2012

A division of The Arizona Republic200 E. Van Buren St., Phoenix AZ 85004

General Manager: CAMI KAISER

Development: ISAAC MOYA

Editor: JIM WILLIAMSEditorial Intern: JESSICA RUSH

Managing Art Director: TRACEY PHALEN

Design: CRAIG KURTZ

THERESA JOHNSON

This report was commissioned by the Hispanic Council for

M A X A S H T O N B Y R I C K D ' E L I A

R