Financial Coaching

Transcript of Financial Coaching

Sign up for webinar email notifications

http://bit.ly/MFLN-Notify

This webinar is approved for 1.5 CEUs for AFCs & CPFCs

A link to the post-test will be provided at the end of the webinar.

Research and evidenced-based professional development

through engaged online communities.

eXtension.org/militaryfamilies

Find us on Twitter by following @MFLNPF

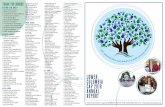

Providing continuing education opportunities and resources for financial educators working with military families

Join our community on Facebook: MFLN Personal Finance

Available resources

Find slides and additional resources under ‘event materials’

https://learn.extension.org/events/2012

Jerry Buchko, MA, AFC®

Counselor, Coach, & Tutor of Personal Finance

● Prior to private practice, worked for almost 14 years in the employee assistance field

● Provided financial counseling to clients from a diverse range of life circumstances and experiences, including military service members and their families

● B.A. in psychology, an M.A. in counseling psychology, and an Accredited Financial Counselor (AFC®)

● Active member within the eXtension Military Families Learning Network (MFLN) and Network Literacy Community of Practice

● Currently serves as a member of the Board of Directors for the Association for Financial Counseling and Planning Education (AFCPE)

● Currently serves as a Practitioner Consultant with the MFLN Personal Finance team

Question: Have you ever coached or received coaching?

What kind?

How?

Question: Have you ever coached or received coaching?

What kind?

How?

Question: What is coaching? How would you briefly describe it?

So what is financial coaching?

● Broad conceptual history of coaching; its emergence as a form of experiential learning

So what is financial coaching?

● Broad conceptual history of coaching; its emergence as a form of experiential learning

● Where financial coaching fits within an emerging framework for financial well-being & personal finance capacity

So what is financial coaching?

● Broad conceptual history of coaching; its emergence as a form of experiential learning

● Where financial coaching fits within an emerging framework for financial well-being & personal finance capacity

● How financial coaching differs from financial education & counseling

So what is financial coaching?

● Broad conceptual history of coaching; its emergence as a form of experiential learning

● Where financial coaching fits within an emerging framework for financial well-being & personal finance capacity

● How financial coaching differs from financial education & counseling

● Role & primary tasks of a financial coach

So what is financial coaching?

● Broad conceptual history of coaching; its emergence as a form of experiential learning

● Where financial coaching fits within an emerging framework for financial well-being & personal finance capacity

● How financial coaching differs from financial education & counseling

● Role & primary tasks of a financial coach

● Core elements of the coaching process

So what is financial coaching?

● Broad conceptual history of coaching; its emergence as a form of experiential learning

● Where financial coaching fits within an emerging framework for financial well-being & personal finance capacity

● How financial coaching differs from financial education & counseling

● Role & primary tasks of a financial coach

● Core elements of the coaching process

● Core techniques of coaching

Ways that people have learned and developed knowledge through a

process of thinking through what they were doing...

~ 1500s “Coach”

Source: http://goo.gl/bj8qv6

Ways that people have learned and developed knowledge by thinking

through what they were doing...

~ 1500s “Coach” ~ 1800s

“Coaching”, university slang; the notion of a tutor “carrying” a student through an exam.

Source: http://goo.gl/bj8qv6

Source: http://goo.gl/6Zixcn

Ways that people have learned and developed knowledge by thinking

through what they were doing...

~ 1500s “Coach” ~ 1800s

“Coaching”, university slang; the notion of a tutor “carrying” a student through an exam.

~ 1950s Humanistic psychology movement.

Broke away from the medical model; “clients” rather than “patients”.

Emergence of “coaching” techniques within various psychotherapy & mental health counseling approaches.

Source: http://goo.gl/bj8qv6

Source: http://goo.gl/xae23N

Source: http://goo.gl/6Zixcn

Ways that people have learned and developed knowledge by thinking

through what they were doing...

Ways that people have learned and developed knowledge by thinking

through what they were doing...

~ 1980s Coaching in the corporate business world.~ 1990s Coaching expanded into different life areas, e.g. life, career, health, etc.

Source: http://goo.gl/8f1ZJ1

~ 2000s Growth of research in coaching psychology.

Emergence of financial coaching.

Emergence of an evolving framework about financial well-being and financial capacity.

Source: https://goo.gl/VKyHto

Source: http://goo.gl/zH9jUi

Source: http://goo.gl/SNA9CA

Ways that people have learned and developed knowledge by thinking

through what they were doing...

~ 1980s Coaching in the corporate business world.~ 1990s Coaching expanded into different life areas, e.g. life, career, health, etc.

Source: http://goo.gl/8f1ZJ1

Where Financial Coaching Fits within an Emerging Framework for Financial Well-being & Personal Finance Capacity

2015 Consumer Finance Protection Bureau (CFPB) research report about financial well-being.

How many of you have read it?

Consumer Financial Protection Bureau, (2015). Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

2015 Consumer Finance Protection Bureau (CFPB) research report about financial well-being.

How many of you have read it? All of it?

Consumer Financial Protection Bureau, (2015). Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

2015 Consumer Finance Protection Bureau (CFPB) research report about financial well-being.

How many of you have read it? All of it?

● Review of research literature

● In-depth qualitative interviews of consumers & financial practitioners/service providers

● Consultation with a panel of leading academic and practitioner experts in the fields of consumer finance and financial capability

2. Research design and methods Consumer Financial Protection Bureau, (2015). Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

Figure 2. What Influences Financial Well-Being. Consumer Financial Protection Bureau, (2015). Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

Contemporary, evolving framework for financial well-being and financial capacity

Contemporary, evolving framework for financial well-being and financial capacity

Figure 2. What Influences Financial Well-Being. Consumer Financial Protection Bureau, (2015). Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

3. Defining financial well-being Consumer Financial Protection Bureau, (2015). Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

Definition of Financial Well-being:

○ Having control over day-to-day, month-to-month finances

Definition of Financial Well-being:

○ Having control over day-to-day, month-to-month finances

○ Having the capacity to absorb a financial shock

3. Defining financial well-being Consumer Financial Protection Bureau, (2015). Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

Definition of Financial Well-being:

○ Having control over day-to-day, month-to-month finances

○ Having the capacity to absorb a financial shock

○ Being on track to meet your financial goals

3. Defining financial well-being Consumer Financial Protection Bureau, (2015). Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

Definition of Financial Well-being:

○ Having control over day-to-day, month-to-month finances

○ Having the capacity to absorb a financial shock

○ Being on track to meet your financial goals

○ Having the financial freedom to make the choices that allow you to enjoy life

3. Defining financial well-being Consumer Financial Protection Bureau, (2015). Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

Figure 1. Four Elements of Well-Being. Consumer Financial Protection Bureau, (2015). Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

How Financial Coaching Differs from Financial Education & Counseling

Figure 1. Distinctions among financial coaching, education, and counseling. Collins, J. and O'Rourke, C. (2012) "The Application of Coaching Techniques to Financial Issues," Journal of Financial Therapy: Vol. 3: Iss. 2, Article 3. http://dx.doi.org/10.4148/jft.v3i2.1659

Other characteristics of coaching orientation:

● Emphasizes well-being and performance improvement (rather than pathology)

Other characteristics of coaching orientation:

● Emphasizes well-being and performance improvement (rather than pathology)

● Emphasizes a greater focus on the present and future (rather than being grounded in the review and analysis of the past)

Role & Primary Tasks of a Financial Coach

Role: Facilitating client's ability to discern values, set goals, develop plans of action, and be accountable

Role: Facilitating client's ability to discern values, set goals, develop plans of action, and be accountable

● Supportive but not prescriptive

○ the coach is not instructing or telling clients what to do or providing solutions to their problems

Role: Facilitating client's ability to discern values, set goals, develop plans of action, and be accountable

● Supportive but not prescriptive

○ the coach is not instructing or telling clients what to do or providing solutions to their problems

○ instead is supporting clients in exploring their own thinking and understanding, values and goals, and helping them develop action plans

Role: Facilitating client's ability to discern values, set goals, develop plans of action, and be accountable

● Supportive but not prescriptive

○ the coach is not instructing or telling clients what to do or providing solutions to their problems

○ instead is supporting clients in exploring their own thinking and understanding, values and goals, and helping them develop action plans

○ holds clients accountable to their own stated values, goals, and plans

As a coach, you are essentially modelling a process of self-regulation and self-learning that the client begins to learn through the experience of the coaching interaction with you.

Generic Model of Self-RegulationGrant, A. (2009). The Evidence for Coaching. Invited paper; Harvard University Coaching and Positive Psychology Conference, Harvard University, Cambridge, MA. Instituteofcoaching.org, Resources. Retrieved 31 March 2015, from http://www.instituteofcoaching.org/index.cfm?page=resources

For example...

Client Driven, Collaborative Relationship & Communication:

● Establish & maintain trust, and a safe coaching environment

● Active Listening○ Verbal○ Non-verbal

● Critical/Perceptive/Thoughtful Questioning

○ Open-ended○ Closed-ended○ Probing/Exploratory○ Clarifying○ Exception Seeking○ Scaling

● Direct Communication○ Clear feedback○ Clear presentation of

objectives, agenda, & purpose

○ Appropriate & respectful

Client Driven, Collaborative Relationship & Communication:

● Establish & maintain trust, and a safe coaching environment

● Active Listening○ Verbal○ Non-verbal

● Critical/Perceptive/Thoughtful Questioning

○ Open-ended○ Closed-ended○ Probing/Exploratory○ Clarifying○ Exception Seeking○ Scaling

● Direct Communication○ Clear feedback○ Clear presentation of

objectives, agenda, & purpose

○ Appropriate & respectful

Assessment: ● Determining the appropriateness of coaching to

meet client’s needs.● Managing Progress & Accountability/Follow

Through● Maintain perspective of the big picture and the

current context for moving forward

Client Driven, Collaborative Relationship & Communication:

● Establish & maintain trust, and a safe coaching environment

● Active Listening○ Verbal○ Non-verbal

● Critical/Perceptive/Thoughtful Questioning

○ Open-ended○ Closed-ended○ Probing/Exploratory○ Clarifying○ Exception Seeking○ Scaling

● Direct Communication○ Clear feedback○ Clear presentation of

objectives, agenda, & purpose

○ Appropriate & respectful

Assessment: ● Determining the appropriateness of coaching to

meet client’s needs.● Managing Progress & Accountability/Follow

Through● Maintain perspective of the big picture and the

current context for moving forward

Establishing Values & Goals:

● Will inform the exploration of options.

Client Driven, Collaborative Relationship & Communication:

● Establish & maintain trust, and a safe coaching environment

● Active Listening○ Verbal○ Non-verbal

● Critical/Perceptive/Thoughtful Questioning

○ Open-ended○ Closed-ended○ Probing/Exploratory○ Clarifying○ Exception Seeking○ Scaling

● Direct Communication○ Clear feedback○ Clear presentation of

objectives, agenda, & purpose

○ Appropriate & respectful

Assessment: ● Determining the appropriateness of coaching to

meet client’s needs.● Managing Progress & Accountability/Follow

Through● Maintain perspective of the big picture and the

current context for moving forward

Establishing Values & Goals:

● Will inform the exploration of options.

Exploration & Expanding of Possibilities & Options:● Will inform the establishment of the action plan.

Client Driven, Collaborative Relationship & Communication:

● Establish & maintain trust, and a safe coaching environment

● Active Listening○ Verbal○ Non-verbal

● Critical/Perceptive/Thoughtful Questioning

○ Open-ended○ Closed-ended○ Probing/Exploratory○ Clarifying○ Exception Seeking○ Scaling

● Direct Communication○ Clear feedback○ Clear presentation of

objectives, agenda, & purpose

○ Appropriate & respectful

Assessment: ● Determining the appropriateness of coaching to

meet client’s needs.● Managing Progress & Accountability/Follow

Through● Maintain perspective of the big picture and the

current context for moving forward

Establishing Values & Goals:

● Will inform the exploration of options.

Action:

● Develop action plan

● SMART goals/results

● Specific steps that client will take towards goals.

● Prioritizing steps, and adjust as needed

● Identify & access learning resources

Exploration & Expanding of Possibilities & Options:● Will inform the establishment of the action plan.

Client Driven, Collaborative Relationship & Communication:

● Establish & maintain trust, and a safe coaching environment

● Active Listening○ Verbal○ Non-verbal

● Critical/Perceptive/Thoughtful Questioning

○ Open-ended○ Closed-ended○ Probing/Exploratory○ Clarifying○ Exception Seeking○ Scaling

● Direct Communication○ Clear feedback○ Clear presentation of

objectives, agenda, & purpose

○ Appropriate & respectful

Assessment: ● Determining the appropriateness of coaching to

meet client’s needs.● Managing Progress & Accountability/Follow

Through● Maintain perspective of the big picture and the

current context for moving forward

Establishing Values & Goals:

● Will inform the exploration of options.

Action:

● Develop action plan

● SMART goals/results

● Specific steps that client will take towards goals.

● Prioritizing steps, and adjust as needed

● Identify & access learning resources

Exploration & Expanding of Possibilities & Options:● Will inform the establishment of the action plan.

In what settings could we use a financial coaching approach?

In what settings could we use a financial coaching approach?

When and how might we be able to use aspects of the coaching approach and particular techniques?

Coaching Key Takeaways

● A form of experiential learning

● About helping clients explore their own thinking and understanding, values and goals, and helping them develop action plans

● Rests on a foundation of a client driven, collaborative relationship

● Models a process of self-learning through

○ assessment

○ discerning values & goals

○ exploring possibilities

○ taking action

○ further assessment & accountability.

Citations:

● Collins, J. and O'Rourke, C. (2012) "The Application of Coaching Techniques to Financial Issues," Journal of Financial Therapy: Vol. 3: Iss. 2, Article 3. http://dx.doi.org/10.4148/jft.v3i2.1659

● Consumer Financial Protection Bureau, (2015).Financial well-being: The goal of financial education > Reports > Consumer Financial Protection Bureau. Retrieved 31 March 2015, from http://www.consumerfinance.gov/reports/financial-well-being/

● Grant, A. (2009). The Evidence for Coaching. Invited paper; Harvard University Coaching and Positive Psychology Conference, Harvard University, Cambridge, MA. Instituteofcoaching.org, Resources. Retrieved 31 March 2015, from http://www.instituteofcoaching.org/index.cfm?page=resources

Citations:

● Oxforddictionaries.com, (2015). Coach: definition of coach in Oxford dictionary (American English) (US). Retrieved 31 March 2015, from http://www.oxforddictionaries.com/us/definition/american_english/coach

● Wikipedia, (2015). Experiential learning. Retrieved 9 April 2015, from http://en.wikipedia.org/wiki/Experiential_learning

● Wikipedia, (2015). Humanistic psychology. Retrieved 14 April 2015, from http://en.wikipedia.org/wiki/Humanistic_psychology

Additional Reading:

● Armypubs.army.mil, (2015). Chapter 2. Counseling Fundamentals. ATP 6-22.1 The Counseling Process. ATP - Army Doctrine and Training Publications. Retrieved 18 May 2015, from http://armypubs.army.mil/doctrine/DR_pubs/dr_a/pdf/atp6_22x1.pdf

● Collins, J. (2014). Financial Coaching, An Asset Building Strategy. A brief written and published collaboratively with the Asset Funders Network and the Center for Financial Security. Retrieved 20 April 2015, from http://assetfunders.org/images/pages/AFN_FinacialCoaching(WEB_version).pdf

Additional Reading:

● Collins, J., Olive, P., and O’Rourke, C. (2013). “Financial Coaching’s Potential for Enhancing Family Financial Security.” The Journal of Extension, 51(1). Retrieved 16 April 2015, from http://www.joe.org/joe/2013february/a8.php

● Coachfederation.org, (2015). Core Competencies - Individual Credentialing - ICF. Retrieved 31 March 2015, from http://www.coachfederation.org/credential/landing.cfm?ItemNumber=2206&navItemNumber=576

● Instituteofcoaching.org, (2015). Resources. Retrieved 31 March 2015, from http://www.instituteofcoaching.org/index.cfm?page=resources

● Lee, M. (2013). Solution-Focused Brief Therapy. Socialwork.oxfordre.com. Retrieved 19 May 2015, from http://socialwork.oxfordre.com/view/10.1093/acrefore/9780199975839.001.0001/acrefore-9780199975839-e-1039

Additional Reading:

● Psychology.org.au, (2015). Australian Psychological Society : Coaching psychology: How did we get here and where are we going? . Retrieved 31 March 2015, from http://www.psychology.org.au/publications/inpsych/coaching/

● University of Wisconsin-Extension, (2015). Financial Coaching Strategies. Retrieved 19 May 2015, from http://fyi.uwex.edu/financialcoaching/

● Wikipedia, (2015). Health coaching. Retrieved 31 March 2015, from http://en.wikipedia.org/wiki/Health_coaching

● Wikipedia, (2015). Solution focused brief therapy. Retrieved 1 May 2015, from http://en.wikipedia.org/wiki/Solution_focused_brief_therapy

CEU Credit• If you would like to receive CEUs, click

here to take the post-test: https://vte.co1.qualtrics.com/SE/?SID=SV_e4zFHezdu5nJX8h

• Enter your email address and name.• Complete the 10-question post-test and pass

with 80% or higher.• You will receive a Certificate of Completion email

immediately after passing the test to the email address provided.

• Save the email as a document and upload to AFCPE or FinCert. No attached certificates will be sent.

• Contact [email protected] with questions.

VLE EvaluationWe appreciate your feedback!

Please share your thoughts on the 2015 VLE experience:

https://vte.co1.qualtrics.com/jfe/form/SV_9BnYfvTZfYhjtYx

Contact [email protected] with questions.

Personal Finance Virtual Learning Event#MFLNchat

Join us today at 1 p.m. ET for a Twitter chat with

Jerry Buchko

Upcoming Personal Finance Webinars:

• July 28, 11 a.m. ET: Predatory Lending Practices & How to Avoid Them – Dr. Barbara O’Neill and Marcus Beauregard. More information:learn.extension.org/events/2113

Find all upcoming and recorded webinars covering:

http://www.extension.org/62581

Personal FinanceMilitary Caregiving

Family Development

Family TransitionsNetwork Literacy

Nutrition & Wellness Community Capacity Building