Farmhouse near mumbai bluegreen properties farmhouse in mumbai farmhouse mumbai farmhouse mumbai

Farmhouse Cookies Consumer Profiling

-

Upload

zohaib-h-shah -

Category

Documents

-

view

100 -

download

1

description

Transcript of Farmhouse Cookies Consumer Profiling

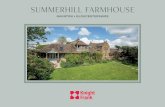

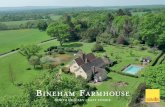

Peek Freans Farmhouse Cookies

i

S u b m i t t e d B y :

A m m a r H a m e e d

M u q t a d i r S . K a z i

Z a i n M a l i k

Z o h a i b H . S h a h

Module 1

Profile of the market area and justification of target market

of choice for the biscuit brand, ‘Farmhouse Cookies’ by Peek

Freans, a part of English Biscuit Manufacturers (Pvt.) Ltd

Table of Contents

Market Area Profile: Lahore.................................................................................................................1

Segmentation......................................................................................................................................1

Age:.........................................................................................................................................................1

Income:....................................................................................................................................................2

User type:................................................................................................................................................2

Competitive Structure..........................................................................................................................3

Leader:.....................................................................................................................................................3

Challenger:..............................................................................................................................................3

Followers:................................................................................................................................................4

Niche:......................................................................................................................................................4

Recent Trends & Market Opportunities................................................................................................4

Economic Trends.....................................................................................................................................4

Demographic Trends...............................................................................................................................5

Psychographic Trends..............................................................................................................................5

Target Market......................................................................................................................................6

Background of the Problem................................................................................................................8

Problem Statement.............................................................................................................................8

Research Objectives............................................................................................................................8

Hypothesis..........................................................................................................................................9

Research Plan...................................................................................................................................10

Methodology.........................................................................................................................................10

Sample Size...........................................................................................................................................10

Scales.....................................................................................................................................................11

Controlled Settings................................................................................................................................11

Tools for Data Interpretation.................................................................................................................11

Research Findings.............................................................................................................................12

Focus Group Findings...........................................................................................................................12

Questionnaire Findings..........................................................................................................................14

Consumer Profile based on Questionnaire Findings:.........................................................................14

i

Consumer Purchase Decision Process...............................................................................................14

Relevant Needs......................................................................................................................................15

Informational Search Process................................................................................................................15

Alternative Evaluation & Purchase Decision.........................................................................................16

Social Influences & Reference Groups..............................................................................................17

Regression Results............................................................................................................................18

Product Concept & Branding...........................................................................................................19

Product Strategy...............................................................................................................................20

Pricing Strategy................................................................................................................................21

Promotional Mix...............................................................................................................................22

TV advertisement..................................................................................................................................22

Print advertisement................................................................................................................................22

Outdoor advertisement..........................................................................................................................23

Channels of distribution...................................................................................................................24

Appendix...........................................................................................................................................25

Exhibit 1: New Farmhouse Logo and & Tag Line.................................................................................25

Exhibit 2: Print Advertisement (Pre Re-launch)....................................................................................25

Exhibit 3: Print Advertisement (Post Re-launch)...................................................................................26

Exhibit 4: Storyboard for TV Advertisement (1)...................................................................................27

Exhibit 4: Storyboard for TV Advertisement (2)...................................................................................28

Exhibit 5: Current Distribution Channel................................................................................................28

References.........................................................................................................................................29

Appendix...........................................................................................................................................31

Questionnaire Results:..........................................................................................................................31

Focus Group Discussion Guideline.........................................................................................................37

i

Market Area Profile: Lahore

Lahore is the second largest city in the country with a total area of 1,772 square kilometers and a

population of over 10 million and due to population growth and urbanization, has been

increasing annually at a rate of 4.1 %.

The city’s economic strength is its large urban population and advanced infrastructure. Lahore

hosts a multitude of commercial businesses all across the city with tourists flocking to the city

from all over the country. The city has also seen an increase in income over the last few years,

resulting in greater spending.

With population trends on the increasing side and the per capita income rising, the country

provides a great consumer market for all kinds of goods, including the biscuit industry.

Segmentation

Segmentation is conducted to divide one large market into groups of people with similar

characteristics; these are known as customer segments. For the biscuit industry, four bases of

segmentation are considered useful from among the ones existing in the current market, listed

below:

Age:

1. Below 15: This segment forms 35.4% of the population and is an active existing market

for the biscuit industry with a lot of potential to grow.

1

2. 15-65: This segment consists of 60.4 % of the population and as such is the largest

segment in the area. This segment is potentially the most profitable due to its sheer size

as well as the fact that it is expected to grow.

3. Above 65: Only 4% of the population and generally not thought of as a viable market for

the business industry, both due to size and general lack of affinity for biscuits.

Income:

1. Below Rs.10, 000: Constitutes 55% of the population and as such may be profitable due

to its size for cheap biscuit products.

2. 10,000 to 25,000: Forming 34% of the population, this segment utilizes biscuits mostly

as treats and as a dessert and is an emerging market as other substitute products’ prices

rise.

3. Above 25,000: Only 11% of the population but still extremely viable due to the fact that

this segment consumes biscuits for all occasions.

User type:

1. Dessert: Although a small segment, this is termed as an emerging market due to the fact

that overall inflation has resulted in people looking to biscuits as cheaper dessert

alternatives.

2. Anytime Snack: The largest segment in terms of size, with the greatest potential for

profit as this use suggests an overall greater frequency of consumption.

3. With Tea: Relatively large in size, this too is a potentially profitable market as tea

consumption is frequent and biscuit consumption becomes dependent.

2

4. Energy Source: Consists of users that consume biscuits for energy, this is a small

segment which may be profitable if considered as a niche market.

5. As Treats (for guests): Medium in size, this is an emerging market for the industry due

to reasons already posted stated within the dessert segment.

Competitive Structure

The Pakistani biscuit industry consists of twelve manufacturers, five of which are considered

major players in terms of market share. These are: English Biscuit Manufacturers (26,7%),

Continental Biscuits (23.6%), Ismail Industries (14,7%), KS Sulemanji Esmailji & Sons (11%)

and Coronet Foods (9.8%). EBM and continental biscuits dominate the industry as they account

for half of the market share combined and although numerous other small competitors exist, they

have failed to make a considerable impact.

Leader:

EBM is the market leader and has been in business since 1967. It is the leader as it offers the

widest variety of products which are known for their quality and taste. These include brands such

as ‘Peanut Pista’ and ‘Sooper’, Cornonet Foods is also an EBM subsidiary which primarily

makes ‘Rio’ and ‘Butter Puff’. EBM is at an advantage due to the fact that its large operations

result in economies of scale and has a wide distribution network however it is difficult for them

to respond to changing consumer demands quickly.

Challenger:

Continental Biscuits fall within this category and have been in operation since 1985. They have

gained a lot of market share from the leader and continue to try and be innovative in their

3

approach. They too benefit from economies of scale and a vast distribution network; however it

is relatively easier for them to change to consumer demands.

Followers:

Ismail Industries and KS Sulemanji Esmailji & Sons fall within this category. These companies

have introduced products on the basis of success of leaders’ product. Their products are an

imitation of the leading brand is sold for a lower price so that they can attract price sensitive

customers. Their main advantage is that there is little need for research. The disadvantages

include: weak distribution network, small market, low awareness among consumers, low quality.

Niche:

‘Farmhouse cookies’ by EBM fall within this category. Although produced by EB, these cater to

a specific small segment of the market, namely those looking for high quality products,

regardless of price. Their advantages include the fact that they provide a need which others do

not and as such can charge higher prices. However the consumer might not prefer such a

differentiated product or competition may increase, resulting in reduction in profits from an

already small segment.

Recent Trends & Market Opportunities

Economic Trends

Pakistan’s economy has shown resilience to shocks which include domestic factors such as the

energy crisis and high levels of inflation. According to Pakistan Biscuit & Confectionery

Manufacturers Association, even in recession, the industry has grown at an average annual rate

of 7%, between 2002 and 2009. Inflation and insufficient supply of raw materials, particularly

sugar, contributed to the unit price increases seen during the first half of 2010.

4

The biscuit industry remains largely unaffected as money spent on biscuits forms a very small

part of their income. Those that have been affected have increased purchase of biscuits which as

stated are sometimes used as a cheaper alternative to more expensive desserts. This represents an

opportunity for Rio to increase the overall size of the market.

Demographic Trends

The various changes in the demographics of Pakistan over the past few years have affected the

production and distribution patterns within the biscuit industry. The population growth rate is

1.57% and the rate of urban population is 36% which has a positive impact on the market for

biscuits. The increase in population and urbanization help to increase overall market size, leading

to a potentially larger market to serve for biscuits while changes in education level provide an

opportunity to market their product to the affluent college going population.

Psychographic Trends

Changes in lifestyle, western influence and a change in the marketing activities of the food

industry are the major changes that have affected the market’s psychographics. Major lifestyle

changes include a greater awareness of healthier food and the need to actively seek out a

healthier living. This, coupled with an increasingly western influence represents a profitable

opportunity for higher end biscuit brands to focus on its current health benefits, make the product

healthier.

5

Target Market

As with any successful business, a target market should be created towards which the brand must

focus its efforts on in order to remain competitive and maximize its potential. This target market

is chosen based on a number of factors, the most important of which is the idea that the product

should satisfy a particular need for a particular audience. The key is to identify which segments

are particularly served by the usage of cookies. Thus we create a consumer profile based on our

previously identified segments:

In terms of age, the 15-64 segment is further divided, specifically targeting young adults and as

such the 18-29 segment is selected. The reason is that these are generally spendthrifts and form a

large part of the overall population.

In the income bracket range, we choose the least populous segment (above 25,000) because of

the fact that they consume more biscuits than any of the other segments and as such, due to their

higher incomes can be charged a higher price resulting in overall greater profit even if sales

volume would be lower in comparison to the below 10,000 category.

Research shows that the urban population consumes are ones that generally consume biscuits and

with over 35% of the population, they are large enough for our market.

In terms of usage type, it is best to target those that consume biscuits as an anytime snack

because such usage results in the most frequent amount of monthly purchase, as well as the fact

that it is the largest among its segments.

6

One should also define the type of young adults that are targeted in terms of offices, universities,

household types, etc. The age segment, along with the income bracket, largely consists of three

types of adults, those who attend universities, those who stay at home and those who are office

going. Out of these three, it is deemed best to target the university going types as these generally

spend more on FMCGs; however the office going types would be considered as the secondary

market.

Thus we come to our target market which consists of university going, urban young adults

between 18 and 29 who consume biscuits as an ‘anytime snack’, with an income of over

Rs.25,000.

7

Background of the Problem

Consumers today, in urban areas, are clamoring for a high quality, high taste biscuit line that aims to

target the higher end consumers. However this need has largely gone unsatisfied by local manufacturers

and as such a product which caters to this portion of the market can become quite successful.

Farmhouse cookies have been on the market for a significant period of time but have yet to create a

major splash in the biscuit industry. It is thought that the major reason for this is that the current

positioning is faulty and as such does not cater to any market at all.

This idea serves as the major research problem which we further dissect.

Problem Statement

The major problem stems from the background provided above; as stated Farmhouse cookies are not

positioned in a manner as to be perceived by any particular segment as ideal. Thus they have failed to

garner a high market share. This is the major problem and as such keeping in mind the fact that the higher

end consumers are not catered to; the problem statement becomes: “To re-position Farmhouse cookies

in such a way as to appeal to the higher end consumers.”

Research Objectives

To comprehend changing consumer attitudes and preferences for biscuits.

To assess the perception of Peek Freans’ Farmhouse Cookies and important factors which

induce customers to select these cookies

To analyze the factors which influence consumers’ choice for different biscuits

To investigate the impact of emerging competitors and their offerings on Farmhouse biscuits

sale

To gauge consumer awareness and usage behavior regarding different types of biscuits

offered by Peak Freans.

8

Hypothesis

H0: Perception of brand image has an insignificant impact on the target audience’s

preferences

H1: Perception of brand image has a significant impact on the target audience’s

preferences

9

Research Plan

Methodology

There are a number of different methods of collecting primary data you need to assess. For

conducting primary research, we will be using both qualitative and quantitative research .For

qualitative research we will be conducting two focus groups. Focus groups are interviews in

which the researchers bring together a group of people who do not necessarily know each other

but who share a characteristic that is relevant to the question to be answered. Each focus group

would consist of 8 members, with a moderator. One focus group would consist of university

students and the other would consist of office going people. Moderator’s guide has been attached

in the appendix, which would be used as a guideline for conducting focus group. For quantitative

research, survey would be done by using questionnaires which would be floated between

university students which would consist of close ended questions. Surveys ask a common set of

questions of everyone who responds, typically offering multiple choice answers or rating scales.

Sample Size

The sample size for conducting the survey would be 40 university students which would be

selected using convenience sampling technique. Convenience sampling is the most common of

all sampling techniques; it is a non probability sampling technique in which subjects are selected

because of their convenient accessibility and proximity to the researcher.

10

Scales

Multiple choice answers and likert scale would be used for making questions in the

questionnaire. This scale would be used because it requires the individuals to make a decision on

their level of agreement, generally on a five-point scale (i.e. Strongly Agree, Agree, Neutral,

Disagree, and Strongly Disagree) with a statement. The number beside each response becomes

the value for that response and the total score is obtained by adding the values for each response,

Controlled Settings

In controlled settings, one or two variables are manipulated whereas the rest of the variables and

external factors are kept constant. For our research no controlled settings would be used.

Tools for Data Interpretation

Analyzing survey data is an important step in the survey process , therefore it is important to

select the proper statistical tool to make useful interpretation of our data For coding, interpreting

and analyzing the data obtained from questionnaires, Stat graphics would be used, which is a

statistics package that performs and explains basic and advanced statistical functions. Descriptive

statistics and regression analysis would be used for analyzing the data and to prove hypothesis

right or wrong.

11

Research Findings

This report (module 3) would focus on the research findings from the focus group as well as the

questionnaire survey; these results have been analyzed and have been listed individually below

along with a combined analysis in terms of how they affect the ‘Consumer Purchase Decision

Process’.

Focus Group Findings

Two focus groups were conducted; each consisting of eight people. One consisted of university

students and the other one of working professionals. These focus groups were recorded and the

video recordings were used to extract a number of common themes that emerged from the two

focus groups.

[Focus groups were conducted in Urdu, with quotes being transliterated into English for this report]

Generally cookies are perceived as a healthy snack for almost everyone. In our society, we have

a culture of drinking tea whenever possible and mostly the tea is complimented by either biscuits

or cookies. Sooper are the widely popular biscuits along with Bakery, Prince and Candy.

However many people (mainly university students) prefer cookies to biscuits as cookies are more

western and to some extend is associated with status symbol. Imported cookies are preferred as

there aren’t many choices of loyally made cookie in Pakistan. All the people said that whenever

they hear about Peek Freans, the first thing that comes to their mind is the pied piper. As stated

‘…pied piper has been in my mind since the childhood.’

When the respondents were asked about the brand personality of Farm House cookies, one stated

‘…for me Farm House cookies are fresh…’ whereas another respondent said that Farm House

cookies are healthy. During the discussion, another respondent added ‘…bakery has a soft image

12

whereas Sooper has more of a friendly image’. Prince was considered an old brand that needed

to be re built its position. According to almost everyone, Farm House cookies needed serious

advertising campaigns to make people aware of the brand. People hardly remembered any of

their advertisements.

However as there are lack of options for locally manufactured cookies, people still consume it

but aren’t brand loyal. Farmhouse cookies are good bad but pale in comparison to imported ones.

They prefer to buy imported cookies instead, but on occasional bases as they are too expensive

for regular use. Thus there is a high demand for quality cookies even if with a higher price than

before (lower price compared to the imported ones). Quality is the single most important factor

when deciding upon cookies, price being second. When discussing about different flavor fo the

cookies, one said ‘out of all the Farm House Cookies chocolate chip is the best’ and this was

agreed by the rest as well. Generally people were satisfied with the packaging design but a few

said that it could have been more innovative by adding more colors to it.

It was suggested that Farm House Cookies should also be available in mini packs. Furthermore

Farm House Cookies are considered to be a product with a low price but unfortunately with a

low quality as well. ‘…Farm House Cookies made its price affordable by decreasing the quality

of the product and that is not acceptable…I am ready to pay more for its price if they promise to

make it a quality product...’

When people were asked about the mode of media they prefer, almost all replied Television with

in a second. University student were mainly focused towards entertainment channels whereas the

working professionals watched news channels most of the time. Many people suggested

13

associating some sports celebrity with cookies advertisement focusing on health whereas others

wanted to endorse it with a TV celebrity.

Questionnaire Findings

The questionnaire was distributed among 40 university students and the data collected was

analyzed to come up with a consumer profile and to identify the consumer decision process for

biscuits in our target segment.

[Please note that the results of each individual question have also been attached in the appendix]

Consumer Profile based on Questionnaire Findings:

Our typical consumer, based on the findings of the questionnaire is a male who lies in the age

bracket of 20-29 with a household income of Rs. 40,000 or above. He consumes biscuits daily

during tea breaks or as a snack. He’s extremely meticulous, he thinks twice before buying

anything. He would switch to another brand of biscuits only if it has an out of the world taste.

His eating habits are such that he eats whenever he feels hungry. His needs are such that he

wants the product to be of a great taste, fresh and easily available in the market. He gets attracted

to biscuit ads in which taste is described and he would try new brands by unknown player

because it might have a great taste. He usually buys biscuits from general stores, prefers

chocolate chip cookies with Oreos being his favorite brand.

Consumer Purchase Decision Process

The first step towards understanding the target market’s needs involves understanding their

needs in terms of biscuits and which aspects of these needs are unfulfilled. Once this has been

established, the relevant needs can be established.

14

Relevant Needs

Our primary research has shown that our target market prefers biscuits which are high in quality

and as such are willing to pay a higher price for what they perceive as high quality. This then

results in a need recognition process among the target market consumers. The need recognition

starts when the individual identifies that he or she wants high quality biscuits, regardless or price.

Informational Search Process

Once need recognition occurs within the individual, the potential consumer carries out an

informational search process, which is conducted in two ways:

Internal Search

The internal search process involves the individual analyzing the product and brand through

one’s own internal cognitive forces. This is done based upon four aspects: existing knowledge,

confidence in that knowledge, the ability to retrieve stored knowledge and satisfaction with prior

purchases. If the individual is satisfied on all four counts, he or she proceeds with the decision to

buy biscuits, else an external search is carried out.

External Search

This involves collecting information from the environment in terms of advertisements, the

internet, friends and family. They use these four areas to gather information to help with decision

making. It should be noted that this may occur when one wants to make a purchase decision (pre-

purchase search) or for information gathering (ongoing search) for later use. These are also the

basic purposes why consumers may carry out external search.

15

In terms of biscuits, the results show that consumers are reliant upon the perceptions that they

have of the brand and act upon those when purchasing biscuits. Customers in general seem to be

aware of the positioning of different brands and as such act accordingly when purchasing

biscuits. Most rely upon an external search process for high quality biscuits.

Alternative Evaluation & Purchase Decision

Once a need has been recognized and the information search is carried out, the consumer starts to form

consideration sets of the products that can satisfy his hunger. The consideration set will include all sorts

of snacks like chips and biscuits. Selection and narrowing down of all these alternatives is based on

consumer perception.

The perceptual interpretation that consumers go through is based on stereotypes, physical appearance,

descriptive terms, first impressions and halo effect. These perceptions can be result of some

advertisement, past experience or social influence. The consumer then narrows his options and decides

on having a biscuit. Now the consumer’s consideration set will become more specific and would contain

only the brands of biscuits. This set will include farm house cookies, bisconni chocolate chip cookies, M

& S cookies, Bakeri, Oreo etc.

After going through first three steps, consumer has to make a purchase decision. Purchase decision is

greatly influenced by consumer’s attitudes and beliefs. Our target market currently looks towards

imported biscuits to satisfy their needs and as such the purchase decision generally involves imported

products (because they’re perceived to be of higher quality).

After he has consumed the cookies, the consumer has reached the post purchase behavior stage. This

stage will measure the value of the product to consumer.

16

Social Influences & Reference Groups

A number of social influences have been identified for our target market; these include family,

friends and celebrities.

It is seen that in terms of cookies, friends have the greatest social influence upon each other that

in turn are affected by celebrity endorsements and past experiences. Families serve as the

secondary reference group that affect biscuit purchase decisions for the majority of our target

market.

What these social influences help to accomplish is the perception in the minds of the consumers

with relation to the perceived quality and value derived from the product, in this case, Farmhouse

cookies.

17

Regression Results

The hypothesis, which stated that the brand image plays a significant role in forming consumer

perception in terms of brand preferences, has been tested using a regression equation.

It has been stated that in order to understand how brand image affects consumer preferences, five

variables are looked at and how they affect perception of brand image for the consumers.

These five variables become the independent variables while brand image becomes the

dependent variable. The independent variables are: product, price, promotion, place and taste.

The regression equation:

Brand image = 0.541632 - 0.0683817*channel distribution + 0.19053*packaging +

0.319941*price + 0.104919*taste + 0.331868*advertisement

ANOVA Table statistics:

R2= 90%

P Value: 0.0013

As can be seen, since the P value is less than 0.01, we state that we do not reject H0 and brand

image plays a significant role in changing consumer perceptions.

In terms of individual variables, it can be seen that apart from channel distribution, all affect

brand image positively while channel distribution affects it negatively. How these results are

used to change band image is explained in each individual section in this report.

18

Product Concept & Branding

The product concept consists of characteristics of the product that showcase the qualities,

performance and features. The product concept is based on the wants of the target market. When

designing the product concept, every detail is tailored to satisfy the needs and wants of the

product’s target audience.

As stated in our earlier research, the target market has specific needs that can be catered by

Farmhouse Cookies. The characteristics of the target audience suggest that these consumers are

willing to pay a higher price as long as the quality is considered to be very high. Currently these

consumers prefer imported cookies such as Oreos (as found out in our research). Based on the

factors listed, Farmhouse Cookies would be repositioned in the market with a new brand image.

The new brand image would convey the idea of quality and luxury and these cookies would be

positioned as the absolute best in the market. In order to completely recreate a new brand image,

a new logo and a new tagline has been created to convey our new message.

The new tagline would be: “Simplicity. Elegance. Luxury.” This would help keep the message

sophisticated yet straightforward, conveying the notion that Farmhouse Cookies are a high

quality brand.

The new logo would consist of tri –color waved stripes with the top one colored blue and would

curve upwards, the middle one colored black and pointing straight, while the tird one would be

colored purple and curving downwards. The three stripes would represent the three types of

cookies that come under the Farmhouse umbrella (butter, chocolate chip and coconut) while the

colors would represent the tag line message, where blue would be for simplicity, black for

elegance and purple to convey luxury. The idea behind this new image is that these new

19

personality characteristics will help the audience of our target market to associate themselves

with the brand.

In order to make this repositioning successful, the marketing mix of the product will also be

completely overhauled. New promotional strategies will be formed emphasising more on

television ads as it is the most liked media choice of our target audience. Pricing will be revised,

making it a higher price niche product and more effective distribution channels will be

established.

Product Strategy

Farm House Cookies, as the name suggests, are manufactured using the best quality of materials and this

fact needs to be highlighted in order to improve the perception of the consumers that these biscuits are of

high quality. Moreover, the irresistible freshness of the biscuits should also be given due attention. This

overall product strategy would be applied to the three different types of cookies that fall under the

‘Farmhouse Cookies’ umbrella; these are: Chocolate Chip Cookies, Butter Cookies and Coconut Cookies.

It is the packaging that plays a key role in presenting the brand values of the product and for a luxury

brand, which differentiates itself on quality and image, the importance of the packaging is intensified.

Luxury brands rely on packaging to cultivate an image of high quality, elegance and sophistication for

their products. Amongst many different packaging types used in the luxury world, steel is gaining more

and more ground because of the unique benefits it can offer, including advanced shaping performance and

a multitude of decorative finishes, embossing and de-bossing.

Farm House Cookies should be packaged in a steel/tin box with special decorative finish, which

demonstrates value through sophisticated printing and luxury shaping, the name embossed

Color is the best way to reflect and enhance a unified image and branding of a product, as it is such a

20

visual medium. The packaging colors should relate to the logo and reflect the image being sent to the

market place to attract buyers.

Farm House Cookies should be packaged in silver as silver packaging implies elegance and sophistication

and silver combines well with most other colors; dark blue decoration will suggest a conservative and

trustworthy product and would be best suited for coconut cookies, purple decoration will suggest

luxuriousness and would be best suited for chocolate chip cookies, black decoration will suggest simple

sophistication and would be best for butter cookies.

Pricing Strategy

There are lots of factors that need be to taken into account when pricing a product and after

thoroughly going through those factors, one need to select the pricing strategy most suitable for

the product and the market conditions. The company needs to set pricing objective, determine

demand, estimate costs, analyze competitors costs and pricing, select a pricing method and then

come up with a final price.

In an environment with multiple competitors, it is important to look at the product’s value in the

eyes of the customer, its perceived value, and what is deemed to be a fair price for such a

product. The competition and their prices also have to be kept in mind and how one wants to

position the product in terms of the competition.

Keeping in mind these factors, premium pricing strategy will be used which involves setting the

price of the product higher than similar products. The reason for selecting this pricing strategy is

that currently consumers perceive Farmhouse cookies as of low quality. This perceived quality

can be defined as the consumer’s judgment about the product’s superiority. High price of

Farmhouse cookies would change the perception of the consumers and would signal the

consumers that the product is high in quality. The reason for doing this is that generally people

equate high prices with high quality therefore it would be easy to change consumer’s perception

by artificially increasing the price of Farmhouse cookies. The benefits of using premium pricing

strategy are that it could easily cover high costs of the new packaging. Premium pricing would

21

also result in high profit margins. Thus Farmhouse Cookies will be highly priced compared to

other local cookies as we promise “Simplicity. Elegance. Luxury.”

Promotional Mix

The promotional or communications mix consists of various forms of advertisements that range

from direct selling to indirect selling, mass communication to public relations. The idea is to

create objectives for major promotional channels and then come up with effective ways to

achieve those objectives through advertisement.

TV advertisement Farmhouse Cookies would be promoted heavily both pre re-launch and post re-launch. The idea

of pre re-launch would be to create awareness which would be mainly through TV

advertisements on music and entertainment channels since the adult urban target markets prefer

watching these stations. The basic idea of Tv ad is to show people that Farmhouse cookies are

‘cookies from heaven’. The purpose is to show consumers that Farmhouse cookies has an out of

the world taste, the awareness campaign would extend itself to SMS marketing as well,

spreading knowledge about the product via SMS.

Print advertisementThe idea of creating a specific image, especially that of simplicity, elegance and luxury would be

created near pre re-launch and post re-launch via print ads which would also be available online

on Face book. In addition, Farmhouse Cookies would have its own website on which both print

and video ads would be shown and latest promotions would be displayed. Print ads would be

using the tag line “Simplicity. Elegance. Luxury” campaign, promoting the product as of high

quality, mainly targeted at the younger audience. The basic idea of using this tag line is to

convey to the consumers that our cookies are so good that we don’t need gimmicks to sell them

because the quality of cookies is enough reason for you to purchase them.

Just before launch, the product would be handed out at select stores in major cities as a free

sample so that people get accustomed to the taste and style of the product.

22

Outdoor advertisementPost re-launch, billboards and posters would run both print campaigns and television

advertisements would change to reinforce the message earlier displayed. Television ads would

come in short bursts of two weeks after which there would be no advertisement of a week and

this cycle would continue for three months.

With the help of electronic media, advertisement boards, banners, advertising on newspapers,

pamphlets, brochures and by stall activity of marketing department; taste of the consumers is

developed and awareness is brought among people about living an elegant life with a healthy

lifestyle.

Channels of distribution

A ‘selective channel distribution’ strategy will be used as these are high quality cookies and as

such would be available only at supermarkets and hyper markets to help with the perception that

these are high quality cookies and as such aren’t available at small stores.

23

55%30%

15%

Post re-launch Brand exposure

Tv

Outdoor

20%

25%

55%

Pre re-launch Brand exposure

Tv

Outdoor

The current distribution channel has too many intermediaries and thus isn’t efficient; the

following distribution channel is proposed: Manufacturing plant -> Company Ware House ->

Regional Ware House ->Distributor -> Retailer

All cookies manufactured at the plant will be shifted to the company warehouse for storage

purposes. Once stock is accumulated it will be shifted to the regional warehouses according to

the demand for further distribution to local distributors and then to the selected retailers.

The five-step easy distribution will help in the following ways:

Centralized approach, which will enhance efficiency

Less cost will be incurred in transporting the cookies since selective distribution would

require lesser number of distribution channels

Record maintenance at fewer areas allowing easy reconciliation

Optimal number of employees engaged to do the task ‘ The Right Way’

Availability at selected retailers will improve perception about the quality of the cookies.

More cookies at a particular location will increase bulk sales

Appendix

24

Exhibit 1: New Farmhouse Logo and & Tag Line

Exhibit 2: Print Advertisement (Pre Re-launch)

25

Exhibit 3: Print Advertisement (Post Re-launch)

Exhibit 4: Storyboard for TV Advertisement (1)

26

27

Exhibit 4: Storyboard for TV Advertisement (2)

Exhibit 5: Current Distribution Channel

28

Exhibit 6: ANOVA Table

References

Ahmed Lodhi (2010), ‘Biscuits in Pakistan’. Euromonitor International.

29

Jawad Afridi (2010) ‘Prince by LU’ . Continental Biscuits Ltd.

Ahsan Butt (2008), ‘Who Counts as Middle Class’. Asian Correspondent.

Miguel Loureiro (2005), ‘Developing Pakistan: The Good, Bad & Ugly’. Daily Times

‘Population Census Organization’ (2011). Government of Pakistan.

30

Appendix

Questionnaire Results:The results of each question are displayed below, with an overall result analysis from the

questionnaire listed after the individual findings of the questions.

1. What is your age?

Below 20 18%

20-24 43%

25-29 28%

Above 29 11%

Most of the respondent’s belonged form the age bracket of 20 to 24 while another major chunk

was from the 25-29 age bracket.

2. What is your current monthly household income?

Below 20,000 2%

20,000 – 39,000 8%

40,000–49,000 27%

Above 49.000 63%

A considerable amount of respondents had a current monthly household income of over 49,000

with the 40-29,000 making up another considerable chunk.

3. Do you consume biscuits?

Yes 95%

No 5%

An overwhelming majority consume biscuits.

4. If No, please specify a reason

31

You don’t like biscuits 48%

You prefer other snacks 35%

You think it’s not healthy 5%

You think its costly. 12%

The major reason provided by the respondents of not consuming biscuits was that they did not

like biscuits in the first place.

5. How often do you purchase biscuits?

Daily 39%

Once in 2-3 days 23%

Once a week 20%

Once a month 18%

A large number of people purchase biscuits on daily basis while the other half bought them on

weekly or monthly basis.

6. When do you generally consume biscuits?

Breakfast 8%

Tea Break/Snacks 34%

In between meals 18%

Whenever Hungry 14%

While studying/working 19%

While traveling 7%

A major chunk of respondent consumes biscuits during their tea breaks or as a snack while some

also took them between meals or when studying.

7. How would you describe your spending habits?

Generally erratic, governed by 32%

32

impulsive likings

Varies, Depends on the product 27%

Extremely meticulous, I think twice

before I buy everything

41%

Most of the respondents are extremely meticulous and think twice before buying everything.

8. How would you describe your eating habits?

I stick to a set number of meals and

the corresponding mealtimes

41%

I eat whenever I'm hungry 59%

The eating habits of respondents are almost equally divided between the options of eating

whenever they feel hungry and sticking to a set number of meals

9. If you would change your existing biscuit brand, on what reason would that change be

based most?

Value for money 19%

Brand Image 26%

Out-of-the-world taste 43%

Healthier choice 12%

The major reason provided by the respondents for changing their existing brand is the out of

world taste.

10. Rate the following attributes in biscuits

33

Most

ImportantImportant Neutral

Not so

important

Not

important

Taste 58% 36% 6% - -

Brand 28% 41% 16% 10% 5%

Price 38% 21% 18% 16% 7%

Packaging 22% 38% 13% 20% 7%

Advertisements 31% 27% 21% 16% 5%

Variety 13% 18% 43% 18% 8%

Availability 57% 29% 14%

Different Sizes/Packages 29% 31% 16% 10% 14%

Freshness 83% 13% 4% - -

Health Quotient 12% 19% 39% 22% 8%

11. Would you try a new brand brought out by an unknown player?

Yes, It could have a really great taste 70%

70%

Maybe only if the packaging is very attractive 20%

20%

Absolutely No 10% 10%

A major chunk of respondents said that yes they would try, while some also said that they would

34

try only if the packaging is very attractive and some said that they would not try the new brand.

12. What attracts you most to a new untried brand of biscuits?

Advertisements 10%

Attractive Packaging 15%

Taste described 60%

Cheaper Price 15%

A large number of people said that they are attracted to new untried brands because of the taste

which is described while others said that they are attracted because of price, packaging or

advertisements.

13. Rank the following types of biscuits on how much you like them

Respondents were asked to rank the above mentioned brands of cookies from 1 to 5 in the order

of their preference. To calculate the aggregate ranking, points/weights =were assigned and total

rankings were calculated. The aggregate ranking shows that 65% of the respondents preferred

butter cookies,15% chocolate chips, 10% cream and nuts and 4% preferred salty cookies.

14. Where do you generally buy biscuits?

Local shop 5%

General stores 60%

35

total

Butter 65%

Chocolate chips 15%

Cream 10%

With nuts 10%

Salt 5%

Super markets 30%

Wholesale Markets 5%

Most of the respondents generally buy biscuits from general stores, a big chunk of respondents

buy from super markets and others buy biscuits from local shops or wholesale market

15. According to you, which is the most effective media for advertising a biscuit brand?

Newspapers 5%

Television 50%

Magazines 30%

Hoardings 15%

A large number of respondents say that television and magazines are the most effective media

for advertising whereas the rest say that newspapers and hoardings are also effective.

16. Rank the following biscuits as per your preference

Total

Oreo cookies 35%

Bakery butter cookies 20%

M & S cookies 15%

Chips Ahoy 15%

Farmhouse cookies 10%

Other 5%

17. Does brand image play an important role when choosing biscuits?

Total

36

Strongly Agree 35%

Agree 20%

Neutral 15%

Disagree 15%

Strongly Disagree 10%

Respondents were asked to rank the above mentioned brands of cookies from 1 to 5 in the order

of their preference. To calculate the aggregate ranking, points were assigned and total rankings

were calculated. The aggregate ranking shows that 30% of the respondents liked Oreo cookies,

20% preferred bakery butter cookies, 15 M & S cookies, 15% Chip Ahoy cookies, 10%

Farmhouse cookies and 5% other cookies.

Focus Group Discussion Guideline

INTRODUCTION/ WARM UP (5 Minutes)

Introduce yourself

Highlight the purpose of focus group

Introduction of respondents

Ask about their hobbies

Try to be friendly and build rapport

Rules of Focus Group

LIST OF PREFERENCES (5 Minutes)

Perception about biscuits

Ask respondents regarding different brands of biscuits

Ask them to list them as per preferences

37

Basis choosing one biscuit over another

WORD ASSOCIATION TEST (5 Minutes)

Ask them to tell about first word comes to their mind when they hear about different

brands of biscuits

PERSONFICATION TEST (5 Minutes)

Screen the list to two or three brand which should have Farm house cookies and ask

respondents to associate a personality trait with Farm house cookies and competitor’s

Brand.

PERCEPTION OF FARM HOUSE COOKIES (5 MINUTES)

Perception about Farm house cookies

When do they like to eat Farm house cookies

How they perceive Farm house cookies when they see advertisements

Ask them about taste of Farm house cookies

Quality of Farm house cookies

Flavors of Farm house cookies

PACKAGING (10 Minutes)

Ask them about packing of Farm house cookies

Ask them about color of packaging

Is the packaging convenient?

What do they suggest regarding any change in packaging and color

PRICE SENSITIVITY (10 Minutes)

38

What do they think about price of Farm house cookies?

Is it fair or over priced or under priced?

Will they pay more for improved Farm house cookies?

MEDIA HABITS (10 Minutes)

Sources of Information

Which mode of media they prefer like TV, Radio and news paper

Favorite TV Channels

Favorite magazine

Favorite celebrity

Area and location, where they travel

Suggestions to improve marketing of Farm house cookies

CLOSING (5 Minutes)

Summarize

Feedback

Closing remarks

Gifts

39