Scheduledshutdownmaintenance 13352344159941 Phpapp02 120423212708 Phpapp02

comparativeanalysisofbrokingfirms-110422110506-phpapp02

-

Upload

minhaal-reema -

Category

Documents

-

view

212 -

download

0

description

Transcript of comparativeanalysisofbrokingfirms-110422110506-phpapp02

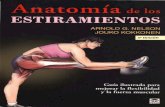

Comparative Analysis Of Broking Firms

Comparative Analysis Of Broking FirmsSubmitted to : Prof. Samarjeet Sen GuptaMINHAAL REEMA

Contents

S/NO.

TOPICS

PAGE NO.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

Acknowledgement

Declaration

Objectives

Introduction

Company Profile

Different players in the Industry

Activation and Other Charges Of Different Co.

Data Analysis

Findings

Annexure

Bibliography

3

4

5

6

8

12

13

14

20

21

22

Acknowledgement

Preservation, inspiration and motivation have always played a key role in the success of any venture. In the present world of competition and success understanding of theoretical and practical working makes you aware about the real Business; willingly we prepared this particular project.

We would like to thank our faculty Prof. Samarjeet Sen Gupta to give us the opportunity to do this project.

We would also like to thank the Microsec Capital Ltd. for helping us to provide the information about their broking firm.

And finally, we would like to thank EIILM for providing us the platform to do this project and to learn about the different broking firms.

Declaration

We the student of Eastern Institute for Integrated Learning in Management, Kolkata , declare that this project report title A COMPARITEIVE STUDY OF VARIOUS BROKING FIRMS submitted, is our original work and has not been previously submitted as a part of any other degree or diploma of another Business school or University.

The findings and conclusions of this report are based on our personal study and experience.

Objectives

1. To know the customers preference in different sector of investment and to know what are the factors consider most important in order to choose their broking firm.

2. To know the different companies Activation and Other charges.

3. To know about the different broking firms and to make a comparison between them with the help of primary and Secondary Data.

Introduction

The Bombay Stock Exchange (BSE) and the National Stock Exchange of India Limited (NSE) are the two primary exchanges in India. In addition, there are 22 Regional Stock Exchanges. However, the BSE and NSE have established themselves as the two leading exchanges and account for about 80% of the equity volume traded in India. The NSE and BSE are equal in size in terms of daily traded volume.

The average daily turnover at the exchanges has increased from Rs851crore in 1997-98 to Rs1284crore in 1998-99 and further to Rs2273crore in 1999-2000. NSE has around 1500 shares listed with the total market capitalization of around Rs9, 21,500crore.

The BSE has over 6000 stocks listed and has a market capitalization of around Rs9, 68,000crore. Most key stocks are traded on both the exchanges and hence the investor could buy on either of the exchanges. Both exchanges have a different settlement cycle, which allows investors to shift their position on the bourses. The primary index of BSE in BSE Sensex comprises 30 stocks. NSE has the S&P NSE 50 Index (Nifty), which consists of fifty stocks. The BSE Sensex is the older and most widely followed index. Both these indices are calculated on the basis of market capitalization and contain the heavily traded shares from key sectors.

The markets are closed on Saturdays and Sundays. Both the exchanges have switched over from the open outcry trading system to a fully automated computerized mode of trading known as BOLT (BSE On Line Trading) and NEAT (National Exchange Automated Trading) system. It facilitates more efficient processing, automatic order matching, faster execution of trades and transparency.

The scrip traded on the BSE has been classified into A, B1, B2, C, F, and Z groups. The A group shares represent those, which are in the carry forward system (Badla). The F group represents the dept market (fixed income securities) segment. The Z group scrip is the blacklisted companies. The C group covers the odd lot securities in A, B1, & B2 groups and Rights renunciations. The key regulator governing Stock Exchanges, Brokers, Depositories, Depository participants, Mutual Funds, FIIs and other participants in Indian secondary and primary market is the Securities and Exchange Board of India (SEBI) Limited.

Financial Market

MONEY MARKET:

The Money Market refers to the market where borrowers and lenders exchange short-term funds to solve their liquidity needs.

CAPITAL MARKET:

The Capital Market is a market for financial investments that are direct or indirect claims to capital (Gart, 1988).

SECURITIES MARKET:

It refers to the markets for those financial instruments/claims/obligations that are commonly and readily transferable by sale. It has two inter-dependent and inseparable segments, the new issues (primary) market and the stock (secondary) market.

Primary Market

Securities generally have two stages in their lifespan. The first stage is when the company initially issues the security directly from its treasury at a predetermined offering price. This is a primary market offering. It is referred to as the Initial Public Offering (IPO). In Primary market, securities are offered to public for subscription for the purpose of raising capital or fund.

Secondary Market

Secondary market refers to a market where securities are traded after being initially offered to the public in the primary market and listed on the Stock Exchange. Majority of the trading is done in the secondary market. Secondary market comprises of equity markets and the debt markets.

Company Profile of Microsec

Microsec endeavors to provide services in the arena of Financial Services which includes Equity & Derivatives Trading on NSE and BSE,Commodities Trading on MCX & NCDEX, Investment Banking, Insurance, Depository Services, Portfolio Management Services, Mutual funds-SIP, Mediclaim.

Microsec Capital Limited has its principal offices in Kolkata and Mumbai with another 250(app.) business locations in 49 Indian Cities/Towns in 13 States. It is an ISO 9000 Certified Process.

EQUITIES

Microsec Capital Limited is a member of National Stock Exchange of India and Bombay Stock Exchange and is in the business of distribution of financial savings products to its clients. Microsec Group provides services to a wide range of clients. In order to keep the pace going we have developed our equity broking team which is equipped with research team, relationship manager, dealers and round the clock back office.

Microsec add value to people by:

Providing data source from Bloomberg

Research Team

Online Back office support

Transaction mailed on daily basis & also through SMS.

Margin Trading

Man to man interaction

In house DP

PRODUCT AND SERVICES PROVIDE BY MICROSEC CAPITAL LTD.

Equity & Derivatives Trading on NSE and BSE

Commodities Trading on MCX & NCDEX

Investment Banking

Insurance

Depository Services

Portfolio Management Services

Mutual funds-SIP

Mediclaim

DE-MAT ACCOUNT

Definition:

De-mat account is a safe and convenient means of holding securities just like a bank account is for funds. Today, practically 99.9% settlement (of shares) takes place on De-mat mode only. Thus, it is advisable to have a Beneficiary Owner (BO) account to trade at the exchanges.

Benefits Of De-mat Account:

1. A safe and convenient way of holding securities. (equity and debt instruments both).

2. Transactions involving physical securities are costlier than those involving dematerialized securities (just like the transactions through a bank teller are costlier than ATM transactions). Therefore, charges applicable to an investor are lesser for each transaction.

3. Securities can be transferred at an instruction immediately.

4. Increased liquidity, as securities can be sold at any time during the trading hours (between 9:00 AM to 3:30 PM on all working days), and payment can be received in a very short period of time.

5. No stamp duty charges.

6. Risks like forgery, thefts, bad delivery, delays in transfer etc, associated with physical certificates, are eliminated.

7. Pledging of securities in a short period of time.

8. Reduced paper work and transaction cost.

9. Odd-lot shares can also be traded (can be even 1 share).

10. Nomination facility available.

11. Any change in address or bank account details can be electronically intimated to all companies in which investor holds any securities, without having to inform each of them separately.

12. Securities are transferred by the DP itself, so no need to correspond with the companies.

13. Shares arising out of bonus, split, consolidation, merger etc. are automatically credited into the De-mat account of the investor.

14. Shares allotted in public issues are directly credited into De-mat account of the applicants in quick time.

Is a demat account a must?

Now a day, practically all trades have to be settled in dematerialized form. Although the market regulator, the Securities and Exchange Board of India (SEBI), has allowed trades of up to 500 shares to be settled in physical form, nobody wants physical shares any more. So a de-mat account is a must for trading and investing.

Different Players in the Industry

Activation and other Charges of firms

COMPANY

A/c Opening

Charges

Brokerage

(Intraday,

Delivery)

AMC

Trading Exposure

Interest Rate

Debit Period

Mode of Trading

Margin Money

Software used

Microsec Capital Ltd

NIL

3p,30p

Rs350pa

5 times

18%

T+2

Online/

Offline

Rs5000

NOW

Sharekhan

NIL

5p,50p

1st yr free, 2nd yr

Rs400

4-6 times

19%

T+4

Online/

Offline

Rs5000

ICICI Direct

Rs750

50p,75p

Rs500pa

3-4 times

18%

T+2

Online/

Offline

NIL

Accesed through net

Indiabulls

Rs900

3-4p,

30-40p

NIL

4-5 times

17%

T+2

Online/

Offline

NIL

Power India Bulls

Angel broking

Rs660

3p,20p

Rs225

4-6 times

18%

T+2

Both online/Offline

Rs5000/10,000

Data Analysis

Primary Data collection

Structured questionnaire for customer.

Secondary Data Collection

Journals

Websites

News papers

Research Approach

Descriptive approach

Techniques to be used in Research Approach

Survey and Interview

Data Findings

Total Sample Size : 82

Male : 47

Female : 35

Online/Offline Trading

Investment Product Preference

Mode Of Awareness

Preference for Broking Firm

Findings

According to the data that have been collected all the people who were surveyed are aware of share market and trading.

Survey shows that the nearly 79% people prefer the online trading rather than that of offline trading through broker.

People like to invest more in equity rather than other investment sectors.

The best preferred broking firm among the people is ICICI direct with 22% rather than other broking firms.

Friends, News paper and Internet are the most preferred mode for awareness of the broking firms and share trading

Annexure

QUESTIONAIRE

1. Are you interested in share trading?a) Yes b) No

2. Which mode of trading would you prefer?a) Online b) Offline

3. Which type of product do you invest in?a) Mutual fund b) Equity c) Commodity d) Insurance e) Others

4. If you trade in future, which broking firm would you prefer?

a) Share khan b) India Bulls c) Angel broking d) ICICI Direct e) Microsec f) Others

5. How did you come to know about the broking firm?a) Newspaper b) Journals c)TV Advertisement d) Friends e)Internet f) Others

6. How important do you think these factors influence in choosing a broking firm?

(Select one)

a) Low brokerageNot very important 1 2 3 4 5 Extremely important

b) Better customer service Not very important 1 2 3 4 5 Extremely important

c) Brand loyaltyNot very important 1 2 3 4 5 Extremely important

d) Margin moneyNot very important 1 2 3 4 5 Extremely important

e) Good trading tipsNot very important 1 2 3 4 5 Extremely important

f) Timely research reportNot very important 1 2 3 4 5 Extremely important

g) Friends recommendations

Not very important 1 2 3 4 5 Extremely important

NAME: AGE:

GENDER: MALE/FEMALE

CONTACT NO:

Bibliography

Internet Referrals:

www.sharekhan.com

www.icicidirect.com

www.nseindia.com

www.google.com

www.indiabulls.com

www.angelbroking.com

Total Sample(82)online(64)offline(18)6418

Column1Mutual FundEquityCommodityInsuranceOthers242681110

Series 1NewspaperJournalsTV Adv.FriendsInternetOthers26721302815

Column1Share KhanIndia BullsAngel BrokingICICI DirectMicrosecOthers1221822911

1

22

Factors while choosing a Broking firm

FACTORS12345

Low brokerage

2.44%14.63%

31.7%39.02%12.2%Bettercust. service01.21%23.17%37.8%20.73%Brand loyalty3.65%7.31%19.51%40.24%29.26%Margin Money2.44%4.87%31.7%43.9%17.07%Good trading Tips1.21%6.1%35.36%30.48%26.82% Timely Research

report

0%13.41%45.12%29.26%12.2%Friends refer1.21%17.07%45.12%26.82%9.75%

Factors while choosing a Broking firm

FACTORS12345Low brokerage 2.44% 14.63% 31.7% 39.02% 12.2%Better cust. service 0 1.21% 23.17% 37.8% 20.73%Brand loyalty 3.65% 7.31% 19.51% 40.24% 29.26%Margin Money 2.44% 4.87% 31.7% 43.9% 17.07%Good trading Tips 1.21% 6.1% 35.36% 30.48% 26.82% Timely Research report 0% 13.41% 45.12% 29.26% 12.2%Friends refer 1.21% 17.07% 45.12% 26.82% 9.75%