BattenBriefing_Jun2011

Click here to load reader

-

Upload

batteninstitute -

Category

Documents

-

view

216 -

download

2

description

Transcript of BattenBriefing_Jun2011

Collapse or Comeback? THE VENTURE CAPITAL DEBATEFINANCING INNOVATION SERIES

Is it déjà vu all over again for venture capital? IPOs remain rare, returns are down, and the business of financing high-growth entrepreneurship seems uncertain, at best. What looks like a market correction to one observer is the demise of the entire VC industry to another. Even though VCs have faced tough times before, today things are looking particularly bleak. A poll of venture capitalists reported that nearly 53% believe their industry is, in fact, “broken.”2 This Batten Briefing, part of a series on the state of ven-ture financing, will examine the current—and ongoing—debate about the vitality and sustainability of the U.S. venture capital industry. Is the system broken, or is it poised for rebirth?

c o n t r i b u t o r s

Sean D. CarrDirector, Intellectual Capital, Batten Institute

Malgorzata GlinskaSenior Researcher, Batten Institute

Amy Halliday Managing Editor, Batten Institute

A RESEARCH BRIEFING FROM THE UNIVERSITY OF VIRGINIA’S DARDEN SCHOOL OF BUSINESS

“With the stock market still turning a cold shoulder, spectacular killings from taking young high-tech companies public are scarce. It’s also getting harder to find promising new companies to bankroll. The game may never again be the bonanza it was.”

Fortune, July 10, 1985

1 Hector, G. and M.A. Elliott. 1985. A Tough Slog for Venture Capitalists. Fortune. 111 (12): 110-116.

2 Polachi, Inc. 2009. Polachi Survey Reveals More than Half of Venture Capital Execs Consider the Industry to Be “Bro-ken.” News Release.

IN BRIEF

1

health care

education

BUSINESSI N N O VAT I O N

ENTREPRENEURSHIPRESEARCH & DEVELOPMENT

EMERGING MARKETS

sustainability

design

s u s t a i n a b i l i t y

creativityv e n t u r ec a p i t a l

economic develoment

technologyGROWTH

e f f e c t u a t i o n

ENTREPRENEURIAL ECOSYSTEMS

B AT T E N B R I E F I N GBATTEN INSTITUTE ADVANCING KNOWLEDGE ABOUT ENTREPRENEURSHIP AND INNOVATION // JUNE 2011

2 BATTEN BRIEFING FINANCING INNOVATION SERIES

“For 20 years, I’ve been hearing that the venture capital model is broken,” said Mark Heesen, president of the National Venture Capital Association. “Is it evolv-ing? Absolutely. But is it broken? No.” John W. Glynn, a founder of Glynn Capital Management in Menlo Park, California, is also skeptical of a doomsday scenario for the industry. “It’s a cyclical business, and we haven’t had a down cycle in many years,” Glynn said. “Now we’re clearly in one.”

Even so, U.S. venture capital faces some harsh realities. With the industry’s reputa-tion tarnished by negative average returns, VC funds raised just $12.3 billion in 2010, a mere 12% of the amount raised in 2000.3 Heesen predicts that only 400 VC firms will be able to raise capital again in the foreseeable future. “The economic turmoil is causing a fair amount of Darwinian change,” he said.

Venture firms are closing, and VC professionals are leaving the business. The number of VC firms has declined from a peak of 1,006 in 2006 to 791 in 2010. Even more significantly, the pool of active VC firms—those that invested at least $5milion in deals—has shrunk to 462 in 2010, the lowest total in ten years.4 “There will be a ton of venture capitalists who disappear over the next 18 to 20 months, and it’s going to be painful for a while,” said Bryan Roberts, a partner at Venrock, a VC firm estab-lished in 1969 by the Rockefeller family.5

3 Thomson Reuters. National Venture Capital Association. Yearbook 2011.

4 Ibid.

5 Miller, C.C. 2009. Venture Capitalists Look for a Return to the ABCs. The New York Times.

Days of reckoning TOUGH TIME FOR VENTURE CAPITAL

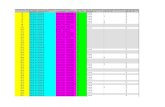

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

6

427

M&A

VENTURE-BACKED IPOs AND M&AsVC FIRMS ACTIVELY INVESTINGVENTURE CAPITAL FUND COMMITMENTS

IPO

7212

272349379

378350

349285

86

41

5757

22 2994

318

355

321

263

1,022

479531 508 538 580 549

462

734

519423

number of firms $ in billions

Venture capital over the past 10 yearsCOMMITMENTS, ACTIVE FIRMS, AND EXITS

$104.8$11.5

$18.7$31.9

$26.4$12.3

$16.3$30.8

$31.2$16.1

$39

FOR 20 YEARS, I’VE BEEN HEARING THAT THE VENTURE CAPITAL MODEL IS BROKEN. IS IT EVOLVING? ABSOLUTELY. BUT IS IT BROKEN? NO.”

Mark Heesen, National Venture Capital Association

3

Initial public offerings have always been the holy grail of venture capital—the most profitable way for VCs to cash out of their portfolio companies. After reaching a high of 281 in 1996, the number of venture-backed IPOs plummeted to only six in 2008. The following year was not much better, with only 12 venture-backed compa-nies exiting through an IPO. In 2010, that number started to improve, but non-U.S. companies funded by U.S. VC firms going public on U.S. exchanges largely drove that volume.6

VCs have little choice now but to adapt to these new exit-market conditions. In a 2010 survey of venture capitalists, 72% of respondents indicated that they no longer view an IPO as an optimal exit strategy.7 “We start with the assumption that all our portfolio investments will be acquired,” said Arthur Marks, founder of Virginia-based Valhalla Partners.8 He believes that taking a company public in today’s environment is not only expensive but also time-consuming and distracting. Instead, Valhalla works with its portfolio companies to identify potential buyers from the start.

Alan Patricof, a venture capital pioneer, suggests that most venture-funded com-panies will find an exit through merger or acquisition.9 Indeed, 2010 was a record-breaking year for M&A exits: 427 acquisitions of VC-backed companies were completed—the most since Thomson Reuters began tracking VC in the 1970s.10

M&A is the new IPO EXIT-MARKET REALITIES

3

6 Thomson Reuters. National Venture Capital Association. 2011. Venture-Backed Acquisitions Break All-Time An-nual Record. News Release.

7 DLA Piper Technology Leaders Forecast Survey. 2010. www.dlapiper.com/tech_leaders_forecast_survey_release/ (accessed 15 April 2011).

8 Gupta, U. 2009. Back to the Future. Institutional Inves-tor. 35 (1): 51-81.

9 Patricof, A. 2009. Another View: VC Investing not Dead, Just Different. http://dealbook.nytimes.com/2009/02/09/another-view-vc-investing-not-dead-just-different/ (accessed 15 April 2011).

10 Thomson Reuters. National Venture Capital Associa-tion. Yearbook 2011.

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

6

427

M&A

VENTURE-BACKED IPOs AND M&AsVC FIRMS ACTIVELY INVESTINGVENTURE CAPITAL FUND COMMITMENTS

IPO

7212

272349379

378350

349285

86

41

5757

22 2994

318

355

321

263

1,022

479531 508 538 580 549

462

734

519423

number of firms $ in billions

Venture capital over the past 10 yearsCOMMITMENTS, ACTIVE FIRMS, AND EXITS

$104.8$11.5

$18.7$31.9

$26.4$12.3

$16.3$30.8

$31.2$16.1

$39

4 BATTEN BRIEFING FINANCING INNOVATION SERIES

Funding young, innovative companies is a risky business. It is very hard to distin-guish eventual winners from losers, and most start-ups will fail. As a result, out of ten investments, VCs expect eight or nine to struggle. One may thrive or even be a home run, which can help cover the failures in a VC’s portfolio.

This portfolio approach has been the paradigm for most of modern VC history, but many say this is no longer a viable strategy. New York-based serial entrepreneur Andrew Reis believes that instead of working hard to help young companies suc-ceed, many VCs simply throw money at them. “VCs put $100 million, $200 million to work in a portfolio, and they’re expecting one investment out of ten to succeed. Frankly, a 10% success rate doesn’t work for me,” Reis said.

But even this rate has been hard to pull off over the past decade. Without a robust IPO market, home runs are rare. Traditionally, IPOs have made VCs their biggest fortunes—selling a company doesn’t carry the same multiples as taking it public.

Some have blamed VC’s problems on the IPO market. Susan Chaplinsky, an expert on entrepreneurial finance at the Darden School of Business, remains skeptical. “It’s maybe not so much that the exit market is broken as that VCs’ selection of compa-nies has been poor,” she said. Paul Kedrosky of the Kauffman Foundation agrees. “If you have a quality deal, you can take anything public,” he said.

As M&A exits have increased and overall returns have decreased, venture capitalists’ apparent appetite for risk has diminished, too. Following the burst of the high-tech bubble, VCs have been moving away from funding early-stage, high-risk companies in favor of later-stage, less risky investments. “Seventy-six percent of investments from VCs over the last several years have gone to late-stage or mezzanine investing, which is diametrically opposed to what it was like ten years ago,” said John May, an angel investor and founder of New Vantage Group.

Mark Heesen disagrees with those who claim that today’s VCs are eschewing early-stage investments. Because of the abysmal exit market, he contends that VCs hold on to their portfolio companies much longer than they had anticipated and so must use their assets to feed and nurture them with additional rounds of financing. “Those rounds, by their very nature, are late-stage rounds,” Heesen said.

As more VCs start to resemble private equity investors, many fear that funding for innovation will suffer and there will be fewer wildly successful companies, such as Google, to help drive the U.S. economy. However, there’s emerging evidence that the vacuum left by large, traditional venture capital firms is creating new opportunities for other classes of investors, such as angels and micro-VCs.

Swinging for the fences NO IPOs, NO HOME RUNS

Playing it safe RISK-AVERSE RISK CAPITAL

THERE’S THE NEED, THE VOID IN THE MARKETPLACE FOR EARLY-STAGE FUNDING, AND SYNDICATES OF ANGELS ARE TAKING THE PLACE OF THE HISTORIC EARLY-STAGE VENTURE FUNDS.”

John May, New Vantage Group

RETURNS TO VENTURE-BACKED IPO AND M&A EXITS

1985-1997PRE-DOTCOM

M&AS IPOS

DOTCOM

POST-DOTCOM

1998-2000

2001-2008

86.3% 135.5%

170.5%

315.2%242.5%

22.4%

5

During the 1990s, VCs flocked to popular sectors such as information technol-ogy, telecommunications, and the Internet. At the time, those sectors were rapidly transforming retail and media, offering the potential for high profit growth. “VCs saw IPOs, and they followed the money, funding start-ups in those sectors,” said Darden’s Susan Chaplinsky.

John Glynn, a VC veteran, said that too much money flowing into deals in the same industry created ruinous competition. “No one company could ever get scale or posi-tion to be a real leader in an industry,” Glynn explained.

Now that information technology and telecommunications are no longer growing at such heady rates, many VCs are stuck with investments they cannot exit. Without any appetite in the public market for IPOs, many VCs consider themselves lucky to find buyers for their portfolio companies. “At the time they thought they’d be blockbuster IPOs, but they ended up having a negative M&A as they sold a piece of IT technology to Google for a lot less than what they’d invested,” said Chaplinsky.

As venture capital grew in scale during the 1990s and 2000s, VC firms expanded their workforces, hiring young MBAs with little or no operational experience.

Francine Sommer, a general partner at Massachusetts-based VC firm Village Ven-tures, has observed dramatic changes in the industry she entered in 1978. “You’ve got [VCs] who are making commitments, who can’t add any value, who are doing it at much too high a price,” Sommer said. “There are too many people who don’t know what they’re doing. And it’s an apprenticeship business.”

Andrew Reis has worked with some top-tier VCs whose expertise helped him tremendously. “These guys have had success after success. They work with the same entrepreneurs over and over again,” Reis said. However, such VCs are the exception rather than the rule, he noted, adding that many VCs today are not equipped to help a start-up succeed.

VC veteran John Glynn believes most MBAs are not ready to work as VCs right after business school. He advises his students at Stanford to gain management expe-rience in a well-run company before considering becoming a VC. “I tell them, ‘You need to be able to work with companies effectively,’” said Glynn. “‘That’s what makes a good VC—your ability to consistently add value to the portfolio companies.’”

Rise of the rookies TOO MANY FIRMS, TOO FEW PROS

Herding behavior TREND FOLLOWERS, NOT TREND SETTERS

I WAS SKEPTICAL OF VCs IN GENERAL FOR TRYING TO FOB OFF TO ME STUFF THAT NEVER SHOULD HAVE BEEN FUNDED. I DIDN’T WANT TO BELIEVE THEY ROUTINELY INVESTED WITH A HERD MENTALITY.”

Robert Faulkner, Redmile Group, LLC

THE VENTURE MODEL IS BROKEN BECAUSE YOU HAVE VCs WHO ARE STRICTLY FINANCIAL AND DATABASE DRIVEN, WITH NO GUT OR INTUITIVE EXPE-RIENCE ON HOW TO GROW A COMPANY.”

Andrew Reis, serial entrepreneur

6 BATTEN BRIEFING FINANCING INNOVATION SERIES

a c k n o w l e d g e m e n t s

The Batten Institute thanks Chuck Newhall, cofound-

er of New Enterprise Associates, for the inspiration

and encouragement to develop this special series of

Batten Briefings about the venture capital industry.

Without his persistence and willingness to provide

access to people and other critical resources, this

project would not have been possible.

We are also indebted to many other industry experts

who generously contributed their time and insight,

including: Susan Chaplinsky, Darden School of

Business; Robert C. Faulkner, Redmile Group LLC;

John W. Glynn, Glynn Capital Management; John

May, New Vantage Group; Andrew Reis, cofounder

and COO of Tremor Media; and Francine Sommer,

Village Ventures. Of course, any opinions otherwise

unattributed belong to the authors, as do errors of

any magnitude.

11 Waters, R. and J. Menn. 2009. Venture Capital Hit by Excesses. http://www.ft.com/cms/s/0/2e6d0aae-2d44-11de-8710-00144feabdc0.html#axzz1JcUu72pc (accessed 15 April 2011).

12 Data from Prof. William A. Sahlman’s chart shown during AlwaysOn’s Venture Capital East conference. June 2010.

Healthy contraction FLUSHING OUT MEDIOCRITY

The U.S. venture capital industry has reached an inflection point. “In 2002 [follow-ing the collapse of the dotcom bubble], a lot of people thought we were going to see a restructuring of the venture industry, and it didn’t happen,” said Paul Holland, a partner at Foundation Capital, a Silicon Valley venture firm. This time, he said, VC “is going through its biggest change in 30 years.”11

Those who believe in the U.S. VC model expect the current financial crisis to have a much-needed cleansing effect on the industry. They even agree with the critics who point out that many VC firms expanded too quickly and haphazardly, bringing in too many rookies. “In 2000, there was a period of great excess, great greed, and not a lot of long-term thinking,” said Chuck Newhall, cofounder of New Enterprise As-sociates. “Some contraction is very healthy.” As NVCA’s Mark Heesen said, “What we’re going through now is the hard lesson that venture capital doesn’t scale.”

The expectation of 20% (or better) returns on VC investments was created during a period of irrational exuberance. The Internet boom of the late 1990s fed an illusion that extraordinary returns in VC were not only possible but also effortless—achieved through a quick turnaround from an idea to liquidity through an IPO. Times have changed. After median investment returns peaked at 45% in 1996, they have since suffered a precipitous decline. By 2008, median investment returns were negative 10%.12

If nothing else, the market for VC investments has become significantly more ratio-nal, and this rationality is forcing a necessary shakeout in the industry. In the years ahead, it is likely that the largest and best-known venture firms, or those that are the most adaptable and nimble, will be the ones to survive and thrive. The emerging brave new world for venture capital will be the subject of the next installment in this Batten Briefing series on venture financing.

7

IN FOCUS // Darden Research

In a recent study, Darden professor Susan Chaplinsky and Swasti Gupta-Mukherjee, an assistant professor at Loyola University, have provided the first detailed account of VC returns from 1985 to 2008, supporting and expanding the current understanding of the industry’s worrisome trajectory. They have also developed a measure that sheds light on VCs’ investment decisions and their increased risk aversion in the face of diminishing returns.

In the study, Chaplinsky and Gupta-Mukherjee estimated re-turns for 1,222 M&A exits and 1,436 IPO exits over the 23-year period, which they divided into three eras: pre-dotcom (1985 through 1997), dotcom (1998 through 2000), and post-dotcom (2001 through 2008). Tracking returns by type of exit—IPO, M&A, or write-off—yielded a particularly valuable view.

As expected, across the study period IPOs generated extremely high “home run”-type returns more frequently than M&A exits, which have long been considered the exit of last resort for VCs. Consistent with the reports of deteriorating returns to VC investments, the period is marked by an increase in M&A, from 25.4% of total exits in the pre-dotcom era to 41% during the dotcom era and 63.4% in the post-dotcom period, during which 68% of those exits resulted in negative returns. Indeed, the researchers found a relatively high incidence of M&A and IPO investments with nearly 100% loss of capital, a stark reminder of the risks VCs face, not just in challenging economic times. They write, “That VCs lose almost all of the capital invested in a significant number of exits cautions against the frequent practice of equating an exit with ‘success.’”

The frequency of large losses also underscores the importance of home-run returns. As part of their study, Chaplinsky and Gupta-Mukherjee developed the exit-to-failure (EXF) ra-tio, which captures how many failures are covered by exits on average. The two researchers have computed EXF ratios across

various industries, month by month, and have found that the ratio provides important signals about how VCs use recent exit returns in an industry to guide their investment decisions. When EXF levels in an industry are high, the upside offered by returns is large relative to the downside of failed investments. “Higher levels of EXF imply greater failure coverage and a lower penalty for mistakes, and therefore potentially higher VC risk appetite,” the researchers write. The reverse is also true: Low EXF levels in an industry indicate an environment in which VCs are unlikely to find lucrative exit possibilities and so will have little cushion to protect them from failed investments. Without that cushion, risk aversion naturally increases.

The picture that emerges from the study is of a vicious cycle: VCs adapt to lower returns by moving away from early-stage ventures—the kind that represent substantial risk but also could be capable of generating outsize returns. Instead, they invest in more-developed businesses, from which they are likely to exit with an M&A. And so they decrease their odds of achieving home-run IPO exits—and turning around the declining perfor-mance of the VC industry. Escaping this downward spiral will take time, given the ten-year commitment of most VC invest-ments.

The shift to M&A exits, the deterioration of returns, and the decreased appetite for risk raise questions about the nature of the U.S. VC industry, which built its reputation by supporting high-risk, high-growth ventures. A willingness to take risks, Chap-linsky argues, has long been a defining characteristic of the U.S. economy and business environment. “Without healthy returns, it’s hard to sustain a VC industry that’s willing to take chances on promising ideas,” Chaplinsky says. “VCs have little coverage for failures, which leads them to feel they have no margin for error. Right now, the economics of the industry make it hard to swing for the fences.”

HOW VENTURE CAPITALISTS ADAPT TO FALLING RETURNS By Amy Halliday

As poor returns force many established venture capital firms to close shop, a promis-ing new breed of fund managers is reinvigorating the industry by taking it back to its roots. Members of this informal group—which some call VC 2.0—contend that the way to generate competitive returns in today’s economic environment is to think small—both in terms of fund size and individual investments. Remarkably, they suc-ceed at attracting investors even in today’s challenging fundraising environment. The next issue of this Batten Briefing series on venture financing will examine this new ecosystem of capital-efficient “retro” funds, which recall venture capital’s pioneers as they undertake traditional seed investing and take a hands-on role to help their portfolio companies get off the ground.

c o p y r i g h t i n f o r m a t i o n

BATTEN BRIEFINGS, June 2011, Volume 1,

Number 2, published by the Batten Institute at the

Darden School of Business, 100 Darden Boulevard,

Charlottesville, VA 22903.

email: [email protected]

www.batteninstitute.org

POSTMASTER: Send address changes to Batten Brief-

ings, P.O. Box 6550, Charlottesville, VA 22906-6550.

©2011 The Darden School Foundation. All rights

reserved.

Non-Profit OrganizationU.S. Postage

PAIDCharlottesville, Virginia

Permit NO. 232

P.O. Box 6550, Charlottesville, Virginia 22906

Next in the series

BATTEN BRIEFINGJ U N E 2 0 1 1 / / V O L U M E 1 , N U M B E R 2