ATM

-

Upload

bulomine-regi -

Category

Technology

-

view

124 -

download

0

Transcript of ATM

1

Automatic Teller Machines

2

Automatic Teller Machines “…one of the most influential

technological innovations of the 20th century”

Began in 1968, more than 500,000 today One of the first commercial use of crypto

(block ciphers), tamper resistant hardware, security protocols, etc.

The “killer app” for commercial crypto

3

ATMs An interesting case study

o What was done correctlyo What was done incorrectly

4

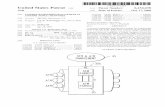

ATM Security Module Security module implemented in

tamper-resistant hardwareo IBM 4758 crypto processoro Security module is at banko All crypto computations done in

security module, such as PIN verification

5

ATM Security Module IBM PIN generation

o Acct number N on magnetic stripeo PIN key K (in tamper-resistant hardware)o “Natural PIN” is F(E(N, K)), where encryption

E is DES, and F is a functiono PIN = natural PIN + offset (so customers

can choose their own PIN) Note: PIN verification relies on N and

secret K, and is done in security module

6

IBM PIN Gen Example Account number: PIN key K: DES encrypt

E(N,K): Decimalize: Natural PIN: Offset: Customer PIN:

8807012345691715FEFEFEFEFEFEFEFEA2CE126C69AEC82D0224126269042823022465656789

7

More ATM Security PIN encrypted with “terminal

master key” and sent to security module

‘Dual controls” --- terminal master key entered in 2 parts (2 people)

PIN “translation” (from one ATM network to another) done in security module

8

Problems Early on, encryption done in software Not feasible for all pairs of banks to

share keys, so KDC used (VISA) Large number of trans, so corners cut

o “Optimization is the process of taking something that works and replacing it with something that doesn’t quite, but is cheaper”

Most ATMs use 56-bit DES

9

What goes wrong ATM system designed to stop

sophisticated attacks In practice, the real issues are

o Processing errors --- e.g., computer crasheso Only 0.001% probability, but 5 billion ATM

trans Card theft from mail Fraud by bank staff

o Laptop inside ATM to record PIN’so Key for test system used for real system

10

Unexpected Attacks Shoulder surfing to get PIN, copy acct

number from receipt One system --- telephone calling card,

ATM thought previous card inserted One system --- output 10 bills when 14-

digit test sequence entered One bank issued same PIN to everybody Fake ATM to collect PINs Steal the ATM (camera is inside ATM)

11

ATMs Biggest mistake in design of ATM

system: “… worried to much about criminals being clever instead of worrying about customers and banks being stupid”

12

ATM legal issues In US, banks carry risk of ATM

technologyo must refund most disputed transactiono costs average bank $15K/year in fraud

In much of Europe, customer bore costo Banks claimed ATMs infallibleo John Munden case

British policeman, found his acct $700 short Bank: no bugs in code since written in assembler Munden convicted and fired Overturned on appeal: bank would not release its

code

13

ATM legal issues If Munden case had occurred in

California, “he would have won enormous punitive damages”

Lessonso Non-repudiation is critical --- camera in ATM

would have solved Munden case immediately

o In general, security system must be able to withstand examination by hostile experts