Africa is Playing Against a Stacked Deck

Transcript of Africa is Playing Against a Stacked Deck

-

7/28/2019 Africa is Playing Against a Stacked Deck

1/26

Africa Is Playing Against A Stacked Deck

Dr. Gary K. Busch

There is a lot of discussion in the worlds press about a new, positive, view of

African development. African nations recent high growth rates coupled with an

increased foreign investment in Africa and the development of national stock

exchanges and African international banks have given rise to the popular idea

that the continent may well be on track to becoming a global powerhouse.

Observers have cited Africa's recent high GDP growth rates, rising per capita

incomes, and the almost universal acquisition of mobile phones and mobile

phone banking as evidence that Africa is "developing." There have been massive

new discoveries of oil and natural gas in Eastern and Western Africa as well asmajor mineral finds of iron ore, coal and uranium. There is now an expanding

African jet set of billionaires spending their wealth around the world.

Indeed, there has been growth. The economies of Sub-Saharan Africa have grown

about 4.8 per cent overall in 2012, despite the higher initial estimate of the World

Bank of 5.2%. According to the World Bans African Pulse reporti high

commodity prices and mineral discoveries are underpinning African growth.

Foreign direct investment into Africa is projected to reach $48.7 billion by 2014

from $31 billion in 2012.

The majority of sub-Saharan Africa's 48 countries could possibly achieve middle

income status by 2025 though their dependency on natural resources is likely to

continue in the medium term.

Countries such as Mozambique, home to some of the world's biggest untapped

natural gas and coal reserves, and iron-ore exporting Sierra Leone are expected

to perform strongly. After ten years of economic advancement, 22 of Africa's 48

countries have already achieved middle-income status, the World Bank said,while another 10 could reach middle-income status by 2025 if current growth

trends continue.ii

However, this growth masks a decline in the African manufacturing sector. There

is a notable and disturbing deficiency in the growth of manufacturing industries

in Sub-Saharan Africa (SSA). Free market economic gurus have concentrated on

advising poor countries to stick to their current primary agriculture and

extractives industries and "integrate" into the global economy as providers of

mineral exports. Today, for many champions of free markets, the mere presence

-

7/28/2019 Africa is Playing Against a Stacked Deck

2/26

of GDP growth and an increase in trade volumes are euphemisms for successful

economic development.

But increased growth and trade are not development. For example, even if an

African country like Malawi achieves higher GDP growth rates and increased

trade volumes, this doesn't mean that manufacturing and services as a per cent

of GDP have increased over time. Malawi may have earned higher export

earnings for tea, tobacco, and coffee on world markets and increased exports,

but it is still largely a primary agricultural economy with little movement towards

the increased manufacturing or labour-intensive job creation that are needed for

Africa to "rise". iii

According to the latest UNCTAD figures Africa remains a continent where most of

the people are still occupied in agricultural labour and their countries are

principally committed to commodity exports.

SSAAgricultural

LabourCommodity

ExportsCountry % Labour Force % Total Exports

Angola 69.0% 100.0%Benin 42.0% 91.0%Burkina Faso 92.0% 94.0%Burundi 89.0% 91.0%

Cameroon 49.0% 89.0%Central AfricanRepublic 63.0% 90.0%Chad 66.0% 96.0%Congo (B) 32.0% 99.0%DRC 57.0% 96.0%Equatorial Guinea 64.0% 98.0%Eritrea 74.0% 46.0%Ethiopia 77.0% 90.0%Gabon 26.0% 96.0%Gambia 76.0% 82.0%Ghana 55.0% 90.0%Guinea 80.0% 85.0%Guinea-Bissau 79.0% 99.0%Ivory Coast 35.0% 85.0%Kenya 71.0% 65.0%Liberia 62.0% 62.0%Malawi 79.0% 90.0%Mali 75.0% 88.0%Mauritania 50.0% 100.0%Mozambique 81.0% 93.0%Namibia 34.0% 73.0%Niger 63.0% 68.0%

Nigeria 25.0% 97.0%Rwanda 89.0% 88.0%

-

7/28/2019 Africa is Playing Against a Stacked Deck

3/26

Senegal 70.0% 66.0%Sierra Leone 60.0% 69.0%South Africa 6.0% 60.0%Sudan 52.0% 99.0%

Tanzania 76.0% 83.0%Togo 53.0% 61.0%Uganda 75.0% 70.0%Zambia 63.0% 89.0%Zimbabwe 56.0% 75.0%iv

There are, of course, several indicators that offer a more precise picture of how

well Africa is developing. One can look at whether manufacturing has been

increasing as a percentage of GDP, or whether the manufacturing value added

(MVA) of exports has been rising. In these cases a comparison between Africa

and East Asia is quite revealing. A recent UN report paints a far less flatteringpicture of Africa's development prospects.

It finds that, despite some improvements in a few countries, the bulk of African

countries are either stagnating or moving backwards when it comes to

industrialization. The share of MVA in Africa's GDP fell from 12.8 per cent in 2000

to 10.5 per cent in 2008, while in developing Asia it rose from 22 per cent to 35

per cent over the same period. There has also been a decline in the importance

of manufacturing in Africa's exports, with the share of manufactures in Africa's

total exports having fallen from 43 per cent in 2000 to 39 per cent in 2008. In

terms of manufacturing growth, while most have stagnated, 23 African countries

had negative MVA per capita growth during the period 1990 - 2010, and only five

countries achieved an MVA per capita growth above 4 per cent.

The report also finds that Africa remains marginal in global manufacturing trade.

Its share of global MVA has actually fallen over recent years. Africa is also losing

ground in labour-intensive manufacturing. Its share of low-technology

manufacturing activities in MVA fell from 23 per cent in 2000 to 20 per cent in2008, and the share of low-technology manufacturing exports in Africa's total

manufacturing exports dropped from 25 per cent in 2000 to 18 per cent in 2008.

Finally, Africa remains heavily dependent on natural resources-based

manufacturing, which is an indication of both its low level of economic

diversification and low level of technological sophistication in production. v

What this means, in short, is that while African economies with extensive mineral

wealth benefit from the expansion of extractive investments in their economy

and the rents they earn from the exploitation of this wealth through exports, the

-

7/28/2019 Africa is Playing Against a Stacked Deck

4/26

value-added of beneficiation of ores or the refining and processing of its

petroleum and gas assets devolve to the industries of those to whom these goods

are exported. The notion that some form of growing national wealth is reflected

in the rising GDP figures or as evidence that development is taking place is a

cruel misuse of statistics when this GDP is converted to GDP per capita. In most

of these African states the large majority of the capita never get near the wealth

these increasing cash flows bring but survive as marginal or subsistence

agriculturalists or artisanal miners earning less than $1.50 per day.

Agriculture

One of the most unfortunate areas in African development derives from the

import and export of agricultural products. One might have thought that with somuch African human capital invested in agriculture that it might be a sector

which is thriving. This is far from the case for a variety of fundamental reasons.

Africa imports close to USD 50 billion worth of food annually; equivalent to what

the continent receives as Official Development Assistance (see ILO statistics

January 29, 2013). The continents food imports take place against the backdrop

of untapped arable land and growing unemployed populations. In Sub Saharan

Africa, an estimated 60 per cent of the continents workforce is involved in

agriculture mostly as unpaid family work. Around 30 per cent of Africas 18 29

year olds are out of work and condemned to a bleak future as there is little scope

for profitable agricultural employment and manufacturing opportunities are

limited as to scope and skill requirements.

Food Trade Impediments:

There are a range of hidden impediments to the ability of Africa to attain food

sufficiency and success in exporting, even in countries like Zimbabwe and Kenya

which have been traditional food exporters. Some of these impediments highlight

Africas weaknesses, even among those products where African exports are

valued and sought. One of the problems which have oppressed African producers

is the Africans inability to choose the best market for the sale of its goods. Our

company used to ship flowers from Zimbabwe to Amsterdam, where they were

bought by the Dutch flower mafia and put in their daily auctions for sales to the

rest of the world. In those days the African farmers were receiving under $6 a

box for roses. The next day those roses would be in Russia (a big buyer of

flowers) for more than $25 a box. The Russians asked us to supply directly to

-

7/28/2019 Africa is Playing Against a Stacked Deck

5/26

Russia and said they would pay the African grower $20 a box (e.g. more than

trebling the price received by the African grower). When we asked the African

growers to supply us they said that they couldnt. They were contracted growers

to the Dutch flower mafia who provided the seeds and the root stock which

carried the obligation that any flowers from these would have to be sold to the

Dutch at an agreed pre-established price. They offered to grow some non-Dutch

flowers for us but it would take a year or so. In the meantime, the value-added of

these flowers went to the Dutch auctioneers.

Things were not too different in the fresh vegetable business. We shipped green

beans, baby corn, etc. from Southern Africa to Europe for the supermarkets

there. About 26% or more of the vegetables designated to be shipped to Europe

were rejected as unacceptable. We could not load them on our planes. There wasnothing wrong with the green beans; some looked different because they were

more curved than the European standard allowed. The buyers rejected them and

they were fed to the animals or ploughed back into the ground. We offered to buy

these rejected vegetables ourselves at the same price as that being sold to

Europe. We wanted to deliver these fresh vegetables to the DRC, Liberia and

Sierra Leone where fresh produce was unavailable because of the wars. We were

told that we could not buy them because they were unacceptable to the

European standards and that the European agribusinesses did not want to havethese substandard goods on the market which would threaten their quality

guarantees. However, they said they would graciously sell us the acceptable ones

at European prices once they had reached Europe. Since these vegetables, too,

were often grown on a contracted basis by the Europeans, the Africans had no

choice but to feed them to their animals or dump them if they were rejected.

There are several tons of perfectly healthy, nutritious and hygienic foods being

thrown away every day in Africa because of the artificial cosmetic standards of

European agribusiness. The African farmer gets nothing for this discarded food.

He cannot even eat them himself.

This system functions in a similar manner in the meat and livestock, poultry and

fish businesses as well as in the horticultural and agricultural products. This is a

burden which every African exporter faces. It is a vicious cycle. African

entrepreneurs cannot get the credit lines which would allow them to buy their

own root stock, seeds, fertilisers, pesticide, etc. They are already in debt trying to

buy energy and water. Therefore, if they are to live they must contract with

-

7/28/2019 Africa is Playing Against a Stacked Deck

6/26

Europeans or others to utilise African land, African labour and African water to

produce goods for the European market on the terms the Europeans dictate.

Structural Adjustment

It is not only agribusiness which impedes African agricultural growth and self-sufficiency. Many developing nations are in debt and poverty partly due to the

policies of international institutions such as the International Monetary Fund (IMF)

and the World Bank. In pursuit of an ideology known as neoliberalism, Structural

Adjustment Policies (SAPs) have been imposed to ensure debt repayment and

economic restructuring. But the way these have happened has required poor

countries to reduce spending on things like health, education and development,

while debt repayment and other economic policies have been made the priority.

In effect, the IMF and World Bank have demanded that poor nations contrive to

lower the standard of living of their people. It foreshadowed the austerity

program now afflicting Europe. This concentration on debt and debt reduction

has severely impeded Africa.

Debt is an efficient tool. It ensures access to other peoples raw materials and

infrastructure on the cheapest possible terms. Dozens of countries must compete

for shrinking export markets and can export only a limited range of products

because of Northern protectionism and their lack of cash to invest indiversification. Market saturation ensues, reducing exporters income to a bare

minimum while the North enjoys huge savings.vi

The important characteristics of these SAPs include cutbacks, liberalization of

the economy and resource extraction/export-oriented open markets as part of

their structural adjustment plan. Privatization is encouraged as well as reduced

protection of domestic industries; there are demands for higher interest rates;

flexibility of the labour market, and the elimination of subsidies such as food

subsidies.vii

While this sounds like a reasoned and thought-out program it was anything but. It

caused, and causes, havoc for African agriculture. A good case in point is the

cashew industry. Nearly 40 % of the worlds cashew harvest comes from Africa,

but African farmers rarely reap the benefits of this valued commodity. Although a

substantial portion of the worlds cashews come from Africa most of the cashew

processing takes place in South Eastern India. About 30% of the worlds cashews

are grown in Mozambique. Mozambique was once the worlds largest producer of

-

7/28/2019 Africa is Playing Against a Stacked Deck

7/26

cashew nuts. At its height, Mozambique supplied over 240,000 tonnes a year,

with a significant proportion being processed in the country prior to export.

The local company, Caju de Mozambique, employed around 6.500 people. It was

a major source of export revenue for the country. However, in 1986 Mozambique

was forced by its heavy international debt which had resulted from its years of

civil war to embark on a series of Bretton Woods imposed SAPs to reduce its

debts. One result of these SAPs was that the Mozambican government was

obliged to remove all price supports to the cashew growers and processors. The

Government was not able to control or protect the internal market price for

cashews paid by the local cashew processor. Caju de Mozambique found itself

competing with the major Indian processors for the supply of Mozambican

cashews. Because of this, by the late 1990s Mozambique was exporting to India98% of its raw cashews for processing in India. Caju de Mozambique had no

domestic raw cashews to process and the factory closed and the workforce

became unemployed. Mozambique lost the value-added of its cashew exports as

a result of the structural adjustment programs. We were contacted by the

Mozambicans to see if we could source raw cashews for them from Sierra Leone

which had a surplus of cashews for export. We had an air operators license in

Sierra Leone so we could fly the cashews to Mozambique efficiently. We

contacted the Sierra Leone Government to see if we could arrange the sale. Bythe time we had made the arrangements with the Sierra Leone officials we were

told we couldnt supply Mozambique because the Indian processors were offering

to pay more than the Mozambicans and as the Sierra Leoneans, too, had a SAP in

place they were unable to protect the price for export.

In recent years there has been a slow return of raw cashews to the Mozambican

processors However, the damage to African cashew producers has not ended. It

has been the basis for major unrest in Guinea-Bissau. Cashew nut farmers andtraders in Guinea Bissau have been left holding tonnes of produce after India

slashed imports, and the low prices being offered by Indian processors have

dramatically increased hardship in the West African country. India, the top

importer of raw cashews has now increased its own domestic production of raw

cashews. By July 2012, Guinea=-Bissaus exports reached only 60,000 tonnes of

cashew nuts compared to more than 100,000 tonnes by the same period in 2011.

The proposed benchmark price of 250 CFA per kilogramme was not respected

and prices fell as low as 100 CFA (around 20 US cents) per kilogramme. Some120,000 tonnes of cashew nuts are still stockpiled in Guinea-Bissau and awaiting

-

7/28/2019 Africa is Playing Against a Stacked Deck

8/26

buyers, lying in piles alongside the major roads across the country. The farmers

and the authorities have tried to find a solution to this problem but the low prices

being offered to the farmers for their stock mean that most cashew farmers will

not earn enough money to pay back their bank loans. The yearly April to June

cashew harvest accounts for 98% of the country's export revenue and employs,

according to the World Bank, nearly nine out of every 10 people, including

children.

Some of the world's tastiest cashews are rotting in roadside piles on rural byways

leading to and from the capital of the Guinea-Bissau, where a recent military

uprising has left farmers stranded with no way to ship their nuts to the Indian

factories that steam the cashew out of its poisonous shell. Not only are the prices

low, the farmers cant even deliver at this low price because transport is toohazardous. On April 13, 2012 soldiers kidnapped Prime Minister Carlos Gomes, Jr.

for the second time in two yearsweeks before he was set to be elected

president of Africa's fifth-biggest cashew grower. Generals opposed his plans to

slash military spending in a country that depends on aid for more than half its

budget. Now the country has no effective government and internal transport has

come to a halt. Ship owners are afraid to approach the berths as they havent

been dredged and there are no trucks to bring produce to and from the harbours.

This has meant windfall profits for the Indians as scarcity has increased andimpoverishment for the African producers of 98% of the national exports.

Between civil unrest and destructive structural adjustment plans the African

farmer faces unending and unresolvable problems.

The Common Agricultural Policy

A look at the European Unions Common Agricultural Policy (CAP) viiishows that it

has several trade distorting effects which have seriously damaged African

agriculture and African economies. In the beginning the CAP was made up ofproduction subsidies, intervention buying, and export subsidies. Through several

reforms with the aim of creating a more liberalised market, the production

subsidies have been changed to a direct subsidies scheme and intervention

prices have been lowered a bit. The production/direct subsidies and the

intervention buying both create higher prices in the internal EU market. This

means that too much is produced, and most overproduction is sold at world

market prices only through the aid of export subsidies. The EU has regularly been

accused of dumping its agricultural products into the African markets. In the

-

7/28/2019 Africa is Playing Against a Stacked Deck

9/26

opposite direction several agreements have been made to ensure African

producers tariff free access to the European market. However, very high food

safety and cosmetic standards have been set along with other non-tariff barriers,

which prevent many African producers from actually exporting to the EU.

The most fundamental change in the CAP since 1992 has been the gradual shift

from price support for EU agricultural products to income support for EU farmers.

The old system of price support required a highly protective tariff regime, to

prevent third-country agricultural products from flooding the high-priced EU

market. However, the high prices served to stimulate production in the more

efficient agricultural areas of the EU, while at the same time lowering demand for

EU-produced feed products for the livestock and industrial sectors. This created

large surpluses, which either had to be stored in the EU at considerable cost, orexported as food aid.

Under this system EU agricultural products would regularly be exported at highly

subsidised prices to African markets, often in ways which disrupted local

production or held back the development of local production. While this might

benefit traders and processors the production effects in what are largely agrarian

economies commonly outweighed these temporary consumer benefits. While

under the CAP reform process EU farmers have largely been insulated from the

income effects of price reductions, African exporters simply had to carry the

income loss. This has served to significantly erode the value of traditional African

trade preferences.ix

So, if one asks where the Grain Mountain and the Milk Lake of the CAP have

gone, the answer is to Africa. The milk was dumped as cheap foreign aid in West

Africa where it collapsed the production of milk in Mali, Chad and the Central

Africa Republic. The grain was delivered elsewhere, in the Horn of Africa and

Sudan, which made it cheaper to acquire than locally-produced grains. Thefarmers lost their domestic market and had no funds to pay back their bank

loans; lost their credit and were unable to plant the next seasons crop because

they had no cash. The culture of aid dependence was fostered and nurtured by

the CAP.

According to Oxfam, the 30bn-a-year EU agricultural subsidy regime is one of

the biggest iniquities facing farmers in Africa and other developing counties.

They cannot export their products because they compete with the lower prices

made possible by EU subsidies to European producers. In addition, European

-

7/28/2019 Africa is Playing Against a Stacked Deck

10/26

countries dump thousands of tons of subsidised exports in Africa every year so

that local producers cannot even compete on a level playing field in their own

land. Meanwhile, governments of developing countries come under intense

pressure from the World Bank and the International Monetary Fund to scrap their

own tariffs and subsidies as part of free trade rules.x

World trade talks aimed at reaching agreement on subsidy reform have stalled

because of the EU's intransigence over its CAP. The CAP costs British taxpayers

3.9bn a year and also adds 16 a week - 832 a year - to the average family of

four's food bill. Recently the 1.34bn-a-year EU sugar regime was ruled illegal by

the World Trade Organisation and European countries were found guilty of

dumping too much subsidised sugar in developing countries under-cutting local

farmers.

European farmers are guaranteed a price for their sugar three times higher than

the world price and there are restrictions on foreign imports - backed up by

import tariffs of 324 per cent. Export subsidies, meanwhile, allow surplus EU

sugar to be dumped at bargain prices in African countries.

Mozambique loses more than 70m a year - equivalent to its entire national

budget for agriculture and rural development - because of the trade distortions

and South Africa also loses 31m a year. While chicken producers in Europe do

not receive direct payments, the grain that feeds the birds is subsidised,

substantially reducing the cost of farming. Kenya, Nigeria and Senegal have been

hit by cheap, subsidised imports from Europe while the 30 paid to British

farmers for every tonne of wheat they produce inflates the price of breakfast

cereals, bread and other goods in Britain to British consumers. European

preference for chicken breasts and legs means that thighs and wings are often

frozen and exported to Africa where they are sold for rock-bottom prices. Chicken

farmers in Senegal and Ghana used to supply most of the country's demand -now their market share has shrunk to 11 per cent because subsidised imports are

50 per cent cheaper.xi

The Sale of African Land

One of the growing trends in African agriculture has been the sale of African land

to foreigners who invest in large-scale modern farms for export of foodstuffs and

biofuel-producing crops to their own countries. This has had a profound effect on

African farming and a devastating effect on the availability of scarce water

supplies.

-

7/28/2019 Africa is Playing Against a Stacked Deck

11/26

Leading the rush into African land are international agribusinesses, investment

banks, hedge funds, commodity traders, sovereign wealth funds as well as UK

pension funds, foundations and individuals attracted by some of the world's

cheapest land.

Together they are scouring Sudan, Kenya, Nigeria, Tanzania, Malawi, Ethiopia,

Congo, Zambia, Uganda, Madagascar, Zimbabwe, Mali, Sierra Leone, Ghana and

elsewhere for land. Ethiopia alone has approved 815 foreign-financed agricultural

projects since 2007. Any land there, which investors have not been able to buy, is

being leased for approximately $1 per year per hectare.

Saudi Arabia, along with other Middle Eastern emirate states such as Qatar,

Kuwait and Abu Dhabi, is thought to be the biggest buyer. In 2008 the Saudi

government, which was one of the Middle East's largest wheat-growers,

announced it was to reduce its domestic cereal production by 12% a year to

conserve its water. It earmarked US$ 5bn to provide loans at preferential rates to

Saudi companies which wanted to invest in countries with a strong agricultural

potential.

For example, the Saudi investment company Foras, backed by the Islamic

Development Bank and wealthy Saudi investors, plans to spend $1bn buying land

and growing 7m tonnes of rice for the Saudi market within seven years. Thecompany says it is investigating buying land in Mali, Senegal, Sudan and Uganda.

By turning to Africa to grow its staple crops, Saudi Arabia is not just acquiring

Africa's land but is securing itself the equivalent of hundreds of millions of gallons

of scarce water a year. Water, says the UN, will be the defining resource of the

next 100 years. Since 2008 Saudi investors have bought heavily in Sudan, Egypt,

Ethiopia and Kenya. Last year the first sacks of wheat grown in Ethiopia for the

Saudi market were presented by Mohammed al-Amoudi to King Abdullahxii from

the new Saudi Star plantation in Gambela.

Food cannot be grown without water. In Africa, one in three people endure water

scarcity and climate change will make things worse. Building on Africas highly

sophisticated indigenous water management systems could help resolve this

growing crisis, but these very systems are being destroyed by large-scale land

grabs amidst claims that Africa's water is abundant, under-utilised and ready to

be harnessed for export-oriented agriculture. The current scramble for land in

Africa reveals a global struggle for what is increasingly seen as a commodity

more precious than gold or oil - water.

http://www.guardian.co.uk/world/ugandahttp://www.guardian.co.uk/world/zimbabwehttp://www.guardian.co.uk/world/saudiarabiahttp://www.guardian.co.uk/world/ugandahttp://www.guardian.co.uk/world/zimbabwehttp://www.guardian.co.uk/world/saudiarabia -

7/28/2019 Africa is Playing Against a Stacked Deck

12/26

The Alwero River in Ethiopias Gambela region provides both sustenance and

identity for the indigenous Anuak People who have fished its waters and farmed

its banks and surrounding lands for centuries. One new plantation in Gambela,

owned by Saudi-based billionaire Mohammed al-Amoudi, is irrigated with water

diverted from the Alwero River. Thousands of people depend on Alwero's water

for their survival and Al-Moudi's industrial irrigation plans could undermine their

access to it. In April 2012, tensions over the project spilled over, when an armed

group ambushed al-Amoudi's Saudi Star Development Company operations,

leaving five people dead.

In recent years, Saudi Arabian companies have been acquiring millions of

hectares of land overseas to produce food to ship back home. Saudi Arabia does

not lack land for food production. Whats missing in the Kingdom is water, and itscompanies are seeking it in countries like Ethiopia.

Indian companies like Bangalore-based Karuturi Global are doing the same.

Aquifers across the Indian sub-continent have been depleted by decades of

unsustainable irrigation. The only way to feed India's growing population, the

claim is made, is by sourcing food production overseas, where water is more

available.

All of the land deals in Africa involve large-scale, industrial agriculture operationsthat will consume massive amounts of water. Nearly all of them are located in

major river basins with access to irrigation. They occupy fertile and fragile

wetlands, or are located in more arid areas that can draw water from major

rivers. In some cases the farms directly access ground water by pumping it up.

These water resources are lifelines for local farmers, pastoralists and other rural

communities. Many already lack sufficient access to water for their livelihoods. If

there is anything to be learnt from the past, it is that such mega-irrigation

schemes can not only put the livelihoods of millions of rural communities at risk,they can threaten the freshwater sources of entire regions.

The reality is that a third of Africans already live in water-scarce environments

and climate change is likely to increase these numbers significantly. Massive land

deals could rob millions of people of their access to water and risk the depletion

of the continent's most precious fresh water sources

It is almost impossible to know just how much of Africa has been sold or leased

out in the past two years because the deals are shrouded in secrecy andhappening at a great pace.

-

7/28/2019 Africa is Playing Against a Stacked Deck

13/26

More than US$100 billion has been mobilised in the past two years for

investing in land, the trick being, according to one analyst not to harvest

food but to harvest money.

There are estimates that in this period, 30 million hectares (an area thesize of Senegal and Benin together) have been grabbed, in at least 28

countries in Africa.

Ethiopia is offering more than a million hectares of what it calls virgin

land to foreign investors.

Almost a third of Mozambique is, quite literally, up for grabs.

It was just such a land investment deal between the South Korean company,

Daewoo, and the former president of Madagascar, which would have accorded

Daewoo about half of the countrys arable land for industrial monoculture

production of food and agrofuels for export to Korea that contributed to the

political turbulence and the overthrow of President Ravalomananaxiii

It isnt only that the most arable land is being sold or that the water resources

have been diverted. In Zambia the farmers are being evicted from their lands as

well to make room for foreign agribusiness. Increased agricultural development

in Zambia is compromising the countrys food security as peasant farmerscontinue to be driven off their customary land to pave the way for large-scale

local and foreign agribusiness; mainly for export. Land grabs increase the

incidence and prevalence of poverty in the country by increasing the number of

people who cant grow their own food, and who cant send their children to

school. Smallholder farmers account for 70 per cent of Zambias farming

community,

The eviction of farmers from their customary land started 12 years ago but has

assumed prominence after 2005 when the government started calling for

increased foreign investment. Land grabs by both foreign and local investors are

now considered commonplace in Zambia. In the Masaiti district, in the mineral-

rich Copperbelt Province, over 2,000 farmers were evicted from their land in

2011 following the acquisition of over 200 hectares by a Nigerian cement

manufacturer. They were later paid 250 dollars per hectare as compensation.

The land-grab in Zambia illustrates a related problem for much of African

smallholder farms; the failure of the bureaucracy to account for land title. TheZambia Land Alliance, an advocacy group, blames the eviction of farmers on the

-

7/28/2019 Africa is Playing Against a Stacked Deck

14/26

cumbersome procedures involved in obtaining title deeds and the archaic

laws which do not recognise customary rights as a form of land ownership. Under

Zambian law, title deeds are the only legal proof of ownership of land. To get a

title deed, it takes anything between two months and 10 years. The system is

very archaic and centralised one can only get the title deeds from the Ministry

of Lands in Lusaka. For farmers in rural areas, obtaining a title deed for their land

is very costly. They have to pay transport fares to and from Lusaka as well as

pay for meals and lodging facilities every time they travel to make a follow-up. It

can cost them up to 10 million Kwacha (about 2,000 dollars) just in the process.

As a result, many of them just sit back and continue farming. Then, without a

title deed they lose their land and often forfeit compensation.xiv

There is a political aspect of this widespread lack of title deeds in Africa. Many ofthe most intense and vicious conflicts on the continent have arisen because the

land, held under customary law, was never properly registered. In the Ivory

Coast the country has been plagued by migrant labour working on farms for

years and never getting title to the lands they farmed. The customary owners

demanded that the migrants leave their property after the harvest but the

migrants refused to leave claiming that their de facto presence on the land gave

them a de jure claim to title.

The lack of a clear title to land has deprived millions of Nigerians of a claim for

compensation for the rights of way for oil pipelines and pumping stations. Even

more, this lack of title has prevented a rational solution to the problem of

taxation and electoral registration. The influx of foreign investment in African

land has made it even harder for indigenous farmers to claim title to their lands

as there is a powerful financial incentive for the investing agribusiness and the

politicians who arrange the sale of the land to delay or inhibit the granting of title

to indigenous farmers or pastoralists.

Transport Impediments

Africa is a vast continent of immense resources but with very poorly developed

transport integration with other centres of commerce. This lack of integration

with the rest of the trading world is a heavy burden on African exporters and has

led to a situation in which an enormous percentage of the prices realised by

African exports in the world marketplace is paid for in transport costs. In the

developed world these transport and insurance costs make up about 5.5%-5.8%

-

7/28/2019 Africa is Playing Against a Stacked Deck

15/26

of the delivered price. In Africa the cost of transport and insurance can make up

to almost 80% of the cost of goods or products delivered to the world markets.

Moreover, absent a developed intra-African air or sea service, this 80% of the

market price for African products is paid mainly in hard currency to foreign

transport companies in the developed world. This burden of external payments

has a marked effect on currency price pressures.

To illustrate this one can work backwards. If the market price of a good is

determined by the price at the export destination then that price is the CIF price

(cost, insurance and freight). If the transport and insurance costs account for

such a high percentage of this price, it then follows that to be competitive; the

African exporter must reduce his FOB price to reflect this differential. For

example, if manganese ore sells at $2,400 per ton CIF Western Europe andtransport and insurance costs of this manganese amount to $380 per metric ton,

then the maximum FOB price of the manganese ore FOB Africa cannot be more

than $2,020 per metric ton. Moreover the price of transport and that of insurance

as well, is not controlled by the African exporter. He is at the mercy of the

shippers for whom transport rates are constantly escalating; especially with the

rising price of fuel.

Extensive research has shown that the most important consequence of high

international transport costs is the detrimental impact on firms' competitiveness

in international markets. First, for small countries that exert little impact on

world prices, the higher the international transport costs, the more firms in that

country will have to pay for imported intermediate goods and the less they will

receive for their exports.

If a country faces a perfectly elastic supply of imports or a perfectly elastic

demand for its exports, changes in international transport costs will be

translated one-for-one into changes in domestic prices. In competitiveglobal markets, higher transport costs have to be offset either by lower

wages or by reduced costs somewhere else in the production process to

allow firms to compete.

Countries with higher international transport costs are less likely to attract

foreign investment in export activities

For exporters of primary products higher international transport costs

reduce the rents earned from natural resources thereby lowering

-

7/28/2019 Africa is Playing Against a Stacked Deck

16/26

aggregate investment and thus growth.

Higher international transport costs increase the price of all imported

capital goods, which reduce investment, the rate of technological transfer

and thus reduce economic growth.

Due to a lack of better data, it has become customary to use the CIF-FOB spread

on import costs as a proxy for international transport costs .The FOB (free on

board) costs of imports measures the costs of an imported item at the point of

shipment by the exporter. The CIF price measures the costs of the exported item

at the point of entry into the importing country, inclusive of the costs of

transportation. Using the CIF-FOB band as a proxy, studies found that for a

sample of 97 developing countries, the mean CIF-FOB band was 12.9%. For

coastal economies this average was 11.8%, while for the 17 fully landlocked

economies the average was 17.8% - this implies that the costs of international

transport for landlocked developing countries was on average 50% higher than

for coastal economies. If one takes into consideration that more African countries

tend to be landlocked than elsewhere, then regional integration to promote

seamless transportation may be important to improve the attractiveness of

investment in export- oriented industries in these countries.

Another important aspect of Africas dilemma is that the transport patterns whichhave emerged as a result of the outsourcing of international transport has been

the continuation of links between African countries and their traditional colonial

markets; e.g. Anglophone Africa to Great Britain; Francophone Africa to France;

Lusophone Africa to Portugal, etc. North-South traffic is the most frequent African

transport route; East-West Africa is almost unknown. Western Europe still takes

about 50% of Africas exports. With the growth of major petroleum and gas

exports from Africa since 1992 this figure of 50% is, in itself, misleading as these

high value exports mask a concomitant decline in the value of African non-hydrocarbon exports. These trade patterns have led to ludicrous anomalies.

Fresh produce from Southern Africa is shipped to Europe and then trans-shipped

again to West Africa. Tobaccos often follow this routing. The hungry displaced

civilians in Africas regional wars in Liberia, Sierra Leone, Angola and the D.R.

Congo were forced to import expensive food from Europe via the World Food

Program while African exporters of food had to send their products to Europe at

low prices because of the transport nexus and punitive European taxes and

quotas.

-

7/28/2019 Africa is Playing Against a Stacked Deck

17/26

A contributory factor in the cycle of transport dependency is the expansion of

Western European owned or affiliated freight forwarders in Africa who are tied to

European transport companies and who determine the type of carriage, the cost

of the carriage and a ready route for tax and currency rules avoidance. The rise

of a major trading route between Africa and China has not offered a better

solution as most of the transport between Africa and China is on Chinese-owned

and operated vessels, aircraft and handled by the forwarding agents of these

Chinese carriers.

The Reliance on Containers

A principal factor in the high costs of transport in Africa has been the reliance of

shipping cargoes, even some ores, in metal containers on dedicated container

vessels. Instead of loading the goods for transport in the holds of a vessel,

current practice is to stuff the cargoes into standard metal containers for

transport. In the maritime trades there is an international system which allows

standard metal containers of either 20 feet (TEU) or 40 (FEU) feet length to be

used to transport goods on specialised container vessels. These containers are of

a uniform size and dimension. Some may be refrigerated.

An increasing amount of world trade is conducted using the containers. The

container-carrying ships are growing ever larger; some are now capable ofcarrying 10,000 to 18,000 units on each carrier vessel. The newest container

vessel is the Triple E. It will be the largest vessel ploughing the sea. Each ship

contains as much steel as eight Eiffel. Each vessel will carry enough containers

than could fill more than 30 trains, each a mile long and stacked two containers

high. Inside those containers, you could fit 36,000 cars or 863 million tins of

baked beans. These are giant ships.

-

7/28/2019 Africa is Playing Against a Stacked Deck

18/26

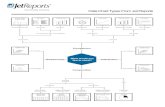

Theoretically the use of the giant container ships reduces the cost of transport by

dint of their sheer size. However, for many nations in Africa they are not efficient

at all. These vessels, as can be seen from the illustration above, require a

draught in the port of up to 16 metres. That means that there needs to be a berth

which has 16 metres of water alongside and 400 metres in length so that the

portal cranes can load and discharge the containers; they must be frequently

dredged to keep their depth... There are very few ports anywhere in Africa which

can accommodate these vessels in a berth accessed by portal cranes. Except for

several specialised berths in South Africa and scattered around the coast there

are few berths on the continent with more than 12 or 13 metres alongside and

400 metres in length. These vessels cannot reach the berth so, to use these large

container ships the cargoes have to be shipped to a port which is equipped to

handle them. That involves double or triple handling.

The nature of container shipping is, even without the distortion of giant sizevessels, very difficult for African importers and exporters. The containers are not

-

7/28/2019 Africa is Playing Against a Stacked Deck

19/26

provided for free. They must be rented in advance; taken to a place of stuffing;

transported to the port; loaded on the vessel; unloaded and de-stuffed at the

receiving end. The rental period covers the entire period and often there is a

charge for repositioning the containers after unloading.

There are other downsides to containerisation. The first is that it is generally

more expensive than conventional shipping; not only because one is paying for

the transport of an empty metal box. The stuffed container needs to be shipped

on special rail flatcars or on trailer trucks to the port. Another downside is that

not every loading or discharging port has a container terminal; replete with the

portal cranes and stacking areas which allow a quick handling of containers. That

means that specialised container vessels cannot call at ports without the draught

or the proper equipment for container handling.

Quite often the goods being shipped do not fit exactly into a container. They

may be too heavy so the container reaches it maximum weight limit with only a

few components or they may be as light and bulky as to require many containers

to carry them. There may also be less than a full load for the container. In that

case the forwarder may offer groupage' which shares the cargo space in the

container with other cargo or a LOL (less than full load) service. Most importantly,

container shipping is very expensive. It is expensive because, although the

international freight rates may seem reasonable, the internal movement of

containers in Africa is very expensive. To ship a standard TEU from Hamburg to

Mombasa may cost US $ 1,625 but the costs of moving that container to an

inland factory or farmstead may well cost another US $ 1,550. That is because

the rail and trucking costs in Africa are prohibitive.

A few years ago India was having an onion crisis. There was a shortage of

onions which are a staple of the Indian diet. They needed onions. There were a

lot of suitable onions in Zimbabwe which we could make available. We contactedthe suppliers and got a reasonable price ex-storehouse. We then contacted some

freight forwarders to give us a shipping price to Porbandar where the Indians

wanted the onions. The price that was given to us was extremely high. They

wanted US$500 for the use of the container; US$600 for the rail costs of the

container to Maputo; US$1,050 for the container to Mumbai; and a further US $35

per ton (that is $700 for a TEU) for the transfer of the onions by conventional

transport to Porbandar because it wasnt a container port and had no facilities to

offload containers. So, that would make the freight cost of the onions around US

-

7/28/2019 Africa is Playing Against a Stacked Deck

20/26

$ 142.50 per ton using a container. It would take forty-two days because of all

the handling and waiting for vessels. That would make the price far too high to

satisfy the Indian buyer.

We decided to use conventional shipping, e.g. without containers. We put the

onions on a freight train to Beira and used a 2,500 deadweight animal carrier (to

get the maximum air circulation around the onions) and sailed for Porbandar. Our

net costs were US$62 a ton and it took eighteen days. So by using conventional

shipping we saved US $80.50 per ton and twenty-four days. The ever-increasing

use of and reliance on container shipping is a heavy tax on African exports and a

major inhibitor of competitive pricing. For much of Africas trade, containerisation

adds little to the efficiency of the transport but rewards the international shipping

and forwarding agencies by their use.

Problems of Taxation

One of the most important aspects of the impediments to African growth and

development is the simple fact that most Africans do not pay direct income or

property taxes to their governments. Revenues for African national budgets

derive primarily from customs and excise taxes and on taxes on the licensing,

sale and production agreements of raw materials sold for export to major

international markets. There are taxes on financial transactions and on

businesses in urban centres but these are minimal in comparison to the massive

revenue flows from foreign investment, foreign aid and rents on land and

resources. For most Africans the tax they know best is school fees for their

children, followed by the heavy taxes on domestic energy costs at the petrol

pump...

Many, if not most, African countries fail to raise the tax revenues needed to

provide for their public sectors. Domestic revenue mobilisation is very weak in

Sub-Saharan Africa and makes up about the equivalent of 12% of GDP.

Governments relay on dealing with importers, exporters and investors for their

revenues. This is why there is such a gap between the politicians, civil servants

and the wananchi (common people).

Politicians and civil servants do not derive their revenues from the common

people. This revenue comes from their relations with large national and

international businesses; granting concessions and leases of mines, oil wells andland; and customs and excise taxes on goods entering and leaving the country.

-

7/28/2019 Africa is Playing Against a Stacked Deck

21/26

The politicians and civil servants know that it is their job to wrest from these

corporations as much revenue as possible to carry out their budgetary

obligations and, quite simply, to use this power to enrich themselves on a

personal basis while they have their chance. Since the common people do not

pay tax and only marginally contribute to the costs of electricity, water and

communications the general notion within African leadership circles is that the

common people do not contribute to the funding of the state and thus should

only be rewarded rhetorically for their participation in the nations economy. In

return for this rhetorical benefit the population is asked periodically, to put their

X next to a name of a candidate or a political party who will continue to operate

and perpetuate the system.

Roads are not built or repaired, schools are not established, hospitals are withoutadequate provision and public services decline with age and are not renewed

because they are theoretically funded by national revenues. In most cases there

is no residue of national revenue available to fund them. The government has

other urgent priorities. In many of the cases of petroleum and mineral extraction

sectors the government is obliged to pay for its share of its joint-venture

partnership insisted upon by the government as its right as a national

stakeholder in the project. The revenue streams from the joint projects are

earmarked for fulfilling the governments infrastructural contributions to theprocess (rail links to the mines, roads through rural areas, etc.) and for revenues

to fund the budget. As these ventures are profit-making and generate revenues

they tend to take priority over non-profit-making capital or service projects which

benefit only the common people and for which they do not pay.

African Wars

By far the most direct impediment to African growth and development is theprofusion of wars on the African continent. An enormous portion of the national

revenue is diverted from civil projects to pay for a large standing army. A

substantial part of the national revenue stream is diverted for this purpose.

Indeed, many African states have known little else than military rule where the

military have seized power for themselves and operated their nations under

military rules and using military justice as a guide. There is the prevailing notion

that military justice is to justice as military music is to music. They are vaguely

similar but recognisably unique.

-

7/28/2019 Africa is Playing Against a Stacked Deck

22/26

African wars have displaced millions from their land and killed many others. As

long as the wars continue, farming is diminished, transport is diverted, and

resources stolen and provide no public revenue Perhaps the best examples are

the Eastern Democratic Republic of the Congo (DRC) and the Ivory Coast.

Between August 1998 and April 2004 some 3.8 million people died violent deaths

in the DRC. Since 2004 this number has almost trebled. Many of these deaths

were due to starvation or disease that resulted from the war, as well as from

summary executions and capture by one or more of a group of irregular

marauding bands. Millions more had become internally displaced or had sought

asylum in neighbouring countries. Rape was endemic; insecurity was the rule;

and impunity the remedy. This war and the rapes, murders and pillaging

associated with them derived from the efforts of Uganda and Rwanda seeking to

profit from the valuable mineral resources of the Eastern Congo. Now the M23

band of irregulars carries on the same war but without the open presence of

Uganda and Rwanda. Nonetheless farming has come to a halt; mining is done by

artisanal miners working as hostages of the M23 and millions of displaced people

are hiding in the bush, more interested in survival than contributing to the GDP.

In the Ivory Coast, once one of the most prosperous countries in Africa was riven

by a rebellion in 2000. The country was divided between North and South and

their dividing line was patrolled by the French Army (Force Licorne) and the UNpeacekeepers. Above the line, in the Muslim North, the nation was run by

warlords and local despots. The civil servants fled and there was no more

government or schools or services. The citizens who hadnt fled stopped paying

rents or taxes; they paid for no services or utilities; and they paid no excise or

customs duties on the products they sent out of the country as exports. These

rebels were united under the leadership of Alassane Ouattara, originally a

Burkinabe citizen, and now the French-installed President of the Ivory Coast.

There was no freedom of movement and investment plans were disrupted and

thousands killed.

While these two cases are good examples of the disruptions caused by wars they

are not unique. The other wars in Sudan, in Darfur, in Somalia, Eritrea, Ethiopia,

Liberia, Sierra Leone and now Mali are recent struggles. The disruption to the

economies of these countries involved cannot be overestimated. Rapes, murder,

starvation, child soldiers, internal displacement and disease are the usual

concomitants. Wars have been a major factor in the lack of development andgrowth in Africa and, while often provoked, incited, armed and funded by

-

7/28/2019 Africa is Playing Against a Stacked Deck

23/26

external nations (notably France and Libya) they engaged a substantial

participation of African leaders.

The Currency CrisisOne of the most serious impediments to the functioning of the African economies

is that, for a large number of African states, the African governments do not have

control of their own monetary or fiscal policies. The best example is the operation

of the CFA franc (the Financial Community of Africa -Communaut financire

d'Afrique CFA franc). There are actually two separate CFA francs in circulation.

The first is that of the West African Economic and Monetary Union (WAEMU)

which comprises eight West African countries (Benin, Burkina Faso, Guinea-

Bissau, Ivory Coast, Mali, Niger, Senegal and Togo). The second is that of theCentral African Economic and Monetary Community (CEMAC) which comprises six

Central African countries (Cameroon, Central African Republic, Chad, Congo-

Brazzaville, Equatorial Guinea and Gabon), This division corresponds to the pre-

colonial AOF (Afrique Occidentale Franaise) and the AEF (Afrique quatoriale

Franaise), with the exception that Guinea-Bissau was formerly Portuguese and

Equatorial Guinea Spanish).

Each of these two groups issues its own CFA franc. The WAEMU CFA franc is

issued by the BCEAO (Banque Centrale des Etats de lAfrique de lOuest) and the

CEMAC CFA franc is issued by the BEAC (Banque des Etats de lAfrique Centrale).

These currencies were originally both pegged at 100 CFA for each French franc

but, after France joined the European Communitys Euro zone at a fixed rate of

6.65957 French francs to one Euro, the CFA rate to the Euro was fixed at CFA

665,957 to each Euro, maintaining the 100 to 1 ratio.

The monetary policy governing such a diverse aggregation of countries is

uncomplicated because it is, in fact, operated by the French Treasury, without

reference to the central fiscal authorities of any of the WAEMU or the CEMAC

states. Under the terms of the agreement which set up these banks and the CFA

the Central Bank of each African country is obliged to keep at least 65% of its

foreign exchange reserves in an operations account held at the French

Treasury, as well as another 20% to cover financial liabilities.

The CFA central banks also impose a cap on credit extended to each member

country equivalent to 20% of that countrys public revenue in the preceding year.Even though the BEAC and the BCEAO have an overdraft facility with the French

-

7/28/2019 Africa is Playing Against a Stacked Deck

24/26

Treasury, the drawdowns on those overdraft facilities are subject to the consent

of the French Treasury. The final say is that of the French Treasury which has

invested the foreign reserves of the African countries in its own name on the

Paris Bourse.

In short, more than 85% of the foreign reserves of these African countries are

deposited in the operations accounts controlled by the French Treasury. The

two CFA banks are African in name, but have no monetary policies of their own.

The countries themselves do not know, nor are they told, how much of the pool of

foreign reserves held by the French Treasury belongs to them as a group or

individually. The earnings of the investment of these funds in the French Treasury

pool are supposed to be added to the pool but no accounting is given to either

the banks or the countries of the details of any such changes. The limited groupof high officials in the French Treasury who have knowledge of the amounts in

the operations accounts, where these funds are invested; whether there is a

profit on these investments; are prohibited from disclosing any of this information

to the CFA banks or the central banks of the African states.

This makes it impossible for African members to regulate their own monetary

policies. Convertibility of the CFA franc into French francs through authorised

intermediaries is supported by provision for central-bank overdrafts on these

accounts. In short, at least 80% of the financial reserves of these African

countries are held in the French Treasury under its control. This has been an

aggregation of currency reserves since 1961; that is over fifty years of

accumulation without recourse by the African states to their capital.

There remained only one market for the CFA zone, and that was France their

colonial master. This enabled Metropolitan France to appropriate to itself the raw

materials needed for its post-War and young industries. The colonies were tied

hand and foot to serve Metropolitan France as other markets closed their doorsto their expensive products. Thus through the new CFA currency, France was able

to economically re-colonise its African colonies that had earlier been cut off from

Paris as a result of the War.xv

The major current problem with the CFA franc is that because of its pegging to a

fixed rate to the Euro its value reflects the successes or failures of European

monetary policies, not African realities. Now, in the wake of the global credit

crunch there are more worrying changes. The principal worry is the state of the

French economy and the pressures on the Euro to cope with the vast monetary

-

7/28/2019 Africa is Playing Against a Stacked Deck

25/26

and fiscal divergences among the twenty-seven states and the impact of the

sovereign debt crisis. The declining value of the African reserves, bound up in

investments in a falling French stock market has diminished the ardour for

French subsidies of development projects in such economic basket cases as

Niger, Mali, Burkina Faso and others. France has shown itself unwilling to

continue to finance the stationing in Africa of so many troops, including those

wearing the blue berets of the United Nations.

If the Euro fails, breaks apart into two zones, or disappears in a mountain of

defaults what happens to the francophone African states? Their money is tied up

in the French Bourse, almost completely out of their control. They have no idea of

their positions and are not confident that a decaying France will be able to

financially maintain a par CFA which will be credible or reflect the value of Africanexports; the very nature of the original bargain. There are many African

economists who are convinced that the French Treasury has been using their

reserves as collateral on French long-term debt. If the Euro breaks up or declines

dramatically, how will the Africans get their own money back?

Conclusion

All of the factors above have contributed to the inability of Africa to fulfil its

potential. Each factor interacts with the other to put hazards and impediments in

the way of growth. There is no one solution or magic wand which can resolve

these problems; they must all be resolved. The absence of these solutions has

had a tragic consequence across Africa. The economic problems which have been

delineated in part above have opened the opportunity for an influx of religious

terrorism in the shape of the Salafists of Boko Haram, Al Qaida of the Islamic

Maghreb, and the Colombian drug cartels. There are now African narco-states

and whole areas of the Sahel and the Horn of Africa which have become terroriststates. While these are security and military problems they cannot be solved

without the restructuring of the economic miasma from which they emerged.

Referring to the success of African stock markets and booming GDP numbers as

measures of African growth and expansion misses out a fuller explanation of how

these mask the fact that Africa is playing against a stacked deck.

-

7/28/2019 Africa is Playing Against a Stacked Deck

26/26