1A_1_KeefeRENGIFO.pdf

-

Upload

meenasawant -

Category

Documents

-

view

217 -

download

1

Transcript of 1A_1_KeefeRENGIFO.pdf

-

Currency Options as Central Bank Risk Management Tool

Preliminary version, April 2014

Helena Glebocki Keefe, Erick W. RengifoFordham University, Economics Department

April 1, 2014

Abstract

Many central banks in emerging markets and developing economies are concerned with excessive

volatility in foreign exchange markets and wish to control the direction and speed with which the value

of their currency changes. Historically, intervention has consisted of using foreign exchange reserves to

purchase and sell foreign currency directly in the spot market. The research presented in this paper

explores how currency options may be a viable central bank tool for intervention. Holding and issuing

bundles of call and put options with multiple strike prices while dynamically delta hedging the port-

folio position curbs excessive reserve accumulation, builds markets and domestic liquidity, establishes

a more effective signaling process between policy makers and the market, and creates a more cohesive

intervention plan than direct spot market intervention. We use the Garman-Kohlhagen options pricing

model to analyze the case study of Colombia and to simulate the impact of using an alternative to a

butterfly strategy as an intervention mechanism on the spot market position of the central bank, reserve

accumulation and total costs accrued from intervention1.

1The research conducted and presented in this paper has been sponsored by the Global Association of Risk Professionals.

1

-

1 Introduction

Holding2 and issuing3 bundles of call and put options while dynamically delta hedging4 the net portfolio

position allows central banks in developing economies to have a targeted approach to currency market

intervention. Previous attempts to use options as an intervention mechanism by Mexico and Colombia

have been abandoned. Deemed ineffective in curbing volatility by some, such as Mandeng (2003), past

failure of options contracts may be due to their sporadic and unhedged issuance, leading to little sustained

impact and no clear picture of how to operate in the spot market. This paper revisits the case of Colombia

to analyze how using an alternative to the butterfly option strategy can provide central banks with an

alternative policy tool to intervene in currency markets to control volatility, influence expectations, build

markets and ensure domestic liquidity at a lower cost than pure spot market intervention.

Central banks in emerging markets and developing economies are concerned with excessive fluctua-

tions of their exchange rates. Such volatility can cause risks associated with banking crises, economic

instability, slowed growth and diminished trade. According to a survey by the Bank of International

Settlements of 19 central banks in developing economies, two-thirds conducted some type of currency

market intervention and found it to be an effective tool for controlling exchange rate volatility (Mihaljek,

2004). Most developing countries are engaging in some type of intervention into currency markets to

exert control over exchange rates. Many intervene to calm disorderly markets and relieve liquidity short-

ages, while others try to correct misalignment and stabilize volatile exchange rates. All policy makers

surveyed stated that intervention which influences future expectations and signals a future stance of

monetary policy is the most effective. Interventions are assumed to have primarily a short-term influ-

ence on currency markets. Since currency markets are very dynamic, even in emerging markets and

developing economies, the most effective strategy for the central bank will be one that is consistent.

Holding and issuing bundles of call and put options at various strike prices on a consistent basis

while dynamically delta hedging the portfolio position in the spot market will allow the central bank

to influence the expectations of traders, target volatility and signal their policy stance. It will also

provide policy makers with a clear target for operating in the spot market while increasing liquidity

domestically. Additionally, the costs associated with intervention will be lower, sterilization problems

2Holding options contracts will refer to ownership of the contract. Specifically, when it is holding a contract, the central bankwill be long the option contract and have the right, but not the obligation to exercise the contract.

3Issuing options contracts will refer to writing and auctioning the option contract. Specifically, when it is issuing a contract,the central bank will be short the option contract and will be obligated to fulfill the contract if it is executed by the ownerat maturity.

4Dynamic delta hedging is the main hedging strategy considered in this research because it reflects a short-run strategy ofintervention, which has been found to be most effective by policymakers (Mihaljek, 2004) and because drastic changes in dayto day value of the currency are not anticipated. An alternative strategy, such as gamma hedging will be considered in futureresearch that builds on the current findings.

2

-

will be alleviated, and signals between traders and the central bank will allow policy makers more time

to react to speculative threats and deviations of the exchange rate from macroeconomic fundamentals.

This paper explores how options may be a viable alternative policy tool for central banks in developing

economies to use in currency market intervention. First, we analyze Colombias past experimentation

with options contracts as the baseline case. Next, we explore which option strategies are most appropriate

to meet the goals of central bank currency market intervention. For the analytical approach, we use both

a random process and an Ornstein-Uhlenbeck process with GARCH volatility to simulate the Colombian

Peso-US Dollar (COPUSD) exchange rate. With the simulated series, we price options contracts at

various strike prices and analyze the outcome of hedging a portfolio position that is tailored to counter

persistent appreciation or depreciation in the exchange rate. We compare the spot market position and

total costs to the central bank of such a strategy with the cost of daily interventions currently conducted

by Colombia.

The remaining sections of the chapter are structured as follows. Sections two presents an overview

of options and basic strategies. Section three lays out the motivation for research and a review of the

literature. Section four presents the data and historical analysis for the case of Colombia. Section five

addresses the possible option strategies that are most effective to the goals of the central bank. Section

six presents the analytical approach, models and methodology for simulation. Section seven reports

the simulation results. Section eight discusses implications of the findings and future extensions of the

research.

2 Overview of Options

An options contract provides the owner the right, but not the obligation, to exercise their position at

the given strike price. In other words, a call (put) option offers the owner the right to buy (sell) the

underlying asset at the given strike price on or before maturity of the contract from the writer or issuer

of the contract. A call (put) option will be exercised when the spot market price at the end of the

contract is above (below) the strike price.

To be long in an option contract is to have purchased the contract, and therefore hold the right to

exercise the option upon maturity. To be short in an option is to have written or sold the option contract

to a market participant.

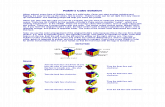

As can be seen in Figure (1), a long call option has limited downside risk when the value of the

underlying asset changes (S) but unlimited payoffs with an increase in the value of S. As the value of

the underlying asset increases, the owner of the call option will be able to exercise the option at the

3

-

agreed upon strike price (K). He is therefore able to buy the asset at a lower price than market value,

in turn buying low, selling high. His downside risk is limited to the premium he must pay to own the

contract if the contract is not exercised. In contrast, a short call option has unlimited downside risk

and limited payoffs. The payoffs of a short call are limited to the premium received by the writer of

the contract when the call is not exercised. As the value of the underlying asset increases, the writer of

the call option is obligated to sell the underlying asset to the owner of the contract (the one in the long

position) at the strike price, which is below the market value of the asset. He is therefore selling low,

buying high, which puts him in a position of unlimited loss as the asset value rises.

On the other side of the market, a long put option has limited downside risk as well as limited

payoffs. The owner of the put option has the right to sell the underlying asset at the strike price K to

the writer of the contract. The long put option will be exercised if the value of the underlying asset

(S) is below the strike price (K). In this scenario, the owner of the long put option sells the asset at a

price higher than the market value to the writer of the contract. He is therefore selling high, buying

low. The downside risk of the long put option is limit to the premium the agent must pay for the right

to own the contract, even if the contract is not exercised. The writer of the contract has a short put

option position, and is also faced with limited payoffs and large but limited downside risks. He will be

obligated to buy the underlying asset from the owner of the contract at the strike price K. Once again,

his payoff is limited to the premium he receives if the contract is not exercised.

Figure 1: Call and Put Option Strategies

The above figure illustrates call and put option positions and payoffs. The value of the underlying asset in the spot market is represented by S and thestrike price of the option is K. Long calls have unlimited gains, and limited losses, whereas long puts have limited gains and limited losses. Short calls haveunlimited losses and limited gains, whereas short puts have limited gains and unlimited losses.

In the context of the foreign exchange market, a currency call option on US dollars (USD) in Colombia

(COP) gives the owner the right to buy USD from the writer of the contract at the strike price. The

4

-

owner of the contract is long a call option in this case. Therefore, the call option will be exercised if the

spot exchange rate of COPUSD is above the strike price, or in other words, COP has depreciated since

the issuance of the option. On the other hand, a put option on USD in Colombia gives the owner the

right to sell USD to the writer of the contract at the strike price. In other words, the owner is long a

put option and the writer of the contract is short a put option. If the put option is exercised, then the

spot price at maturity has fallen below the strike price and COP has appreciated in value.

Currency option contracts are beneficial for traders and hedgers alike because they mitigate some of

the risk of drastic movements in the future value of the exchange rate. Market participants interested

in further offsetting risks associated with long or short options positions can also engage in dynamic

delta hedging, which allows them to continuously rebalance their portfolio in the the underlying asset

(DeRosa, 2011).

As explained in Chen (1998), the standard technique for a trader to hedge their position in the

options market against the risk of changing prices is referred to as dynamic delta hedging. Traders are

able to reduce risks associated with the movement in the price of the underlying asset by taking an

offsetting position in the spot market. For small movements in the exchange rate, the value of the hedge

will change in an equal but opposite direction. The delta is the responsiveness of the price of the option

to changes in the value of the underlying asset. The delta of an option will change as the contract nears

expiration or when implied volatility or the exchange rate changes. As the delta changes, traders will

adjust their offsetting position through buying or selling the underlying asset.

For a long call option, the offsetting delta hedging position in the spot market will be to short the

underlying asset. When an owner of the long call wants to hedge his position, he will sell a given amount

of the underlying asset directly in the spot market. The amount sold is determined by the delta of the

option at the time of hedging. Therefore, if the contract is for USD, the owner will sell USD in the spot

market. For a short call option, an offsetting delta hedging position in the spot market will be to long

the underlying asset. For the writer of the contract, he will purchase a given amount of the underlying

asset in the spot market to hedge his option contract position. If the contract is in USD, he will buy

USD in the spot market.

For a long put option, the offsetting delta hedging position in the spot market will be to long the

underlying asset. For a contract in USD, the owner of a put option will purchase a given amount of

USD in the spot market. The size of the purchase will be determined by the delta of the contract at the

time of hedging. For a short put option, the writer of the contract will offset his position in the options

market by selling the underlying asset in the spot market. For a contract in USD, the writer of the

contract will sell a given amount of USD in the spot market to hedge his short put option position. Once

5

-

again, the size of the offsetting spot market position is determined by the delta, or the responsiveness

of the option price to changes in the value of the underlying asset at the time of hedging.

By taking an offsetting position in the spot market, agents that are dynamically delta hedging their

options contracts should theoretically cover their hedging costs by the premium or payoff they gain from

the option contract. Even if the contract is not exercised, through consistent daily or weekly hedging,

the agent will be able to purchase or sell off the underlying asset over the period to maturity and cover

his costs with the premium or payoff derived from the option contract. Dynamically delta hedging allows

the agent to hold a neutral portfolio position with lower costs than relying solely on the spot market or

options market.

3 Literature Review

The following section will first delve into details on the currency options market and past literature

that has addressed how they can be used by central banks. It will then detail literature on central

bank intervention into foreign exchange markets in general. Finally, it will address macroeconomic

fundamentals that influence exchange rate movements as well as the linkages between inflation targeting

goals and exchange rates in emerging markets.

3.1 Currency Options

Currency options are used by various agents in the foreign exchange market, including currency traders,

speculators, hedgers and portfolio managers. The options market is mainly an interbank over-the-counter

market. The majority of currency options are European, meaning the option can only be exercised at

expiration (DeRosa, 2011). The global daily average turnover on a net-net basis5 in the foreign exchange

market in April 2013 was US$ 5.3 trillion, of which spot transactions were 38 percent and options were

less than 6 percent. Net-gross daily turnover6 in emerging markets made up roughly 6 percent of the

global foreign exchange market (BIS, 2013).3

If the central bank is the main writer of options, it can crowd out all other writers who may engage

in dynamic delta hedging that is potentially destabilizing (HKMA, 2000). Breuer (1999) argues that if

market makers are net long positions, their dynamic delta hedging behavior can lower volatility. When

option buyers purchase domestic currency in the spot market to hedge their positions when the currency

5Net-net basis adjusts for local and cross-border inter-dealer double-counting6Net-gross basis adjusts for only local inter-dealer double-counting3This omits Singapore and Hong Kong turnover. Including these two would increase the share of turnover in emerging marketsto 40.2 percent

6

-

is depreciating, and sell it when it is appreciating, this will help stabilize exchange rates. In other

words, given the option is written for USD, in a long call a delta hedging position would sell USD

when the domestic currency is depreciating and buy USD when it is appreciating, therefore canceling

out volatile pressure. Archer (2005) argues that the transparency with which the central bank auctions

options contracts to market participants introduces stability and additional hedging instruments into

the market. Therefore, central bank use of currency options can be effective in stabilizing the foreign

exchange market and controlling volatility when it influences market liquidity and expectations.

The Hong Kong Monetary authority notes that options contracts can lower costs of hedging risk,

enhance the liquidity of the underlying asset and work to stabilize the foreign exchange market when

issued by the central bank (HKMA, 2000). Options contracts issued by the central bank can mitigate

the destabilizing dynamic delta hedging behavior that would otherwise be conducted by private market

participants in reaction to changing market conditions.

Authors such as Garber and Spencer (1995) and Grossman and Zhou (1996) have found a positive

link between dynamic delta hedging and spot market volatility. Therefore, one risk central banks must

consider when writing options contracts while dynamically delta hedging their position is that such

hedging activity may amplify the appreciation or depreciation pressure on the exchange rate, which

is contrary to the objectives of the central bank. The authors take into consideration only one-sided

positions, such as issuing only calls or only puts. The alternative butterfly strategy position, or issuing

both calls and puts, establishes a net hedging position that is smaller than a one-sided position in the

market, and therefore will be less destabilizing.

As HKMA (2000) notes, this stabilization will occur even if the amount of options contracts sold

remains constant because the price of the option changes in response to changes in the market value of

the domestic currency. When the central bank is holding a long position in the domestic currency (or

a short position in USD), as market pressures increase, the central banks long position increases while

the option buyers hold an offsetting short position. This would have a similar impact as a spot market

intervention. The effectiveness of this strategy will depend on the extent to which market participants

dynamically hedge their positions, and whether the size of the options contracts are large enough to

have a significant impact.

Wiseman (1999) argues that governments should commit themselves to frequent and regular auctions

of short-dated physically-delivered currency options as a mechanism to stabilize exchange rates. Since

almost all central bank authorities would like to reduce exchange rate volatility, without pushing it all

the way to zero, official auctions would encourage private banks to buy options and exercise them when

profitable. dynamic delta hedging on the part of the trader will substitute for actively pursuing the

7

-

same position in the market.

3.2 Central Bank Currency Market Intervention

The main goals of the central bank when intervening in currency markets are to smooth exchange

rate volatility, supply liquidity into foreign exchange markets and to control the amount of foreign

exchange reserves (Moreno, 2005). The broad motives for intervention are driven by macroeconomic

goals, such as inflation targeting, maintaining economic stability and competitiveness, preventing crises

and boosting growth. Acosta-Ormaechea and Coble (2011) find that in emerging markets with high

levels of dollarization and a strong exchange rate pass through, inflation targeting is more effective

through policies that target exchange rates rather than interest rates.

There are four main channels through which the central bank can intervene into currency markets

(Archer, 2005). First, in the monetary channel, changes in the domestic interest rate relative to the

foreign interest rate can alter the value of the domestic currency. This occurs through a change in

the domestic monetary policy. Next, in the portfolio balance channel, relative scarcity of the domestic

currency to the foreign currency can appreciate the value of the domestic currency. Here the central

bank intervention into the spot market determines the relative scarcity or abundance of the domestic

currency, in turn directly influencing the value of the nominal exchange rate. Third, through the signaling

and expectations channel, the central bank can shape expectations on future monetary and exchange

rate policy. Influencing expectations through the promise of future intervention can curb speculative

behavior and coordinate the direction of the currency towards equilibrium. The credibility of the signal

is also critical. Signals to control appreciation tend to be more credible than those to curb depreciation.

Lastly, in the order flow channel, the central bank tracks order flows to predict subsequent price action.

Central bankers can alter the order flow with their own orders that must be large relative to the total

market turnover. Due to less liquidity in the market and better access to information on order flows,

this channel may be more effective in emerging markets than advanced economies.

Canales-Kriljenko (2003) finds that in emerging markets and developing economies, 82 percent of

interventions take place in the spot market because this is the main or only currency market in the

economy. If the intervention is unsterilized, it can directly influence the direction of nominal exchange

rates through the monetary channel. If sterilized, the intervention will affect volatility through expecta-

tions and by attempting to curb speculative behavior. The success of the latter interventions in lowering

volatility has been questionable (Breuer, 1999).

Sterilized spot market interventions involve exchange rate intervention by the central bank without

any change in the countrys monetary base. The intervention occurs through the buying and selling

8

-

of domestic and foreign bonds by the central bank (Weber, 1986). The primary purpose of sterilized

interventions has been to counter appreciation of the domestic currency in fixed or managed float ex-

change rate regimes without impacting real exchange rates to diminish inflationary pressure coming from

changes in foreign currency inflows (Agenor, 2004).

Weber (1986) finds that from a theoretical perspective, sterilized interventions can in fact influence

exchange rates if bonds denominated in different currencies are not perfect substitutes, but empiri-

cal evidence from the US indicates that sterilized interventions do not impact exchange rates. Craig

and Humpage (2001) agree that such interventions have been ineffective because they do not affect

macroeconomic fundamentals and instead influence expectations and perceptions, whereas unsterilized

interventions can conflict with price stabilization but are unnecessary because the same effect can be

achieved through open market operations.

In terms of the size, frequency and timing of intervention, Mihaljek (2004) cites that when the

goal of the intervention is to influence the exchange rate, central banks find larger and less frequent

interventions to be more effective. In contrast, when the goal is reserve accumulation, frequent but

smaller interventions are more successful. Emerging market policy makers viewed small and less frequent

interventions as more likely to be successful than large but less frequent interventions.

Over the last decade, emerging markets have experienced a significant increase in international finan-

cial flows. Even though these flows are generally beneficial in terms of growth and welfare enhancement,

emerging markets frequently experience surges or sudden stops in flows, creating economic instability.

Such volatile flows contribute to large fluctuations in exchange rates, fueling of domestic asset bubbles,

poor resource allocation, balance sheet risks and banking or financial crises. One way central banks have

created a buffer against the downside of surges and sudden stops has been the build up of reserves and

intervention directly in the spot market (IMF, 2010).

3.3 Macroeconomic Fundamentals, Inflation Targeting and Exchange Rates

The value of one countrys currency reflects the markets expectation about current and future macroe-

conomic conditions, and therefore reacts to changes in macroeconomic fundamentals, such as trade,

monetary policy, balance of payments, aggregate demand and aggregate supply (Obstfeld and Rogoff,

1999). Many theoretical models have linked exchange rate movements to changes in macroeconomic

conditions. These include the monetary model presented in Dornbusch (1976) where an increase in

the money supply decreases domestic interest rates to adjust for the excess supply of real money bal-

ances. Through the uncovered interest rate parity, the decrease in the domestic interest rate requires

a change in the nominal exchange rate. Due to short run sticky prices, the depreciation in the short

9

-

run is larger than in the long run equilibrium. In portfolio balance model presented in Dornbusch and

Fischer (1980), the exchange rate determines the equilibrium between domestic money, domestic bonds

and foreign bonds. Changes in money supply or supply of bonds will drive changes in the exchange rates

to maintain equilibrium. An increase in the supply of domestic bonds, an increase in the foreign interest

rate, or expectation of future depreciation will result in a depreciation of the domestic currency. An

increase the supply of foreign bonds or an increase in the domestic interest rate result in an appreciation

of the domestic currency.

Inflation targeting has been adopted by a number of both emerging and advanced economies over

the last two decades. Even though it has been considered advantageous as a framework for monetary

policy, the macroeconomic effects of inflation targeting in empirical terms have been limited (Levin,

Natalucci and Piger, 2004). In industrialized economies, inflation targeting has been most effective in

controlling long run inflation expectations and lowering the persistence of inflation. Fraga, Goldajn

and Minella (2003) argue that emerging markets face more acute trade-offs when choosing the design

of their inflation targeting monetary policy, including higher output and inflation volatility. Due to a

more volatile macroeconomic environment, the implementation and commitment to inflation targeting

becomes more difficult in emerging markets than in advanced economies.

The impact of exchange rates on inflation targets and on monetary policy goals has been a concern

for many emerging economies due to the weaker financial system and their susceptibility to external

shocks. Stone, Roger, Nordstrom, Shimizu, Kisinbay and Restrepo (2009) argue that the exchange rate

is more important as a policy tool for inflation-targeting emerging markets than for their counterparts

in advanced economies for a number of reasons. In emerging markets, a high exchange rate pass-

through indicates lower policy credibility and translates to a closer link between price and exchange rate

movements. Additionally, less developed financial systems in these countries correspond to more rigidity

in currency markets, which amplifies the impact of exchange rate shocks on the domestic economy.

Intervention into currency markets reflects the desire of central banks in emerging markets to mitigate

the impact of short-term currency fluctuations on output. Finally, active management of the exchange

rate is seen as a way to promote financial stability, which can also minimize the negative impact of

sudden stops in foreign currency inflows.

In contrast, Sek (2008) finds that the reaction of monetary policy7 to exchange rate shocks in three

inflation-targeting East Asian economies has declined after the East Asian crisis.6 A high exchange

rate pass-through in emerging markets makes it more difficult for central banks to target low inflation

rates and maintain price stability (Minella, de Freitas, Goldfajn and Muinhos, 2003, Fraga et al., 2003).

7The monetary policy measures used include money demand (M1), short-term interest rates, output gap, and inflation6The three economies are Thailand, Korea and Philippines.

10

-

Reyes (2013) argues that the lower pass-through effect is a natural reaction to the implementation of

inflation-targeting policies in emerging economies, but the effects of nominal exchange rate fluctuations

on inflation rates can still be felt. If the pass-through effect is on the decline, this may explain why Sek

finds a lower reaction of monetary policy to exchange rate shocks post-crisis.

An appreciation of the domestic currency can lead to lower output and inflation in future periods

due to expenditure switching and because import prices will not rise as quickly with the appreciation

(Taylor, 2001). The reaction of interest rates to an appreciation is indirect as interest rates react to

changes in inflation and real GDP instead of directly to fluctuations in the exchange rate. Taylor

concludes the reaction of policy makers to changes in the exchange rate by adjusting interest rates may

not improve performance because this mechanism is already build into the policy rule indirectly and

because the reaction may make swings in real output and inflation even worse. Additionally, changes

in exchange rates under floating exchange rate regimes may indicate changing productivity and should

not be negated.

4 Historical Analysis of Issuing Options: The Case of Colombia

Colombia has experimented with many different intervention tools in its recent history. The Colom-

bian central bank began systemic currency market intervention following the introduction of a floating

exchange rate regime and adoption on inflation-targeting monetary policy in 1999 (Uribe and Toro,

2005). It first started with the introduction of currency options for the purposes of reserve accumulation

and later to control for volatility. From 2000 to 2012, the average yearly purchase of US dollars by

the Colombian Central Bank was US$ 2.2 billion8, or an average of 1.7 percent of market transactions

(Echavarria, Melo, Tellez and Villamizar, 2013). From 2005 to 2007 as well as from 2010 to 2012, the

purchase of US dollars by the central bank was much larger, the latter reflecting a change in policy to

daily discretionary purchases.

Trading of Colombias currency represents approximately 0.05 percent of all currencies traded on a

net-gross basis, amounting to daily average trades of US$ 3.34 billion in 2013. The domestic interbank

forex market makes up only 25 percent of the total market for COPUSD. Domestic foreign exchange

markets in Chile and Peru represent similar characteristics, as can be seen in Table (1). As discussed

above, the majority of domestic forex transactions are interbank transactions. In Chile, for example,

interbank spot market transactions make up approximately 52 percent of all domestic spot transactions.2

8Sales were smaller at US$ 571 million2Based on data from Central Bank of Chile. Data from statistics on forex trading in the formal market. Represents sum ofinterbank transactions, total sales and total purchases in USD in Chile in 2013.

11

-

Table 1: Foreign Exchange Markets: Global vs. Domestic

Colombia2004 2007 2010 2013

Global Amount (USD Mil) 802 1,860 2,794 3,343Percent World Total 0.03% 0.04% 0.06% 0.05%

Domestic Amount (USD Mil) 396 780 1041 845Percent of Total Traded 49.38% 41.93% 37.26% 25.28%

Chile2004 2007 2010 2013

Global Amount (USD Mil) 2,462 4,003 5,544 11,956Percent World Total 0.09% 0.09% 0.11% 0.18%

Domestic Amount (USD Mil) 1,295 1,698 1,518 2,488Percent of Total Traded 52.59% 42.42% 27.38% 20.81%

Peru2004 2007 2010 2013

Global Amount (USD Mil) 306 805 1,425 2,171Percent World Total 0.01% 0.02% 0.03 % 0.03%

Domestic Amount (USD Mil) 81 140 477 841Percent of Total Traded 26.39% 17.42% 33.50% 38.72%

Global amount traded reflects average daily net-gross transactions. Domestic amount traded reflects interbank trading volume asreported by the central banks. Data for global transactions from Bank of International Settlements.

The Colombian peso has been experiencing steady appreciation since 2009. From 2002 to 2009, it

experienced a number of periods with high volatility, where the bid-ask prices on the market exchange

rate were notably different official exchange rate. Figure (2) illustrates the differences between the bid

price, ask price, and official exchange rate in Colombia from 2002 to 2014, as well as the differences

between the official rates and bid or ask prices. Since 2012, the spread between official rates and market

prices has been much lower than in previous periods.

Colombia is one of the few countries to date that have auctioned call and put options to mitigate

exchange rate volatility and accumulate reserves. For the purposes of reserve accumulation and decu-

mulation, the central bank auctioned options contracts on a monthly basis. The options were exercised

when the exchange rate appreciated or depreciated over than 20-day moving average mean, and the

amount to be auctioned in the subsequent month was determined at the end of each contract.

The volatility options with 30-day maturity were auctioned whenever the exchange rate changed

more that 4 percent of the 20-day moving average. The maximum exercise amount was US$ 180 million.

From 1999 to 2009, there were a total of 38 options contracts auctioned by the Colombian central bank.

The options intervention strategy was abandoned when the central bank switched intervention strategies

to a daily discrete intervention plan, where the central bank purchased an average of US$ 20 million

per day. From August 2012, the amount purchased varied from US$ 20 million to US$ 50 million daily.

The average intervention was 3.72 percent of total USD traded in the Colombian FOREX market, with

12

-

Figure 2: Colombian Peso Dynamics

The top graph represents the value of the official COPUSD exchange rate, the bid price and the ask price in the market. The bottom graph illustrates thedifference between the official exchange rate and the market exchange rates (bid price and ask price). The spread between official and market rates hasdiminished in recent years. Market rates from OANDA. Official exchange rate data from Banco Republica de Colombia.

13

-

a maximum intervention that totaled 33.6 percent of the market volume.

The auction of options contracts in Colombia were fully transparent and the benefits of these auctions

were derived from the hedging operations of market participants (Uribe and Toro, 2005). When issuing

options contracts, the main objectives of the central bank were to avoid excessive volatility in the

exchange rate in a way that would uphold inflation targets, to strengthen the international liquidity

position domestically, and smooth any deviations of the exchange rate from its long run trend. From

2000 to 2005, call options were deemed successful in influencing both the value of foreign exchange rate

and the volatility. The call options were able to mitigate the increasing depreciation trend in 2003 that

threatened inflation targets. Mandeng (2003) finds that volatility call options issued until 2003 were only

moderately successful. On the other hand, Uribe and Toro (2005) state that put options were successful

in the accumulation of reserves from 1999 to 2002. They also find that Colombias intervention policies

have been largely consistent with its goals of inflation targeting, such that changes in monetary policy

came first through interest rates, and then through intervention in currency markets.

Starting in 2008, the Colombian central bank began purchasing US$ 20 million daily, first for two

months in 2008, then in 2010 for five months, in 2011 for six months, and every month since 2012.

Following the policies of Chile and Israel for daily discretionary intervention, US$ 20 million is the

average of the daily purchases in those countries (Echavarria et al., 2013). Colombia abandoned the use

of options-based intervention once it began the daily purchase of US dollars. The change in policy has

been considered a good mechanism for accumulating reserves without promoting speculative behavior

because it is a consistent and transparent intervention.

Mandeng (2003) uses an event study to observe the impact of auctioning three call options on

exchange rate volatility, comparing the volatility before and after the time of maturity. At the time of

his paper, Colombia had only issued these three options as a means to control volatility, and Mandeng

finds them to be only slightly successful in lowering volatility. Using a similar approach, Table (2)

illustrates the same analysis for all the call and put options issued since 2002. Volatility is measured

as the annualized standard deviation of the log difference in daily exchange rates over a 10 day rolling

window. Comparing volatility 2, 5, and 10 days before and after the contract maturity yields similar

results, where volatility is successfully lowered only in 30 to 40 percent of the cases.

In Table (3) the volatility calculation spans a two day, five day and ten day window depending on

which period is observed. Volatility is measured as the annualized standard deviation of the log difference

in daily exchange rates with a rolling window of 2, 5, and 10 days. With this calculation volatility after

contract expiration compared to volatility at the time of maturity is lower in 52 to 58 percent of the

cases. Using the latter calculation with different rolling windows captures the volatility in exchange rates

14

-

related specifically to the period that is being observed. The previous calculation compares volatility

that includes exchange rates before, during, and after maturity, yielding misleading results.

Part of the reason that past volatility options contracts were only moderately successful in lowering

volatility in Colombia may be due to their sporadic issuance that went unhedged. Figures (3) and (4)

illustrate intervention with put options and call options respectively. The sporadic issuance of options

yields inconsistent results in lowering volatility. The benefits of greater liquidity, building markets

and increasing the flow of information between policy makers and traders occur when auctions of the

contracts occur consistently, as discussed in (Breuer, 1999).

Additionally, the Central Bank only issued either calls or puts, not bundles of calls and puts at

different strike prices. Auctioning bundles of calls and puts at different strike prices, while holding an

offsetting position increases the information flow between policy makers and traders of expectations,

lowers the chances of speculative attacks9, and mitigates some of the costs of hedging. The net hedging

position is lower for a mixed portfolio, therefore the position of the central bank in the spot market is

less disruptive than if it took only one side of the market. Though the Colombian central bank issued

only one side of the market at a time, there is no evidence that it engaged in dynamic delta hedging to

offset the risks associated with issuing volatility options.

In Tables (4) and (5), a simple regression tests the impact of the volatility options on the change in

the value of COPUSD from the day before maturity to the day the contract was exercised(t-1 to t), and

from the day of exercise to one day after maturity (t to t+1). The issuance of volatility calls options

had a significant, contemporaneous effect on exchange rate value at the time of maturity. At the day

of exercise of the call options, the change in COPUSD from the previous day was lower. The issuance

of volatility put options had a lagged effect on the exchange rate value. The exercise of put options

impacted the difference in value of the COPUSD the following day. In Table (5), the dummy variable

represents the size of the option relative to the total volume traded in one day. If the exercised volume

at maturity was greater than 20 percent of total volume, the dummy variable took on the value of one,

otherwise zero. Taking into consideration the relative size of the intervention did not significantly alter

the results, which may reflect the influence of volatility options through the expectations channel rather

than through the portfolio balance channel.

9Speculative attacks in currency markets occur when there is a massive sell off of a particular currency, leading to a significantdepreciation or devaluation of the currency, depending on whether the exchange rate regime is floating or fixed.

15

-

Table 2: Volatility Options Contracts Issued in Colombia - Part 1

Put OptionsDate Exercised Volatility Before Volatility After Success

USD Mil 10 Days 5 Days 2 Days 2 Days 5 Days 10 Days Short Mid Long17-Dec-04 179.9 4.57% 5.14% 5.0% 5.46% 4.75% 6.93% - Lower -11-Jul-06 180.0 15.94% 13.81% 14.14% 13.50% 15.83% 11.27% Lower - Lower31-Jul-06 180.0 11.27% 13.90% 13.93% 9.56% 9.99% 9.21% Lower Lower Lower10-Aug-06 33.8 14.17% 9.99% 7.77% 9.00% 6.75% 4.86% - Lower Lower30-Oct-06 180.0 2.81% 5.31% 4.22% 3.89% 4.32% 5.83% Lower Lower -21-Dec-06 10.0 3.64% 3.01% 3.14% 4.14% 4.21% 3.22% - - Lower30-Mar-07 0.0 4.37% 7.22% 6.21% 11.30% 12.37% 11.58% - - -3-May-07 180.0 7.75% 7.06% 3.15% 5.51% 7.45% 9.76% - - -15-May-07 180.0 5.51% 10.31% 9.76% 11.49% 8.18% 9.04% - Lower -4-Jun-07 14.5 9.04% 12.56% 15.05% 12.77% 15.80% 9.40% Lower - -20-Sep-07 180.0 9.00% 14.04% 10.23% 19.59% 19.91% 14.09% - - -11-Dec-07 0.0 12.51% 11.66% 9.09% 8.11% 6.73% 5.44% Lower Lower Lower15-Jan-08 102.7 5.63% 4.25% 6.75% 13.16% 15.25% 18.77% - - -20-Feb-08 168.0 8.25% 7.55% 6.91% 10.98% 10.41% 11.94% - - -25-Mar-08 62.5 18.50% 16.72% 13.10% 15.26% 9.82% 11.15% - Lower Lower4-Jun-08 180.0 5.64% 5.89% 5.20% 7.39% 7.81% 10.10% - - -18-Dec-08 2.3 3.87% 9.37% 8.38% 14.47% 15.35% 6.61% - - -17-Mar-09 179.0 12.93% 14.71% 12.31% 16.06% 17.80% 21.00% - - -27-Apr-09 0.0 11.84% 16.53% 16.61% 19.96% 18.32% 18.46% - - -3-Jun-09 180.0 11.60% 12.88% 14.93% 17.18% 16.20% 14.27% - - -22-Jul-09 179.5 12.37% 17.85% 16.27% 13.69% 11.87% 24.92% Lower Lower -

Call OptionsDate Exercised Volatility Before Volatility After Success

USD Mil 10 Days 5 Days 2 Days 2 Days 5 Days 10 Days Short Mid Long29-Jul-02 180.0 9.28% 9.90% 11.23% 10.55% 8.45% 6.57% Lower Lower Lower01-Aug-02 109.5 8.50% 10.63% 10.55% 6.14% 6.57% 20.24% Lower Lower -02-Oct-02 124.5 7.00% 10.70% 9.87% 9.72% 8.75% 6.25% Lower Lower Lower10-Apr-06 168.5 2.87% 4.08% 8.62% 10.52% 10.16% 10.98% - - -16-May-06 179.8 7.46% 6.49% 11.84% 17.90% 14.57% 13.37% - - -18-May-06 179.8 3.42% 11.86% 16.60% 15.34% 15.92% 16.88% Lower - -23-May-06 179.9 11.86% 17.90% 14.57% 16.25% 16.88% 13.01% - Lower -25-May-06 179.9 11.79% 15.34% 15.92% 17.57% 16.62% 12.78% - - -27-Jun-06 56.4 11.30% 9.96% 7.72% 7.19% 15.93 % 13.92% Lower - -26-Jun-07 176.5 13.13% 17.10% 16.28% 17.45 % 11.00% 10.41% - Lower Lower13-Aug-07 179.9 10.95% 8.62% 8.23% 9.01% 9.39% 5.38% - - Lower22-Nov-07 12.5 5.02% 9.35% 8.81% 10.57% 6.78% 10.81% - Lower -07-Oct-08 174.9 47.27% 32.35% 26.48% 34.99% 41.28% 49.22% - - -24-Oct-08 59.7 39.20% 46.64% 41.88% 24.36% 21.19% 11.89% Lower Lower Lower30-Jan-09 180.0 8.40% 12.32% 11.30% 15.13% 15.61% 14.12% - - -02-Feb-09 180.0 9.43% 11.30% 15.07% 15.61% 17.55% 17.43% - - -12-Feb-09 8.5 15.29% 17.55% 11.87% 18.07% 15.86% 15.81% - Lower -

Volatility is measured as the annualized standard deviation of the log difference in daily exchange rates over a 10 day rollingwindow. Using this calculation to test whether volatility is lowered after the option is exercised yields only moderatelysuccessful results partly because it accounts of movements in the exchange rate before, during and after the contractmaturity.

16

-

Table 3: Volatility Options Contracts Issued in Colombia - Part 2

Put OptionsDate Volatility at Maturity Volatility After Success

(2) (5) (10) 2 days 5 days 10 days 2 days 5 days 10 days17-Dec-04 1.10% 9.97% 10.19% 2.45% 10.91% 22.23% - - -11-Jul-06 18.34% 13.68% 11.11% 14.70% 9.51% 11.27% Lower Lower -31-Jul-06 0.00% 10.43% 14.17% 5.22% 4.09% 9.21% - Lower Lower10-Aug-06 12.84% 8.61% 9.21% 4.83% 2.91% 4.86% Lower Lower Lower30-Oct-06 0.00% 5.47% 4.29% 4.39% 4.09% 4.17% - Lower Lower21-Dec-06 5.33% 5.24% 4.34% 2.76% 1.90% 3.22% Lower Lower Lower30-Mar-07 7.62% 5.39% 6.76% 21.91% 17.03% 11.58% - - -03-May-07 12.24% 7.53% 5.82% 0.05% 7.66% 9.76% Lower - -15-May-07 18.20% 10.86% 11.94% 0.21% 4.14% 9.04% Lower Lower Lower04-Jun-07 0.00% 17.37% 14.65% 0.32% 11.99% 9.40% - Lower Lower20-Sep-07 40.66% 27.97% 20.43% 2.48% 8.03% 14.09% Lower Lower Lower11-Dec-07 4.66% 5.29% 8.25% 1.40% 7.62% 5.44% Lower - Lower15-Jan-08 24.67% 15.47% 12.06% 8.36% 12.47% 18.77% Lower Lower -20-Feb-08 10.41% 9.01% 7.31% 24.88% 12.72% 11.94% - - -25-Mar-08 0.00% 0.00% 12.69% 24.45% 14.70% 11.15% - - Lower04-Jun-08 10.42% 7.63% 6.15% 13.33% 8.88% 10.10% - - -18-Dec-08 11.55% 18.34% 14.09% 12.20% 5.13% 6.61% - Lower Lower17-Mar-09 30.36% 18.51% 16.46% 4.44% 17.57% 21.00% Lower Lower -27-Apr-09 0.00% 8.38% 15.26% 20.20% 24.92% 18.46% - - -03-Jun-09 1.05% 19.55% 17.48% 1.25% 3.42% 14.27% - Lower Lower22-Jul-09 13.85% 10.28% 14.96% 7.38% 14.13% 24.92% Lower - -

Call OptionsDate Volatility at Maturity Volatility After Success

(2) (5) (10) 2 days 5 days 10 days 2 days 5 days 10 days29-Jul-02 0.00% 10.43% 10.59% 11.46% 7.07% 6.57% - Lower Lower01-Aug-02 7.41% 7.89% 10.25% 2.60% 6.28% 6.25% Lower Lower Lower02-Oct-02 5.67% 10.59% 11.44% 4.31% 11.33% 9.76% Lower - Lower10-Apr-06 0.00% 10.46% 8.80% 15.29% 7.75% 10.98% - Lower -16-May-06 27.25% 16.50% 16.60% 21.13% 11.51% 13.37% Lower Lower Lower18-May-06 21.13% 19.50% 17.90% 15.17% 8.71% 17.57% Lower Lower Lower23-May-06 22.66% 13.76% 15.92% 17.38% 24.77% 16.62% Lower - -25-May-06 17.38% 15.72% 16.25% 22.08% 19.10% 15.32% - - Lower27-Jun-06 0.00% 9.39% 7.07% 0.84% 20.48% 13.92% - - -26-Jun-07 11.29% 13.89% 14.45% 8.19% 14.58% 10.26% Lower - Lower13-Aug-07 0.00% 18.11% 12.70% 19.09% 32.76% 27.18% - - -22-Nov-07 10.68% 8.03% 10.13% 8.85% 5.52% 10.81% Lower Lower -07-Oct-08 55.54% 40.19% 33.43% 31.23% 47.03% 49.22% Lower - -24-Oct-08 20.84% 28.82% 44.15% 14.50% 10.01% 14.69% Lower Lower Lower30-Jan-09 8.42% 16.65% 14.44% 18.93% 15.11% 14.12% - Lower Lower02-Feb-09 0.00% 16.76% 15.29% 20.85% 17.45% 17.43% - - -12-Feb-09 0.26% 18.14% 17.43% 3.81% 6.17% 15.81% - Lower Lower

Volatility is measured as the annualized standard deviation of the log difference in daily exchange rates with a rolling window of 2, 5,and 10 days. Comparing volatility at the time of maturity to 2, 5, and 10 days after maturity yields more successful results. After theoption is exercised, volatility decreases in 52 to 58 percent of all cases.

17

-

Figure 3: Volatility Put Options Interventions

Data from Banco Republica de Colombia.

Figure 4: Volatility Call Options Interventions

Data from Banco Republica de Colombia.

18

-

Table 4: Impact of Options Issued on COPUSD

Dependent Variable: Change in COPUSD (t-1 to t)Calls Puts

C 12.90** 0.02(2.07) (0.23)

Amount Issued (Calls) -0.0717**(2.07)

Amount Issued (Puts) -0.0002(-0.35)

R2 0.22 0.10N.obs 17 21

Dependent Variable: Change in COPUSD (t to t+1)

Calls PutsC -3.12 0.15***

(0.81) (2.64)Amount Issued (Calls) 0.02

(0.82)Amount Issued (Puts) -0.0009***

(2.62)R2 0.04 0.27N.obs 17 21

The dependent variable is the change in exchange rate value of COPUSD during time of option maturity.It is calculated as the [St/St1] 1. The maturity of put options has a lagged impact on the exchangerate, whereas the maturity of call options has a contemporaneous impact on the exchange rate.

Table 5: Impact of Options Issued on COPUSD with Dummy

Dependent Variable: Change in COPUSD (t-1 to t)Calls Puts

C 12.42* 0.03(1.94) (0.30)

Amount Issued (Calls) -0.007*(-1.94)

Amount Issued (Puts) -0.0002(-0.35)

Dummy -0.003 0.0015(0.63) (0.37)

R2 0.24 0.01N.obs 17 21

Dependent Variable: Change in COPUSD (t to t+1)Calls Puts

C -2.88 0.15**(0.73) (2.43)

Amount Issued (Calls) 0.016(0.73)

Amount Issued (Puts) -0.0008**(2.39)

Dummy 0.0015 - 0.0017(0.62) (0.60)

R2 0.06 0.28N.obs 17 21

The dependent variable is the change in exchange rate value of COPUSD during time of option maturity.It is calculated as the [St/St1]1. The maturity of put options has a lagged impact on the exchange rate,whereas the maturity of call options has a contemporaneous impact on the exchange rate. The dummyvariable represents the size of the option relative to the total volume traded in one day. If the exercisedvolume at maturity was greater than 20 percent of total volume, the dummy variable took on the valueof one, otherwise zero. The values in parenthesis are t-statistics, and *, **, *** represent significance of10, 5, and 1 percent.

19

-

5 Trading Strategies for the Central Bank

As seen Figure (1) above, holding only one side of the market, either call or put, would expose the

central bank to risks associated with a drastic movement in the exchange rate that can be caused by

speculative attacks or macroeconomic fundamentals. Because the central bank is such a large player in

the market, hedging one side of the market may introduce adverse signals to traders. The central bank

has the means to move the market in its favor. Therefore, market participants may be weary to enter

into contracts with the central bank if there are any incentives for or suspicions of market manipulation.

Entering into long contracts in either the put or call position will expose the currency market to

excessive volatility through the hedging behavior of the traders on the opposite side of the contract.

This is exactly the opposite to the goals of the central bank. It would also create opportunities for large

market makers to hold short positions and diminish the control of the central bank over expectations of

market participants.

A short strangle trading strategy combines the short put option and short call option strategy. The

short strangle strategy can be a good one for the central bank if there are limited risks of drastic exchange

rate movements. The strategy allows the central bank to be the main market maker, exert control over

the currency options market, and ensure liquidity in both the spot and options market.

Despite the benefits of this strategy, there are a number of sizable drawbacks of pursuing such the

short strangle strategy for the central bank specifically. Issuing call and put options exposes the central

bank to unlimited downside risk with limited gains, as can be seen in Figure (5). Such a strategy would

need to be dynamically delta hedged to protect the central bank from losses associated with drastic

movement in the exchange rate. Hedging such a position through an offsetting spot market position

would force the central bank to contribute to the persistent appreciation or depreciation of the exchange

rate. The position of the central bank in the spot market to offset the risks of the short options counters

the goals of the central bank to ensure stable exchange rate values and limit the volatility in the market.

Authors such as Breuer (1999) have noted that dynamically delta hedging a long option contract

position can introduce stabilizing forces into currency markets. By dynamically delta hedging a long

call on USD, the trader will hold an offsetting short position in USD, for example. If the currency

(COPUSD) depreciates, the trader will sell USD in domestic spot market. By doing so, the supply of

USD in the spot market rises and therefore introduces appreciationary pressure that can counter the

depreciation of the COP through the portfolio balance channel. Similarly, by holding a long put position,

the offsetting spot market position would be long in USD. As the currency depreciates, the long put will

expire out of the money and not be exercised. The trader will sell USD (or buy COP) in spot market

to offset his position at maturity of the option contract. The offsetting spot market position contributes

20

-

Figure 5: Short Strangle Option Strategy

Short strangle presents an options trading position with unlimited risks and limited gains. The strike price for the short call and short put position equal atK.

to a counteracting appreciation pressure on the depreciation of the COP.

Due to the limited risks associated with a long options position, few traders would have the incentives

to engage in dynamically delta hedging the position. Therefore, despite the fact that the hedging of a

long position may introduce a stabilizing force into the currency market, the central bank cannot rely

on market participants to act in such a way.

The optimal strategy for the central bank will be one that includes both long and short positions

in call and put options. Taking on both long and short positions in the option contract is considered a

butterfly spread trading strategy. It is a neutral strategy with limited gains and limited downside risks.

Call butterfly spreads consist of the trader holding two long and two short positions in the call option.

Put butterfly spreads consist of the trader holding two long and two short positions in the put option.

In each, the options with a high and low strike price are purchased, whereas two options in the middle

strike price are issued. The strike prices for the long position are K1 and K3 in Table (6). The strike

price (K2) for the short position is the midpoint price between the long strike prices.

The traditional butterfly strategy has some benefits and drawbacks to reaching the goals of the

central bank. Dynamic delta hedging of such a strategy is typically unnecessary, since holding a long

and short position in each contract already hedges the risks to the trader of any movement in value of

the underlying asset.

For the central bank to have a strategic position in the spot market that is determined by the

dynamic delta hedge, which increases information flow, domestic liquidity and which lowers costs of

intervention, the optimal portfolio position for the central bank will be an alternative to the butterfly

strategy. Specifically, the optimal strategy will be for the central bank to write or short one call or one

21

-

Figure 6: Call and Put Butterfly Spreads

Call and put butterfly spreads present a neutral position with limited risks and limited gains. The middle strike price for the short position is determined asK1+K3

2.

put option contract at one strike price, and buy or long two call options or two put options at strike

prices that are slightly out of the money.

The alternative strategy that is used to simulate the position of the central bank in the spot market

is a derivative of the butterfly strategy. The gains and losses will be limited, and the net position of the

central bank in the spot market will one similar to hedging a long position. The central bank will be

able to issue contracts in the domestic market, purchase long positions in the global market, and hedge

its portfolio in the domestic spot market.

The long positions of the alternative butterfly strategy will hedge the risks associated with the short

position. By dynamically delta hedging the net portfolio position with an offsetting position in the spot

market, the central bank will have a position in the spot market that will stabilize the movement of the

domestic currency, smooth volatility, and influence the expectations of traders in a favorable way so as

to contribute to the stabilization goals of policymakers.

By holding and issuing bundles of call and put options at varying strike prices, the central bank

signals to the market that it is taking two positions. It is betting on the exchange rate to appreciate or

depreciate, and therefore is protecting itself by nullifying the net impact when the exchange rate moves

in either direction. The signal to the central bank from the market will come from how many of each

option will be purchased by market participants. If traders anticipate the currency to depreciate, more

call options will be purchased to hedge against the movement in the exchange rate. Between the date

of issue and maturity of the contract, the central bank will hedge its net portfolio position in the spot

market, which will provide a stabilizing force in the market.

22

-

6 Analytical Approach

In the following section, we will address the analytical approach used to determine how options contacts

may be used by central banks for intervention into currency markets. First, we will present the Garman-

Kohlhagen option pricing model, the alternative butterfly strategy and dynamic delta hedging. Next,

we will address the simulation of exchange rate movements used for analysis, as well as the derivation of

option prices and hedging positions based on the simulated exchange rates. The main objective of the

research is to test whether an alternative butterfly strategy with dynamic delta hedging can be a viable

strategy for central bank currency market intervention. The goal is to understand whether dynamic

delta hedging under this scenario is stabilizing and whether this strategy can provide the central bank

with a low cost, targeted intervention plan.

6.1 Alternative Butterfly Strategy with Dynamic Delta Hedging

The Garman-Kohlhagen option pricing model is a derivative of the Black-Scholes option valuation model.

The valuation of call options can be defined by the following:

vcall = erSt

lnStK +(r r +

2

2

)

2

(1)The valuation of a put option is defined as:

vput = erSt

lnStK +(r r +

2

2

)

2

(2)where = T t, or time to maturity, is the standard normal distribution function, is the volatility

of the underlying asset, r and r are the domestic and foreign risk free interest rates, St is the spot rate,

and K is the strike price. In the analysis presented in this segment of research, the purchaser of the call

(put) option, or the agent that is long in the option, has the right but not the obligation to buy (sell)

one unit of foreign currency or USD. The issuer, which will be the central bank, has the obligation to

sell (buy) one USD to the call (put) holder upon maturity if the option is exercised. All options in this

research are European options, and therefore cannot be exercised until maturity.

Dynamic delta hedging allows the issuer of the option to take an offsetting position in the spot

market to cover their risk. The delta of the option is the responsiveness of the option value to changes

in the value of the underlying asset and is the basis for risk management using dynamic delta hedging.

The call and put deltas the derivative of the option value with respect to the spot exchange rate, and

23

-

can be presented as follows:

vcall = er(x+

2) (3)

vput = er

((x+

2) 1

)(4)

where x =lnStK +

(rr+22

)

2

and 0 vcall 1 for call deltas and 1 vput 0 for put deltas.

For traders in the short option position, the trader would take a long position in the spot market

for the underlying asset by delta units. For small changes in the underlying, the value of the hedge

will change by an equal amount in the opposite direction. The trader incrementally adjusts his position

throughout the time to maturity. In reality, traders hedge their entire portfolios, not single options

contracts. Therefore, the trader takes into consideration their net position when determining the dynamic

hedge (Chen, 1998, DeRosa, 2011).

As discussed by a number of authors mentioned above, dynamic delta hedging of a short option

position by the central bank may create additional destabilization in currency markets. These approaches

consider only the scenario under which the central bank issues only calls or only put options, where in

fact the hedging position would exacerbate the movement in the exchange rate. By positioning itself in

the alternative butterfly strategy, the central bank can strategically hedge its net position in a way that

would counteract the persistent appreciation or depreciation of the currency.

If we consider an example where there has been persistent appreciation over the last 10, 20 or 30

days, the central bank can hold and issue a bundle of calls and puts. The put options will be exercised,

while the call options will expire out of the money. By hedging the net position, the central bank

would be buying USD in the spot market to hedge both the call and put option position. Through

the portfolio balance channel, it would therefore introduce depreciationary pressure to counteract the

persistent appreciation.

In contrast, if there is a persistent depreciation over the last 10, 20 or 30 days, the call options will be

exercised, while the put options will expire out of the money. By hedging the net portfolio position, the

central bank would be selling USD in the spot market for both the call and put option position. Through

the portfolio balance channel, it would therefore introduce appreciationary pressure to counteract the

persistent depreciation.

The stabilization effect of holding and issuing a tailored bundle of call and put options is twofold.

First, as discussed in Machnes (2006) and Sarwar (2003), the amount of calls and puts that are traded

will effect the movement of the exchange rate and future volatility. Specifically, Machnes finds that

trading of calls (puts) corresponds to greater depreciation (appreciation) pressure from one day to the

next. Secondly, the dynamic delta hedging of a tailored net position will contribute to a position in the

24

-

spot market that counters the persistent movement of the exchange rate.

6.2 Simulation of Options Strategy

To understand the potential for central banks to use options as a currency market intervention tool, we

approach the analysis in three steps. Based on data from Colombia for COPUSD spot rates, we first

simulate exchange rate movements using first a random process and then an Ornstein-Uhlenbeck process

with GARCH volatility. The second simulation allows for price volatility to remain non-constant and

ensure positive exchange rate values. Next, we use data from Colombia for the domestic interest rate,

an estimation for volatility, and US three month t-bill rates for the foreign interest rate to calculate call

and put prices and the corresponding deltas with the simulated exchange rate values. Lastly, using the

simulated time series, we calculate the dynamic delta hedging position, or spot market position during

the period when the option is issued to date of maturity, for the central bank when it issues only calls,

only puts, or a bundle of both calls and puts, or a alternative butterfly strategy.

6.2.1 Simulating Exchange Rates

Since Colombia has been intervening on a daily basis in its currency markets since 2010, to appropriately

analyze the potential for using an options-based intervention strategy without bias in the data, we

employ a simulated time series to calculate options prices and the dynamic delta hedging position for

the central bank. We simulate the exchange rate using first a random process with 90 repetitions and

then the Ornstein-Uhlenbeck process with GARCH volatility for 200 repetitions each with a time period

of 30 days.

In the random process simulation of exchange rates, we create two scenarios that represent persistent

appreciation and persistent depreciation of the COPUSD. We use a uniformly distributed psuedorandom

generation of exchange rates based on the value of COPUSD on October 20, 2012. This process controls

the simulation environment to test the option pricing and dynamic delta hedging position when the

exchange rate is moving strongly in one direction. It provides a clear picture of how the strategic

hedging behavior of the central bank may introduce stabilizing pressure into currency markets.

Simulating the exchange rate movement using an Ornstein-Uhlenbeck process with GARCH volatility

is an optimal approach because it allows for non-constant volatility while ensuring positive exchange

rate values. The Ornstein-Uhlenbeck process is a stochastic process that is stationary, Gaussian and

Markovian. Therefore, time shifts leave joint probabilities unchanged, the vector of values if multivariate

normally distributed, and the future is determined only by the present and not past values (Finch,

2004). The process is also mean-reverting and has been used to model interest rates, exchange rates and

25

-

commodity prices in financial mathematics.

The Ornstein-Uhlenbeck process must first satisfy the following linear stochastic difference equation:

dXt = (Xt )dt+ dWt (5)

where Wt is a Brownian motion so that t 0. In the asymptotically stationary case, , , are constants

which yield the following moments:

E(Xt | X0) = + (c )et (6)

Cov(Xs, Xt) =2

2

(e|st| e(s+t)

)(7)

To follow a Brownian motion, = c = 0, = 1 and tends to zero. Here, the variance, is positive

and constant. To simulate exchange rate movements, it is preferable for the variance or volatility to be

non-constant. Therefore, to alter the process, is determined with a GARCH(1,1) process.

Modeling volatility based on GARCH(p,q) model is typical in the financial mathematics literature,

and is used extensively by professionals and academics alike. Modeling stochastic volatility using the

GARCH process assumes that the randomness of the variance process varies with the variance of the

model, allowing volatility to be non-constant. The standard GARCH(p,q) model is defined as:

2 = 0 + 12t1 + ...+ q

2tq + 1

2t1 + ...+ p

2tp

2 = 0 +

qi=1

i2ti +

pi=1

i2ti (8)

The structure of the volatility model can be defined as

xt = t() + t (9)

t = t()zt (10)

where

2() = E (xt t())2 | Ft1 (11)

where Ft1 is the information set available at time t, t() is the dynamics of the conditional mean set

by an ARMA(p,q) process, t is the residual term, and is the vector of unknown parameters (Jondeau,

Poon and Rockinger, 2007). Volatility in this model is an exact function of a set of given variables.

Specifically, for the process presented below the known variables used to calculate volatility are past

26

-

values of the COPUSD exchange rate.

After simulating 200 processes, we calculate the average difference in exchange rates over thirty days

for each process. Based on the average change in exchange rates over thirty days, we segment the

processes into two groups for additional analysis. The first group experienced on average a negative

change in exchange rates, or a period of appreciation of the COPUSD. The second group experienced

on average a positive change in exchange rates, or a period of depreciation of the COPUSD. The groups

will be referred to below as appreciation-periods and depreciation-periods to distinguish between the

prior movements of the exchange rate.

The reason for segmentation into two groups is to account for the appropriate distribution of calls

and puts issued in the alternative butterfly strategy bundle. During periods of appreciation, a put-

call ratio below one would ensures the central banks dynamic delta hedging strategy will introduce

depreciationary pressure into the market through net purchase of USD over the period to maturity. In

addition, with more calls exercised at maturity, this will also contribute to counteracting the appreciation

(Machnes, 2006). During depreciationary periods, a put-call ratio greater than one will yield pressure

from the central bank that may counter the rise in COPUSD and introduce more stability into the

market. Segmenting the simulated processes into two groups makes this analysis much easier to conduct

and interpret.

6.2.2 Calculating Options Bundle and Dynamic Delta Hedging Position

To calculate the dynamic delta hedging position and option prices, we first start with deriving the

volatility that will be used for analysis. In this model, we use the standard deviation of the log difference

of the exchange rate over ten days.2 The next step is to determine the strike prices that will be used to

calculate the option prices. The set of strike prices in the results presented below are defined as follows,

where St represents the spot market exchange rate at time t:

Kt,1 = 0.9975 St

Kt,3 = 1.0025 St

Kt,2 =Kt,1+Kt,3

2

After the volatility and strike prices are determined, we determine the call and put prices, as well

as the deltas of each using the Colombia risk free interest rate, the US risk free interest rate, and the

simulated exchange rate series discussed above. The time to maturity for all contracts is 30 days.

To determine the dynamic delta hedging position of the central bank, we calculate for each option

the total shares purchased on a daily basis, the daily interest and cumulative costs, and the end of

2Volatility measured over a 5, 10 and 20 day period were estimated with little difference in analysis.

27

-

period cumulative costs, payoffs and profits. The daily total shares purchased are the daily option delta

multiplied by the option contract size, which is assumed to be USD$ 10,000.

The cumulative costs at t = 1 are the total shares of USD purchased in the domestic currency or

SharesUSD,t. For t > 1, cumulative costs are calculated as:

CostCum,t = CostCum,t1 + CostInt,t1 + SharesUSD,t

The interest costs are determined as:

CostInt,t =(er

(t+1)365

t365 1

)CostCum,t

The end of period cumulative cost for the long position is calculated as:

CostCum,T = CostCum,t=T + TST

The end of period cumulative cost for the short position is calculated as:

CostCum,T = CostCum,t=T TST

where is the number of shares per contract, or US$ 10,000. The end of period payoff for call options

is:

Payoffcalls = max(ST K, 0)

and for put options:

Payoffputs = max(K ST , 0)

For the long position, the net gains are equal to the payoff at the end of the period, and the net losses are

equal to the cumulative delta hedging costs over the 30 days plus the premium paid for the contract. For

the short position, the net gains are equal to the premium, and the net losses are equal to the cumulative

delta hedging costs over the 30 days plus the payoffs. Table (6) presents a summary of calculations.

Theoretically, the profit or loss for the issuer when dynamically delta hedging should be zero.

7 Currency Options as a Central Bank Intervention Tool

The goals of research are to analyze whether the net dynamic delta hedging position for an alternative

butterfly strategy for a bundle of call and put options is smaller than holding a one-sided position, to

understand if such a hedging strategy may introduce pressure into the market to counteract the current

movement of the exchange rate and to determine whether the costs to issue such a portfolio position

while hedging are lower than the costs of daily currency market interventions. It is assumed that one

contract is for $ 10,000 USD, and that the central bank issues a total of 10,000 contracts at one time.

28

-

Table 6: Summary of Dynamic Delta Hedging Cost Calculations

End of Period (T = 30)Long Call Position Short Call Position Long Put Position Short Put Position

Cumulative Hedging Costs CostCum,t=T +TST CostCum,t=TTST CostCum,t=T +TST CostCum,t=T TST

Payoff max(ST K, 0) max(ST K, 0) max(K ST , 0) max(K ST , 0)

Premium CallPrice CallPrice PutPrice PutPrice

Net Gains Payoff Premium Payoff Premium

Net Losses Hedge Costs + Pre-mium

Hedge Costs + Payoff Hedge Costs + Pre-mium

Hedge Costs + Payoff

Cost calculations to the central bank to dynamically delta hedge its net portfolio position over an option contract period of 30 days. STrepresents the spot exchange rate at maturity, or t = T . represents the contract size which is US$ 10,000. CostCum,t=T represents thecumulative dynamic delta hedging cost on the last day of the contract or t = T . T is the delta of the option contract at t = T where T = 30.

To understand the potential for using currency options as a central bank tool for intervention into

foreign exchange markets, we start first with the simulated exchange rates for COPUSD over 90 repeti-

tions under scenarios with persistent appreciation and persistent depreciation. Figure (7) illustrates the

simulation. Using these simulations introduces a controlled environment under which we can first test

the alternative butterfly strategy with dynamic delta hedging.

Figure 7: Series of Simulated Exchange Rates

Exchange rates are simulated as a random distribution to represent periods of appreciation and depreciation. The start value of simulation is based on 10day average COPUSD exchange rates ending in October 20, 2012.

Figures (8) and (9) calculate the dynamic delta hedging position and daily cumulative costs of hedging

during a period of depreciation. The daily shares purchased represent the actual amount of USD the

central bank is buying or selling in the spot market based on the net portfolio position and is determined

29

-

by the deltas of each option contract in the portfolio. The cumulative daily hedging costs include the

interest costs and costs of purchasing shares of the foreign currency in the spot market.

There are three scenarios depicted in each figure. The first is a call butterfly strategy, where the

central bank is holding (long) and issuing (short) only call options. The initial spot market position is

substantial, requiring the central bank to sell approximately $ 60 million USD in the spot market in

one day. Throughout the period to maturity, the net portfolio position will require the central bank to

continue selling USD in the spot market to dynamically delta hedge its options portfolio. By doing so,

it will in turn introduce a counteracting pressure to the persistent depreciation. Under a put butterfly

position, the central bank initially conducts large purchase of USD in the spot market and subsequently

sells off its initial spot market position throughout the period to maturity.

The net dynamic delta hedging position of both strategies allows the central bank to have a smaller

initial position in the spot market, but it continues to sell USD over the period to maturity. Through

dynamically delta hedging its net portfolio position, the central bank has a clear strategic approach to

its spot market position, one that also introduces a stabilizing force into currency markets through the

portfolio balance channel. Altering the put-call ratio to represent more call options, as seen in Figure

(9), strengthens the position of the central bank on the initial day of the contract, but does not change