1.6962!2008_334

-

Upload

himanshu-dogra -

Category

Documents

-

view

217 -

download

0

Transcript of 1.6962!2008_334

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 1/74

1 (74)

Supply Chain Management in the Swedish SteelIndustry

Av

Gustav TerlandJonathan Mankowitz

Examensarbete 2008-xxxKTH Industriell ProduktionSE-100 44 STOCKHOLM

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 2/74

2 (74)

SUPPLY CHAIN MANAGEMENT IN THE

SWEDISH STEEL INDUSTRY

HAS THE NICHE STRATEGY IMPLIED LOST FOCUS ON PRODUCTION PROCESSES INFAVOR OF PRODUCTS?

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 3/74

3 (74)

ABSTRACT

This research aims to investigate Supply Chain Management in the Swedish steel industry. Morespecifically, how actors in the industry regard their supply chains in relation to their overallstrategy and what implications industry specifics have when the flow of material and informationis to be optimized. Furthermore, this thesis looks into the reasons behind value chain positioning;is it desirable to encompass all the activities in the value chain into the core businesses(integration) or rather focus on a particular field of work? What are the reasons behind a certain

positioning strategy? In order to bring clarity to those questions, in-depth interviews have beenconducted with five of the largest Swedish steel companies. An additional survey has been sent toa selection of other steel companies with a Swedish connection. The interviews and surveys,together with a financial analysis of the companies, constitute the empiric base for this study.

The findings suggest that forward vertical integration is a trend among Swedish steel companiesand that the proximity to the end-user of steel is the main motive for the deployed strategy.Despite the fact that margins are generally lower for the latter parts of the value chain, the steel

producers see financial incentives for encompassing these activities. Stabilized demand andsecured sales volumes are reasons why these activities are taken over by the producers.

The Swedish steel companies have chosen to focus on high value niche products since they cannever compete with low cost bulk producers. The niche strategy has made efficiency efforts lesslucrative than increasing margins by developing leading and customized products.

Furthermore, as an effect of the product focus, delivery accuracy is one of the leading issues for

the industry. Even though all companies are aware of this problem and strive to improve deliveryaccuracy, the absence of a top performer in the industry takes away the pressure for realimprovements. Acceptance by customers, due to the favorable market situation for steel

producers, is further an implication why this matter is currently not critical for survival.

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 4/74

4 (74)

1 BACKGROUND & PURPOSE ................................................................5

1.1 BACKGROUND ............................................................................................................................................... 5 1.2 PURPOSE .......................................................................................................................................................... 6

2 METHOD..................................................................................................7

2.1 SELECTION CRITERIA FOR STEEL COMPANIES.................................................................................. 7 2.2 SURVEY ............................................................................................................................................................ 8 2.3 IN DEPTH INTERVIEWS ............................................................................................................................... 9 2.4 METRICS ........................................................................................................................................................ 10

3 THEORETICAL FRAMEWORK ............................................................11

3.1 SUPPLY CHAIN ............................................................................................................................................. 11

4 ANALYSIS AND RESULTS ..................................................................15

4.1 INTERVIEWS ................................................................................................................................................. 15 4.1.1 Case Studies ................................................................................................................................................ 15 4.1.2 Case Study Conclusions - Common Characteristics In The Swedish Steel Industry..............................42

4.2 SURVEY .......................................................................................................................................................... 44 4.2.1 Tools Deployed ........................................................................................................................................... 44 4.2.2 SCM-Score .................................................................................................................................................. 48 4.2.3 AHP - Potential Cost Savings And Profit Possibilities ............................................................................ 49 4.2.4 Survey Conclusions – Methods deployed .................................................................................................. 50

4.3 VALUE CHAIN – WHERE IS THE GOLD IN THE STEEL INDUSTRY?.............................................51 4.3.1 Profit Along The Value Chain.................................................................................................................... 51 4.3.2 Value Chain Conclusions - Reasons Behind Value Chain Positioning Strategies .................................52

5 CONCLUSIONS.....................................................................................53

6 CRITICAL REVIEW AND SUGGESTIONS ..........................................56

7 REFERENCES.......................................................................................57

APPENDIX 1 – DESCRIPTIONS & BEST PRACTICES ............................60

APPENDIX 2 – DESCRIPTION OF SCOR AREAS....................................63

APPENDIX 3 – COMPANIES: INTERVIEWED/SURVEYED .....................64

APPENDIX 4 – SURVEY .............................................................................65

APPENDIX 5 – CALCULATIONS & SOURCE DATA................................70

APPENDIX 6 – AHP METHODOLOGY ......................................................72

APPENDIX 7 – SURVEY RESULT .............................................................74

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 5/74

5 (74)

1 BA C K GR O U ND

&P URP O S E

1 BACKGROUND & PURPOSE

1.1 BACKGROUND

Historically the focus of improvement methods within Supply Chain Management (SCM) hasvaried substantially. This is partly due to new manufacturing technologies and strategies, but alsoa result of the changing state of the world economy.

In the 1980s, as manufacturing strategies such as lean, total quality management and just in timespread to a broader audience, reduced costs became the focus within SCM (Simchi Levi et al.,2007). The intense pressure to reduce costs further contributed to the trend of outsourcing in the1990s, along with the focus on increased availability, and supply chain agility (Simchi Levi et al.2007; Lindh 2004; Christopher & Towill 2000). Recently the risk management factor has beenintegrated to balance the focus on cost (Simchi Levi et al. 2007), and the importance of

optimizing entire value- and supply chains rather than just parts of separate companies - such asinventory, manufacturing or transports - has increased (Lindh 2004; Stadtler & kilger 2005).

Furthermore, it is apparent that the focus lies on costs when the economy is souring, while productivity is prioritized during upturns (Lindh 2004). The effects of capacity restrictions duringupturns can be minimized by closer relationships with suppliers and customers, in other words;integration, which is the most apparent trend within SCM related literature today (Simchi Levi etal. 2007; Lindh 2004; Christopher & Towill 2000). It can also be noted that the past 5 years(since 2003) have been characterized by strong growth in the global steel market, much due to theindustrial investments in China and the rest of Asia (Jernkontoret 2006).

The Swedish steel industry’s characteristics are largely a result of the energy crisis in the 1970s.One of the most apparent reasons for this is that the Swedish ship building industry almostdisappeared. This industry was at the time the second largest in the world and consumed most of the domestically produced steel. In addition the building sector reduced its activities and thedomestic steel consumption shrunk by 50% from 1975 to 1990. As a result of this, the industrywas restructured and the remaining companies specialized the production intensely towards niche

product groups, with more value added than traditional steel. As a consequence, they no longer compete with each other. During this period there was also an intense focus on cost reducingstrategies, which is characteristic for a recessionary industry. (Nyquist O. 1998)

The steel industry in general has distinct characteristics that separate it from other industries. For

example the products have relative long life-cycles, the companies are highly capital intensiveand there is a global overcapacity of steel. This means that low cost production is, in general, a

prerequisite to become a market winner and companies cannot rely on increased prices to ensuretheir profitability (Standard & Poor’s 2007). The Swedish steel industry, specifically, is highlyspecialized and therefore should not comply with the strategies used globally, where volumes andeconomies of scale are the center of attention today (Nyquist O. 1998). This makes anexamination of SCM-strategies in Swedish companies especially interesting.

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 6/74

6 (74)

1 BA C K GR O U ND

&P URP O S E

1.2 PURPOSE

The main purpose of this thesis is to describe Supply Chain Management from the view of theSwedish Steel Industry. In other words, how do the actors in this industry regard their SupplyChains in relation to their overall strategy and what implications do industry specifics have when

the flow of material and information is to be optimized? The following sections break down themain purpose into more tangible objectives.

• Is there an unequivocal emphasis on certain Supply Chain areas by companies in the steelindustry? And do the companies face the same challenges i.e. are the problems due toindustry specifics or do they exist isolated?

• What are the reasons behind value chain positioning? Is it favorable to be integrated allalong the value chain or is it more attractive to focus on certain activities from a valuecreating point of view?

• What methods are used in the different areas of the Supply Chain and is the purpose of thedeployed methods in-line with the academic research. Do they really aim at increasinginformation transparency and system wide efficiency?

• Are there any correlations between the use of Supply Chain Management methods andKPIs regarding performance and value creation?

• What areas of the Supply Chain are regarded as most strategically important and is thiscoherent with current emphasis on overall business strategies?

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 7/74

7 (74)

2 ME T H O

D

2 METHOD

This thesis contains several sources of information to address the above stated purpose. Thetheoretical part consists of well-known sources complemented with academic articles on the

subject.

The empirical part of the thesis consists of two main sources, in-depth-interviews and a survey.The survey was sent out to get the broad picture of what specific tools are deployed in theindustry, while the interviews have been conducted in order to understand the reasons behindcertain SCM strategies. This material has been complemented by information from thecompanies’ annual reports.

2.1 SELECTION CRITERIA FOR STEEL COMPANIES

Members of the trade organization Jernkontoret have been selected to constitute the market,

which is referred to as the Swedish steel industry. To ensure that the selected companies are a fair representation of the Swedish market, the selection of companies has been complemented withsteel companies listed by Statistiska Centralbyrån (SCB).

Steel companies have been defined as companies producing steel, from steelworks to processedsteel. Hence, excluding the mining industry (raw materials) and the engineering industry(modular production) according to figure 1. The last stage included here encompasses finalactivities such as cutting, bending etc. This is often done by an external part, referred to as SteelService Centers (SSC), often with the responsibility to also distribute the steel locally.

The companies have been selected according to the following criteria:

• For the survey all steel producing members of Jernkontoret and steel companies listed bySCB with revenues larger than 500 MSEK have been selected1.

• For the in depth interviews the six largest steel producers (regarding revenue) have beentargeted. Five of these have been successfully interviewed (Outokumpu Avesta, Sandvik,SSAB Oxelösund, SSAB Tunnplåt and Uddeholm Tooling).

• Additionally well-known, large steel service centers linked to international steel producers have been selected for the survey (e.g. Arcelor, Thyssen Krupp).

• For companies with several units within the same group (e.g. Ovako) the two largestunits have been chosen.

1 This delimitation has been made to ensure some stability in revenues over the years. Too small companies dependtoo much on single customer orders to make a comparison with more stable/bigger companies possible. SCB steelcompanies include following SNI-codes: 24100, 24200, 24310, 24320, 24330, 24340, 24520.

Explorationand Mining Smelting and Slabproduction

Rolling, Hardening

& Finishing of metalCoiling/Coating/-

Formatting

- SSC -

Cutting, Stripping,Welding, Bending of

Metal

Modular Production

Figure 1 - Delimitation of the “steel industry”

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 8/74

8 (74)

2 ME T H O

D

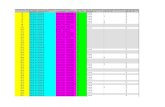

These delimitations have resulted in a list containing 29 selected companies shown in table 1 below sorted by revenue. SSCs are written in Italics and the interviewed companies in Bold. Thecomplete list with excluded companies can be viewed in appendix 3.

Table 1 - Selected companiesCompanies

1 Outokumpu Stainless 16 Lindab Steel

2 Sandvik Materials Technology 17 Erasteel Kloster

3 SSAB Tunnplåt 18 Plannja

4 SSAB Oxelösund 19 Surahammars Bruks5 Tibnor 20 Haldex Garphyttan6 Ovako Steel 21 Scana Steel Björneborg

7 BE Group 22 Burseryds Bruk

8 Ruukki Sverige 23 ThyssenKrupp Materials

9 Acerinox Scandinavia 24 Böhler-Uddeholm Precision Strip

10 Höganäs 25 Arcelor SSC

11 Ovako Bar 26 Structo Hydralics12 Outokumpu Tubular 27 Boxholm Stål13 Uddeholm Tooling 28 Scana Steel Söderfors

14 Fagersta 29 Carpenter

15 Kanthal

2.2 SURVEY

A large part of this thesis consists of investigating the SCM-tools that are used in the steelindustry. As interviewing each one of the companies would have been too extensive, a surveywas conducted in order to understand the great picture. The targets have been either site

managers or managers within logistics or SCM who have been called in advance to increase thenumber of respondents.

The survey answers the following questions: (1) How are steel companies positioned in the valuechain, (2) What parts of the supply chain are emphasized, (3) What tools are used for managingthe supply chain, and (4) Where in the supply chain do steel companies see most potential for cost savings and areas for profit generating possibilities. The complete survey can be found inappendix 4.

In the first part of the survey the respondent is simply asked to indicate the stages in the valuechain that are part of the company activities.

The tools used in (3) are a collection of best/leading practice methods from the SCOR model andother credible sources (see theory). Best/leading practices are marked yellow in appendix 7.Abbreviations are explained in appendix 1, where also the source claiming the best/leading

practice is listed for each method. Furthermore, the questions in the survey are sorted by supplychain area (e.g. source, make) and are constructed as statements where the respondent is asked tofill out to what extent the statements coincide with the supply chain activities taking place at

present.

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 9/74

9 (74)

2 ME T H O

D

SCM-ScoreRespondents are asked to rank to what extent each method is used, from “strongly disagree (1)”to “strongly agree (4)”. This allows for a simple computation of a SCM-Score. More specifically,

the SCM-score has been calculated as the sum of all best practice methods multiplied with thedegree of usage (1-4) and then divided with the total possible score (the sum of all methodsmultiplied with 4) to receive the percentage.

The SCM-score is an indicator of Supply Chain Management maturity and is used in comparisonwith other metrics to reveal if there exists a correlation between the use of Supply ChainManagement methods and performance.

Representation of methods deployedFor the representation of the survey results the answers 3 and 4, for each Supply ChainManagement method, have been characterized as used to a “high extent”. The percentage of high

extent users per method is shown in tables for each SCM area.

To bring clarity and stringency the companies have been divided into two categories; steel producers (Stage 1&2) and service centers (Stage 3). This is due to the fact that the former is very production intensive while the latter is rather a middleman.

AHPThe final part of the survey consists of a pair-wise comparison of the supply chain areas, wherethe respondent is asked to rank each area in regard to potential. Information from this part is usedin order to do an analytical hierarchy process (AHP)2, where the degree of potential for each areais revealed for the industry in general.

For the evaluation of the survey the companies have been divided into two groups, producers andservice centers. The reason for this is that a clear distinction can be made as the activities differ significantly, and thereby also the supply chain management strategies.

2.3 IN DEPTH INTERVIEWS

The purpose of the interviews was to get a more detailed picture of how the supply chain for eachcompany is outlined and the strategic reasons behind choosing a certain approach. The in-depthinterviews have been carried out with the five of the largest steel producing companies in regardto revenues.

In order to reach out to people with knowledge in the supply chain processes, the interviews have been carried out at the factory sites. Steel companies usually have several industrial unitsscattered throughout the country and for this thesis the major plant that encompasses steel

production has been selected for the interviews.

2 Description can be found in appendix 6

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 10/74

10 (74)

2 ME T H O

D

To be able to cover the whole supply chain from a strategic perspective, managers from market, production and logistics have been interviewed at each site. This grants a total of 15 interviews.

The interviews were carried out with open-ended questions based on the survey, but from a moreexplanatory angle. In other words, the respondents were given space to speak freely in order to

extract as much relevant information as possible.

2.4 METRICS

For comparison with the SCM-Score and the positioning by the various companies well knownfinancial and Supply Chain Management specific key performance indicators (KPI) have beencalculated. To minimize the effect of specific years, the metrics have been calculated as theaverage for the period 2003-2006. The complete results can be viewed in appendix 5.

EBIT MARGIN (EBIT %) – EARNINGS BEFORE INTEREST AND TAXESEBIT takes all operational profits into account, i.e. exclusive interest payments and income taxes

and is an indicator of a company’s profitability. The reason for the use is that the measurementexcludes the effects of capital structures and tax rates, thereby making cross-companycomparisons possible.3

EBIT % = OPERATING PROFIT / REVENUES

ROCE – RETURN ON CAPITAL EMPLOYED

ROCE indicates how efficient and profitable a company’s investments are, or in other words,how well the assets are used. As the operating profit is related to the investments it requires, this

measurement should reflect more specifically the relative operational success of a company.4

ROCE = EBIT / (TOTAL ASSETS – CURRENT LIABILITIES)

STOCK TURNS

Stock turns, or inventory turns, is used as a measurement of how many times the inventory is soldand replaced in one year. A low value indicates poor sales and excess inventory (in relation to thesales volume). This is also one of the main KPIs used to measure a Supply Chain’s effectivenessand is supposed to improve with the use of best practice methods (Stadtler & Kilger 2005).Revenue and Inventory are measured in MSEK.5

STOCK TURNS = REVENUE / INVENTORY

3 http://www.investopedia.com/terms/e/ebit.asp 4 http://www.investopedia.com/terms/r/roce.asp 5 http://www.investopedia.com/terms/i/inventoryturnover.asp

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 11/74

11 (74)

3 T HE OR

Y

3 THEORETICAL FRAMEWORK

3.1 SUPPLY CHAIN

The following section describes the origin of the methods used in the survey, the questions askedin the interviews and the model used for analysis. Abbreviations and explanations to specificmethods can be read in appendix 1.

DEFINITION OF SUPPLY CHAIN AND SUPPLY CHAIN MANAGEMENT

Stadtler & Kilger define the supply chain as “a network of organizations that are involved,

through upstream and downstream linkages, in the different processes and activities that producevalue in the form of products and services in the hands of the ultimate customer ”. The chain

involves two or more legally separated organizations that are linked together by either material,information or financial flows and includes the ultimate customer. Supply Chain Managementhas the objective of governing all parts of the supply chain as a unit, instead of singleorganizational elements, in order to achieve increased competitiveness. (Stadtler & Kilger 2005)

There are two ways to improve a supply chain, i) closer integration of involved companies and ii) better coordination of material, information and financial flows. In order to achieve this,companies must overcome their own organizational barriers and align strategies with the other constituents of the chain. Hence, this is the core of Supply Chain Management and the definitionis as follows:

“The task of integrating organizational units along a supply chain and coordinating material,information and financial flows in order to fulfill (ultimate) customer demands with the aim of improving the competitiveness of a supply chain as a whole” (Stadtler & Kilger 2005)

Simchi-Levi has similar definition of Supply Chain Management with an apparent focus onreducing cost and increased efficiency throughout the supply chain:

“Supply Chain Management is a set of approaches utilized to efficiently integrate suppliers,manufacturers, warehouses and stores, so that merchandise is produced and distributed at the

right quantities, to the right locations, an at the right time, in order to minimize systemwide costswhile satisfying service level requirements” (Simchi-Levi et al. 2007)

Integration is a necessity for an effective supply chain, where the ideal is that information andknow-how is shared openly among the members. Competition along the supply chain is supposedto be replaced by the commitment to achieve increased competitiveness along the chain as awhole. On the other hand market interactions imply that companies can cancel their collaborationat any time for short-term reasons (better prices in other supply chains, etc.). Therefore bondsshould be used to ensure the cooperation among supply chain members. These bonds can beeither technical (common technologies), knowledge (about each others’ businesses), social,administrative or legal. (Stadtler & Kilger 2005)

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 12/74

12 (74)

3 T HE OR

Y

Coordination, the second part of SCM, includes utilization of information and communicationtechnology, process orientation and advanced planning. Electronic Data Interchange (EDI) for example is favorably used to achieve instantaneous information exchange among members in thesupply chain. Process orientation refers to the streamlining of cross-company processes to reduce

system-wide costs while enhancing quality and various operations’ speeds (e.g. steel companies performing simple machining operations to facilitate the next production step for customers).Finally, advanced planning incorporates both short- and long-term planning where APS systems(Advanced Planning Systems) exist to complement ERP systems to include inter-organizational

planning. (Stadtler & Kilger 2005)

Collaboration is, in other words, essential to a company’s success and sequential processes oughtto be replaced by global optimization. Therefore collaboration has become the focus of supplychain systems in recent years, resulting in development of standards for collaboration betweensuppliers and vendors (such as Collaborative Planning, Forecasting and Replenishment, CPFR).(Simchi-Levi et al. 2007)

Furthermore a vital issue is that SCM should not be a strategy on its own, but rather an integral part of both each member’s strategy and the supply chain’s strategy as a whole. This can also becomplemented by consolidations among different supply chains, e.g. combining demands for standard parts to increase the purchasing power. (Stadtler & Kilger 2005)

THE BULLWHIP EFFECT

“The increasing amplification of orders occurring within a supply chain the more one moves

upstream. This phenomenon also occurs even if the end item demand is fairly stable”. (Stadtler &Kilger 2005)

The Bullwhip effect is regarded as a classic problem within SCM, that results is unnecessaryinventory, shortage costs and unstable system behaviors. One source for this effect is the use of multiple demand forecasts. The theory states that orders should be based on the ultimate customer demand and not that of intermediaries, which can be achieved by information integration through,for example, EDI-links or VMIs. In other words problems concerning all three parameters of working capital (unnecessary inventory), costs (unstable production) and lost revenues (supplyshortages) can be related to the Bullwhip effect and minimized by better integration. (Stadtler &Kilger 2005)

Other principles to reduce the Bullwhip effect are order batching (consolidating transports), prizestabilization (discounting increases the Bullwhip effect) and elimination of gaming (additionalordering as a result of speculations). These counteractions to the Bullwhip effect are simplified

by the use of timely information, both intra- and inter-organizational. (Stadtler & Kilger 2005)

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 13/74

13 (74)

3 T HE OR

Y

SCOR-Model

The SCOR model is a reference instrument, developed by the Supply Chain Council (SCC) inorder to describe Supply Chains and the activities they encompass in a standardized way. As aresult Supply Chains can be benchmarked against each other and best practice methods for

specific processes are shared. (Stadtler & Kilger 2005)

Furthermore the SCOR-model constitutes the base for the analysis model used to position theinterviewed companies relative each other. The SCOR model consists of the process types: plan,source, make, deliver and return (recycle) and includes activities from suppliers to customers.Appendix 2 provides a brief explanation of the different areas.

Figure 2 SCOR-model6

In addition to best practices for Supply Chain Management, there are key performance indicators(KPIs) that are applicable and important for all supply chains. These are delivery performance

(delivery accuracy), supply chain responsiveness (the ability to react to market changes), assetsand inventories (inventory turns) and costs (e.g. cost of goods sold). (Stadtler & Kilger 2005)

One important aspect of Supply Chain Management is demand fulfillment (delivery accuracy).Closely connected to demand fulfillment is the process of order promising, with the traditionalapproach that is standard for MRP systems of promising supply against inventory. If there is noavailable inventory, orders are quoted against production lead-time (backlog) which oftenviolates other constraints, such as available capacity. A better approach to promise orders isavailable-to-promise (ATP), which considers all constraints along the supply chain to give moreaccurate and realistic promises. “ATP is the result of a synchronized supply and capacity plan

and represents actual and future availability of supply and capacity that can be used to accept

new customer orders on”. This method is especially useful in the case of a supply constraint inthe industry, i.e. material and/or production capacity are bottlenecks. (Stadtler & Kilger 2005)

6 Supply Chain Council

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 14/74

14 (74)

3 T HE OR

Y

THE ANALYSIS MODEL

The analysis model comprises the operational processes from the SCOR model (Source, Make,Deliver & Return), briefly described in the previous chapter. The model has been complementedwith the dimension of working capital/revenues/costs. This will supposedly explain the use of

certain methods as the focus shifts depending on each company’s state and the steel industry’sstate in general.

To further reflect the importance of integrating suppliers and customers and clarifying thestrategies for this, these two areas have been added to the SCOR processes (to some extent this isincorporated in the excluded “plan” area from the SCOR model). Even though productdevelopment (“design”) is not addressed by the SCOR-model this area has been added as themodel would not reflect the companies’ complete emphasis without it. The Supply Chain Forum,where these three areas are described as integrated processes in Supply Chain Management,further validates this addition to the SCOR model. (Stadtler & Kilger 2005)

Combined, the various sources have resulted in an analysis model shown below (figure 3).

Figure 3 Analysis model

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 15/74

15 (74)

4 A NAL Y S I S &

RE S UL T S

4 ANALYSIS AND RESULTS

4.1 INTERVIEWS

The following sections contain information about the largest steel companies in Sweden. Eachchapter first contains an overview of the company’s strategy followed by more Supply ChainManagement specific strategies. The SCM areas “supplier” and “source” have been merged inthis section as strategies often overlap.

4.1.1 Case Studies

The following case studies are based on the conducted interviews and are interpretations of theconversations with company representatives. In addition to the in-depth-interviews eachcompany’s annual report has been used as a complementary source of information.

4.1.1.1 SSAB Oxelösund – Plate Division

• Revenue: 9.563 MSEK 7 • Production: 586 kt (kilo tonnes)8 • Employees: 25199 • Niche: Quenched heavy plate• Customers: Construction machinery, mining equipment & crane manufacturers• Strategy: Superior product, service & know-how, physical closeness to

customers

SSAB Oxelösund is one of two divisions within the SSAB Group, producing heavy plate with itstwo most recognized brands HARDOX and WELDOX. The facility in Oxelösund is an integratedsteelworks, covering all production from smelting to hardening, quenching and finishing.Oxelösund’s products have better strength and resistance characteristics while maintaining alower weight than competitors’ products. This is a source for competitive advantage, enabling asales price that is often close to double that of other steel producers. Notable is also that by theend of 2007 almost no ordinary plate was produced as a result of the strategy of focusing more onniche products (quenched plate) 10.

The main customers for Oxelösund are construction machinery, mining equipment and cranemanufacturers. These industries have high requirements regarding safety and reliability and

hence enable steel makers to charge more for superior product characteristics. Also the increasedfocus on environmental issues favors producers of lighter materials but with similar strengths.SSAB has very well-known brands in this niche, going as far as being recognized and requested

by end-consumers (for example the buyer of a Caterpillar machine) when buying equipment.

7 Affärsdata (for 2006)8SSAB Annual Report 2007, p. 29 (for 2006)9 Affärsdata - 200610 SSAB Annual Report 2007, p. 28

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 16/74

16 (74)

4 A NAL Y S I S &

RE S UL T S

Generally the market for quenched plates shows a good growth. This is much due to investmentsin developing regions but also the developed regions have shown continuously increaseddemand11. For Oxelösund specifically, the demand is far bigger than the available productioncapacity, giving the company’s sales organization a highly favorable position. Rather thanactively selling the steel, this is an operation of allocating small volumes to preferred customers.

As a result of the above-mentioned factors Oxelösund has an extremely high EBIT margincompared to most other companies in the steel industry (as can be seen in appendix 5).

Tied to the insufficient production capacity, is Oxelösund’s strategy to supply small customersthat are not attractive to the big players in the industry, mainly due to small order volumes.Examples of this kind of customers are small local after-market service centers with demands for customized products. Going after this kind of customers, means not only supplying unattractivemarkets, but also being almost invisible to bigger competitors. It would be very difficult to findall these small customers to make counter-offers even if they wanted to.12

As it is impossible for Oxelösund to compete with lower prices – volumes are too small – the

company constantly tries to develop products that are difficult to produce with high productivity.In other words they manufacture products that are unattractive to produce for modern flow-optimized factories where maximum tonnage at lowest possible cost is prioritized. This onceagain makes the products unattractive for competitors and is a part of the long-term strategy todig deeper into the niche. 13

The activities with the most unique production knowledge at Oxelösund are the smelting(material recipe) and the hardening/quenching process. These two processes surround the processof rolling, which could theoretically be outsourced. The main reason for keeping this process in-house is to remain integrated with minimal external risk. Another factor is the desire thatcustomers consider the products unique and special, something that would be harder to achieve if

production processes were outsourced. 14

The sales strategy to concentrate on small customers is complemented with a very developedcollaboration with end-customers. Specific about this collaboration is that it goes beyondmarketing and long-term relationships, to have expert knowledge about the customers’ processes.This gives Oxelösund a very favorable position in negotiations and the possibility to sell the exactright steel at a higher price. In other words the products sold contain a high level of service, fromapplication support to long-term relationships. For example Oxelösund has application engineersspecialized in the mining industry where demands regarding safety and product reliability areextremely high.

As a part of the strategy to go after small customers, mainly in the after-market, Oxelösund doesnot sell at all via wholesalers. Instead products are sold either directly to customers, often sub-suppliers to Original Equipment Manufacturers (OEM), or distributed by their own warehouse.The simplified value chain for Oxelösund is interpreted below.

11 SSAB Annual Report 2007, p. 912 Interview with SSAB Oxelösund representative13 Interview with SSAB Oxelösund representative14 Interview with SSAB Oxelösund representative

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 17/74

17 (74)

4 A NAL Y S I S &

RE S UL T S

Figure 4 Value Chain SSAB Oxelösund

The collaboration with customers in the after-market furthermore creates a pull for Oxelösunds products in earlier stages (OEMs and end-users). Alongside the collaboration with these after-market service centers, Oxelösund owns its own service centers. This is mainly in markets wherethere are few local SSCs and they must have their own in order to create an infrastructure to beclose to potential customers. Owning SSC facilities is especially important when establishingoperations in developing regions due to the lack of existing infrastructures for distribution.Furthermore Oxelösund is ready to buy local centers that are often family-owned and otherwisewould be closed down. Apart from resulting in increased integration and a closeness to customersthis strategy reduces uncertainties in demand.15

SCM-EMPHASISThe fact that demand is far greater than capacity affects lots of different areas of the company,although no apparent SCM strategy is deployed company-wide. Some extra attention should begiven to the fact that most work focuses on increasing revenues, whether it is increased

production or pro-active work with deliveries. As it turns out, it is currently much easier for thecompany to earn more by increasing sales than trying to reduce costs. 16

SUPPLIER/ SOURCE When purchasing raw materials the company uses few suppliers and long-term relationships tokeep the raw material inventory at a minimum. The main raw materials (ore and coal) are bought

at global market prices and conditions and are therefore considered difficult to affect from a SCM point of view. For example VMIs or EDIs are not used and there is a relatively low transparency between supplier and customer regarding demand.17

The sourcing process is furthermore aimed at lowering costs and keeping the inventories as lowas possible. Although the money that can be saved by lowering inventory levels can never be

15 Interview with SSAB Oxelösund representative16 Interview with SSAB Oxelösund representative17 Interview with SSAB Oxelösund representative

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 18/74

18 (74)

4 A NAL Y S I S &

RE S UL T S

compared to the loss in production due to a lack of raw materials. Therefore costs are not prioritized when it comes to critical input materials, but the main focus regarding non-criticalinputs. 18

DESIGN

Design, or product development, has always been regarded as one of the main drivers for success by SSAB Oxelösund. The unit has a desire to be considered the market leader regarding productcharacteristics and innovation and therefore has to put emphasis on this area. Since therestructuring of the steel industry in the 1970s, Oxelösund has produced products with asignificant quality advantage. Even though competitors are closing in regarding productcharacteristics, Oxelösund still has the leading edge. The strategy is to remain in this position andtherefore the company focuses a lot of attention in this SCM area.19

MAKE Some best practice methods are used in order to create an efficient flow of goods. These methodsare for example “drum-buffer-rope” (optimizing in regard to bottlenecks) and creating a capacity

abundance in final production steps. This only helps to some extent as the factory site is old andthe layout is not optimized to create a flow of products from the start.20

Being able to sell more than can be produced also comes with some problems. The factory atOxelösund has been constantly occupied with orders for more than 100% of available capacity.The slightest problem in the factory therefore creates a huge gap and delivery accuracy has beenvery low in the past. A way of avoiding this problem is to have a close communication betweensales offices and production. The slightest stop in production is immediately communicated tosales offices where allowed sales volumes are reduced correspondingly.21

DELIVER

External transports are constantly being improved and remain an important area within SCM atOxelösund. Transports are being optimized in regard to costs in the long run, but the main reasonfor improvements in this area is that it must not become a future bottleneck. This would be highly

plausible if production capacity would be more in line with demand. In other words the work is pro-active in this case.

As part of the distribution strategies Oxelösund also develops methods for loading containers for transport and shifting to trains from trucks. Apart from being more environmentally friendly thisalternative allows for fewer transshipments and hence is more effective. 22

RECYCLE Within the factory site, excess material and scrap is recycled and used as input material. When itcomes to recycling material from customers or various service centers, the potential cost savingsare very small. Furthermore the logistics solution for achieving this would have to be established

18 Interview with SSAB Oxelösund representative19 Interview with SSAB Oxelösund representative20 Interview with SSAB Oxelösund representative21 Interview with SSAB Oxelösund representative22 Interview with SSAB Oxelösund representative

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 19/74

19 (74)

4 A NAL Y S I S &

RE S UL T S

as there are lots of outgoing transports but only a few incoming, i.e. cross-docking solutions aredifficult to achieve. 23

CUSTOMERS One important aspect of the Supply Chain Management theory is sharing information openly.

This strategy is currently not used between Oxelösund and its customers. The reason for this isvery specific, namely that the company does not want customers to view the products in stocks asavailable at wish. This of course relates to the strategy that the sales force basically allocatesvolumes to customers.

On the other hand the company focuses lots of attention on this area when it comes tocooperating, long-term relationships and knowledge about customers’ processes (as described

previously). Hence, it is one of the main aspects of the company’s strategy and helps to reducedemand uncertainties while increasing the sales volumes. 24

ANALYSIS

SSAB Oxelösund does not seem to have a general SCM strategy, although some specific SCMmethods are used in the various sections. Because of the favorable market the company does notfocus on costs at the moment and most strategies are directed towards increasing productioncapacity and short- and long-term revenues.

The emphasis on Supply Chain Management is recapped in figure 5 below. The SCM areas“supplier”, “source” and “recycling” receive by far the least attention. These areas are typicallyassociated with cost reduction and as the company rather focuses on increasing sales, they aregiven less emphasis.

Suppliers Design Source Make Deliver Recycle Customers

Working

Capital

Revenues

Costs

Strong emphasis Medium emphasis Some emphasis

Figure 5 Supply Chain emphasis SSAB Oxelösund

23 Interview with SSAB Oxelösund representative24 Interview with SSAB Oxelösund representative

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 20/74

20 (74)

4 A NAL Y S I S &

RE S UL T S

• Delivery accuracy is low due to the over-scheduled production system.

• Focus lies on developing the products rather than developing the production processes.

This is due to the fact that a Dollar in increased sales is easier to achieve than saving aDollar in making the product.

• Customer relationships and collaboration go beyond the end-user to even include theaftermarket, creating a very favorable position that is difficult to reach by competitors. A

pull for the products is created throughout the value chain when end-users demand that products should contain steel from Oxelösund.

• Even though small customers are preferred, global steel consumers constitute animportant part of the total sales volume. These companies demand a global presence bythe steel supplier in order to have a consistent steel quality throughout their production

sites. Hence the global distribution net becomes an important aspect, placing emphasis onimproving logistic solutions.

4.1.1.2 SSAB Tunnplåt – Strip Division

• Revenue: 14.824 MSEK 25 • Production: 2660 kt26 • Employees: 405627 • Niche: Advanced high strength steels (strip)•

Customers: High strength: Heavy & light vehicles, crane manufacturers,Ordinary: Engineering & construction• Strategy: Advantageous distribution net on home market, increased focus on

niche products

SSAB Tunnplåt, the strip products division, manufactures both ordinary and high-strength stripsteel. Customers for high strength steel are mainly in the automotive industry with applicationsranging from containers (hot rolled) to safety components (cold rolled). The main competitors inthis product area are Arcelor Mittal and Thyssen Krupp. Ordinary steel has applications in theconstruction, engineering and automotive industry and competitors are most European steel

producers. In summary, the market for the products manufactured by the SSAB Tunnplåt facility,

is highly competitive (more so for ordinary than high-strength) and the prices depend much onthe competitors. Therefore a strategy that focuses on reducing costs is necessary for this division,although reduced working capital has recently become an important issue. This is the opposite of the SSAB Oxelösund division that basically dictates conditions and focuses a lot on increasingrevenues.

25 Affärsdata (for 2006)26 SSAB Annual Report 2007, p. 10 (for 2006)27 SSAB Annual Report 2007, p. 25 (for 2006)

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 21/74

21 (74)

4 A NAL Y S I S &

RE S UL T S

Sweden, as SSABs home market, is the absolutely largest market for the Tunnplåt division withapproximately 35% of the total deliveries. The remaining shares are somewhat equally distributedacross Europe completed with small shares in the USA and China. In the Nordic market thecompany sells both ordinary and high-strength steel, whereas the strategy is to only supply high-strength in the remaining markets. Ordinary steel sales in the home market are made possible

mainly by the proximity to customers and a well established distribution net. Environmentalissues and requirements have a positive effect on the demand of high-strength steel as reducedweight can be achieved with similar or higher strength and a longer product life (this is mainlyrelevant for sales in the automotive sector). As the company has also come relatively far in theemissions reduction area (compared to competitors in other countries), stricter, but equal,environmental regulations could be of advantage.28

The strip products division consists of two units; a slab production plant in Luleå and rolling plants and after-treatment in Borlänge. As the capacity in Luleå is not sufficient, the remainingslabs are purchased from the Oxelösund unit. To increase the capacity in the final steps, severalsub-contractors are used for various finishing operations close to the customers. 29

Generally the production sets limits for how much high-strength steel can be produced and sold.The production flow is very complex for the different high-strength products, with many

bottlenecks at final steps. This allows for the remaining production capacity in the first steps(rolling) to be utilized for ordinary strip steel production. Tunnplåt has the same strategy as thecompany as a whole, namely to increase the focus on niche products. Investments in the

production capacity for advanced high-strength steels are in line with this strategy and as a resultthe share of high-strength steel increased from approximately 28 % in 2006 to 33 % in 2007.Compared to the Oxelösund facility, where almost only niche products (quenched steels) were

produced towards the end of 2007, this strategy still has large potential. 30

The material flows for the Tunnplåt division are shown simplified in figure 6 below.

28 Interview with SSAB Tunnplåt representative29 Interview with SSAB Tunnplåt representative30 Interview with SSAB Tunnplåt representative

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 22/74

22 (74)

4 A NAL Y S I S &

RE S UL T S

Figure 6 Value Chain SSAB Tunnplåt

As can be seen in figure 6 the products are sold mainly via wholesalers but also directly to sub-suppliers and manufacturers. Especially in the home market, Sweden, the distribution net is veryelaborated including the ownership of distributor Tibnor and building sheet producer Plannja.This distribution net and local presence is also the main competitive advantage for ordinary stripsteel in the home and neighboring markets.31

SCM-EMPHASIS The strip division has no common SCM strategy to increase the company-wide efficiency.Despite this, several improvement methods are used within each of the defined areas that aredescribed below. Generally Tunnplåt strives to improve delivery accuracy, although the main

focus lies on reducing costs and increasing the share of niche products through investments and productivity improvements.32

SUPPLIER / SOURCE Within purchasing there is not so much to do in order to lower the prices because of theindustry’s characteristics. Rather, this is a cash-flow issue where raw material stock levels oughtto be optimized to minimize the working capital. The current focus in this area therefore lies onreducing the number of suppliers in order to increase long-term collaboration, which potentiallymeans advantageous payment conditions.

Also, the stock levels are not optimized at the current, as a result of insufficient inventory

management systems. This area has large potential for savings and for that reason focus lies onoptimizing order sizes and inventory levels.

Otherwise, the raw material prices are regarded as a relatively small problem as the increasesapply to all other global competitors as well. Although there is some lag, the price increases are

31 Interview with SSAB Tunnplåt representative32 Interview with SSAB Tunnplåt representative

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 23/74

23 (74)

4 A NAL Y S I S &

RE S UL T S

also shifted to the end-price for the customers. This should be compared to environmentalrequirements that vary in different countries and hence distort the competition.33

DESIGN As the strip division manufactures products that are relatively standard, research and

development becomes very important - niche products within this steel area today, often become bulk products within ten years. Therefore the company has to invent numerous new steels eachyear to keep the competitive advantage of being the leader in innovation. For this purpose a“technology-push” way of working is applied, i.e. instead of focusing on customers’ demands theresearch is technology driven.

Most research is conducted within the areas of cold and hot rolled steel as the focus on niche products increases. To sum up, there is a large focus on this area even though no specific SCMstrategies are apparent. This is a result of the recent strategy to focus more on increasing thevariety of products provided instead of expanding globally.34

MAKE As stated above the production can only handle a certain amount of high-strength steel as thereare several bottlenecks in the different flows. All volumes are produced on customer orders(MTO) as the products are highly differentiated and customizable (with restrictions). This alsomakes the batches relatively small (compared to other strip steel producers) and places pressureon reducing changeover times. Therefore this is a focus area in production at the strip divisionand methods like Total Productive Maintenance are used to improve the efficiency.

As high strength volumes are restricted, the marketing and sales forces reserve volumes uponreceived orders. These volumes are then converted by the production planning units into batchesthat are realizable regarding lead and changeover times. Hence the production sets the limits,regarding high strength steel, for the sales forces whose task it is to keep the sales volumes even.This communication, however, shows great potential for improvements as the information flow

between market units and production is often not good enough. Partly this is due to obsolete ITsolutions, but also focus should be shifted to treating different areas in the company as customers,i.e. the customer-orientation should be exploited internally as well. A better communicationwould lead to better production planning and a significant competitive advantage as the share of niche products could be increased.

Even though production is said to be completely MTO, prognosis are used indirectly for the production planning process. Customers place a preliminary order, weeks or months ahead of

production, with the various sales companies but are not bound to that volume instantly (ordersare bound to the customer in the rolling stage). The same volume is used for production planningand discrepancies occur if customers change their order later in the process. Better forecastswould therefore show a large potential. Once again a more integrated communication systemwould prove useful for this scenario as information could be shared faster and easier internally.35

33 Interview with SSAB Tunnplåt representative34 Interview with SSAB Tunnplåt representative35 Interview with SSAB Tunnplåt representative

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 24/74

24 (74)

4 A NAL Y S I S &

RE S UL T S

DELIVER

For the delivery process SSAB Tunnplåt uses several large distribution platforms, with the maindistribution center in Rotterdam. The transports are carried out by rail/truck/ship to Rotterdamand then by trucks to the end destination. This end destination can either be a customer or one of the approximately 50 smaller Distribution Centers (DC), mainly in Europe.

The company uses a large service center in Maastricht, otherwise service operations are carriedout close to the customers through an elaborated cluster of partner companies. Although thestrategy is to be as close as possible to the customers, there is not a current plan to own theseservice centers but they are needed as the product range exceeds the own capacity.

For the distribution in general and transports to these local service centers, the strip division has atool for real time control. In other words the products that are currently not in their own

possession can be monitored easily. The system also generates an invoice automatically for thecustomers. 36

RECYCLE This area was not mentioned during the interviews as the area was not perceived as a prioritizedissue.

CUSTOMERS

As mentioned above the strip division has a very close collaboration with customers in the homemarket. For a few large and strategically important customers in the Nordic area the companyuses EDI-links as a way to simplify the order flows. These customers often have extremedemands regarding delivery times and delivery accuracy why this kind of system and somereserved stock is needed. Otherwise the strategy is to increase the number of smaller customers inorder to create barriers. Small customers make it easier to retain a higher price level since their relative bargaining power is lower.

The collaboration with customers otherwise receives large focus as application knowledge isregarded as one of the competitive advantages for the company. A trustworthy and high qualitysales force is vital to the operations On the other hand information is not shared openly regardingcapacities and prognosis outside the companies boundaries. 37

ANALYSIS

Most important areas are R&D, collaboration with, and proximity to customers and superior production knowledge. There is additionally a small focus on reducing working capital, mainly inthe areas of sourcing and deliver. Apart from production, where the focus is directed towards costreductions, the most emphasized areas are focused towards increasing revenues.

36 Interview with SSAB Tunnplåt representative37 Interview with SSAB Tunnplåt representative

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 25/74

25 (74)

4 A NAL Y S I S &

RE S UL T S

Suppliers Design Source Make Deliver Recycle Customers

Working

Capital

Revenues

Costs

Strong emphasis Medium emphasis Some emphasis

Figure 7 Supply Chain emphasis SSAB Tunnplåt

• The intense focus on niche products that are highly differentiated implies a production process that is not optimized in regard to material flows. In other words the production process is sub-ordinate to the niche product strategy.

• Apart from enhancing the products’ physical attributes, R&D functions focus onincreasing knowledge about customers’ processes through collaboration. The products’value consists of the physical characteristics and the knowledge provided by the steel

producer. Steel characteristics can only be developed to a certain level while the knowhow still shows a lot of potential.

•

As a result of the desire to have small customers a more complex distribution net isneeded, implying for increased working capital. Increasing raw material cost will further contribute to this rise of working capital. The recent focus on lowering working capitaltherefore makes logistic solutions (Deliver) important to improve.

• Generally Tunnplåt strives to improve delivery accuracy in the production, although themain focus lies on reducing costs and increasing the share of niche products throughinvestments and productivity improvements.

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 26/74

26 (74)

4 A NAL Y S I S &

RE S UL T S

4.1.1.3 Outokumpu Stainless - Avesta

• Revenue: 20.016 MSEK 38 • Production: 656 kt39 • Employees: 219140 • Niche: 2m wide cold and hot rolled plate - Stainless• Customers: Process industries, e.g. oil & gas, chemical, pulp & paper industry• Strategy: Superior production methods, application know-how, enhanced

SSC network to increase end-user & project customers, customer-orientation

Outokumpu is a global producer of stainless steel with production facilities in Finland, Sweden,the UK, the US and the Netherlands. The production facility in Tornio, Finland is considered to

be the most cost-efficient General Stainless Steel factory in the world, focusing on large-volume production and integration to even include its own chromite mine (chrome used for some steelgrades, reducing price volatility and increasing cost competitiveness). The Swedish mills focuson Specialty Stainless, an area that produces half the volume compared to General Stainless whilecontributing with the same sales value. This gives approximately the double per tonne price(EUR/t) and the double margin for Specialty products41. The biggest Swedish subsidiary, Avesta,represents Outokumpu in this text.

Customers for the Specialty Stainless area are typically in the oil & gas, chemical, nuclear power or pulp & paper industry. These industries typically demand tailored solutions for their projectorders and have high requirements regarding product properties. This increases the importance of the R&D function and collaboration with customers through application engineers and sales

personnel

42

.

Recently, there have been major investments in Avesta, totaling about EUR 550 million, toalmost double the production capacity and enable increased focus on Specialty Stainless. Todaysome General Stainless is produced as well but the strategy is to produce higher shares of Specialty Stainless in the future. This shift will decrease productivity but the total value added issupposed to account for the productivity losses.43

The Stainless pricing mechanism works differently than that of normal steel. The price dependson the global steel price but with an addition for alloys (for example Nickel), which makes theend-price44 and thereby the demand very dependent on the alloy prices45. This increased exposure

to financial institutions’ trading adds volatility to the end-product price. This means that even if the underlying demand for products is stable and in line with production capacity, the sales

38 Affärsdata (for 2006)39 Outokumpu Annual Report 2007, p. 25 (for 2006) - aggregate figure for Specialty Stainless division40 Affärsdata (for 2006)41 Outokumpu Annual Report 2007, p.22 & 2542 Outokumpu Annual Report 2007, p.25 & 3843 Interview with Outokumpu representative44 Transaction price = base price + alloy surcharge45 Nickel accounted for 75% of raw material costs for the Group in 2007, Outokumpu Annual Report 2007, p. 34

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 27/74

27 (74)

4 A NAL Y S I S &

RE S UL T S

volume will vary substantially, creating extreme Bullwhip effects for Outokumpu. As anexample, quarterly EBIT for the Outokumpu Group, varied from approximately EUR 400 millionto negative EUR 280 million due to changes in Nickel prices46.

Avesta’s production facility is adjusted to produce high quality Stainless from a lower quality of

raw material (mainly scrap) and works with material recipes that contain smaller amounts of alloys than competitors but with similar material properties. This, of course, gives a competitiveadvantage while reducing volatility for the own company’s margins. Furthermore Avesta

produces 2m wide slabs as one of only 3 factories in the world, a differentiation that further reduces dependence on the world’s trading markets.47

Outokumpu Avesta considers its main strength to be competence in the areas of sales, productionmethods and applications for their products. The advantage in production has been partially

pointed out above, but an area that is especially important in the Special Stainless industry isapplication know-how. It is impossible for Outokumpu Avesta to compete with prices and thefocus is shifted to selling better products than competitors. Therefore a big task for the sales force

is often to explain the superior material characteristics to customers, both for existing andrecently developed products. At the same time this collaboration with customers providesinformation about their real needs.

Outokumpu Avesta currently sells approximately 50% of its products via internal distributors anddirectly to sub-suppliers, while the rest is sold to external distributors48. Simplified the mainflows in the value chain for Outokumpu Avesta are shown below in figure 8.

Figure 8 Value Chain Outokumpu

A company-wide strategy for Outokumpu is to increase and invest in the service center network in order to increase the share of end-user and project customers49. By buying service anddistribution centers the company is often able to increase the center’s share of Outokumpu steel.

46 Outokumpu Annual Report 2007, p. 8-947 Interview with Outokumpu representative48 Interview with Outokumpu representative49 Outokumpu Annual Report 2007, p. 4

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 28/74

28 (74)

4 A NAL Y S I S &

RE S UL T S

This means that an investment in service centers indirectly means taking over production to end-customers and increasing the demand for the company’s own products.50

Distribution centers in general make large profits by speculating on material prices and therebyincreasing the volatility of Stainless products. In other words they build up large stocks when the

prices are low and sell of stock when prices increase. This is a main reason for the varyingdemand during 2007. Therefore another aspect of the investments made in this area, is that theyreduce the volatility for Outokumpu’s products by smoothening the demand, which is a centralstrategy for the Avesta facility.51

SCM-EMPHASISOutokumpu has launched a program called OK>1 to increase focus on SCM in the entirecompany. This company-wide introduction combined with emphasis from top management onSCM constitutes a ground for successful implementation. The main idea of the program is tocreate a “customer-oriented supply chain thinking with end-to-end management” of the internalvalue chain52. Combined with some other strategies this program is described for each SCM area

in the following sections.

SUPPLIERS/SOURCE

Apart from ferrochrome Outokumpu uses external suppliers for all input materials. The generalstrategy is to enter long-term contracts, but also the company has changed its pricing model for the alloy surcharge in order for the end-price to faster reflect the changes in supplier contractsand prices (this is mainly due to the volatile Nickel prices).53

The increased scrap prices have increased the attention on invested capital in inventories, but themain focus in sourcing is still reducing costs (inventory accounts for a very large part of theGroup’s total costs54). An explanation for this is that production cannot be allowed to stand stilldue to empty raw material inventories, i.e. they must not be bottlenecks.55

As part of OK>1 Outokumpu has established a new category organization within procurement inorder to leverage the Group’s size and thereby buying power. This means that all contracts aremade at company level by the Supply Chain Management function to guarantee lowest possible

price across different business units. This improvement work alone has resulted in savings of EUR 10 million (for the entire Group).56

DESIGN R&D is an area within Outokumpu’s work that achieves some extra attention. One of the

advantages Outokumpu has over its competitors is that the steel produced has a similar, or better,quality but with a lower quality of scrap as input material. Also, a smaller amount of alloys per tonne Stainless is used, which is a result of thorough research. To keep this advantage the

50 Interview with Outokumpu representative51 Interview with Outokumpu representative52 Outokumpu Annual Report 2007, p. 3453 Outokumpu Annual Report 2007, p. 36 & 4554 Outokumpu Annual Report 2007, p. 3455 Interview with Outokumpu representative56 Outokumpu Annual Report 2007, p. 36

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 29/74

29 (74)

4 A NAL Y S I S &

RE S UL T S

company focuses a lot of attention on this area with an R&D center in Avesta, mainly to increaserevenues and margins.57

There is also a linkage between the R&D functions and the Production Excellence program(OK>1) at Outokumpu, to ensure system-wide efficiency at all levels. While research at Avesta

in concentrated on developing new grades, there is a constant parallel development of productiontechnology to keep up with the pace. Furthermore the R&D experts with Outokumpu are the link to sales departments and customers, providing both advice and valuable feedback.58

MAKE Some areas in the internal supply chain attract some extra attention, with production (“Make”) asthe most outstanding part. In production the focus lies mainly on reducing costs while constantlyimproving processes and lead times to secure delivery accuracy in the long run. The major key

performance indicator (KPI) for this area is OEE, or Operational Equipment Efficiency, whichhas improved continuously since the program was introduced. The value of the KPI itself is notas important as the drive it gives each employee to achieve improvements. The financial

implications are difficult to see, but the program is a pro-active approach to meet potentiallyhigher future demands when it comes to delivery accuracy and lead times.

Furthermore approximately 90% of the production volume at Avesta is produced and tied directlyto a specific customer (MTO) after leaving the steelworks (Stage 1). This means that internalstocks are kept at a minimum to reduce working capital in later stages. Interesting is that thesteelworks run at a fairly constant speed, while later activities, like rolling, are adjusted directlyto demand and thereby highly flexible. This is possible because the steelworks can supply for other Outokumpu units but also sell of material as General Stainless bulk steel. It is apparent thatthe bottleneck lies in later stages at the present, but the investments might shift the bottleneck

back to the steelworks making it possible to produce more Specialty Stainless.

Although most of the production is made to order (MTO), the company uses prognoses for production planning in the longer run. These forecasts are based on collaboration betweensalesmen and their customers. When an actual order is made it is entered into an MPS system butstill not visible to all separate facilities in Avesta. The steelworks for example downloadinformation from the general MPS system twice a week after it has been processed by production

planning.59

DELIVERThe main thing that has come up within the distribution area is that Outokumpu continuously

invests in local distribution and service centers. Apart from smoothening the demand this ensuresreliable distribution channels to chosen markets. Also this area is part of the responsibilities of the SCM function at a corporate level, ensuring system-wide efficiencies 60. Locally there is awell established information flow regarding production capacity and stock levels and some of the

best practice methods regarding transports are used (for example wave picking). Despite this

57 Interview with Outokumpu representative58 Outokumpu Annual Report 2007, p. 3859 Interview with Outokumpu representative60 Outokumpu Annual Report 2007, p. 34

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 30/74

30 (74)

4 A NAL Y S I S &

RE S UL T S

“deliver” does not give the impression as one of the most prioritized improvement areas for thecompany.61

RECYCLE Similarly to “deliver”, recycling is not one of the most focused areas within SCM at Outokumpu.

Having a close collaboration with its customers in the home market although enables the Avestafacility to have an elaborated recycling strategy. For example rest products are taken care of internally and there is a logistics solution for reusing excess steel from the customers. At thesame time this area is regarded as having the least potential regarding profit generating and costsaving possibilities.62

CUSTOMERS Outokumpu has a strategy to increase collaboration with customers through a structure that isvery similar to SSAB’s application engineers (as described in the “design” section). Thecompany has a very good understanding of both end-customers’ and distribution centers’ needs.

Furthermore Outokumpu has a very well established distribution net in the home market (Nordicregion), partly through ownership but also through long-term relationships with distributioncenters. This combined with the fact that Outokumpu is often the single largest provider gives alarge competitive advantage, which has to be built on in order not to lose market share whenother global players enter this market. Therefore collaboration with customers is an importantarea for the company’s future success. 63

ANALYSIS

Generally Outokumpu gives the impression of focusing more attention on Supply ChainManagement than other interviewed companies in this report. The reason is a company-wideimprovement program that has come up at all interviews and permeates all levels of the Avestafacility when interviewed. The focus within SCM appears to lie mainly on cost reduction andstabilizing demand. This is achieved through increased integration, increased customer collaboration and implementation of well-known production methods.

The results are visualized in figure 9 below.

61 Interview with Outokumpu representative62 Interview with Outokumpu representative63 Interview with Outokumpu representative

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 31/74

31 (74)

4 A NAL Y S I S &

RE S UL T S

Suppliers Design Source Make Deliver Recycle Customers

Working

Capital

Revenues

Costs

Strong emphasis Medium emphasis Some emphasis

Figure 9 Supply Chain emphasis Outokumpu

• The improvement program, OK>1, permeates all levels of the organization with mostsignificant impact within the production (Make). General KPIs are broken down intospecific measurements for each sub-division, creating a coherent way of working withimprovements throughout the organization.

• The overall most important KPI for Outokumpu is “delivery accuracy”. Althoughimprovements have been initiated there is still work to be done in order to meet higher customer expectations in the future.

•

By investing in the service and distribution center network the company increase thesales volumes, although the main reason for these investments is to reduce the volatility.Thus the effect from speculating distribution centers is decreased.

• So far, the Supply Chain Management initiative has not implied any significant financialimprovements, nevertheless the work is part of a pro-active effort for future potential

benefits.

• Close collaboration, knowledge about customers and an effective distribution net aresignificant barriers for the home market.

8/8/2019 1.6962!2008_334

http://slidepdf.com/reader/full/169622008334 32/74

32 (74)

4 A NAL Y S I S &

RE S UL T S

4.1.1.4 Sandvik Materials Technology

• Revenue: 19.337 MSEK 64 • Production: not relevant, too different steels and grades• Employees: 858565 • Niche: Advanced Stainless Steel• Customers: Petrochemical, medical, paper, oil & gas industry, knifes & razors• Strategy: Few and big customers, increased focus on niche products,

customer-orientation, enhanced production efficiency

Sandvik is a global industrial group divided in three major areas, steel tools for metal workingapplications, equipment and tools for rock-excavation and stainless high-alloy steels. In thisthesis the latter product area which is organized under the unit Sandvik Material Technologies(SMT) has been studied and referred to as Sandvik 66

Sandvik is a highly integrated stainless steel producer, which includes all activities from steelsmelting to finished products. The strategy is to produce advanced value-added products whereSandvik has a possibility to become the market leader. SMT’s products are divided in three

product groups: wire, tube and strip. Typical customers are found in the petrochemical, oil, gasand power industries as well as producers of applications with a need for special alloy grades,such as razor blade and knife manufacturers. 67

Like Outokumpu, Sandvik is very dependent on the various prices of alloys (Nickel, Cobalt &Tungsten) used in Stainless Steel production. The Nickel price fluctuation for example resulted in

estimated losses of approximately 450 MSEK during 2007

68

. As for Outokumpu the Stainless price depends on the steel base price plus an alloy surcharge, but the effect of increased alloy prices is not immediately transferred to the price of Stainless. This lag impacts Sandvik’s resultnegatively and enhances demand variations as customers adjust their orders to the current alloysurcharge.69

With the intention of being a provider of a complete range of products in the niche of StainlessSteel, additional steel products are purchased from other steel producers. Sandvik’s strategy is toconcentrate the production in Sandviken on high margin products and to complete the assortmentof less specialized steel from external producers. This is a part of the enunciated plan to increasethe share of high-margin steel, a shift that aligns with the strategy to move away from bulk-like

products. Manufacturing products that are difficult to produce with a maintained productivity in bulk-producing factories, is used as a strategy to avoid competition.70

64 Sandvik Annual Report 200665 Sandvik Annual Report 2006, p. 1266 Sandvik Annual Report 200667 Sandvik Annual Report 200668 Sandvik Annual Report 2007, p. 1269 Interview with Sandvik representative70 Interview with Sandvik representative