1. Definitions for Savings Account 2. Common Compounding Periods 3. New from Previous Balance 4....

-

Upload

duane-johns -

Category

Documents

-

view

213 -

download

0

Transcript of 1. Definitions for Savings Account 2. Common Compounding Periods 3. New from Previous Balance 4....

10.1 Interest

1. Definitions for Savings Account2. Common Compounding Periods3. New from Previous Balance4. Present and Future Value5. Simple Interest6. Effective Rate of Interest 7. Calculator Solutions

1

Definitions for Savings Account Interest is the fee a bank pays for the use

of money deposited into a savings account.

The amount deposited is called the principal.

The amount to which the principal grows (after the addition of interest) is called the compound amount or balance.

If interest is compounded m times per year and the annual interest rate is r, then the interest rate per period is i = r/m.

2

Example Definitions for Savings Account

For the passbook above, determine the principal, compound amount after 1 year, compound interest rate and annual interest rate.

3

Date Deposits Withdrawals Interest Balance

1/1/05 $100.00 $100.004/1/05 $1.00 $101.007/1/05 1.01 $102.01

10/1/05 1.02 $103.031/1/06 1.03 $104.06

Example Definitions - Savings Account (2)

The principal is $100.00. The compound amount after 1 year is

$104.06. The compound interest rate is 1% since

the interest earned in the first period, $1.00, is 1% of the principal.

Interest is compounded 4 times per year so the annual interest rate is 4·1% = 4%.

4

Common Compounding Periods

5

Number of interest periods

per year

Length of each interest period

Interest compounded

1 1 year Annually

2 6 months Semiannually

4 3 months Quarterly

12 1 month Monthly

52 1 week Weekly

365 1 day Daily

New from Previous Balance

For a savings account in which the interest rate per period is i, the interest earned during a period is i times the previous balance.

The new balance, Bnew is computed by adding the interest earned during the period to the previous balance, Bprevious.

Bnew = Bprevious + i · Bprevious Bnew = (1 + i)Bprevious

6

Example New from Previous Balance

Compute the interest and the balance for the first two interest periods for a deposit of $1000 at 4% compounded semiannually.

For semiannually m = 2 so i = (4/2)% = 2% = .02.

First period: interest = .02(1000) = $20 B1 = 1000 + 20 = $1020 Second period: interest = .02(1020) =

$20.40 B2 = 1020 + 20.40 = $1040.40 7

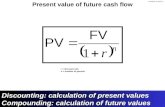

Present and Future Value

Let i be the interest per period, P the principal and F the balance after n periods, then

F is also referred to as the future value and P as the present value.

8

1 , and

.1

n

n

F i P

FP

i

Example Present and Future Value

If an account pays 6% compound quarterly,

a) find the amount in the account after 5 years if $1000 is initially deposited;

b) find the amount that must be initially deposited if $3000 is needed in 5 years.

9

Example Present and Future Value (2)

Period interest is i = .06/4 = .015. Number of periods is n = 4*5 = 20. a) P = $1000 so F = 1000(1 + .015)20 =

$1346.86.

b) F = $3000 so

10

20

3000$2227.41.

(1 .015)P

Simple Interest

Simple interest is earned only on the principal and is not compounded.

If r is the annual percentage rate and n is the number of years, then

Interest = nrP, and F = P + nrP = (1 + nr)P.

11

Example Simple Interest

Calculate the amount after 4 years if $1000 is invested at 5% simple interest.

F = (1 + 4(.05))1000 = $1200

12

Effective Rate of Interest

The effective rate of interest is the simple interest rate that yields the same amount after one year as the annual rate of interest.

If r is the annual interest rate compounded m times a year, then i = r/m and

reff = (1 + i)m – 1.

13

Example Effective Rate of Interest

Calculate the effective rate of interest for a savings account paying 3.65% compounded quarterly.

reff = (1 + .0365/4)4 - 1 = .037 So the effective rate is 3.7%.

14

Calculator Solutions

Use a calculator to determine when the balance in a savings account in which $100 is deposited at 4% compounded quarterly reaches $130.

For a TI-83 set Y1 = (1 + .04/4)^X*100 and Y2 = 130. Find the intersection of the two graphs.

15

Calculator Solutions (2)

The intersection is at X = 26.367391, so in 27 quarters the balance will exceed $130.

16

Graph of Y1 and Y2 with intersection

Table of Y1

Summary Section 10.1 - Part 1

Money deposited into a savings account earns interest at regular time periods. Interest paid on the initial deposit only is called simple interest. Interest paid on the current balance (that is, on the initial deposit and the accumulated interest) is called compound interest.

Successive balances of a savings account with compound interest can be calculated with Bnew = (1 + i)Bprevious.

17

Summary Section 10.1 - Part 2

P - principal, the initial amount of money deposited into a savings account. P also represents the present value of a sum of money to be received in the future; that is, the amount of money needed to generate the future money.

r - annual rate of interest, interest rate stated by the bank and used to calculate the interest rate per period.

18

Summary Section 10.1 - Part 3

m - number of (compound) interest periods per year, most commonly 1, 4, or 12.

i - compound interest rate per period, calculated as r/m.

n - number of interest periods. F - future value, compound amount, or

balance, value in a savings account. F = (1 + i)nP with compound interest, and

F = (1 + nr)P with simple interest.

19

Summary Section 10.1 - Part 4

reff - effective rate of interest, the simple interest rate that yields the same amount after one year as the annual rate of interest. reff = (1 + i)m – 1

20